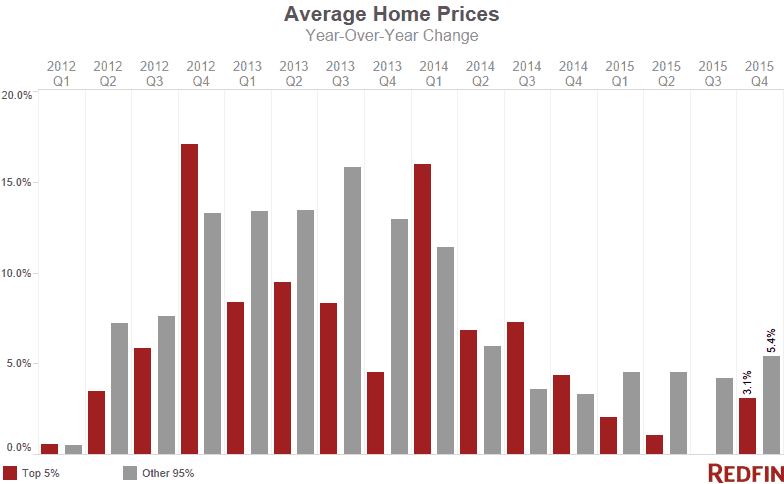

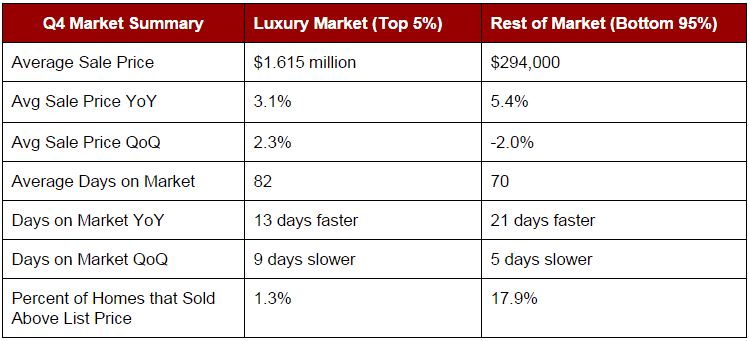

The luxury home market rallied at the end of 2015, ending a nine-month slump. Sale prices for the most expensive 5 percent of homes gained 3.1 percent in the fourth quarter compared to a year earlier, led by big gains in Philadelphia, Austin and Sacramento.

Sale prices in the bottom 95 percent of the market grew 5.4 percent over the same period, outpacing luxury price growth for the fourth-straight quarter.

The number of homes for sale priced at $1 million or more fell 6.4 percent from a year prior. A low supply of luxury homes in many cities likely played a role in driving up prices at the top of the market.

While the late-year price increase is welcome news for luxury real estate investors, Redfin Chief Economist Nela Richardson is hesitant to call it a lasting trend.

“A slowing economy and volatile stock market have many luxury home sellers on edge,” Richardson said. “This concern is warranted in large luxury markets such as Houston, Miami, Tampa and Chicago. Instead to shifting into high gear, luxury prices in these markets declined.”

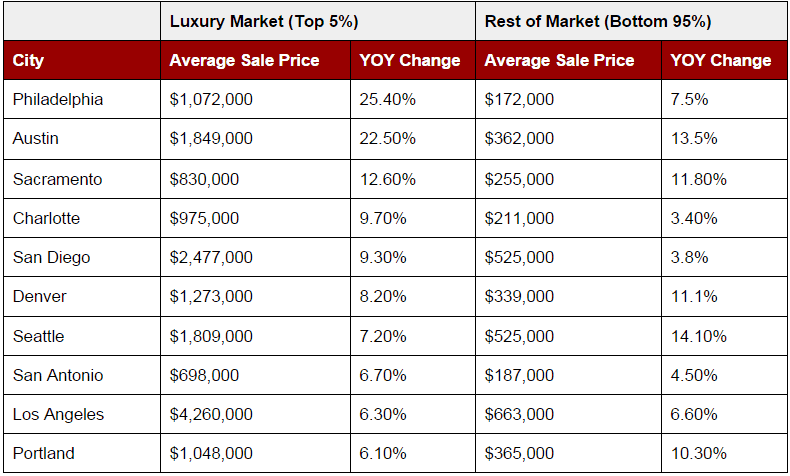

Biggest Winners

In Philadelphia and Austin the average price for a luxury home was more than 20 percent higher than a year earlier.

Austin is one of the fastest growing cities in the nation, so it’s not surprising that prices there are booming.

The big jump in Philadelphia’s luxury market is more unexpected. Redfin agent Tom Lewis said the change might be linked to the sale of several multi-million-dollar condos in a new Society Hill development.

The 12.6 percent price boost at the top of Sacramento’s market is driven by buyers relocating to the area from other parts of the state, fleeing dismally low inventory and high prices in San Francisco and Silicon Valley.

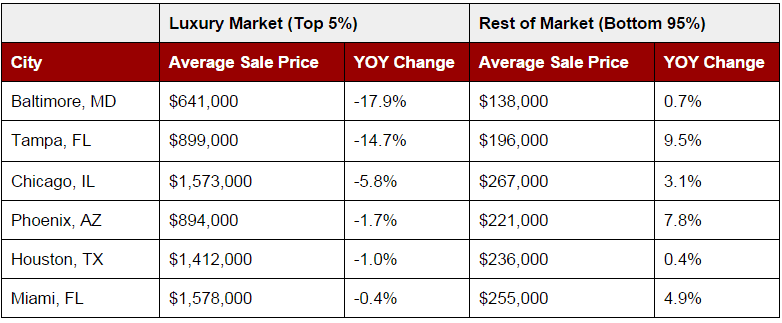

Biggest Losers

Baltimore’s luxury market had the largest price drop, falling 17.9 percent, followed by Tampa, Fla., where prices fell 14.7 percent.

Tampa luxury prices fell nearly 9 percent from the third quarter to the fourth quarter, which Redfin agent Wendy Peterson attributed to buyers timing their purchase to the school calendar.

“The most desirable communities are known for their highly-rated schools,” said Peterson, “So the market often tapers off at the end of the year.”

Luxury home prices have fallen for two consecutive quarters in Baltimore, Chicago and Houston.

“The slowdown in the Houston market is a knee-jerk reaction from buyers due to all the attention on low oil prices,” Redfin agent Tara Waggoner said. “The mindset is that we’re such an oil and gas city, but our economy is quite diversified. It’s more about the mindset than anything else right now. Houstonians are being cautious.”

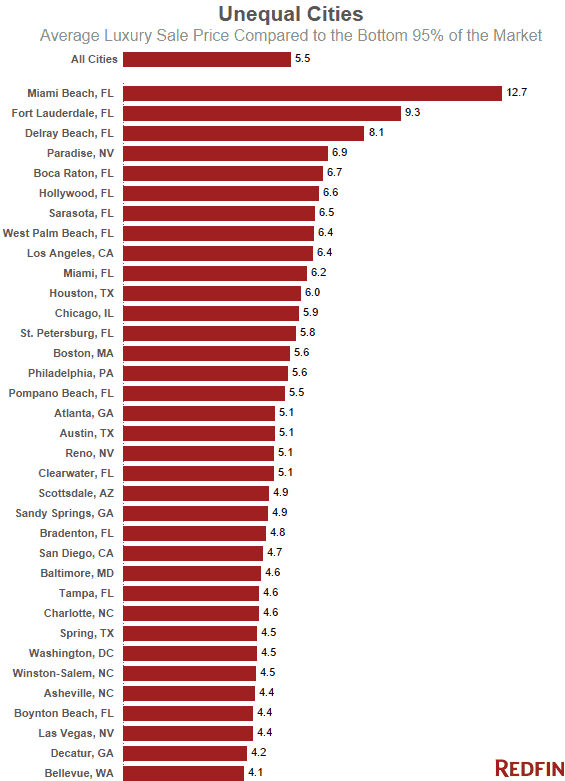

Most Unequal Cities

Miami Beach and other South Florida cities continue to feature prominently on our list of the most unequal cities in America. New to the ranking this quarter was Paradise, Nev., home to the Las Vegas strip.

Philadelphia was another newcomer to the ranking. A luxury condo or historic townhome in the exclusive downtown enclaves of Society Hill or Rittenhouse Square costs more than five times as much as the city’s average sale price of $172,000.

Redfin agent Tom Lewis said Philadelphia is historically a working class town, but has a large and growing business and financial services sector.

“Unlike cities like Miami, our luxury market is driven by owner-occupant buyers, not foreign investors,” Lewis said. “We’re seeing more high-income Philadelphia workers deciding to buy downtown where they can enjoy our world-class restaurants and cultural amenities instead of purchasing sprawling homes in the suburbs.”

To see data for your city, download the data at this link. Visit the Redfin Data Center more housing market data and analysis.

Methodology: Redfin tracks the most expensive five percent of homes sold in more than 600 U.S. cities and compares price changes to the bottom 95 percent of homes in those markets. Analysis is based on multiple-listing and county recorder sales data in markets served by Redfin, as of Feb. 1. To determine luxury market winners and losers, we looked at cities with at least 100 luxury sales in the quarter. To determine the most unequal cities, we looked at cities with at least 25 luxury sales in the quarter. The data in this report reflect national sales.

Other popular posts:

1. How to Safely Observe Wildlife from Your Home

2. How to Create an Autism-Friendly Environment for Kids

3. How to Make Your Backyard a Sanctuary for Wildlife

United States

United States Canada

Canada