Is it getting easier to get a home loan? Maybe for some people. JPMorgan Chase & Co. this week said it would loosen credit standards and lower down payment requirements for jumbo loans. A qualified buyer with a 680 FICO score can put as little as 15 percent down on a single-family house and get a $3 million mortgage.

A jumbo is just what it sounds like – a big mortgage on an expensive house. But for most of us, getting approved for a smaller, plain-vanilla home loan can still be pretty difficult. That’s because the U.S. government plays an oversized role in most mortgages of $417,000 or less and goes to great lengths to make sure taxpayers aren’t saddled with a bunch of defaults. Jumbos, by contrast, are largely unregulated.

This week, we got three new snapshots of those government-backed mortgages. What we saw were borrowers with really good credit and scores way above 680.

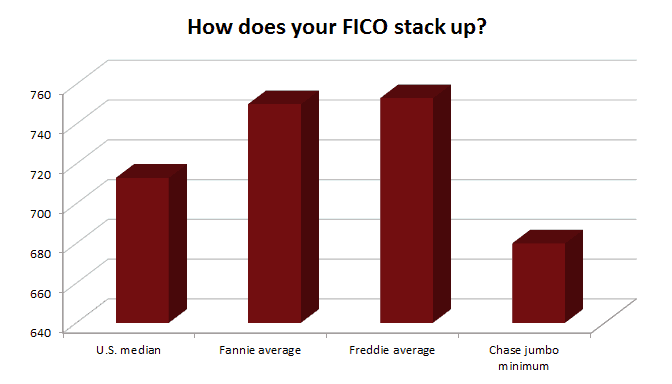

At Freddie Mac, the average borrower so far this year has a FICO score of 753, up from 748 in 2014. At Fannie Mae, the average score is 750, up from 743 last year. Ellie Mae, a company that tracks Fannie, Freddie, FHA and VA mortgages, said the average score for loans closed in June was 727.

So what?

Lenders use FICO scores to measure creditworthiness. They range from 300 to 850, and half of Americans come in at 713 or lower. As we’ve seen, that might not be enough to get you a $417,000, government-backed mortgage, even if it can get you a $3 million jumbo from Chase.

That’s crazy!

Not really. Chase, the nation’s biggest bank, can offer easier credit terms because it keeps loans on its books and takes all the risk — it has skin in the game. If Chase wanted to approve you for a $417,000 loan and sell it to Fannie or Freddie, different rules would apply. That’s because if a Chase jumbo loan fails, Chase loses. If a Fannie or Freddie loan fails, the taxpayer loses.

Since the 2008 bank bailout, policymakers, industry leaders and economists have debated how best to prevent mortgage defaults. Require higher credit scores? Bigger down payments? Chase and other banks have done their own risk analysis and come up with some ideas. But for most borrowers who aren’t shopping in jumbo territory, the government’s rules apply, and for now they’re a lot tougher.

United States

United States Canada

Canada