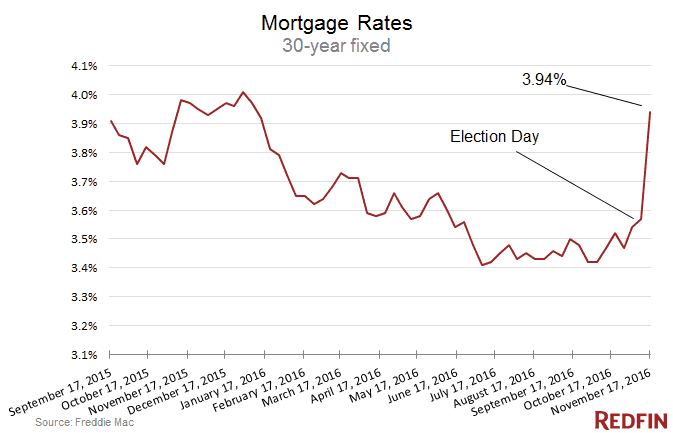

Mortgage rates shot up this week, averaging 3.94 percent for a 30-year, fixed-rate loan, up from 3.57 percent last week. Last year at this time, rates were 3.97 percent, according to Freddie Mac.

What does this mean for homebuyers and homeowners going forward? That’s not as clear.

“The new Trump administration’s economic plan has the potential to have long term effects on housing,” said Redfin chief economist Nela Richardson.

“We are awaiting specific details on a gamut of housing related policy issues from government-sponsored enterprise reform to immigration policy. To the extent that the cumulative effect of Trump’s economic plans is to increase affordable housing supply and expand mortgage credit, this would be a boon to the housing market in general and to first-time buyers in particular.

“In the short term, we are already seeing an effect of the Trump presidency on mortgage costs. In the past 2 weeks, the 30-year fixed mortgage rate has increased 40 basis points to just shy of 4 percent. The recent rise in mortgage rates is largely attributed to Wall Street optimism regarding Trump’s proposals for increased infrastructure spending and tax cuts. In short, Wall Street is now anticipating higher economic growth and inflation in 2017.

“We expect rates will be higher in 2017 than the rock bottom rates of 2016. However, we don’t expect that the rise in rates will be high enough to significantly affect consumers’ plans to buy or sell. There are a host of reasons why a family chooses to purchase a home. Rates are just one of them. In that sense, it’s the economic basics of everyday life – job relocation, family changes, lifestyle preferences, desire for more highly ranked schools and shorter commutes – that will continue to be the key drivers of a family’s decision to buy or sell, regardless of who resides in the White House.”

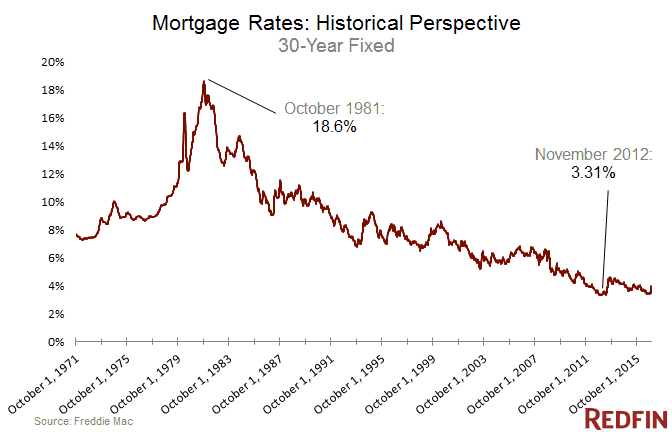

While such a steep hike in rates in one week can be jarring, it’s important to remember that rates below 4 percent are still historically low – and that the rate was higher at this time last year. For borrowers, this is still a good time to be on the market.

United States

United States Canada

Canada