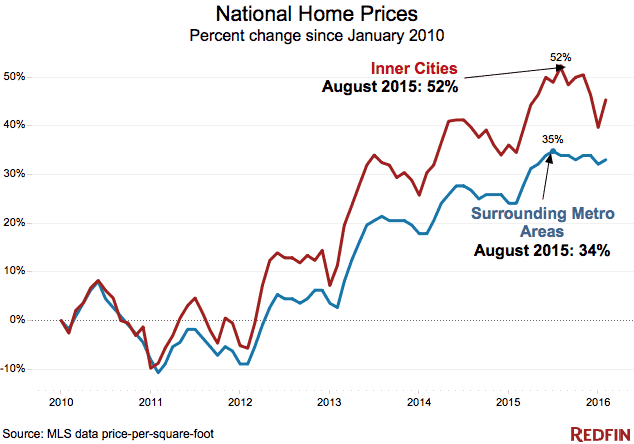

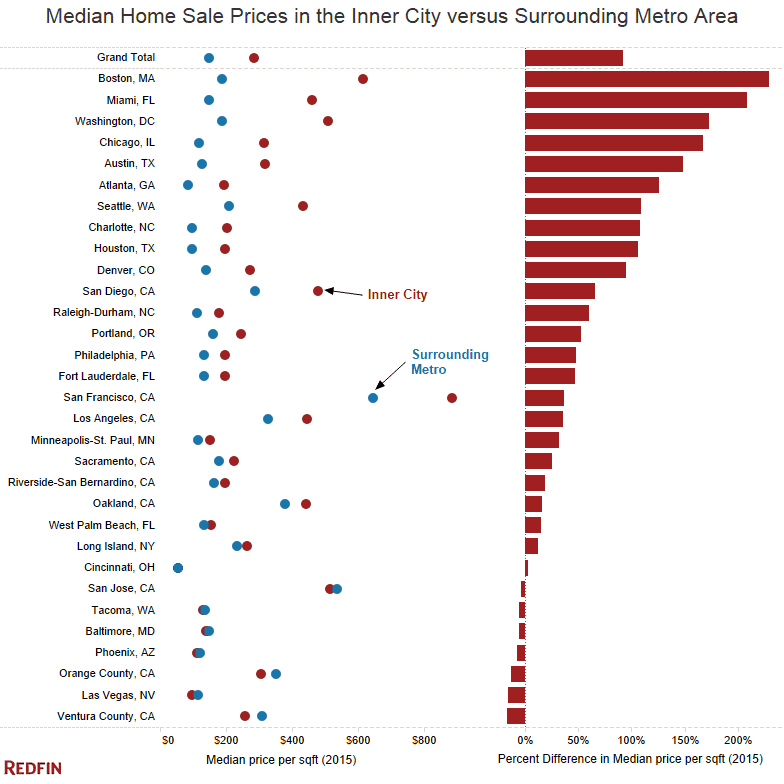

Donald Trump mentioned “inner cities” 10 times in last night’s second presidential debate, using words like “disaster” and “devastating” to describe them. When neighborhoods decay, home prices decrease. However, a look at home prices in the “inner cities” of most major U.S. metro areas shows that the opposite is happening. Instead of falling, the median price per square foot of homes sold in the inner cities of 31 major metro areas has jumped 52 percent over the last six years, outpacing price growth in the surrounding metro areas by 18 percentage points. The only inner cities where price growth has fallen behind that of the surrounding metro area are Chicago, Houston and Miami. For this analysis, we defined “inner city” as the 5 kilometers around the city center of a given metro area, recognizing that we imperfectly assigned a precise measure to the imprecise idea of the “inner city.”

Not only have inner cities seen stronger price growth in the past five years, inner-city homes tend to cost 92 percent more per square foot than homes in the surrounding metro area. In Boston, a typical inner-city home costs more than twice as much as a typical home in greater Boston. In only seven of the inner cities we looked at, homes were less expensive than those farther out.

The concept of the inner city has changed radically since the 1970s when central districts were synonymous with crime and poverty. In recent years, cities have undergone an economic and cultural Renaissance, making the urban core a popular and highly demanded place to live and to work. New light-rail infrastructure has been built in many inner-city areas, and nowadays the high-paying jobs are showing up downtown instead of in suburban office parks.

That’s not to say that people aren’t struggling, but Donald’s Trump’s picture of the urban core doesn’t match the real estate market, and he more than anyone should know that when it comes to house prices, it’s all about location.

Methodology:

We first determined the city center of the primary city within each metropolitan statistical area using the polygon centroids of the city or local knowledge about each metro region. Then, using data on more than 6 million home sales, we calculated the distance of every property sold to the city center of its metro. We used this distance calculated to classify any property within 5 kilometers (i.e. 3.1 miles) of the city center, about a 15-minute bike ride, as the “inner city” of a metro. We used the median sale price per square foot for measuring changes in price between the metro and urban core.

United States

United States Canada

Canada