Who cares about housing? Nearly everyone, but you wouldn’t know it listening to the presidential candidates. Crickets. New Jersey Gov. Chris Christie summed it up when he said housing “isn’t the sexiest issue in the world.”

Maybe not, but it’s one of the most important. Housing accounts for about 18 percent of our economy and homeownership remains one of the most effective ways for Americans to build wealth. A healthy real estate market is key to a virtuous cycle that creates jobs and stimulates consumer spending. And when things go wrong, housing can push the economy and people’s lives to the brink.

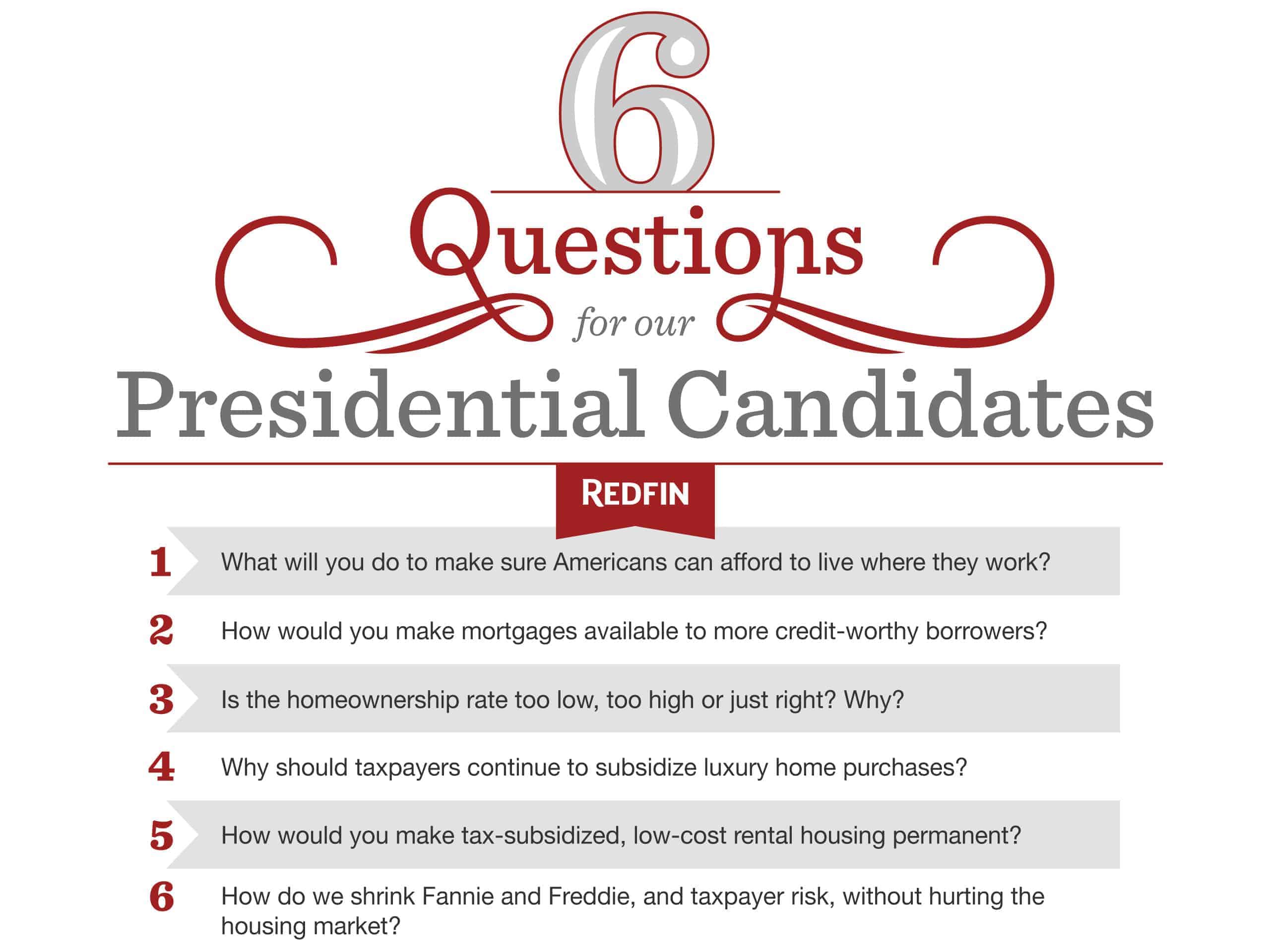

Are you listening, candidates? It’s time to jump on the housing bandwagon. To make it easy for you, here are some free talking points. You’re welcome.

Affordability

Home prices are too high in job centers such as San Francisco, Seattle and Boston, forcing teachers and other middle-class workers to flee. When people can’t afford to live where the jobs are, the whole economy suffers.

- Question: What will you do to make sure Americans can afford to live where they work?

Getting a Mortgage

Too many people can’t get home loans, even when they have jobs and pay their bills. We’re using outdated measures of creditworthiness that are locking first-time buyers and people of color out of the housing market.

- Question: How would you make mortgages available to more credit-worthy borrowers?

Homeownership

The share of Americans who own homes is near a 30-year low after peaking in 2004. As the homeownership rate declines, so does the ability of the middle class to build wealth.

- Question: Is the homeownership rate too low, too high or just right? Why?

Tax Breaks

The mortgage interest tax deduction is unfair. Homeowners will get an estimated $77 billion in mortgage tax breaks this year, most of it going to the wealthy. In 2016, households earning between $40,000 and $50,000 will get a $528 mortgage tax break. People earning $1 million or more will collect $8,835.

- Question: Why should taxpayers continue to subsidize luxury home purchases?

Shelter Poverty

Too many families spend more than a third of their income on housing. On most low-cost rentals, affordability sunsets as tax credits or other subsidies expire. The value of the property goes up and we’re back to too few units and too much need.

- Question: How would you make tax-subsidized, low-cost rental housing permanent?

Fannie and Freddie

Taxpayers are on the hook for nearly 74 percent of all mortgage dollars, a lot of them funneled through Fannie Mae and Freddie Mac, who pay investors if any loans go bad. It’s no wonder so little private mortgage money has come back into the market.

- Question: How do we reduce taxpayer mortgage risk without hurting the housing market?

What are we missing? Leave a comment below or drop me an email.

United States

United States Canada

Canada