We all paid a price when the housing market came crashing down — $187.5 billion to bail out Fannie Mae and Freddie Mac alone. They’ve paid us back, with interest, but they haven’t been fixed.

It hasn’t really mattered lately because the companies are making money and sending their profits to taxpayers. But it’s a good bet the good times won’t last. Earnings took a steep dive last quarter and reserves will disappear by 2018. If Fannie and Freddie start reporting losses, we’re still on the hook to help them out.

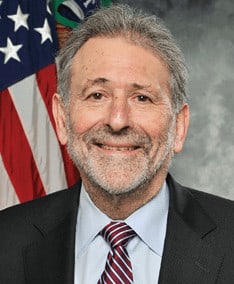

Yesterday, the Obama administration planted a flag in the sand when Treasury official Michael Stegman said he won’t allow the companies to build up capital reserves to protect against another downturn.

Plowing billions of dollars back into the companies would expose taxpayers to “great risk” and be “irresponsible,” Stegman said at a Goldman Sachs event in New York.

But why not just force Fannie and Freddie to start amassing cash so they won’t need our help if there’s a next time? That’s what banks do.

Size is one problem. As a nation, our combined mortgage debt is almost $10 trillion. The Federal Reserve likes to see a risk-weighted capital ratio of 8 percent and, last year, the nation’s 31 biggest banks combined held nearly $8.8 trillion in risk-weighted assets. Fannie and Freddie are starting near ground zero. It would take billions of taxpayer dollars for them to catch up.

That’s a gross simplification, but it gives you an idea of the scope of the problem. Fannie and Freddie have paid about $40 billion in interest on their bailout so far. Even if they’d kept that cash, it’s a mighty thin capital cushion.

Real reform will require legislation from Congress. Stegman’s speech sent the message to Capitol Hill and the markets that, until then, Fannie and Freddie will remain wards of the state.

If you own a home or want to buy, the debate is important. If Washington does nothing or makes the wrong move, another bailout could be in the making and mortgages would be even harder to get than they are now.

March 6, 2015 by Lorraine Woellert, Makayla Zurn, Luis Mojica and Suzanne Harrison

Updated on October 6th, 2020

United States

United States Canada

Canada