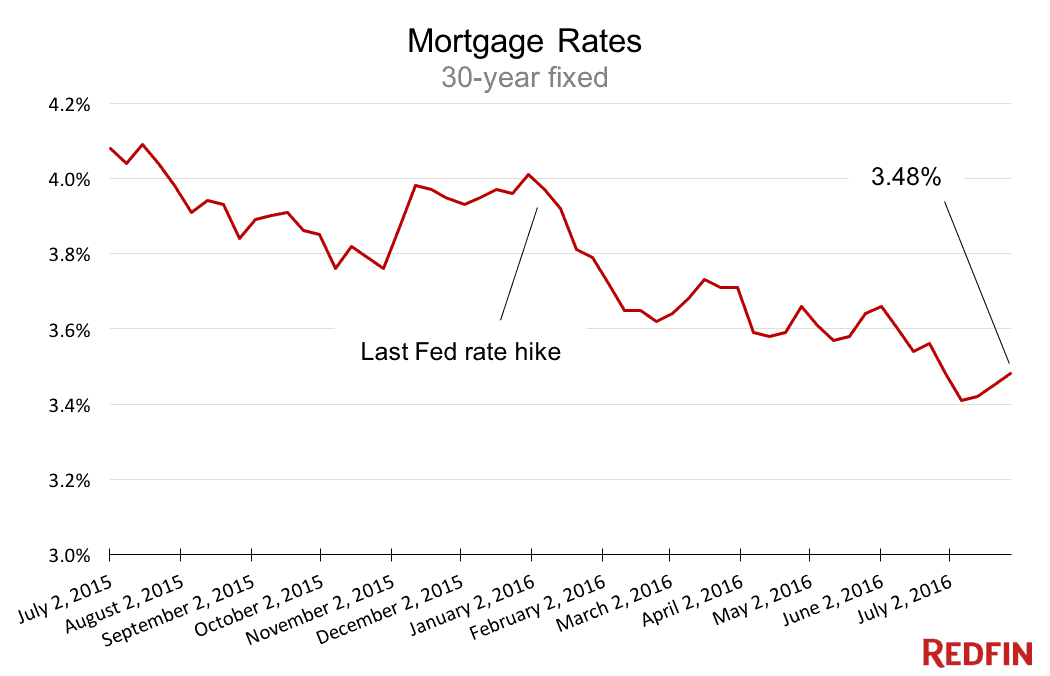

Mortgage rates rose for the third week, averaging 3.48 percent for a 30-year, fixed-rate loan, up from 3.45 percent the week before.

A year ago, rates averaged 3.98 percent, according to Freddie Mac’s weekly survey.

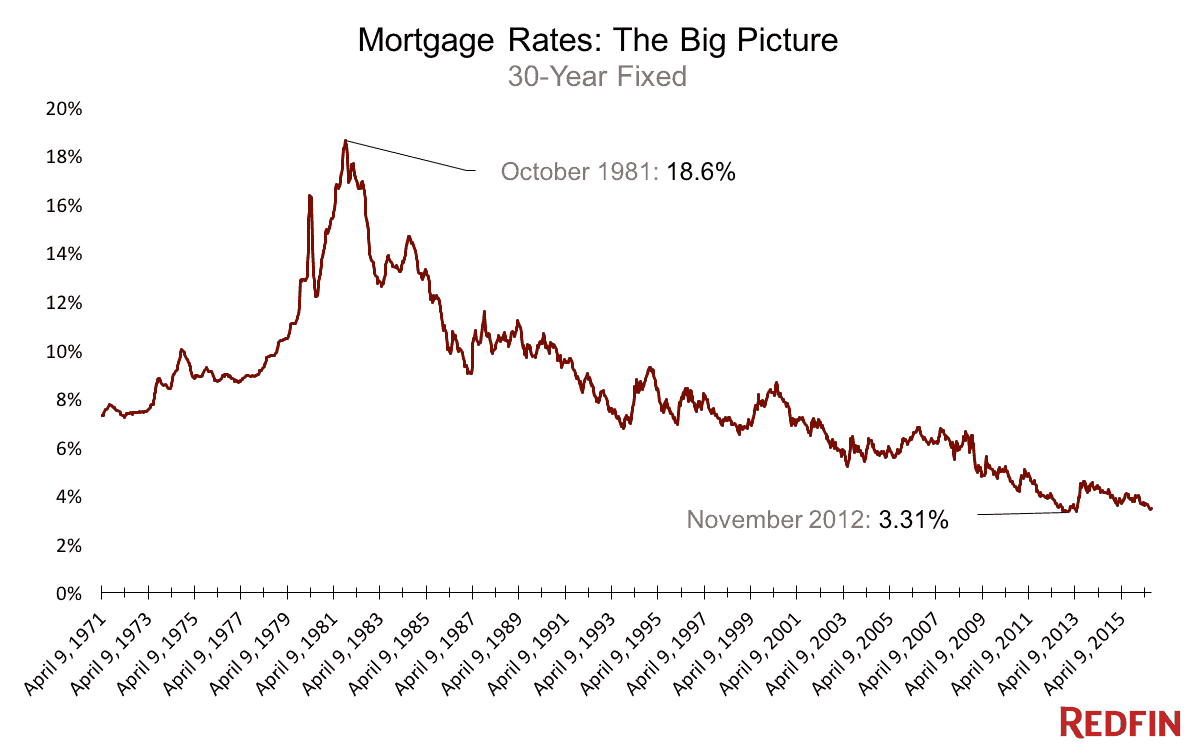

Rates have held below 4 percent since December. That’s 30 weeks, the second-longest run of cheap borrowing ever. The record was set from March 2012 to June 2013, when the cost of a 30-year loan held below 4 percent for 65 weeks, hitting a historic low of 3.31 percent in November 2012.

Would-be buyers are still sidelined

That epic run of cheap borrowing hasn’t been enough to lure new buyers into the market this year, however. Homeownership in the U.S. fell to a 51-year low this spring, the Census Bureau reported today. The share of Americans who own their homes was 62.9 percent, the lowest since 1965 and the second-straight quarterly decrease, down from 63.5 percent at the beginning of this year.

Low rates also haven’t been enough to offset rising home prices in many markets. Wage growth has been sluggish. And eight years after the collapse, loans are still too hard or impossible to get for many middle-class workers.

Are millennials spooked?

Peak millennials — the biggest cohort of their generation — turned 25 last year and soon will be starting families and buying homes. They’ve barely seen interest rates higher than 4 percent, but they’re particularly sensitive to fluctuations that might make buying more expensive.

A Redfin survey in May found that 47 percent of homebuyers said they’d look for a less expensive house if rates rose by a point or more. Among respondents 34 and younger, though, that number jumped, with more than half saying they’d scale back on price. Five percent of millennials said they’d give up looking for a house altogether if rates rose significantly.

Sellers, too, have interest rates on their minds. In a Redfin survey this month, nearly 65 percent of sellers said borrowing costs were important or very important in their decision to put a house on the market.

“If I decide to sell, I’ll need to buy as well and the rates will factor in that decision,” said a millennial homeowner in Chicago. Others worried that rising rates could discourage buyers.

Yesterday, policymakers at the Federal Reserve gave an upbeat assessment of the economy, opening the door to a central bank interest rate hike later this year. The Fed doesn’t control the cost of mortgages, but as the economy improves, interest rates on home loans could go up.

Fortunately mortgages are still cheap by any standard and any significant cost increase will be gradual.

United States

United States Canada

Canada