“Greed,” Gordon Gekko once declared, “is good.” Oliver Stone’s private-equity titan was referring to the process of creative destruction, in which ravenous corporate raiders strip a businesses to its bones in three months flat.

Venture capitalists have the same simple attitude toward growth: growth is good. Their fish of choice is not a piranha but a mola mola, a fish whose only defense against predators is becoming, within a year of birth, too large to swallow.

If the mola mola were a startup, its competitive advantage would be its business model, which is simply to grow faster than any other fish in the sea. This is what I’ve spent my whole professional life trying to do: hit $100 million in revenue within five years of founding.

But now I wonder if the fastest-growing business is the best business. Growth, to be sure, is still good and the time it takes a business to grow matters. But it still matters less than what you ultimately become.

In my experience, venture capitalists tend to focus on business models that can grow quickly. But for entrepreneurs, all the talk about business models — economies of scale, time-to-market, stock-price multiples, gross margins, network effects and expansion rates — is mostly a distraction from the long, lonely task of perfecting the customer experience.

Microsoft, for example, grew faster by building software that could run on a wide range of cheap computers, but Apple won by controlling every aspect of the customer’s experience, from the hardware to the software to the retail store.

Amazon beat eBay in the same way. Rather than hosting a purely digital marketplace with purely digital margins, Amazon selected, priced, packed and shipped most of the items for sales on its site.

While eBay sold everything from beanie babies to BMWs, Amazon launched one product category at a time, sometimes losing hundreds of millions on electronics or clothes.

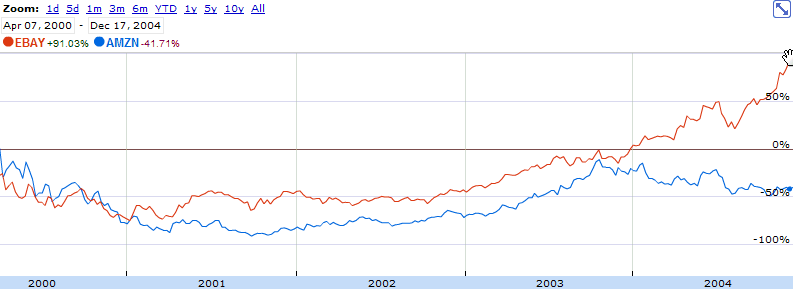

Investors initially loved the network effects, financial performance and scalability of an auction site, with no warehouses, and no employees working as buyers and merchandisers. For five years, eBay’s stock surged past Amazon’s, giving Benchmark Capital a far better return on eBay than Madrona Venture Group got on Amazon:

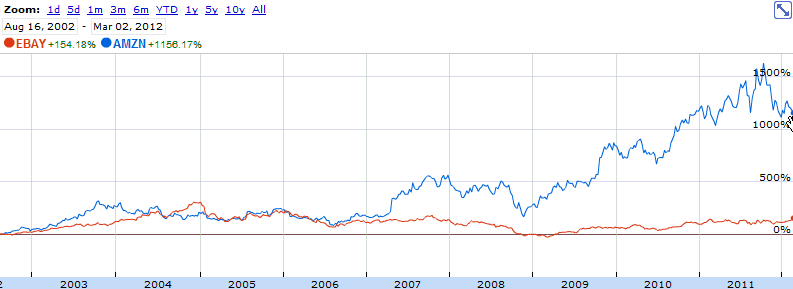

But it turned out that customers preferred a well-run online store, with a wide selection of high-quality products that arrived on time. Amazon eventually pulverized eBay:

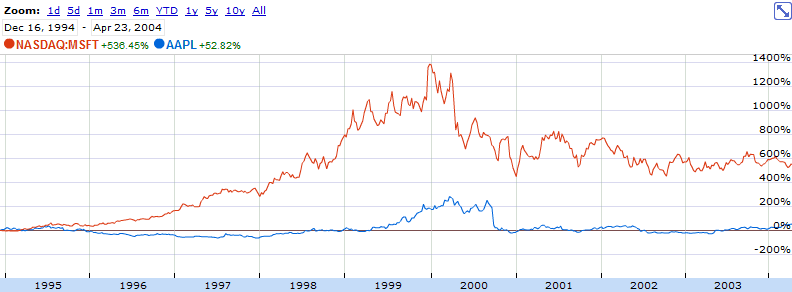

It is almost cruel to make the same comparison between Apple and Microsoft, but doing so just reminds us how permanent Microsoft’s advantage over Apple once seemed to be. The market initially loved Microsoft for its model of making software for a wide range of devices:

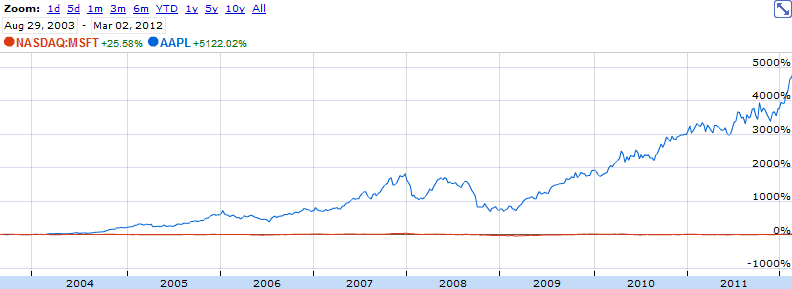

Microsoft’s model scaled better, but customers struggled to get Microsoft’s software to work with a wide range of hardware, a problem no one has had with Microsoft’s singular win over the past few years, the X-Box. And once the innovations shifted to the devices themselves, with new phones and tablets, the ability to pair hardware and software into a perfect customer experience propelled Apple past Microsoft.

The results have been shocking. In a graph comparing any other stock with Apple’s over the past decade, the other stock just looks like the x-axis:

Microsoft just has the misfortune of most often being the comparison stock.

Many people say Microsoft couldn’t keep up because it stopped developing innovative software after Bill Gates left, but the real problem has been that Microsoft’s software hasn’t been running on innovative hardware, because Microsoft lost control of half the customer experience. Whoever leads Microsoft back to greatness will need a mandate to use all of the company’s capital to start building its own computers, phones and tablets alongside an operating system

The moral of the story is clear. Seven years ago, any investor seeking to catch the nearest way would have cited the “business model” as the primary advantage that Microsoft had over poor proprietary Apple, or that eBay had over the laggards at Amazon’s merchandising groups and distribution centers. But entrepreneurs like Jeff Bezos and Steve Jobs only talked about the customer experience.

This focus on customer experience, not business model, was a lesson I first learned from a retailer. When I moved back to Seattle in 2004, investors loved to talk about Wal-Mart’s business model, which was open to every consumer and which sold everything. Wal-Mart was the mola mola of retail, with terrifying economies of scale.

That was the year I met Costco’s chief financial officer, to ask him about a company my friend and I wanted to start. The CFO graciously dismissed the idea in two or three minutes. As I prepared to go, I asked about Wal-Mart, and suddenly had the surreal experience of hearing a very conservative, middle-aged man explain to me how all that is solid could melt into air.

“Wait right there,” he said. “How do you feel when you shop at Wal-Mart?” Then he answered his own question. “Terrible.”

“What do you think it’s like to work there?” he asked. “Terrible.”

“And what do you think it’s like to be Wal-Mart’s supplier? Terrible.”

He talked about how many Costco stores have employees who worked there twenty years. He said that Costco sells the best products at the best value, which is a lot different than selling the cheapest stuff for even cheaper prices.

I later learned that Costco never likes to account for more than 20% of a supplier’s sales, to ensure that stocking decisions never jeopardize a supplier’s business.

“The Costco experience is a better customer experience,” he said. “And the better customer experience always wins in the end.” His focus on how a shopper felt in a store seemed painfully naive at the time; I’d just read a Business 2.0 article about Wal-Mart’s leverage over a pickle company’s pricing, about its technology for tracking every grape, its data on who buys carrots and kettle chips together. But this guy was talking about the shirt-pins Costco employees wear, the ones that say “Associate since 1992.”

All the same, the CFO’s conviction unsettled me. It was the first time I’d heard an adult insist that everything that seemed so permanent could change, and I’ve often reminded myself since what an essential quality of leadership this is.

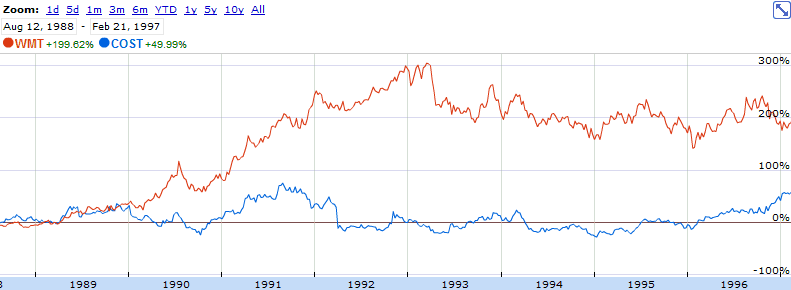

So the next day I bought Costco’s stock. I held it for a few weeks, then lost track of why I ever thought Costco could beat Wal-Mart, and sold. This turned out to be a terrible mistake. Yes, Wal-Mart had been crushing Costco:

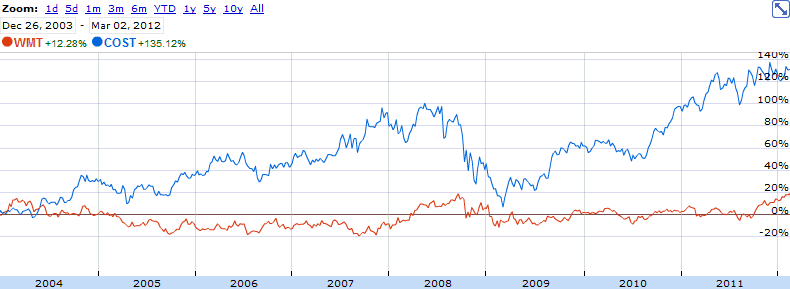

But now look at what Costco, with a bizarre business model that limited selection and required membership, did in the past seven years to Wal-Mart:

Businesses focused on the best customer experience rather than the best business model may appeal to investors less, because they take longer to perfect. But usually they win.

The same dynamic is why Facebook, which once grew a single college campus at a time, overtook the growth-by-spam model of MySpace. It’s why Twitter developed its own mobile clients, creating a better customer experience at the expense of the open model that drove its initial proliferation.

And it’s why the New York Times will beat content aggregators and link farms, why Uber will beat Taxi Magic, and why I hope Redfin, in the end, will be one of the most valuable technology-powered companies in our industry.

United States

United States Canada

Canada