Do you know how much home equity you have? Fannie Mae’s research shows that despite steadily rising home prices many homeowners continue to underestimate the amount of equity they have in their homes. As a result, consumers may be less likely to refinance their mortgage, apply for a home equity loan, or buy a new home.

What’s more, underestimating home equity has an impact on other lifestyle choices, including neighborhoods, jobs, spending, savings and, even the entire economy. Knowing your home equity can help you make better- informed decisions that may significantly change the quality of life for homeowners.

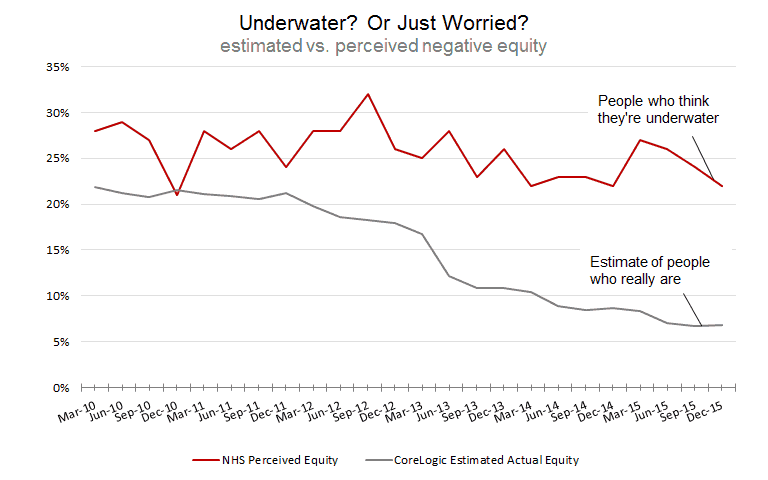

Estimated Versus Perceived Home Equity

House prices have continued to rise since 2012. Just as previous declines in prices pushed some homeowners underwater, meaning they had more mortgage debt than their home was worth, rising prices would be expected to significantly reduce the number of underwater households while raising the number of households with substantial home equity.

That’s exactly what’s happened, according to estimates from CoreLogic. But many consumers simply aren’t aware of it. Each month, as part of Fannie Mae’s National Housing Survey (NHS), we interview homeowners about their attitudes toward owning and renting a home, home and rental price changes, the economy and more.

As shown in the chart below, despite continuing home price growth, the percentage of homeowners who believed they were underwater has remained fairly consistent over time in spite of rising home prices, even though the number of homeowners underwater has decreased, according to CoreLogic. (See Fannie Mae’s commentary on invisible equity for more detail.)

When we asked homeowners to compare their total mortgage debt to the value of their home in December 2014, 23 percent believed that they were underwater.

A year later, this perception increased to 24 percent while, in sharp contrast, only an estimated 7 percent of homeowners were in fact underwater, according to CoreLogic estimates.

At the same time, consumers significantly underestimate their home equity.

While only 40 percent of homeowners said their homes had equity of 20 percent or more, 73 percent did according to CoreLogic estimates. That’s a vast disparity between the perception and the likely reality of the household wealth Americans have at their disposal.

Knowing Your Home Equity is Important

Almost no one buys a home outright with cash, most people get loans. As homeowners pay off those loans and home values rise, they accumulate equity. Home equity is what we actually “own” at any given time. The amount of equity homeowners have isn’t constant, but depends on the current home value and mortgage balance.

Whether to pay for home repairs, college education, or other personal uses, at some point in our lives, many homeowners borrow money against the equity they have in their home to do so. The first step in that process is knowing how much equity you have.

To calculate your home equity, find out the market value of your home. Tally the total debt on the property, including all mortgages and liens and subtract them from the market value of the home.

Once homeowners have a better handle on how much equity they actually have, as opposed to how much they think they have, they can more thoughtfully make key life decisions. One may choose to buy a new home, move to a new neighborhood or community, change schools and perhaps even their job.

Additionally, once homeowners understand their equity position and if they decide to sell their home, this has the added benefit of potentially providing inventory for other home buyers, which is especially needed today in markets with tight supplies.

The idea is not to take on unnecessary mortgage debt or unsustainable behavior, but to be better informed to make major life decisions. What’s more, reducing the gap between perceived and actual home equity has the potential to remove a barrier that may have hindered housing market activity in general and could create a virtuous cycle that is sorely needed in today’s market.

To find out more about home equity, and for the most accurate estimate of your home’s value, contact your Redfin real estate agent or lender.

United States

United States Canada

Canada