Meanwhile, San Francisco has experienced a flood of homes for sale as Americans flee dense, expensive cities.

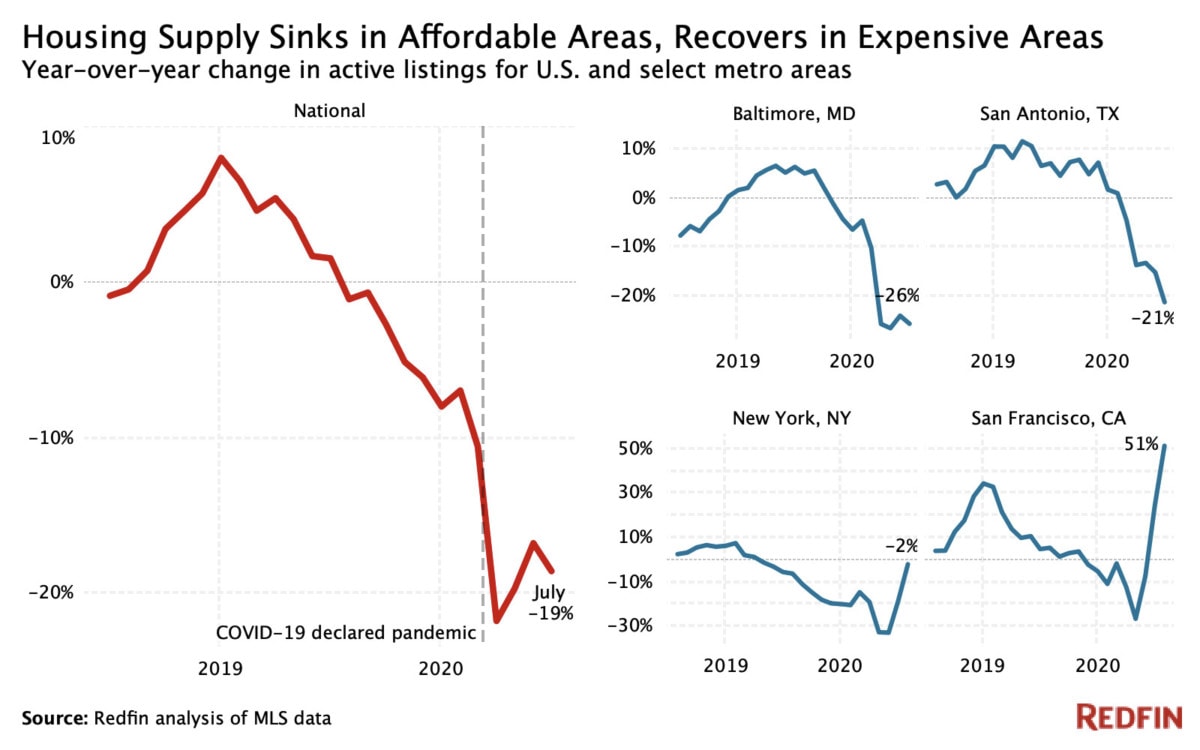

America’s housing shortage was intense before the coronavirus hit, with the number of homes for sale slumping 7% year over year in February. Now it’s even more acute: Supply dropped for the twelfth-straight month in July, plummeting nearly 20% to just 1.9 million homes—the lowest level of any July on record. Some of the nation’s most affordable areas are driving the deficit.

In San Antonio, TX, the number of homes for sale was down 21% year over year in July after having been up 1% in February. That 22 percentage point decline represents the largest drop among the 50 most populous U.S. metropolitan areas, followed by Baltimore’s 21 percentage point decrease. Frederick, MD, Newark, NJ and Chicago tied for third place, all falling 20 percentage points.

A handful of dense, expensive places bucked the national trend. In the San Francisco metro area, the number of homes for sale skyrocketed 51% year over year in July after having dropped 2% in February. The 53 percentage point increase was the biggest gain of any other major metro. New York saw the second largest increase, rising 13 percentage points, followed by San Jose, up 7 percentage points.

Of the top 50 metros, 40 have seen supply growth rates decline since February. The number of homes for sale across the country has dwindled as record-low mortgage rates have sparked a deluge of homebuyer demand that hasn’t been matched by an equal increase in the number of people putting their houses on the market. At the same time, the pandemic has exacerbated the trend of Americans moving from expensive, coastal cities to affordable, inland places—intensifying the supply deficit in the latter areas. These factors have deepened an already-acute housing shortage set off by a homebuilding slowdown after the 2008 financial crisis and the increasing tendency of homeowners to hold onto their houses for longer.

Where Supply Is Shrinking

“There’s a perfect storm in the housing market right now,” said Jason Allen, Redfin’s market manager in Baltimore. “People are more comfortable staying in their homes; they’re investing in pools, offices and better backyards instead of moving. But at the same time, there are suddenly a lot more people who want those amenities, so we’re seeing this huge wave of buyers. We’re meeting far more clients who want to buy a home than sell a home.”

In San Antonio, many homeowners have been nervous to put their houses up for sale, according to local Redfin agent Shea Voss.

“They’ve been preparing for the sky to fall on the housing market because that’s what happened during the last recession,” she said. “As a result, it’s been extremely hard for my buyers to find what they’re looking for, and when they do, there might be 18 other buyers in line. You’ve got to pull out every trick in the book to compete in a bidding war, and oftentimes, you’ll still lose because there are so many buyers and so few homes for sale.”

The fierce competition among buyers has driven up national home prices, which climbed 8% year over year to a record high of about $323,000 in July. Redfin agent Dan Borowy said he’s seeing this play out in the Baltimore area.

“Buyers are willing to pay more for a house than I’ve ever seen—I’m talking $30,000 to $50,000 over the listing price, compared with maybe $5,000 or $10,000 over before the pandemic,” he said. “They’re desperate because homes are flying off the market so quickly. I’m selling all of the homes I’m listing within three days.”

The bidding wars caused by Baltimore’s housing deficit are pushing out many first-time and lower-income homebuyers, Borowy added. When making an offer on a home, buyers have the option to ask sellers for help covering a portion of their closing costs, down payments or other fees. But with so many bidders to choose from, today’s sellers are going with those who don’t need this so-called seller assistance, Borowy said. Oftentimes, they’re also choosing buyers who agree to pay the full listing price of a home even if the appraisal comes in low, which has been happening frequently during the pandemic.

“Baltimore is one of the few major cities in the country where you can still find a home for around $250,000, but those homes are going to disappear in the near future if this level of competition continues,” added Allen.

Where Supply Is Growing

San Francisco has seen the number of homes for sale surge since the pandemic became widespread in the U.S. With so many technology companies allowing employees to work remotely, Bay Area residents are leaving for places that offer more space and affordability, according to local Redfin agent Carlos Barrientos.

“With offices and entertainment shut down, there’s no incentive to stay in San Francisco,” he said. “We have a very high concentration of tech jobs, which means we also have a very high concentration of people who can leave the city for parts of the state with bigger backyards and better weather. All they have to do is set up their Zoom room and get to work.”

In July, 23.9% of Redfin.com users searching from San Francisco were looking for homes in a different metro area, up from 21.1% a year earlier. Sacramento and Seattle were among the top destinations of interest. An even higher share—34.2%—were looking to leave New York City, though that’s down from 39.8% a year prior.

As people depart the San Francisco metro area, new listings there have surged, rising 77% year over year in July. That’s more than any other major metro and far outpaces the 16.5% increase in pending sales—a gauge of buyer demand. This imbalance has been rough on sellers, according to Redfin agent Gabrielle Bunker.

“I had one client who spent $50,000 renovating their home in Mission Dolores—a very desirable, walkable neighborhood. They put in new floors, fancy kitchen appliances and a high-power electric-car charger,” Bunker said. “They got zero offers, and now they’re thinking about moving back in. Buyers here have so many choices right now.”

Bunker said that a rise in construction activity is also part of the reason there’s so much excess supply in San Francisco.

Looking Ahead

Building more homes across the country is one solution to the nationwide housing shortage, according to Redfin lead economist Taylor Marr. It’s already starting to happen. Residential construction projects in the U.S. surged 23.4% year over year in July, and building permits rebounded to their historical average, jumping 9.4% to a seasonally adjusted annual rate of 1.5 million.

“Builders got burned big time during the housing bubble, but they’re finally starting to climb out of the hole as homebuyer demand rebounds, which is a good sign for U.S. housing supply,” Marr said. “What remains to be seen is whether lumber producers, which are facing slowdowns due to the pandemic, will be able to keep up.”

Summary of Housing Supply by Metro Area, July vs. February:

| Metro Area | Change in YoY Active Listings Growth, February to July | February Active Listings Growth, YoY | July Active Listings Growth, YoY | July Median Sale Price | July Median Sale Price, YoY |

|---|---|---|---|---|---|

| San Antonio, TX | -22 pts | 1% | -21% | $260,000 | 9% |

| Baltimore, MD | -21 pts | -5% | -26% | $320,000 | 7% |

| Frederick, MD | -20 pts | 2% | -18% | $448,900 | 7% |

| Newark, NJ | -20 pts | 2% | -17% | $412,500 | 8% |

| Chicago, IL | -20 pts | 2% | -17% | $281,000 | 7% |

| Houston, TX | -17 pts | 1% | -17% | $271,000 | 8% |

| Dallas, TX | -17 pts | -2% | -19% | $322,500 | 8% |

| Minneapolis, MN | -17 pts | 4% | -13% | $312,650 | 10% |

| Detroit, MI | -16 pts | -1% | -17% | $165,000 | 14% |

| Fort Worth, TX | -16 pts | 1% | -15% | $265,000 | 6% |

| Cleveland, OH | -15 pts | -13% | -28% | $175,000 | 3% |

| Memphis, TN | -15 pts | -9% | -24% | $220,000 | 5% |

| Indianapolis, IN | -15 pts | -6% | -21% | $225,000 | 13% |

| Providence, RI | -15 pts | -10% | -24% | $325,000 | 10% |

| New Brunswick, NJ | -14 pts | -9% | -23% | $361,500 | 8% |

| Warren, MI | -14 pts | -4% | -18% | $247,500 | 10% |

| Riverside, CA | -14 pts | -14% | -28% | $420,000 | 11% |

| Columbus, OH | -14 pts | 0% | -14% | $254,200 | 11% |

| Portland, OR | -13 pts | -8% | -21% | $439,000 | 8% |

| Sacramento, CA | -13 pts | -10% | -22% | $462,000 | 10% |

| Atlanta, GA | -13 pts | -5% | -17% | $277,000 | 9% |

| Virginia Beach, VA | -13 pts | -13% | -25% | $273,000 | 9% |

| Oklahoma City, OK | -11 pts | -5% | -16% | $207,000 | 11% |

| Nashville, TN | -11 pts | -5% | -16% | $327,828 | 9% |

| Boston, MA | -11 pts | -1% | -11% | $555,000 | 5% |

| Washington, D.C. | -9 pts | -4% | -13% | $469,000 | 11% |

| Nassau County, NY | -9 pts | -6% | -15% | $481,000 | 1% |

| Jacksonville, FL | -8 pts | -9% | -17% | $264,250 | 8% |

| Austin, TX | -8 pts | -9% | -17% | $355,000 | 11% |

| Tampa, FL | -8 pts | -15% | -22% | $265,000 | 11% |

| Montgomery County, PA | -7 pts | -10% | -17% | $360,000 | 8% |

| Milwaukee, WI | -7 pts | 1% | -6% | $259,000 | 14% |

| Denver, CO | -4 pts | -10% | -14% | $455,000 | 7% |

| Philadelphia, PA | -4 pts | -3% | -6% | $248,000 | 10% |

| Las Vegas, NV | -3 pts | -17% | -21% | $309,500 | 9% |

| Seattle, WA | -3 pts | -13% | -16% | $622,716 | 11% |

| Anaheim, CA | -2 pts | -17% | -20% | $763,000 | 5% |

| Pittsburgh, PA | -2 pts | -1% | -3% | $200,000 | 9% |

| San Diego, CA | -2 pts | -20% | -21% | $642,000 | 10% |

| Cincinnati, OH | -1 pts | -14% | -15% | $222,000 | 13% |

| Fort Lauderdale, FL | 0 pts | -9% | -9% | $318,500 | 14% |

| Miami, FL | 1 pts | -9% | -8% | $340,000 | 8% |

| Los Angeles, CA | 2 pts | -17% | -16% | $700,000 | 8% |

| Orlando, FL | 2 pts | -12% | -10% | $280,000 | 9% |

| Oakland, CA | 4 pts | -17% | -13% | $815,000 | 9% |

| West Palm Beach, FL | 5 pts | -10% | -5% | $325,000 | 14% |

| Phoenix, AZ | 7 pts | -22% | -16% | $318,975 | 14% |

| San Jose, CA | 7 pts | -20% | -13% | $1,195,000 | 6% |

| New York, NY | 13 pts | -15% | -2% | $532,500 | 1% |

| San Francisco, CA | 53 pts | -2% | 51% | $1,475,000 | 4% |

| National | -12 pts | -7% | -19% | $323,245 | 8% |

United States

United States Canada

Canada