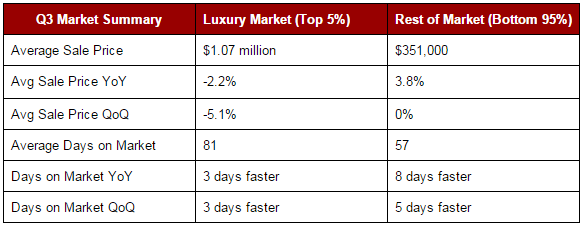

Home prices in the luxury market fell 2.2 percent in the third quarter compared to last year, the first time prices for the nation’s most expensive homes have fallen since the first quarter of 2012. The luxury market, which we identify as the priciest 5 percent, was shown up by the bottom 95 percent, where prices grew 3.8 percent over the same period. The bottom 95 percent of the market has seen consistent price growth of around 4 percent in each of the past four quarters.

Last quarter’s dip in values might indicate that wealthy buyers and foreign investors are stepping out, as not even they want to buy at the top of the market. Volatility in global markets and a bigger supply of luxury products might also be pushing prices down.

Redfin San Francisco agent Mia Simon said three clients decided to back away from purchases due to volatility in the stock market and concerns about their liquidity. “Luxury buyers don’t buy because they need a place to live, so they have flexibility to time a home purchase when the market is favorable,” she said.

Redfin chief economist Nela Richardson said, “High-end buyers are usually not weighed down by rates, mortgages or competition from other buyers, but they do look for deals. The luxury market was the first to recover from the housing downturn, and now it’s a bellwether of slowing price growth for the rest of the market. Sales at the top end of the market continue to soar, but prices are downshifting.”

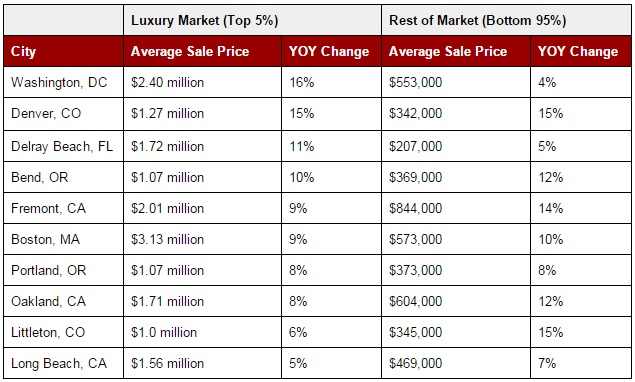

Biggest Winners

Several cities bucked the price depreciation trend with significant luxury price growth in the third quarter. Washington, Denver, Delray Beach, Fla., and Bend, Ore., saw double- digit, year-over-year gains. Delray Beach and Bend have been on the winners’ list for two consecutive quarters.

Several emerging tech hubs were among the winners, including Denver and its suburb Littleton, as well as Bend and Portland, Ore.

In California, the East Bay also was hot. In Oakland and Fremont, luxury home prices increased 9 percent and 8 percent respectively. As we reported in our San Francisco Market Tracker, low inventory has plagued the Bay Area, driving values up and pushing buyers out.

Redfin agent Mia Simon explains that Fremont is appealing due to highly-ranked schools and proximity to Silicon Valley, while the high-end parts Oakland offer a mix of city and suburban life that is increasingly attractive to those who would normally look in San Francisco. “These areas tend to have highly ranked elementary schools, walkability and great public transportation options for those who work in downtown San Francisco,” she said.

Simon expects Oakland and Fremont to continue to see above average appreciation in the years to come.

Biggest Losers

Scottsdale, Ariz., and Boca Raton, Fla., were the luxury-market losers of the quarter, with year-over-year price decreases of 15 percent.

Fort Lauderdale wasn’t far behind, with a 14 percent drop in values. Boca Raton and Fort Lauderdale made the losers list for the second quarter in a row, with luxury prices likely sinking due to a wave of luxury condos hitting the market.

“There’s very limited land area to build single-family homes in Boca and Fort Lauderdale, so builders are focusing on luxury high-rises,” said Aaron Drucker, Redfin managing broker in South Florida. “The increase in supply is pulling down sale prices for the entire luxury segment.”

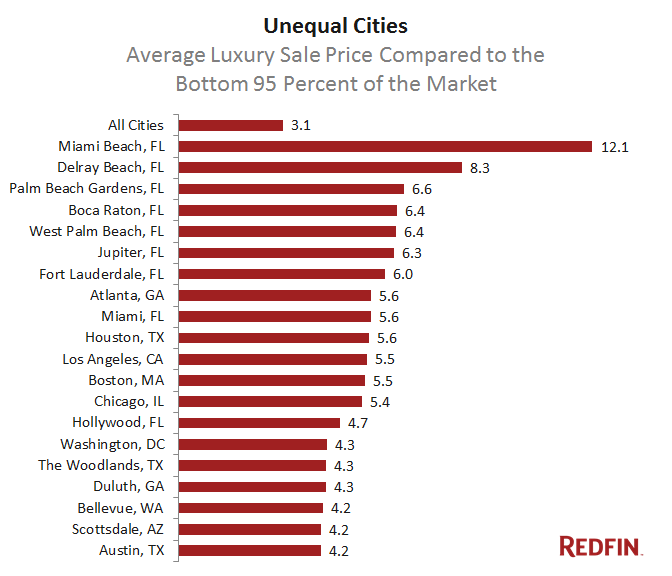

Most Unequal Cities

For the second quarter in a row, Miami Beach earned the title of most unequal city. The average price for a Miami Beach luxury home was $6.32 million, more than 12 times the average price in the rest of the city.

Nine of the 20 most unequal cities were in south Florida, where the luxury real estate market isn’t driven by the local economy. The median income in Miami-Dade County is only $43,000, and there’s no high-paying oil or tech industry.

“It’s a case of the haves and the have nots,” Drucker said. “Buyers in the multi-million dollar luxury market are foreign or coming from out of state, while the folks who live and work here full time make up the rest of the real estate market.”

Other cities on the unequal list: Atlanta, Houston and Los Angeles, where luxury properties are more than five times more expensive than a typical home.

Methodology: Redfin tracks the most expensive 5 percent of homes sold in more than 600 U.S. cities and compares price changes to the bottom 95 percent of homes in those markets. Analysis is based on multiple-listing and county recorder sales data in markets served by Redfin. To determine luxury market winners and losers, we look at cities with at least 40 luxury sales in the quarter and a luxury price point of at least $1 million. To determine the most unequal cities, we look at cities with at least 25 luxury sales in the quarter and a luxury price point of at least $1 million.

Want to receive reports like these regularly? Click here to join our media email list.

United States

United States Canada

Canada