Whether you’re thinking about buying your first home or upgrading to something different based on life changes, there can be a lot of unknowns. For some it’s hard to know when and how to start the planning process. For others who are closer to purchase, they might be wondering the impact of buying a home on their other important goals, like retirement.

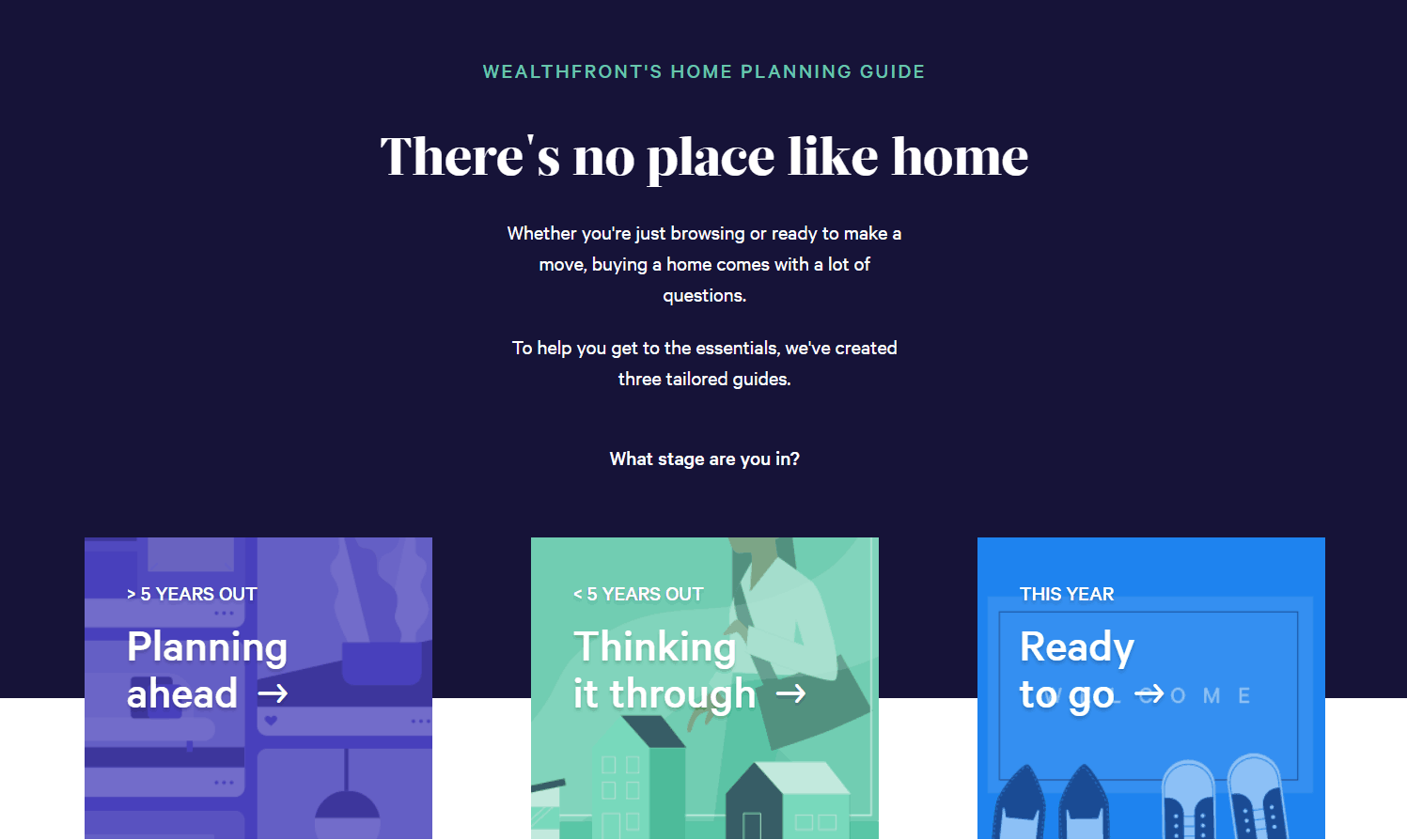

Wealthfront, the automated financial planning and investing service, aims to answer those tough questions with their new Home Planning Guide, powered by data from Redfin.

No matter where you are in the home buying process, Wealthfront’s guide helps get you focused on the most important things to think about. For those just starting to think about a home, the guide helps you start preparing by breaking down the benefits of owning a home, as well as how to think about investing your savings when a purchase is more than five years away.

For those a within five years of a purchase, the guide spells out the all-in costs of owning home by location, using national and city-level data from Redfin. The guide also helps you compare owning to renting based on Redfin data that looks at both scenarios over a 10-year horizon. For those concerned that buying a home might get them off track of their other goals, Wealthfront helps you understand the tradeoffs, such how the size and cost of a home will affect your desired retirement lifestyle.

If you have more immediate needs and plan to make a purchase within the year, the guide dives into what it takes to qualify for a mortgage and what you should consider for a down payment. The guide also highlights the true costs of owning a home, so you can understand your total, one-time closing costs and what you’ll need all-in on a monthly basis. Because costs vary by market, Wealthfront uses data from Redfin that looks at national averages, as well as averages across New York City, Chicago and San Francisco. Of course, buying and selling a home with Redfin helps reduce closing costs. Because Redfin charges less than the typical commission, your total brokerage fee with Redfin is reduced, putting more money in your pocket to help decorate your new place.

Wealthfront developed the Home Planning Guide in conjunction with the launch of the home planning feature in Path, their automated financial planning solution. Like the guide, Path also uses Redfin data to help Wealthfront clients understand their total affordability and personalize their plan based on location and other parameters. Wealthfront is committed to helping their clients fully optimize and automate their finances, and their home planning experience and guide are important additions to helping people have a more holistic understanding of owning a home.

United States

United States Canada

Canada