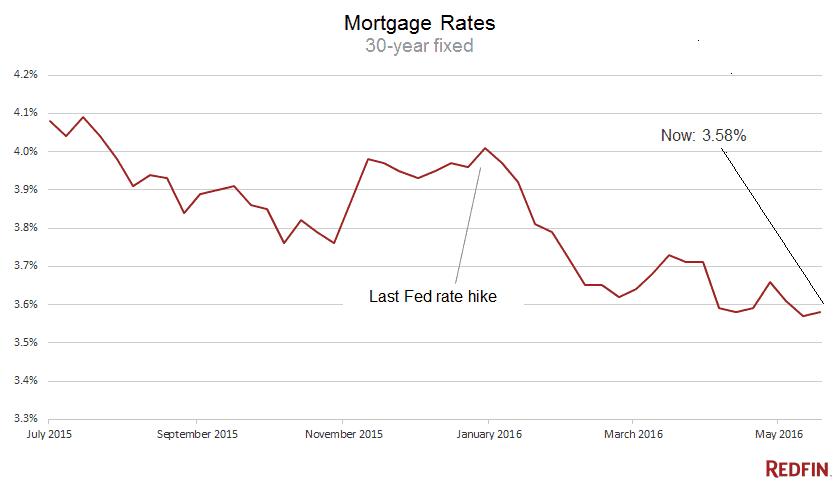

Mortgage rates held close to a three-year low this week, ticking up slightly to an average 3.58 percent on 30-year fixed loans. A year ago, the rate averaged 3.84 percent, according to a survey from Freddie Mac.

Yesterday, Federal Reserve policymakers sent a signal that they might raise rates on their own short-term loans, news that sent financial markets into a tailspin. Most of Janet Yellen’s team think the labor market is improving and economic growth is picking up, according to meeting minutes released yesterday.

Those are good reasons to make money more expensive. The economy is improving and inflation is starting to rise. A lot of financial traders took the Fed’s message to mean that a rate hike could come as soon as next month, pushing the odds of that happening from almost nothing to more than one in four.

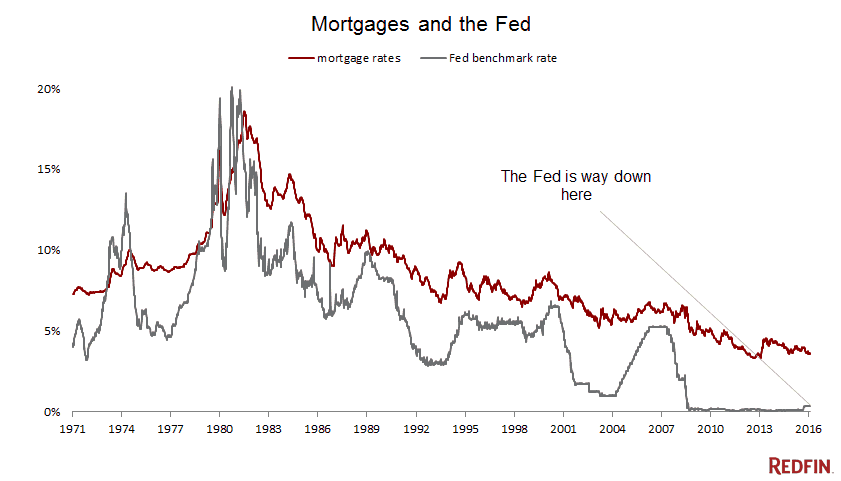

Homebuyers shouldn’t fret. First of all, the Fed doesn’t directly control rates on long-term loans like mortgages. When the central bank dropped its benchmark rate to near zero in 2009, mortgages got cheaper, but not that much cheaper.

Second, home loans are near all-time lows — a slight increase won’t be a make-or-break for most buyers. Third, big investors are still worried about the global economy and are parking money in safe assets, including mortgages, which has the effect of holding rates down.

“If you want to predict mortgage rate increases, look for a steady and sustained clip of good news like strong wage growth, robust economic expansion and soaring global investment, conditions we’re still waiting on seven years into the recovery,” Redfin chief economist Nela Richardson said. “Lacking these conditions, a Fed rate increase in June barely moves the needle on mortgages.”

Fed policymakers meet again June 14-15. Here’s what happened to mortgages the last time they raised rates.

Source: Freddie Mac

United States

United States Canada

Canada