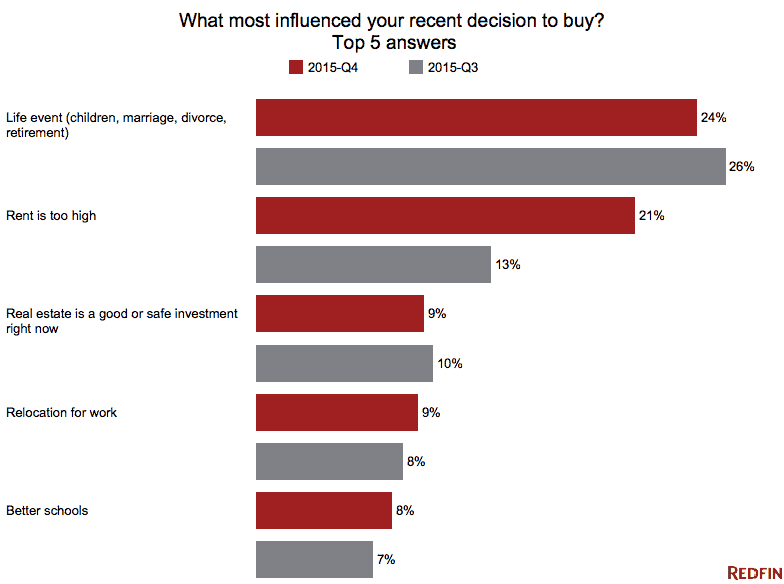

The cost of rent is pushing more people into the housing market, according to a Redfin survey of homebuyers. More than one in five cited high rent as their top reason for house hunting in November, up from only 13 percent in our previous survey in July.

It’s no surprise, given that rents have been rising rapidly while wages haven’t. Nationally, rents rose between four percent and five percent in 2015 and have advanced by double digits in tech hubs and other cities.

The change in sentiment wasn’t driven by changes in geography, age, price or first-time buyers, all of which remained constant in both surveys.

Affordability

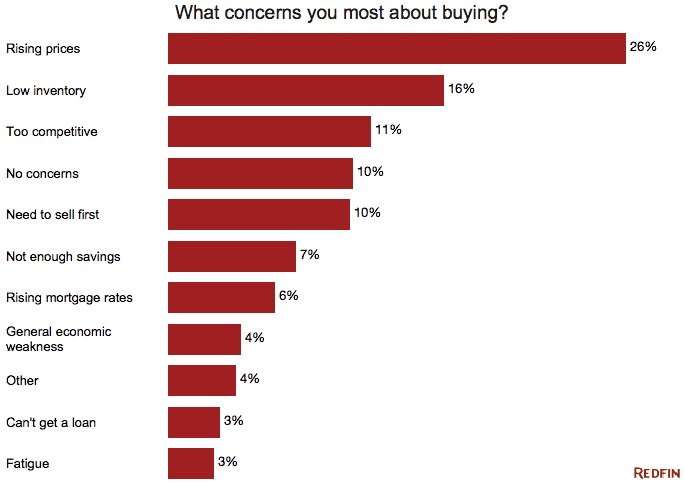

While rents are a growing motivator, buyers cited affordability as their top concern. Prices have been uppermost in buyers’ minds since at least August 2014. Sale prices mounted steadily in 2015, notching 8.8 percent growth in December compared to the previous year.

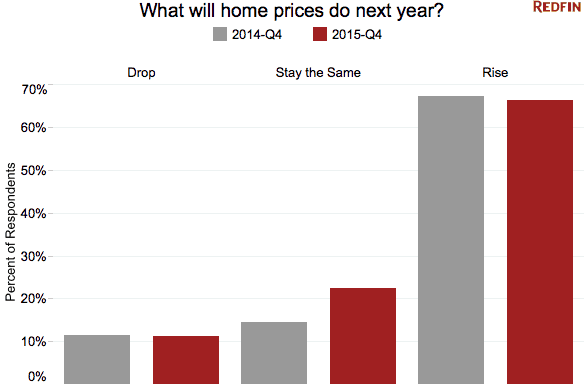

Price Expectations

A big share of buyers–66 percent– think home prices will rise this year, in line with findings from a year earlier and a shift from July, when less than half of the respondents anticipated rising prices.

At the same time, more buyers expect prices to stay the same this year, 23 percent in November compared to 14 percent last year.

Buyers’ Sentiment

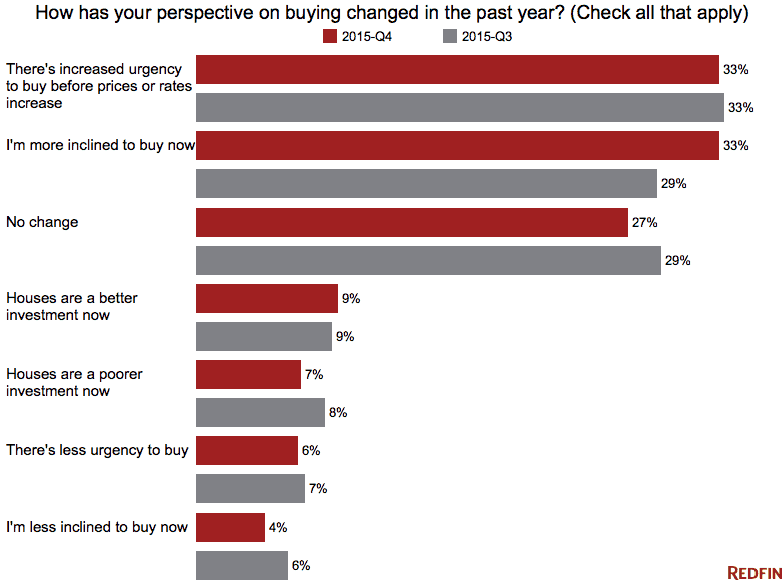

Sentiment improved, with an increasing share of buyers saying they’re more inclined to buy now, an increase of about four percentage points from the previous survey three months prior.

About the Survey

This survey was conducted Nov. 15-18 with responses from 1,146 Redfin customers in 35 states.

United States

United States Canada

Canada