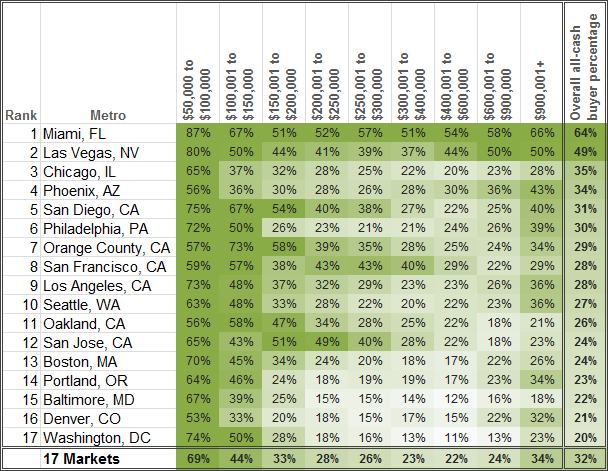

In 17 of the largest U.S. cities, 32 percent of homes purchased so far in 2014 were paid for with all cash. All-cash purchases have been at this level – or even higher – since 2011. The rise in all-cash purchases began in 2007 as the housing bubble popped, and cash purchases accounted for nearly a third of all purchases by 2011. Tighter mortgage lending standards, investor purchases and fewer homes on the market have all contributed to keeping that rate high.

The largest percentages of homes purchased without a mortgage are at the low and high ends of the market. As home prices get into the upper echelon, all-cash purchases become more likely. Miami, Las Vegas, Chicago and Phoenix have the highest percentage of all-cash purchases, while Washington, D.C., Denver, Baltimore and Portland have the lowest percentage.

All-Cash Purchases Less Common In $200,000 to $600,000 Homes

The good news for homebuyers in large metro areas who don’t have a stash of cash is that these all-cash purchases are less common in the middle price range, from $200,000 to $600,000. With over 50 percent of purchases falling in that range, it means that a large group of homebuyers will be a bit less likely to face all-cash offers. In this middle range of home prices, Washington, D.C. (15%), Denver (16%), Baltimore (14%), Portland, Ore. (18%) and Boston (20%) had the lowest percentage of all-cash buyers.

Financed Purchases Not Back to 2000 Levels

In 2000, across the 17 metros, there were 800,000 home purchases financed with a mortgage. By 2011, that number had plummeted to 440,000 and had only recovered to 520,000 in 2013. And while interest rates today are still appealing, tighter lending standards mean less-qualified buyers who don’t have hundreds of thousands of dollars saved up have not entered or re-entered the housing market. Mel Watt, the overseer of Fannie and Freddie (who back the majority of new mortgage loans), recently said we should be making more credit available to homeowners. But there is a sliver of good news: Financed home purchases have been on the rise since 2011, while all-cash purchases remained flat from 2012 to 2013. If this trend continues, financed buyers will face fewer situations where they are competing against all-cash buyers.

United States

United States Canada

Canada