Buyers seem undeterred, as pending sales soar 28% and a 9% increase in new listings brings little relief.

Key housing market takeaways for 434 U.S. metro areas during the 4-week period ending September 6:

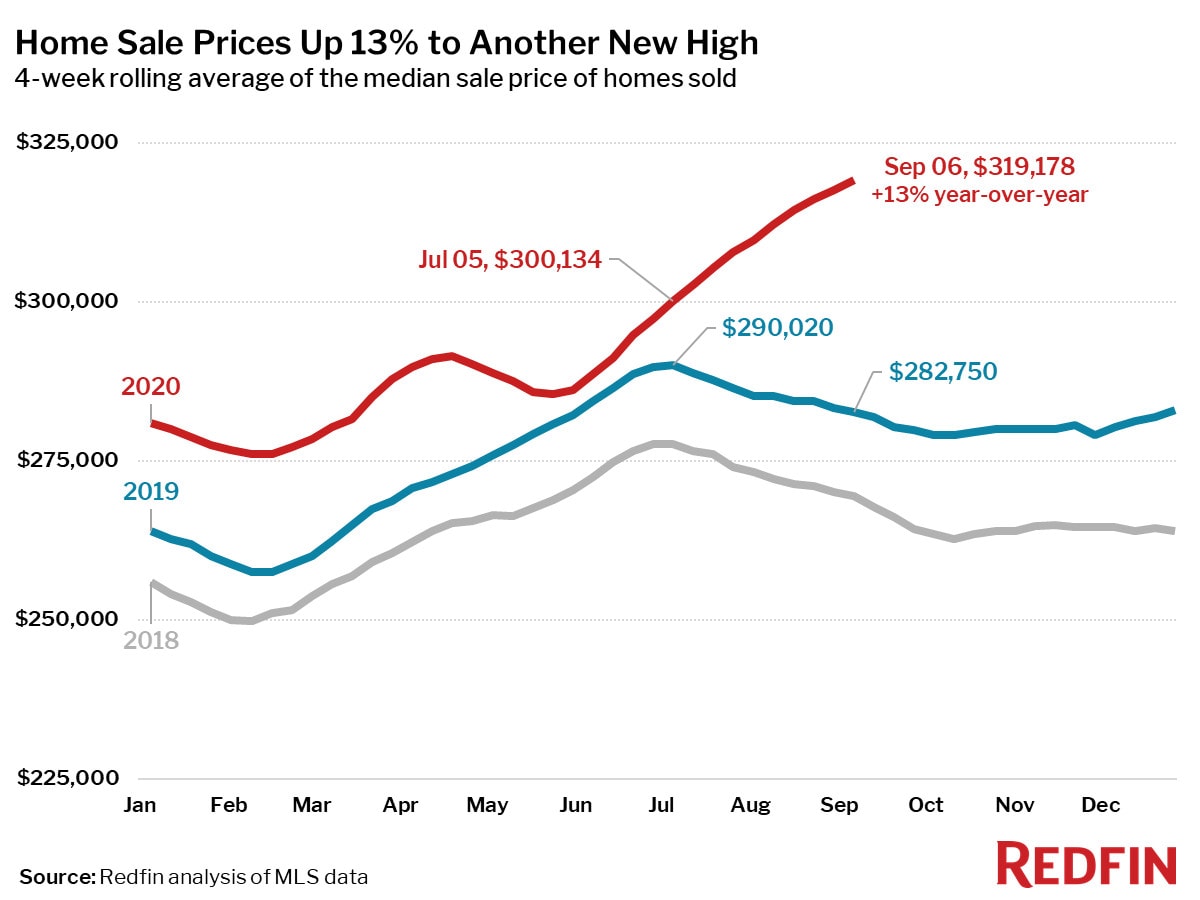

- Median home sale price increased 13% from 2019 to $319,178—the highest on record. The 13% year-over-year increase was the largest since October 2013.

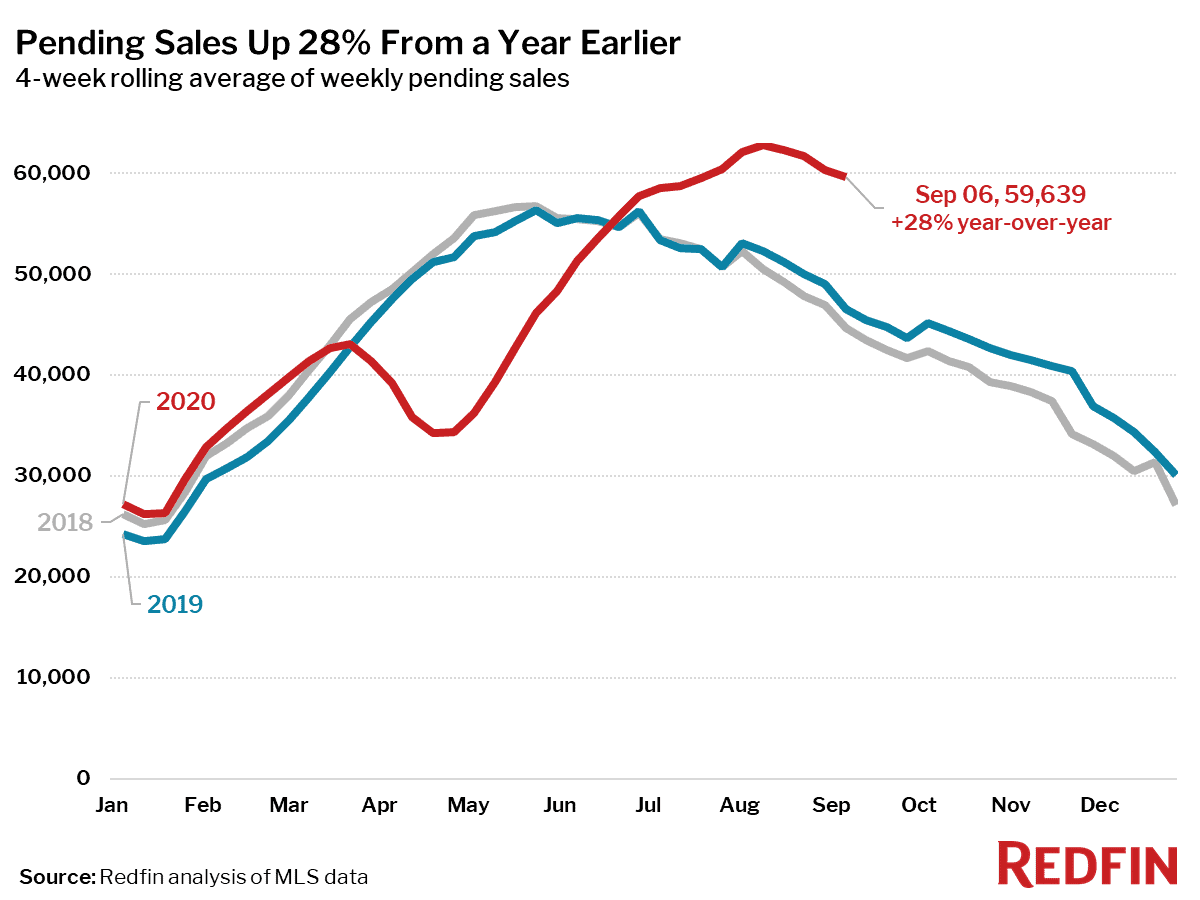

- Pending home sales climbed 28% year over year, the largest increase since the four weeks ending August 2, 2015.

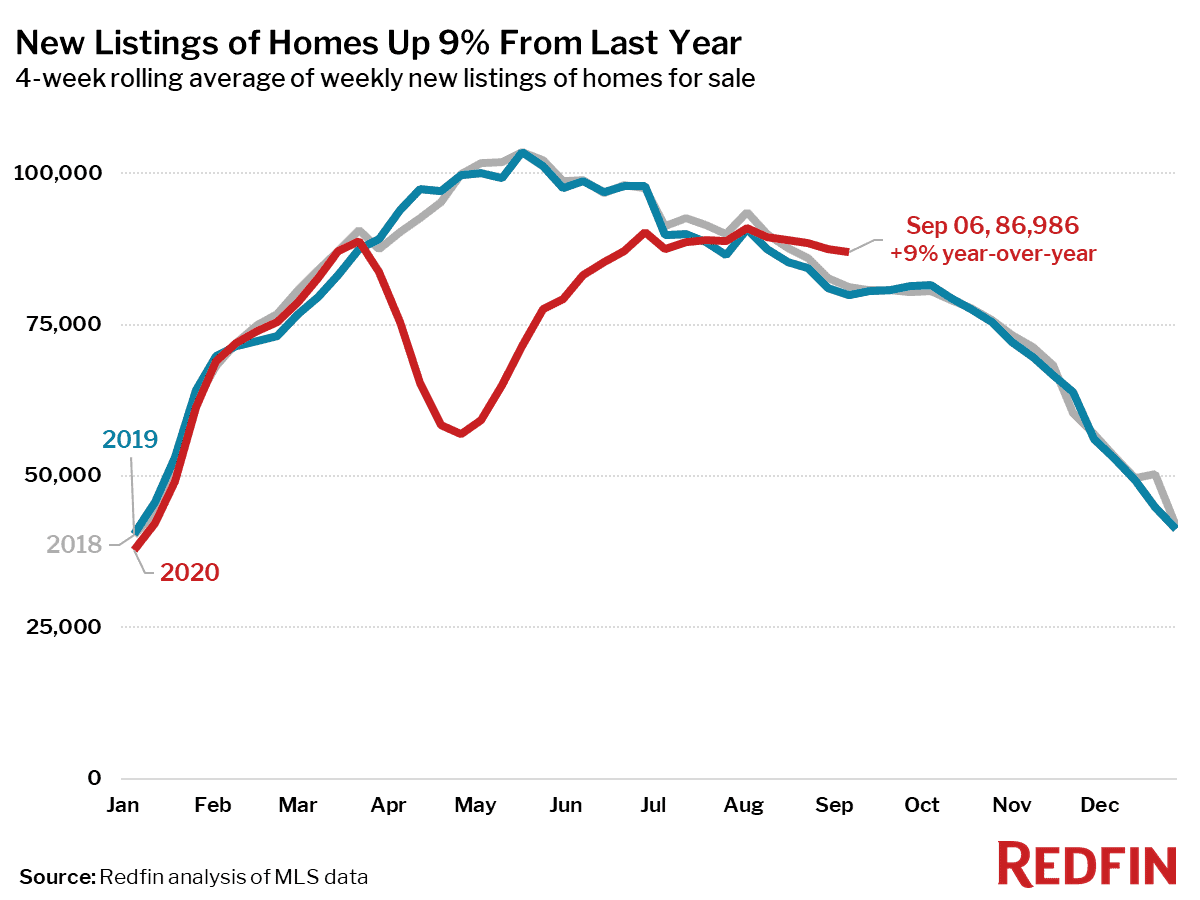

- New listings of homes for sale were up 9% from a year ago—the largest increase since the four weeks ending December 20, 2015.

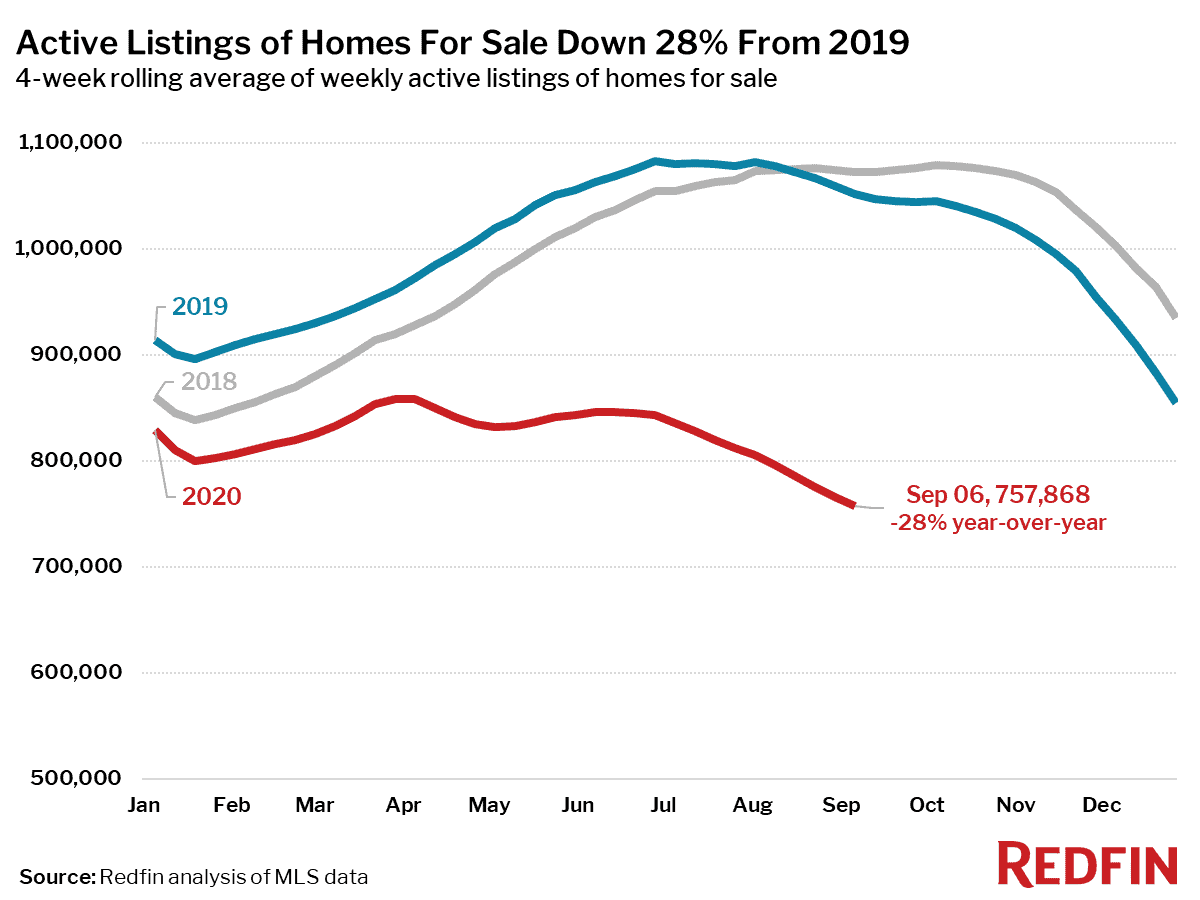

- Active listings (the number of homes listed for sale at any point during the period) fell 28% from 2019 to a new all-time low. The year-over-year decline has been about the same for the past couple of months.

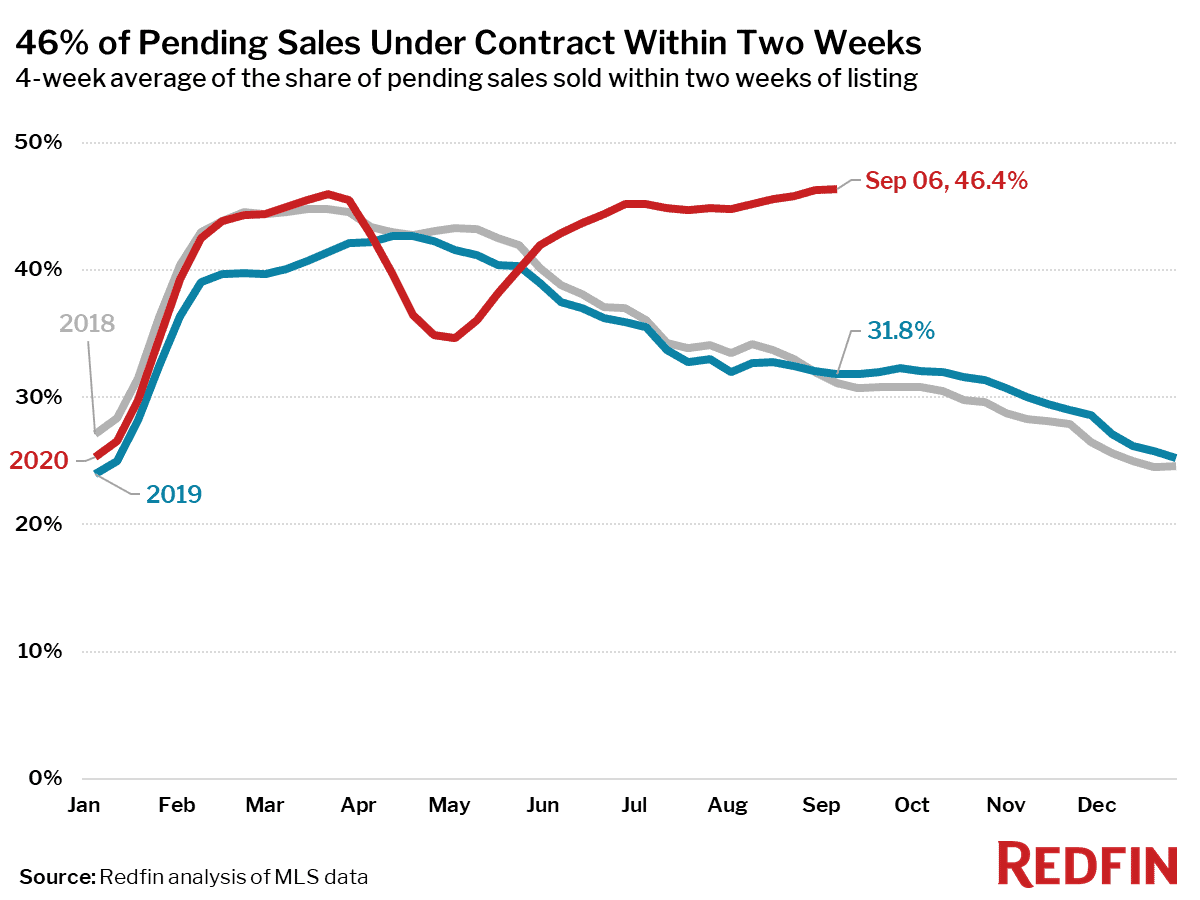

- 46.4% of homes that went under contract had an accepted offer within the first two weeks on the market, the highest level since at least 2012 (as far back as our data on this measure goes).

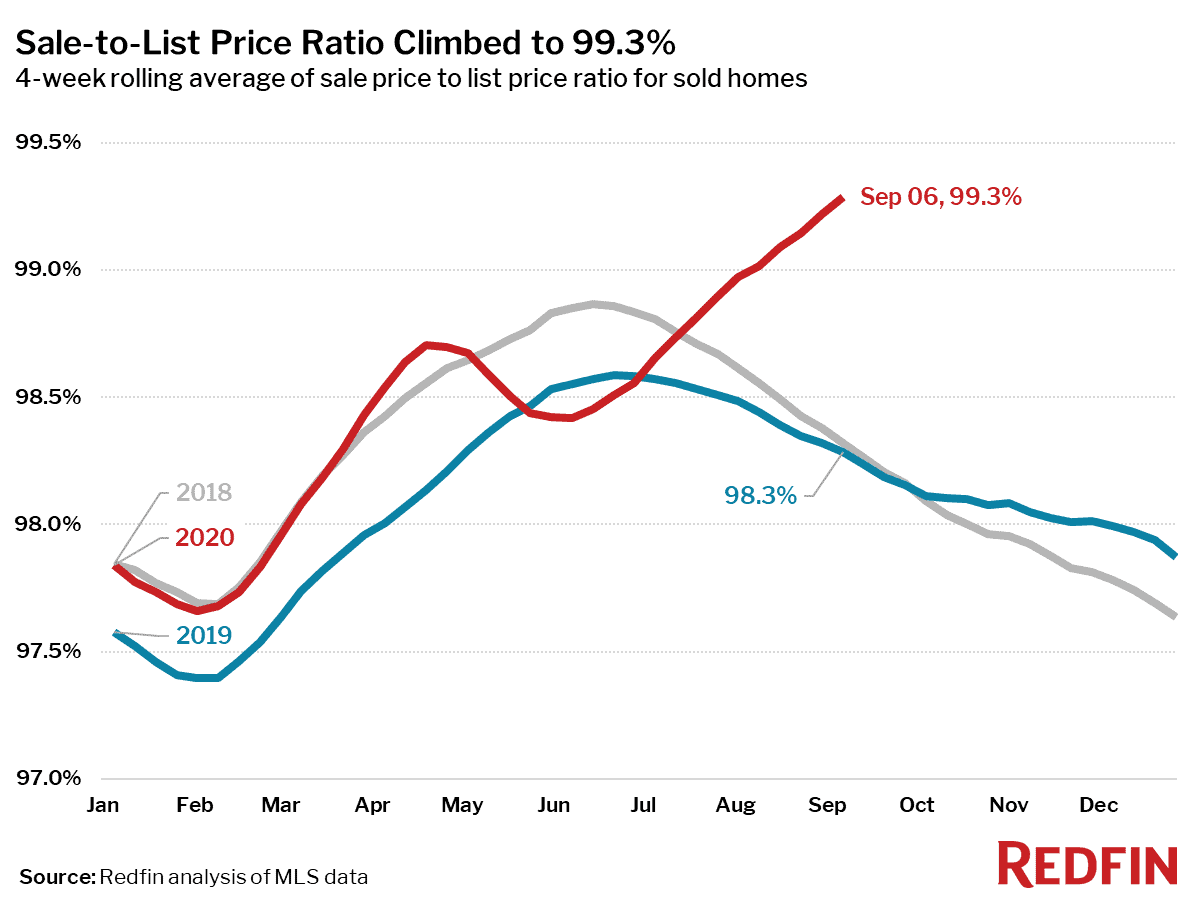

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 99.3%—an all-time high and a full percentage point higher than a year earlier.

- For the week ending September 6, the seasonally adjusted Redfin Homebuyer Demand Index was up 21% from pre-pandemic levels in January and February.

“Home price growth this high is making the housing market especially difficult for first-time homebuyers right now,” said Redfin chief economist Daryl Fairweather. “Rising prices are just one more reason for people to leave expensive urban neighborhoods behind. The sudden rise of remote work has allowed homebuyers who are priced out of one neighborhood to expand their search to more affordable areas. In turn, they are pushing up home prices in those relatively affordable areas, causing more people to look to even more affordable areas, and so on. Price growth may slow in 2021, but even if it does, high prices are going to continue to make affordability a concern for buyers.”

“I’ve been helping more buyers from out of town lately, mostly from the Bay Area,” said Seattle Redfin agent Christian Cerone. “They’re unfazed by the intensity of the market, since that’s been the norm there for quite a while. We’ve also started to see bidding wars even on homes above $1 million, which were seemingly immune to bidding wars even when the market got really crazy in recent years. With so much wealth coming into the city from more expensive places, there are plenty of buyers right now who have the potential to buy those $1-$2 million homes.”

Redfin agents in areas affected by wildfires report that the smoke is slowing down some home-buying activity.

“Home touring is slowing down in San Francisco due to the fires—people don’t want to go outside with all of the smoke in the air,” said local Redfin agent Gabrielle Bunker. “Some buyers have also started raising concerns about being able to get fire insurance because insurance companies have tightened up their requirements for fire coverage.”

United States

United States Canada

Canada