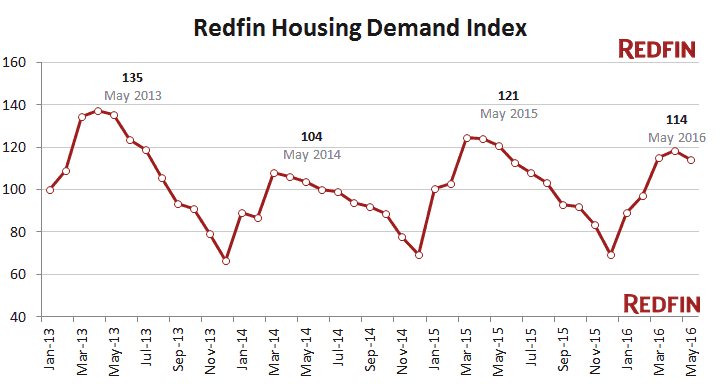

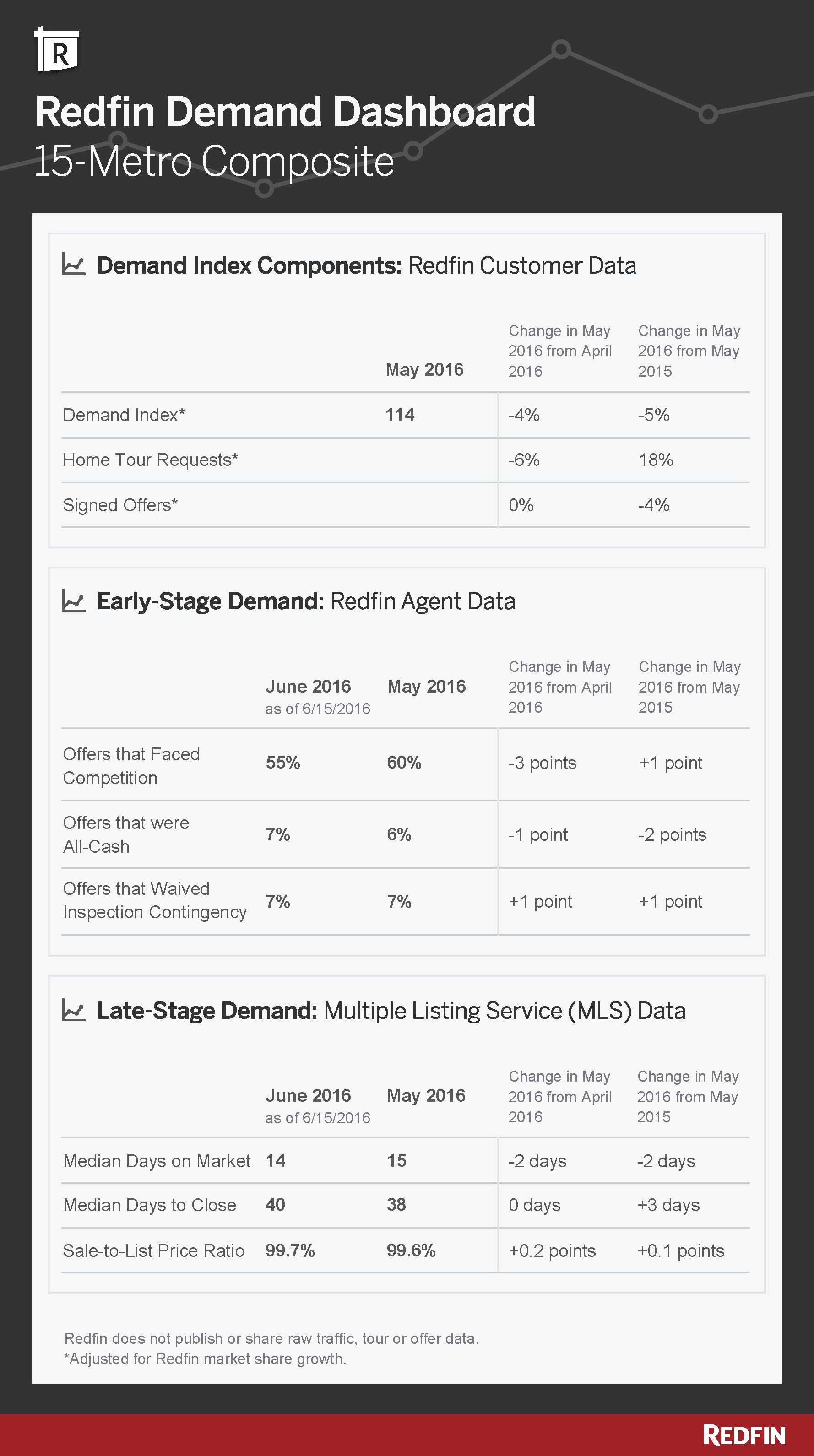

The Redfin Housing Demand Index fell 5.3 percent to 114 in May, the sixth-consecutive month of year-over-year declines. Early stage demand remained strong, with the number of Redfin customers requesting tours up 17.7 percent year over year, down from the 19.8 percent increase recorded in April. Faced with a diminishing number of homes to choose from, 4.5 percent fewer people wrote offers last month than a year earlier. May marked the third month of year-over-year declines in offer activity.

“Two of the fundamental drivers of buyer demand are better this year than last year, yet we still saw buyer interest retreat,” said Redfin chief economist Nela Richardson. “Thirty-year mortgage rates are at three-year lows and the unemployment rate is down to 4.7 percent nationally, compared to 5.5 percent last year. However, steady job growth and low rates are no match for the drought in available homes for sale, which stifled buyer demand.”

Across the 15 metro areas measured by the Demand Index, home prices grew 4.7 percent from a year earlier, while sales increased 5.3 percent. May marked the 13th-consecutive month of year-over-year declines in inventory, falling another 3.5 percent last month. A 1.1 percent drop in new listings further exacerbated the supply shortage last month.

May was a record breaker in terms of speed and intensity. Homes sold at their fastest pace on record since at least 2009. Across the 15 metro areas tracked by the Demand Index, the typical home stayed on the market for only 15 days last month, two days faster than last year.

Nearly 29 percent of homes sold for more than their asking price, up from 26.8 percent last year and the largest portion recorded since July 2013. The average sale-to-list price ratio came in at a record-breaking 99.7 percent, up from 99.5 percent a year earlier.

Sixty percent of offers Redfin agents wrote faced competition in May, up one percentage point from last year. So far in June, however, just 55 percent of offers have faced bidding wars.

How is it that the market feels so intense, yet overall demand is lower than last year?

In Denver, the nation’s fastest market where the typical home sells in just six days, Redfin agent Michelle Ackerman describes the market as “lackluster” due to the extreme scarcity of homes for sale.

“The root of Denver’s inventory shortage this year is that move-up buyers can’t move up because there’s nothing for them to buy, and they’re fearful of selling their homes and having nowhere to go,” Ackerman said. “If we could get them into their move-up properties then we’d have more entry-level ones for sale.”

Still, serious buyers are finding homes and getting them under contract in fewer tries than it took people in previous years.

“People who are out there with very competitive offers are hitting home runs,” Ackerman said. “In 2014, when the market first started heating up, many buyers had to write six or seven offers before winning a bidding war. Today, we’re down to just two or three.”

The Demand Index tracks millions of visits to Redfin.com and the touring and purchase offers of thousands of Redfin customers in 15 major metro areas. The index equaled 100 on January 2013, the first month of the estimation period, and is adjusted for changes in Redfin market share.

United States

United States Canada

Canada