Move-up buyers can afford to buy a $26,000 more expensive home in the Seattle area than they could last year thanks to falling interest rates and stalling home prices.

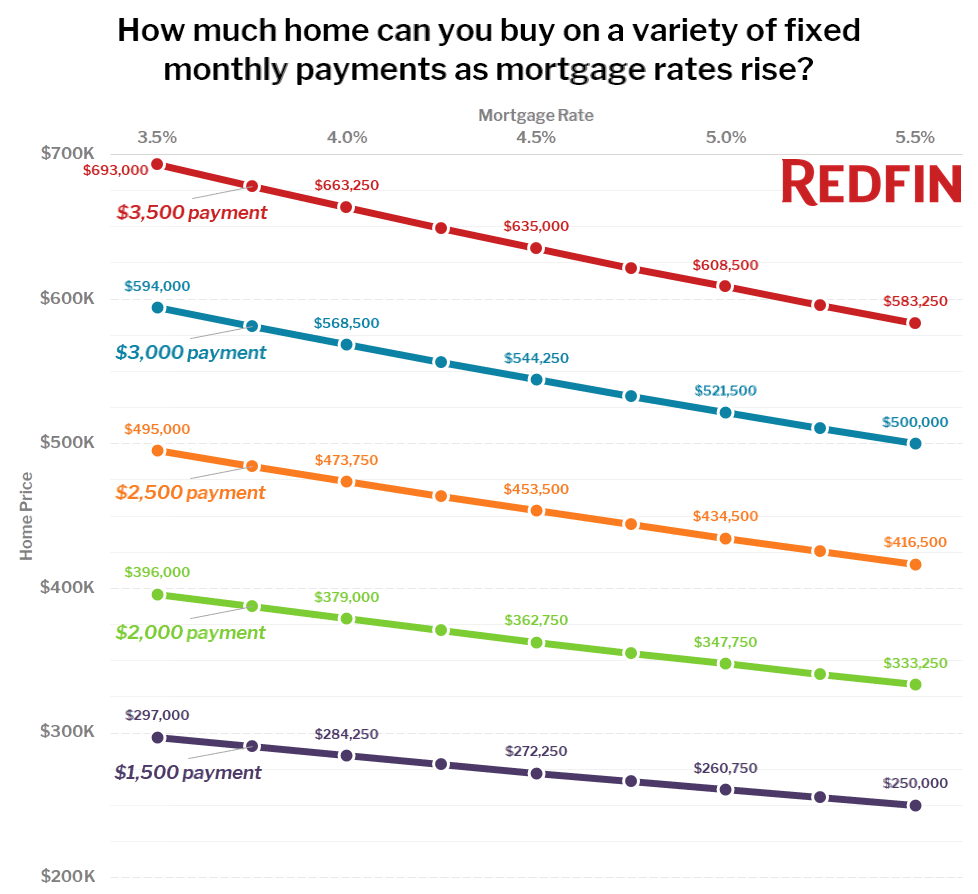

Last October when mortgage rates were at 4.75 percent—up nearly a full point from a year earlier—we shared a version of the chart below to demonstrate how your buying power would decline if mortgage rates continued to increase.

The one-two punch of rising interest rates and rapidly-climbing home prices over the last few years has been discouraging for homeowners who were hoping to sell and move to a larger home or a more desirable neighborhood. Thankfully this spring the combination of stalling prices and falling interest rates has re-opened the window of opportunity for these move-up buyers.

As an example, consider a Seattle-area homeowner who purchased an 1,800 square-foot home in March of 2013 for $325,000, put 20 percent down, and locked in a rate of 3.57 percent on their 30-year mortgage. Here’s a hypothetical look at how their move-up buying power has changed from a year ago:

Based on the 69 percent growth in home prices since 2013, a Seattle-area home purchased for $325,000 in March of 2013 would likely sell for around $550,000 today, unchanged from a year ago. With a remaining mortgage of around $205,000, the proceeds from the sale of that $550,000 home would be about $310,000. Using that money as a down payment with a monthly budget of $3,000, today’s move-up buyer has a budget of $767,000, up from $741,000 a year ago. Dividing the home purchase prices of $767,000 by the $301 median price per square foot translates to a 2,550 square foot home, about 110 square foot larger than you could buy on $741,000 a year ago.

Moving up from a 1,800 square-foot home in Seattle

| Measure | March 2018 | March 2019 | Change |

|---|---|---|---|

| Current Home Sale Price | $550,000 | $550,000 | 0% |

| Remaining Mortgage | $212,750 | $205,150 | -3.6% |

| Home Equity | $337,250 | $344,850 | +2.2% |

| Home Sale Proceeds (i.e. down payment) |

$302,500 | $310,000 | +2.5% |

| Monthly Payment Budget | $3,000 | $3,000 | 0% |

| Interest Rate | 4.44% | 4.00% | -0.44 |

| Median Price per sqft | $304 | $301 | -1.0% |

| New Home Loan Budget (based on down payment, monthly payment & interest rate) |

$438,500 | $457,000 | +4.2% |

| New Home Price Budget (down payment + home loan) |

$741,000 | $767,000 | +3.5% |

| New Home Size | 2,440 sqft | 2,550 sqft | +4.5% |

To run the same numbers for your own move-up situation, start with Redfin’s Home Sale Proceeds Calculator (you can also look up your address on Redfin and find a version of the calculator customized for your home’s value partway down your home’s page), then use the results of that calculator as your down payment in our Home Affordability Calculator.

“Interest rates could stay low for months, but they could shoot up in a flash, so the safe bet is to lock in a mortgage rate as soon as possible,” said Redfin chief economist Daryl Fairweather. “Global economic uncertainty has pushed interest rates down because investors see mortgages as a safe investment even if the rate of return is low. Once Brexit is finally resolved, interest rates could rise overnight as investors regain their confidence.”

We can’t be certain which way interest rates will move in the future, but what is certain is that if you’re a homeowner who is thinking of moving up, the recent drop in rates combined with the slowdown in the housing market make now a good time to just do it.

United States

United States Canada

Canada