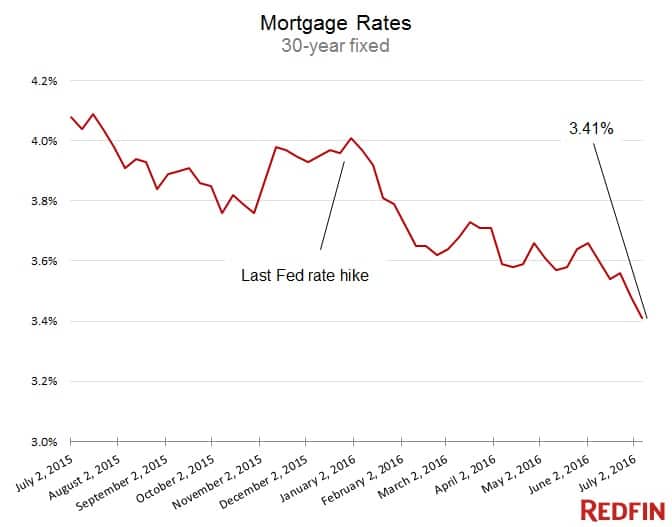

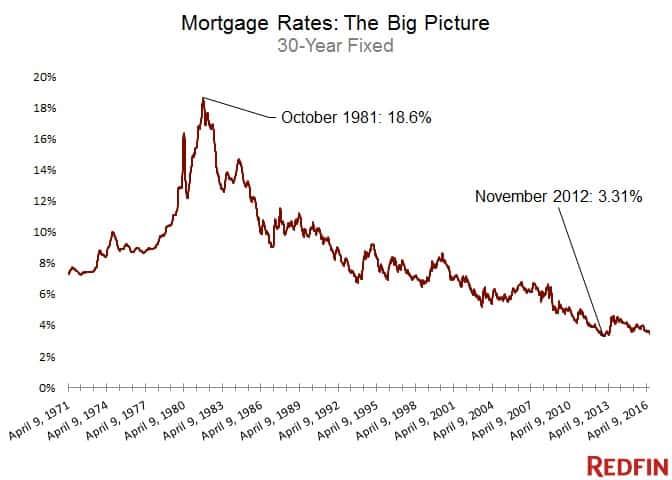

Mortgage rates hit a new 2016 low last week, falling to 3.41 percent in the wake of the Brexit vote. Home loans haven’t been this cheap in three years and are flirting with the record-low 3.31 percent reached in November 2012, according to Freddie Mac.

Here’s another near record: Rates have held below 4 percent all year — 27 straight weeks — a run that’s closing in on the record 29-week stretch we saw in 2014.

This time, though, loans are cheaper, averaging 3.65 percent over the past six months, compared to 3.77 percent in 2014. It’s a spectacular streak.

What’s Going On?

Borrowing has gotten cheaper since Britain announced its surprise divorce from Europe — Brexit — which spooked global markets and sent money rushing into safe investments such as Treasuries and U.S. home loans. That sort of financial volatility typically pushes interest rates down.

Brexit shockwaves are still breaking across the globe, meaning rates will stay low for now and might even fall further amid market mood swings.

“There’s every indication rates have further to fall and no indication that they’ll rise any time soon,” Redfin chief economist Nela Richardson said.

That’s Good for the Housing Market, Right?

Brexit isn’t good for the global economy overall and most analysts think it could put a damper on U.S. growth this year. But the low rates it triggered are an upside for homebuyers.

Last week’s rapid rate drop led to a deluge of refinancing applications, which hit their highest level since January 2015, according to the Mortgage Bankers Association. More than 61 percent of those applications came from current homeowners looking to lower their monthly payments. Far fewer were would-be buyers looking to take advantage of cheap borrowing.

That’s partly because mortgages have been so cheap for so long that they seem normal, especially to first-time buyers.

“Rate drops don’t motivate homebuyers, the potential for a rate increase motivates them,” said Steve Centrella, a Redfin agent in Washington, D.C. “I wouldn’t expect this to spur significant new urgency to buy. You still have other limiting factors, including price and inventory.”

United States

United States Canada

Canada