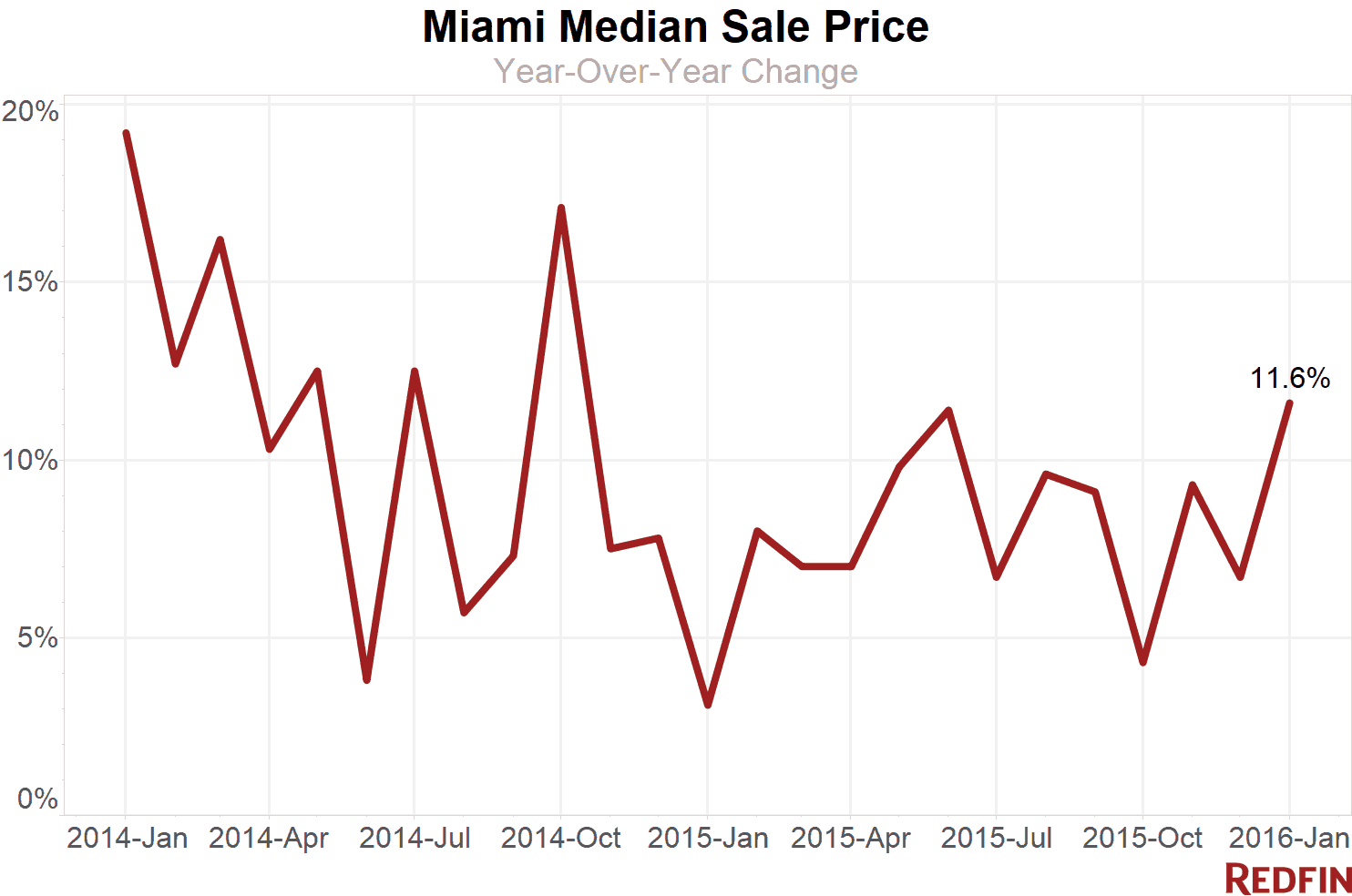

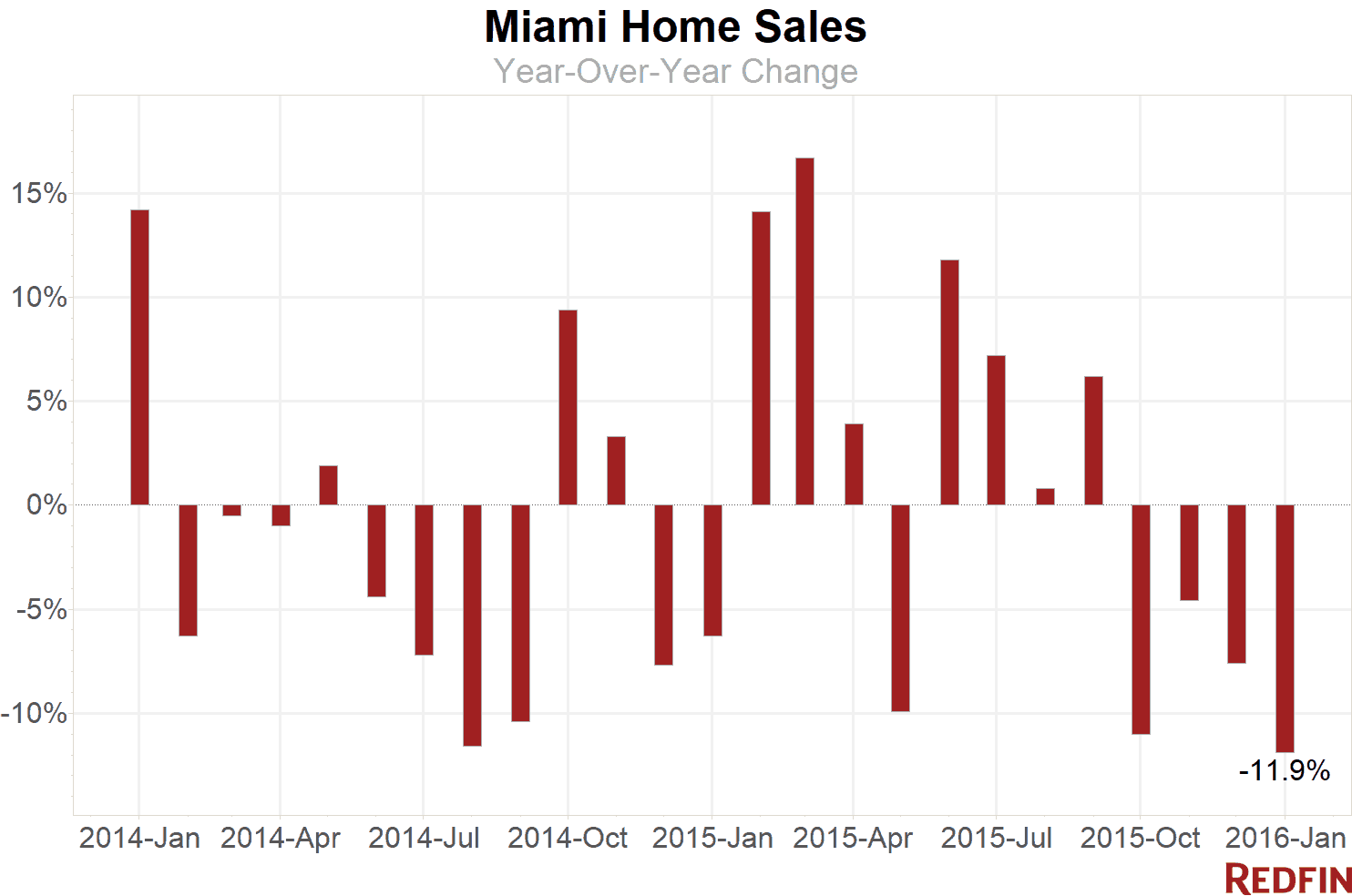

Miami home sale prices increased 11.6 percent in January from a year earlier to a median price of $240,000. Sales fell for the fourth-straight month, down 11.9 percent year over year.

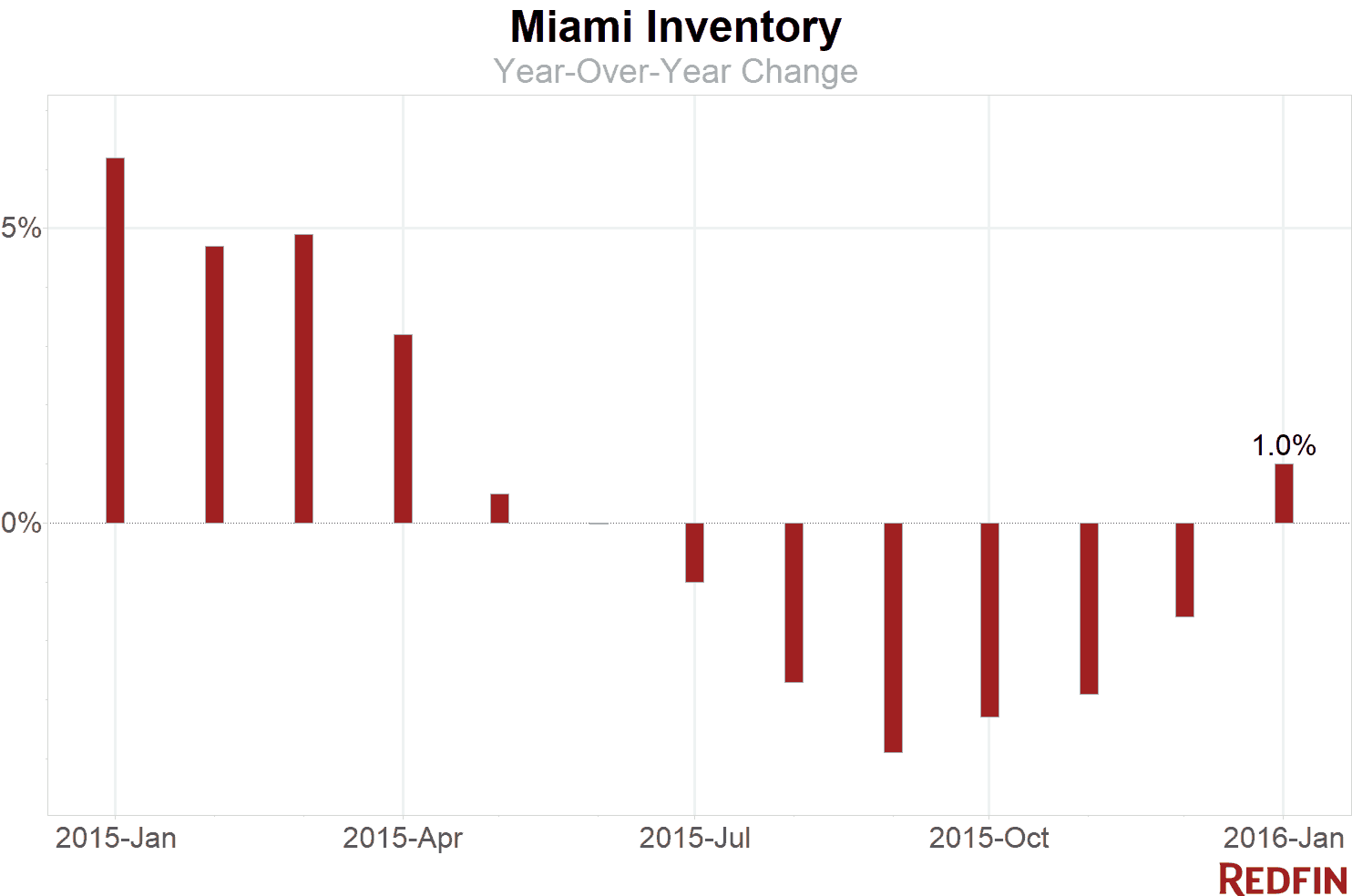

Following six months of declines, inventory was up 1 percent year over year, thanks in large part to the nearly 6,000 new listings added to the market in January, the highest level recorded in at least two years.

Much of this new inventory has come in the form of high-end beachfront condos.

With sales declining and inventory on the rise, Miami now has a 6.9 month supply of homes, surpassing the six-month tipping point that signals that the balance of power has shifted into buyers’ favor.

But Miami has two separate and distinct housing markets: condos and single-family homes. To understand their intricate dynamics, especially in 2016, they must be analyzed separately.

As we climbed out of the recession, Miami condo developers began a long period of rapid construction to meet the demands of foreign investors — mostly from South America and Europe — who wanted to take advantage of the weak U.S. dollar. Developers were further bolstered by the fact that these eager foreign buyers were willing to put 50 percent down to pre-purchase new units, which was commonplace until late last year when foreign markets began to waver. Come early 2016, and many of these new developments are nearing completion and entering the market just as foreign buyers from oil-producing countries face twin challenges from a stronger dollar and weaker oil prices.

Inventory in the Miami market is an unusual combination of the remaining condo units that weren’t pre-purchased, and a large stock of condos already back on the market for resale by foreign investors looking to cash out on their investments. The number of homes in the former group is difficult to measure and may be much higher than what is recorded in industry data, because developers tend to list only a sample of available units on the MLS.

“Investors from South America, concerned about their home economies and the potential resale value of a condo in Miami, are taking a pause,” said Redfin agent Aaron Drucker. “This cooling demand has pushed a few developers to cancel projects or turn them into rental properties, while others have lowered their deposit requirements in an effort to entice foreign buyers back to the market. Developers cancelling projects is actually a sign of a healthy slowdown in the market.”

Some developers are reaching for demand from buyers in China, who have yet to enter the Miami market in large numbers like they have in other U.S. coastal cities like San Francisco, New York City and Washington, D.C. “Chinese buyers are searching for value, and Miami offers a much lower price per square foot,” said Drucker.

But despite developers’ efforts to secure new foreign investors and regain the ones who have retreated, Miami’s condo inventory will likely continue to grow as more projects reach completion and new properties sit on the market.

“The problem is that there’s now a mismatch between where development is currently focused and where the demand is greatest,” Drucker explained. “Many of Miami’s condo buildings aren’t even an option for local buyers, who cannot afford the price point because these condominiums also require a large down payment of 25 percent or more. That’s pushing more local buyers to the single-family home market, but their options are sparse since new development in that sector has stalled.”

The rapid development of Miami’s condo market has left out these buyers in the single-family home market, who are facing lower inventory and rising prices. In nearby Hialeah, for example, inventory is down 14.4 percent and new listings are down 14.6 percent for the year, while prices have risen 15.4 percent to $180,000.

“The good news for local homebuyers is that mortgage rates are likely to stay low,” said Drucker. “That means that more people will be able to afford a home this year. What’s concerning is that on top of stagnant wages and slow job growth, a shortage of single-family inventory will continue to push the price of houses up this year, while a small price correction in the luxury condo market is looming.”

Hot Areas

Among Miami neighborhoods, Wynwood-Edgewater saw one of the largest upticks in inventory with a 60 percent increase. The rise is largely due to the 63.6 percent hike in new listings, mostly comprised of condos. Brickell also had a large increase in inventory, adding 694 new listings for the year.

The outlook in Upper Eastside is positive for buyers. Prices fell 14.8 percent year over year to $302,550 while inventory increased 90.6 percent.

Little Haiti had one of the highest price jumps, up 111.2 percent to $207,500, still below the city’s median sale price. Little Haiti also had a large drop in sales, down 36.2 percent year over year.

Prices in Southwest Coconut Grove are up 18.6 percent for the year to $710,000, inventory is up 41.9 percent and sales are down 18.4 percent.

A similar pattern followed in the city of Doral, where prices increased 10.91 percent to $305,000, and sales dropped 19.67 percent.

METHODOLOGY: Data is based on multiple listing service (MLS) information and might not reflect all real estate activity in the market. Neighborhood-specific data covers November 1, 2015 to January 31, 2016. City-specific data covers January 1 – 31, 2016. Miami data includes the surrounding cities of Miami Beach, Miami Gardens, Miami Lakes, Miami Shores, Miami Springs, Fisher Island, West Miami, El Portal, Biscayne Park, North Miami, North Miami Beach, South Miami, Aventura, Bal Harbour, Bay Harbor Islands, Coral Gables, Hialeah, Kendall, Pinecrest, Doral, Key Biscayne, North Bay Village, Palmetto Bay, Sunny Isles Beach, Homestead, Cutler Bay and Sweetwater.

For more information, contact Redfin journalist services:

Phone: 206-588-6863

Email: press@redfin.com

To be added to Redfin’s press release distribution list, please click here.

United States

United States Canada

Canada