Homebuyers with the income to take on a mortgage payment but without the savings to make a 20 percent down payment have options. Chief among them are loan programs offered by the Federal Housing Administration (FHA), Fannie Mae and Freddie Mac.

Each allows borrowers to put as little as 3.5 percent down. Fannie and Freddie accept as little as 3 percent. So which is better?

Until last month, the answer for many buyers was FHA. But in April, insurers for Fannie Mae and Freddie Mac reduced the fees they charge on low-downpayment mortgages, making them less expensive for a select group of borrowers — those with nearly perfect credit.

Understanding mortgage insurance

Loans backed by Fannie and Freddie, known as conventional loans, make up the majority of the mortgage market today. After a lender finalizes your mortgage, it’s usually sold to one of the government-sponsored enterprises, which guarantees it against loss then sells it again, this time to big investors such as pension funds.

At Fannie and Freddie, homebuyers who put less than 20 percent down must also buy private mortgage insurance (PMI), which protects those investors if the borrower defaults.

At FHA, the government insures the loans directly, charging a premium that becomes part of the borrower’s monthly payment. The program was designed to encourage mortgage lending to first-time homebuyers, low-income borrowers, minorities and other underserved populations.

The FHA premium and Fannie and Freddie private mortgage insurance serve the same purpose – protecting the note holder if the borrower can’t pay.

What’s better for you?

Here’s the big difference. With Fannie and Freddie, the better your credit, the cheaper the insurance. At FHA, the price is static.

When calculating the monthly cost of a low-downpayment mortgage from Fannie or Freddie, a buyer needs to factor in the cost of private mortgage insurance. If you have a high credit score, you’re lower risk and your PMI – and your monthly mortgage payment — is lower.

At FHA, the fee doesn’t change. People with pristine credit pay the same as everyone else.

Borrowers should do careful math when choosing between the two programs.

Some history

After the housing crash, FHA premiums rose significantly as the agency worked to shore up its finances. In January 2015, President Obama cut those premiums, making FHA mortgages a better deal for all borrowers regardless of credit score.

The Urban Institute published a blog and graph at the time to show how many people would benefit from switching to an FHA loan.

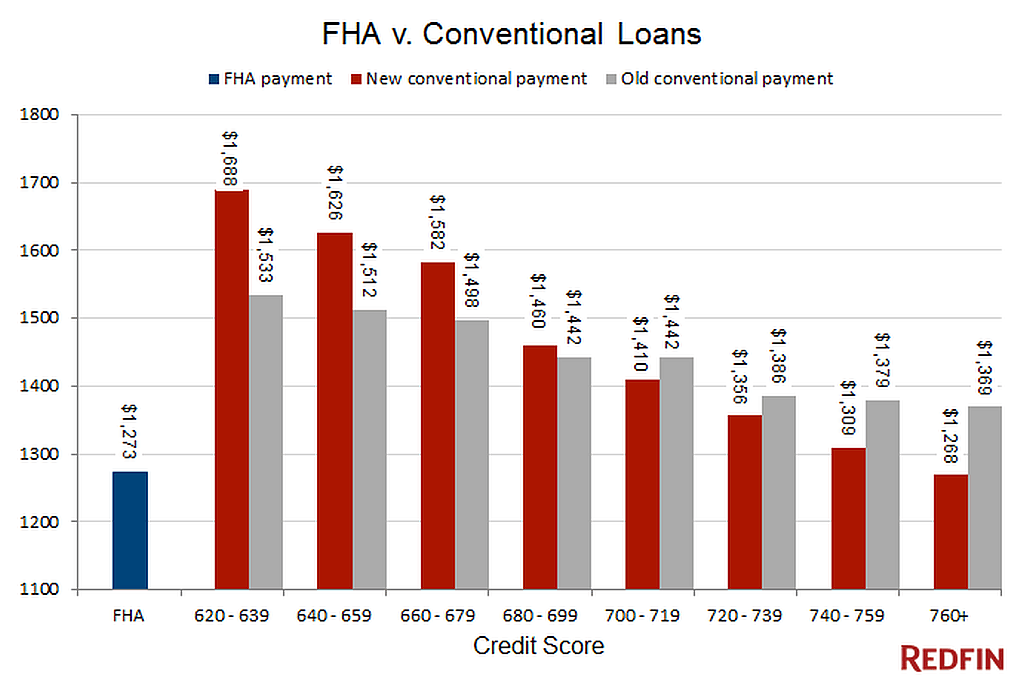

Take someone buying a $250,000 home with 3.5 percent down. From January 2015 until last month, an FHA loan had a lower monthly payment than one from Fannie or Freddie. Even borrowers with great credit paid almost $100 more using a conventional loan.

For borrowers with credit scores of 700 and higher, the new, less-expensive mortgage insurance premium at Fannie and Freddie translates to savings of $30 to $101 a month. For homebuyers with the best credit, payments fall sharply, to $5 less than an FHA loan.

For borrowers with scores of 740 to 759, a low-money down conventional loan is still more expensive than one from FHA but the gap has narrowed substantially, from $106 to $30.

It’s important to remember that Fannie and Freddie insurance payments stop once the mortgage balance falls to less than 78 percent of the home’s value. The FHA’s premium never goes away. That’s another reason for potential borrowers to favor conventional loans, even if the monthly payment is slightly higher.

The Upshot

The Fannie and Freddie price change is a boon for borrowers with good credit, but as the chart shows it raises costs for borrowers with lower scores, making conventional loans even less attractive than they were for those homebuyers.

How big a group could be impacted? The overwhelming majority of FHA borrowers put 5 percent or less down for their mortgage. About a third of them have credit scores above 700, the range where conventional loans just got cheaper. And 13 percent have credit scores above 740, where they might now find Fannie and Freddie loans more attractive.

So while this change impacts only a small number of borrowers, it’s worth checking to see if it might help you.

United States

United States Canada

Canada