The New York Times called over the weekend, for a front-page story about how consumers are reacting to Standard & Poor’s downgrading of U.S. debt and a bear run on the stock market.

I was alone with my kids who were going bananas all around me. The story was going to print in ten minutes, and my laptop was out of batteries. I remembered the last crisis in 2008, when our phone rang off the hook with customers walking away from pending sales and $30,000 in earnest money — and thought “here we go again.”

Then I said, “demand is falling off a cliff even as we speak.”

I hung up and plugged in my laptop. Because we store every tour request, offer, listing consultation and agent query in our customer database, I could quite easily determine, in real-time, if demand was falling off a cliff. And the thing was, it wasn’t.

I knew that it would, but it hadn’t yet. I sat there for a beat wondering what to do, then called the reporter back and said I was wrong. I felt very silly. He was very gracious about it, and called the New York desk to pull my quote from the story.

I came into work this week just waiting for the other shoe to drop. But it hasn’t. For the first time ever, Standard & Poor’s downgraded U.S. debt on Friday night. The stock market lost $1 trillion in value Monday, the largest drop since the financial crisis.

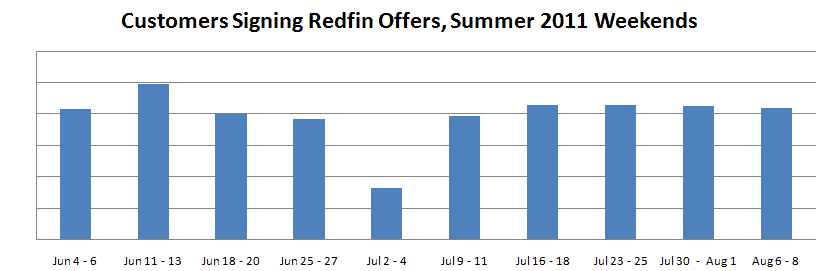

But if you compare Saturday – Monday of this week to the same days of the week over the last eight weeks you find that signed offers actually increased 7%, with a nice strong kick on Monday. Nothing apparently phases the American consumer anymore.

The number of new customers contacting us for the first time decreased 4%. But the truth is we expect new customers and signed offers to decrease even more this time of year, just because the summer home-buying season is winding down. Every year, the number of customers making offers peaks in late May or June, and closings peak 45 days later in July.

I called a few Redfin agents to understand what home-buyers who are writing contracts and touring properties could be thinking.

Febe Cude said that her customers fell into two groups. One group of folks, mostly at the beginning of their home search, needed to sell stocks for their down-payment and had now called off the search entirely. But the second group is moving ahead. “On Friday, they were thinking of ways out, but now with interest rates falling, they’re feeling comfortable again.”

Trevor Smith described the same reaction, saying that buyers who normally might have changed plans decided they had to stay the course because rates are so low. Kenny Whiteside described his customers as scared, angry and anxious. Some are stepping back, he said, but some are stepping in, rushing to complete deals before their financing falls apart. A few have landlords kicking them out of their rental in favor of family members, so they have nowhere else to go.

We aren’t sure what will happen next. But the damage report we expected to get on Monday here at Redfin wasn’t a damage report at all, which we thought was noteworthy in and of itself. (Many thanks to Pete Ziemkiewicz for pulling the numbers.)

United States

United States Canada

Canada