Key takeaways for the week ending July 5

- Home sales were up 2% from pre-pandemic levels and are likely to continue rising; pending sales were up 10% during the same period.

- Weekly average mortgage rates fell to a new low of 3.03%, fueling homebuyer demand.

- New listings recovered to pre-pandemic levels for the third straight week, but can’t keep pace with buyer demand; the number of homes for sale was down 29% from last year.

- Nearly half of homes that sold during the week spent two weeks or less on the market, making the market feel “chaotic” for buyers.

- Low rates and low inventory pushed home sale prices up 7% from a year earlier.

With mortgage rates at a record low, pending sales and homebuyer demand remain above pre-pandemic levels

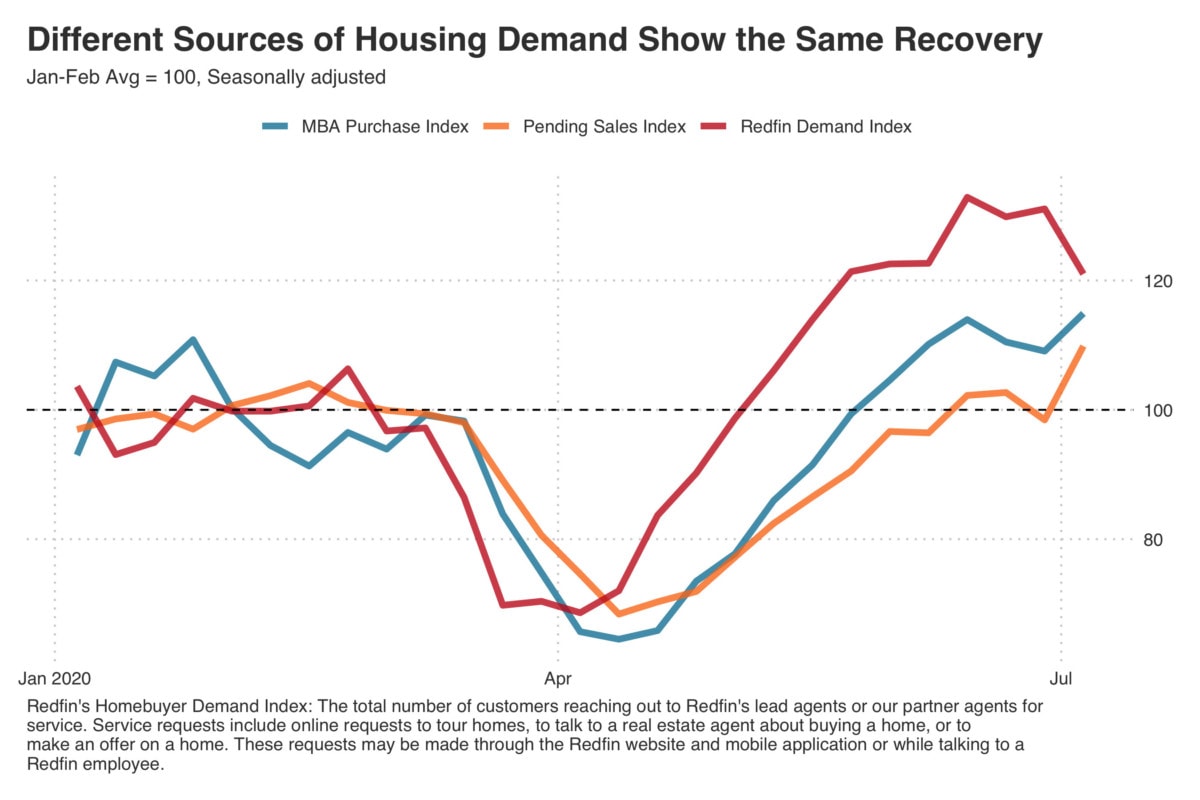

The housing market continued its recovery in the week ending July 5 despite the rise in COVID-19 cases. For the first time, home sales exceeded pre-pandemic levels from January and February, up 2% on a seasonally adjusted basis. Demand is being propelled primarily by record low mortgage rates; the average 30-year fixed rate was down to 3.03% for the week ending July 9.

“The industry is responding to an avalanche of applications for refinances and purchases.” said Rob Foos, a mortgage advisor with Redfin Mortgage in Boston. “A combination of rock-bottom rates plus pent-up purchase demand has resulted in the highest levels of purchase applications in about a decade.”

Several leading indicators suggest that home sales will continue to increase in the coming weeks; pending sales grew 10% from pre-pandemic levels on a seasonally adjusted basis and the Redfin home-buying demand index has hovered around 20% above the pre-pandemic levels for seven straight weeks. Mortgage purchase applications were also about 15% above pre-pandemic levels.

Potential sellers worry about finding their next home

New listings were at their pre-pandemic levels for three straight weeks, up 1% on average on a seasonally adjusted basis. But there aren’t enough new listings to satisfy the strong homebuying demand. As a result, the total number of homes for sale was down 29% from a year ago. Redfin agents report that sellers are now rarely citing coronavirus concerns as a reason not to list, but more often cite the lack of homes for sale itself as the thing that’s holding them back.

“Some of my clients are considering selling, but it’s a matter of finding a home they can buy,” said Redfin agent Thomas Wiederstein in Phoenix. “Even if they do find a home that checks all the boxes, many move-up buyers can’t buy a new home before they sell their current one. With bidding wars so common, it’s very hard to get an offer accepted that’s contingent on the sale of the buyer’s current home.”

Lack of homes for sale fuels competition

Buyers face competition more often than not, as more than half of Redfin offers faced a bidding war in June for the second month in a row, and homes are going off-market quickly. The share of listings that went off market within two weeks stood at 45% this week, up from 35% a year ago. Shoshana Godwin, a Redfin agent in Seattle, is seeing a return to bidding wars and buyers waiving contingencies to make their offers more attractive.

“We’re back to buyers waiving their rights to cancel the contract if something pops up during the inspection or they can’t get their loan approved. Buyers used to try to inspect the home before writing an offer, but now sellers are providing an inspection report upfront. That brings in even more bidders because they don’t need to spend $500 on an inspection just to make an offer,” Godwin said.

Redfin San Francisco agent Chad Eng describes a housing market that feels “chaotic” in the absence of pre-pandemic norms.

“Due to COVID-19, agents are scheduling back-to-back 15-minute in-person home tours instead of holding traditional open houses. If you miss your appointment, you’re out of luck. Sellers often set a deadline for buyers to submit offers so they can review all of their options at once, but now that there’s so much uncertainty, sellers who receive one strong offer are less willing to wait around to see what else trickles in. I’ve seen multiple sellers accept an offer before the deadline, meaning buyers who wait miss out on their shot at buying the home.”

With competition comes rising home prices. The average sale price for the week ending July 5 was $310,000, up 7% from a year ago. The big question is how high prices will go? Asking prices for newly listed homes continue to accelerate as well, rising 16% over the same week last year to $324,900.

What’s ahead?

Right now the market shows no signs of slowing down, but it will face a new test at the end of July. Thanks to the CARES Act, roughly 30 million Americans are receiving an extra $600 in weekly unemployment benefits. That extra benefit is set to expire July 31, unless lawmakers pass an extension or new legislation to supplement income for folks who are out of work.

The expiration of these enhanced unemployment benefits could adversely affect personal spending, a crucial component of the economy that makes up 68% of GDP. A pullback in consumer spending could hit industries outside of travel, service and hospitality which so far haven’t been as impacted during the pandemic. That’s notable because so far, highly-paid employees have been largely insulated from the recession and the high unemployment rate in service jobs has had a limited impact on housing demand. If job losses creep into new industries, all bets are off.

Methodology

For this report covering the week that ended on July 5, we are presenting seasonally adjusted data for pending sales, new listings and home sales. This week includes the last two days of June and typically sales are disproportionately large on the last day of the month. It also includes the independence day holiday which typically results in a decline in housing market metrics. Seasonal adjustment allows us to account for these peculiarities. Pre-pandemic levels of these metrics refers to their average seasonally adjusted levels during January and February 2020. The Redfin COVID-19 week housing market dashboard does not include these seasonally adjusted data (as of the publication date of this report).

United States

United States Canada

Canada