Last week brought a bushel of economic data and a Senate plan to tap your home loan to build highways. This week brings news on jobs and the financial health of Fannie Mae and Freddie Mac. Thursday, elephants crowd into a room at Quicken Loans Arena. Maybe the location will inspire them to talk rents, homeownership and mortgages, but we won’t hold our breath. Read on.

Could a slowdown be good?

Housing has been one of the economy’s strong points lately, perhaps to a fault. Prices keep hitting record highs in cities like San Francisco and bidding wars have become routine in much of the country. In Denver, which has notched double-digit increases for eight straight months, a Redfin customer recently sold a house he bought in 2013. In just two years, he netted a $100,000 profit, which he plans to spend on law school.

His timing is good. Denver market manager Michelle Ackerman is reporting early signs of a slowdown, with fewer homes getting multiple offers and smaller crowds at open houses.

Sales typically ebb at this time of year, but we’re seeing signs of an enduring slowdown, and that’s not necessarily bad. Call it a normalization of the housing market.

Let’s look at the data. Redfin’s Housing Demand Index, which tracks home tours and purchase offers in 15 metro areas to give one of the earliest signals in the market, showed a 6.7 percent drop in June, a far steeper decline than at the same time last year. We expect prices to grow a modest 2.2 percent in August.

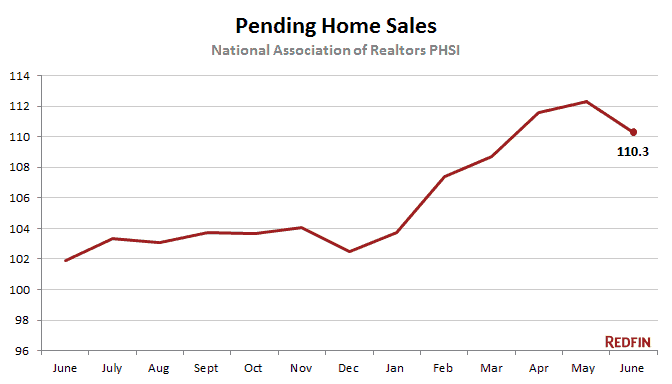

The National Association of Realtors’ pending sales index, another early indicator of activity, also took a dive, meaning agents reported fewer purchase contracts in the pipeline. While it’s routine for sales to slow this time of year, the steep decline caught economists off guard.

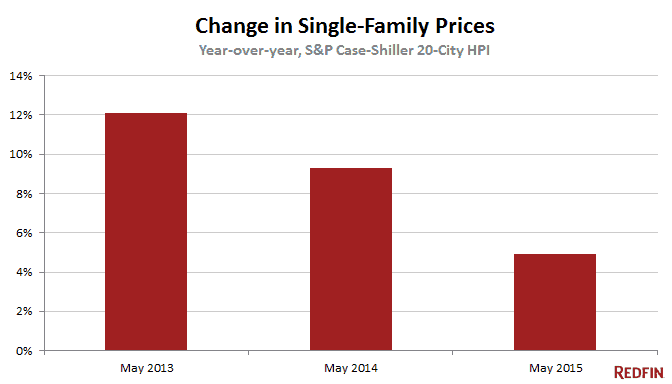

Two broad measures of prices — Redfin’s Market Tracker and the S&P Case-Shiller Home Price Index — are decelerating.

![]()

Properties aren’t losing value, they’re just appreciating more slowly. That’s a good thing in this environment, especially for buyers.

What’s the upshot?

Mortgage credit is tighter than it used to be, wage growth is weak and a lot of houses already are priced out of reach for a lot of people. Even though companies are hiring, employers aren’t spending more on workers. A broad measure of compensation from the Labor Department showed almost no growth in pay and benefits last quarter, a report economists at PNC Financial Services called “a definite disappointment” that might give pause to the Fed as it ponders a rate hike.

Global pressures are being brought to bear on housing, too. Economists at Wells Fargo, the nation’s biggest mortgage lender, last week trimmed price forecasts for this year and next because the strong U.S. dollar might discourage foreign buyers in markets such as Miami and New York.

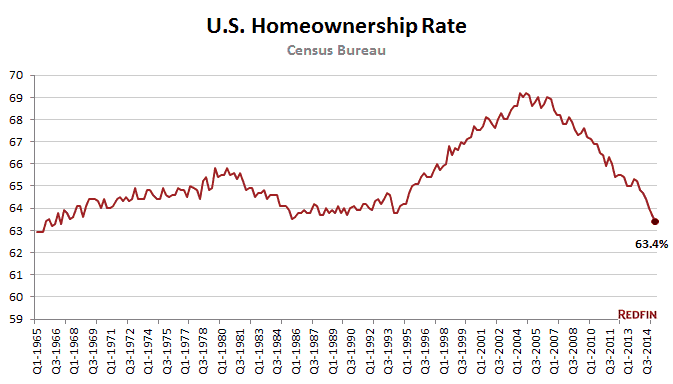

Homeownership – so last decade? That Redfin customer in Denver who’s cashing out is part of another phenomenon, the dwindling rate of homeownership. This year, the share of Americans who own houses fell to its lowest since 1967.

Demographics are part of the story there. The U.S. is getting younger as the millennial generation crests. But since 2007, while the population of 18- to 34-year-olds grew by 3 million, the number of young adults living independently from mom and dad actually fell, from 42.7 million to 42.2 million this year, according to the Pew Research Center. It’s a confounding development born of student debt and the slow economic recovery. As millennials enter their 30s, we think they’ll buy houses, but this is uncharted territory. No one knows for sure.

In the big picture, declining homeownership could be significant. Despite the roller-coaster ride of the past decade, homeownership remains a reliable way to build wealth and savings over the long run, especially with today’s low interest rates. If fewer of us can buy in, investors will be the ones reaping the benefits of equity building. That spells trouble for the wealth gap.

The rent is still too #$%@ high, too

Not only are more Americans renting, they’re paying more rent than ever. It’s a familiar story, but things are getting worse, with one in four households shelling out more than half their income toward rent. And it’s affecting everyone, not just lower-income families, according to Harvard. In Washington, the housing-industrial complex is sounding the alarm with editorials and an ad campaign featuring musicians performing in overpriced apartments (John and Jacob, Timothy Bloom and Carley Rae Jepsen).

In October, housers will take the #$%@ rent message to Saint Anselm College, the epicenter of New Hampshire politics, where they hope to get the attention of all those presidential candidates (both species). Stay tuned.

Etc.

“No dragons, no zombies.” David Simon (“The Wire”) has a promising new show about — wait for it — housing. Public housing, to be exact. “Show Me a Hero” debuts Aug. 16 on HBO.

Experian reminds us that young adults have lower credit scores and incomes. Zzzz. More interesting: Millennials aren’t big fans of credit cards.

Banks are becoming less entrepreneurial when it comes to credit. They blame government regulation — no surprise there. A third have rejected creditworthy mortgage applicants because of rules adopted since the financial collapse.

Cute dogs and homemade pie. Clickbait from Bloomberg and a good read for would-be buyers.

The Optimism Boom. An Allstate/National Journal Heartland Monitor poll found that two-thirds of Americans think their hometowns are doing just fine.

Fun with maps. Yeah, this. Mean streets from CityObservatory.

Should you and yours SO buy a house before the wedding? Redfin millennial Katy Klein makes the case at Money. Congrats, Lady!

Want to chat? Vent? Join the mailing list? I’m at Lorraine.woellert@redfin.com. You can find all Redfin news and analysis here.

Other popular posts:

1. How to Search for a Home When You Have Pets

2. Identify and Prevent Illness-Causing Elements in Your Home

3. Introducing Your Kids to Birdwatching in Your Backyard

United States

United States Canada

Canada