Redfin Local Insights is a new analysis focusing on a single metro area, based on interviews with local Redfin agents, and statistics compiled from the Multiple Listing Service, public records data, and Redfin’s proprietary statistics, which are anecdotes about winning and losing offers by Redfin agents for Redfin’s home-buying clients.

Market Summary

Buyers Burning Out…

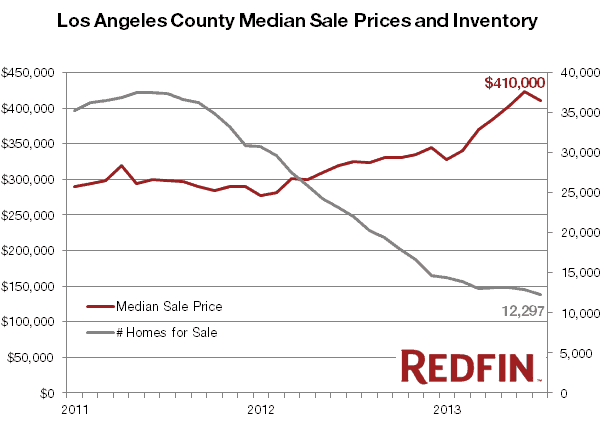

While Los Angeles County remains one of the nation’s most competitive real estate markets, the home-buying frenzy that dominated the area over the past year has started to ease. Since mid-2012, rising home prices and historically low mortgage rates drew buyers from all quarters—first-time buyers, foreign buyers, institutional investors, and home flippers—into the LA market. Increased demand and low inventory triggered aggressive bidding wars, causing median sale prices to swell 26 percent between July 2012 and July 2013.

Redfin agents report that competition turned a corner starting in late June as buyers started to burn out. According to Redfin agent, Ryan Stires, “Buyers are jaded and are passing on houses or temporarily stepping back from house hunting because they don’t want to compete in cutthroat bidding wars.” While it was common for properties this spring to receive more than 30 offers, Redfin agents in July noted that 5 to 10 offers on a property were the norm. In Los Angeles, the percentage of offers written by Redfin agents that faced bidding wars fell to 80 percent in July from 86 percent in June.

…And Getting Priced Out

Aside from general weariness, the area’s steep home-price growth and climbing interest rates have also priced many buyers out of the market. Median home prices in Los Angeles County and average interest rates have grown from approximately $325,000 and 3.5 percent to $410,000 and 4.5 percent between July 2012 and July 2013. This means that buyers now need to cough up at least $600 more per month to afford a comparable home.

Seller Control Waning Slightly

Redfin agents say that these developments are causing sellers to lose some market control even though inventory remains extremely tight. Redfin agent, Eric Tan, says that “Sellers know properties are now sitting on the market a bit longer and are taking care to price their home right, rather than assuming it will sell no matter what.” Median sale prices fell three percent to $410,000 from June to July, suggesting that buyers are starting to put their foot down on prices. Inventory remains tight because many Los Angeles County homeowners are still underwater on their mortgages and home prices have not yet risen enough for them to list.

New Developments

Light Rail Extensions a Commute Game-Changer

As immortalized by Saturday Night Live’s popular skit, The Californians, dodging traffic is a part of life in Los Angeles. However, new Metro rail extensions are underway, which will provide commuting alternatives and expand housing options for commuters west and northeast of downtown. The new Metro Expo rail line, which opened in 2012 and currently connects Culver City to downtown, will extend to Santa Monica by 2016. The new line promises a 45-minute ride from Santa Monica—a welcome break from the 1.5 hours it often takes by car. The City of Santa Monica is already gearing up for the Expo line extension and in May approved a $13.7 million pedestrian esplanade at the site of the future rail station. Developers are also near completion on The Village at Santa Monica, a huge $350 million residential and retail project.

The Gold Line Foothill extension, which will stretch from Pasadena to Azusa, is also under construction and expected to be completed by late 2015. According to Redfin LA agent Sylva Khayalian, “More buyers are likely to choose homes east of Pasadena because their money can stretch further there and the rail extension will offer traffic-free commuting.” Homes along the Gold Line offer relative affordability compared to other suburbs closer to downtown. For example, in July the median sale price for homes in Azusa was $315,000 compared with $475,000 in Los Angeles. Redfin agents also report that new housing developments are popping up in cities along this line, including Monrovia, Azusa, and Glendora, expanding options for buyers. Once finished, the rail line should take commuters approximately 45 minutes to ride from Azusa to Union Station.

Up-and-Coming Neighborhoods

Buyers Movin’ On Up To the (North)east Side

Redfin agents in Los Angeles consistently name neighborhoods northeast of downtown as the most in-demand “up-and-coming” areas in LA County. Ultra-exclusive neighborhoods to the west, like Santa Monica and West Hollywood, are traditionally in high demand and have seen dramatic price spikes over the past year. These northeast neighborhoods have also seen rising prices, yet still offer relative affordability as well as close proximity to downtown. This is highly attractive to buyers and sparking revitalization:

Highland Park. With its relatively low home prices, close distance to downtown LA, metro stop, and plethora of local shops, it is no wonder why Highland Park is in high demand. For downtown commuters, Highland Park’s own Gold Line station is a major benefit and transit to Union Station takes riders just 12 minutes during morning rush hour. Highland Park’s median sale price was $448,000 as of July 2013, but competition has driven sale prices up 36 percent over the past year. Between May and July 2013, homes for sale in Highland Park received an average of 17 offers and sold for five percent over the asking price.

Eagle Rock. Just north of Highland Park and Mount Washington, Eagle Rock’s low-key vibe and proximity to Hollywood have made it a popular setting for movie cameos including Top Gun, Hunt for Red October, and Reservoir Dogs. A price step above, median sale prices in Eagle Rock were $569,000 in July 2013, up 26 percent from the year before. Homes in Eagle Rock since May have fetched at least four offers on average and sell for about four percent over the asking price.

Mount Washington. Mount Washington residents enjoy an assorted mix of Victorian homes, modern mansions, and 1920’s bungalows. The Southwest Museum stop on the Gold Line makes commuting easy for young professionals, with a short 10-minute ride to Union Station, and the neighborhood’s award-winning Mount Washington Elementary School district is a big draw for families with young children. With a median sale price of $580,000 as of July 2013, prices here are a tier above Eagle Rock and have grown 35 percent since July 2012. Since May, homes for sale have averaged five offers and have sold for three percent over the list price.

Market Outlook

Market on Slow Path Towards Balance

While still a solid seller’s market, Los Angeles over the next six months is likely to continue to slowly trend towards more balance. Tight inventory will continue to push prices up, but probably at a slower rate than the first half of 2013. Inventory is unlikely to grow dramatically over the next six months, but probably will begin to show positive gains as prices rise and homeowners decide to list their homes so that they, too, can lock in historically low rates and move up. Home builders also seem poised to contribute with some new homes; as of June 2013, building permits for new single family homes in Los Angeles County were up 56 percent from the year before, according to the National Association of Home Builders. New homes take on average six months to complete, suggesting that more new inventory will be coming online through new year.

Table 2: Los Angeles County Select Home Price Data – July 2013

| City | Median Sale Price ($) | Median Sale Price YoY (%) | Median Sale Price ($/Sqft) | Mean Sale-to-List Ratio(%) |

|---|---|---|---|---|

| Beverly Hills | $1,386,000 | 10.6% | $752 | 96.3% |

| Burbank | $553,000 | 30.4% | $386 | 102.1% |

| Culver City | $580,000 | 12.7% | $405 | 102.6% |

| Glendale | $546,000 | 10.8% | $348 | 103.7% |

| Los Angeles | $475,000 | 31.9% | $332 | 101.5% |

| Pasadena | $418,000 | 19.8% | $418 | 101.6% |

| Santa Monica | $990,000 | 20.4% | $726 | 103.8% |

| View Park-Windsor Hills | $520,000 | 33.8% | $259 | 100.2% |

| West Hollywood | $601,000 | 23.9% | $503 | 99.9% |

United States

United States Canada

Canada