Energy costs are an important factor to consider when choosing a home to buy or rent, yet they’re rarely included among statistics reflecting housing affordability. And given their seasonal fluctuations in many areas, they can be tricky to budget for. But they’re worth paying more attention to. Here’s why:

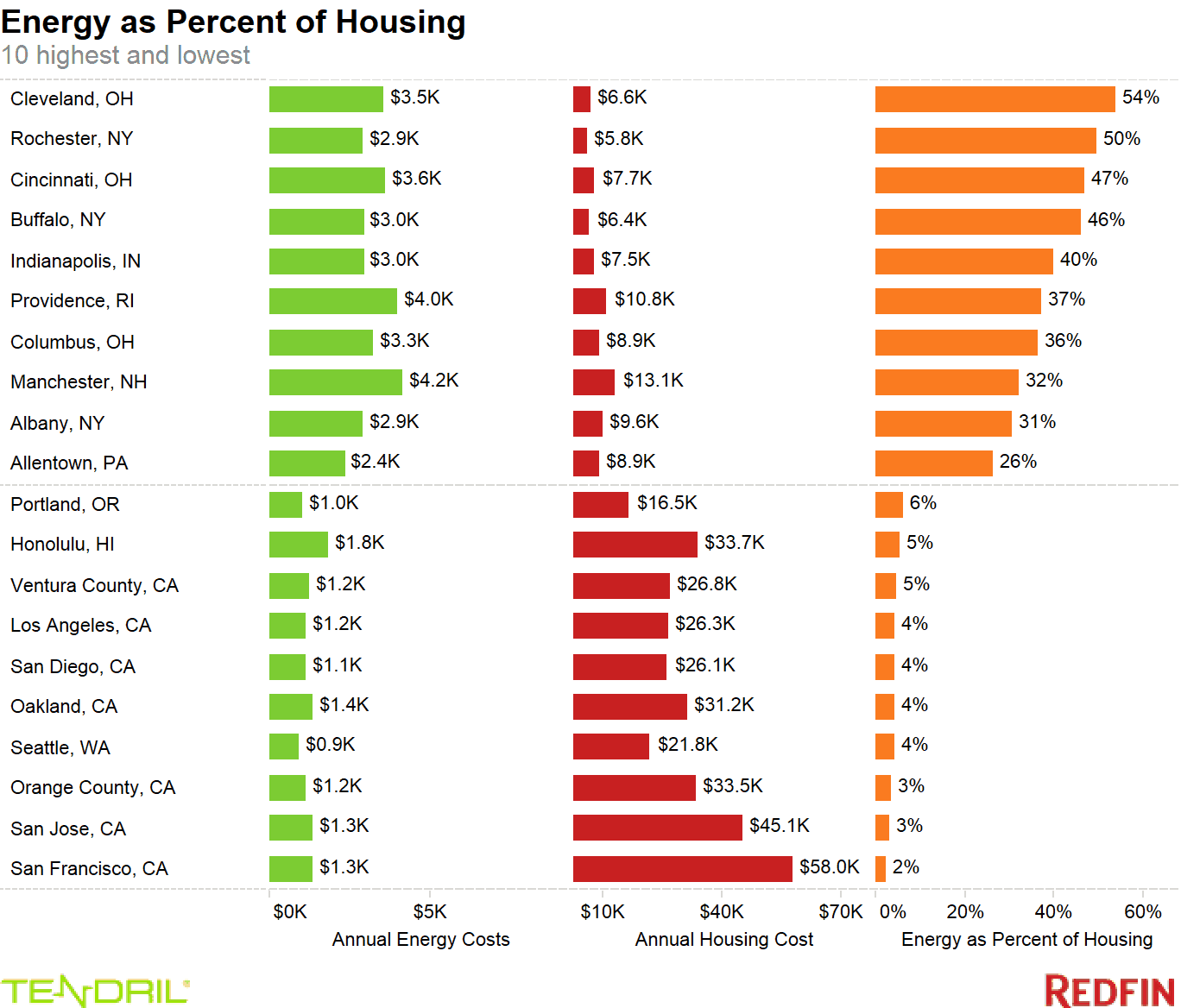

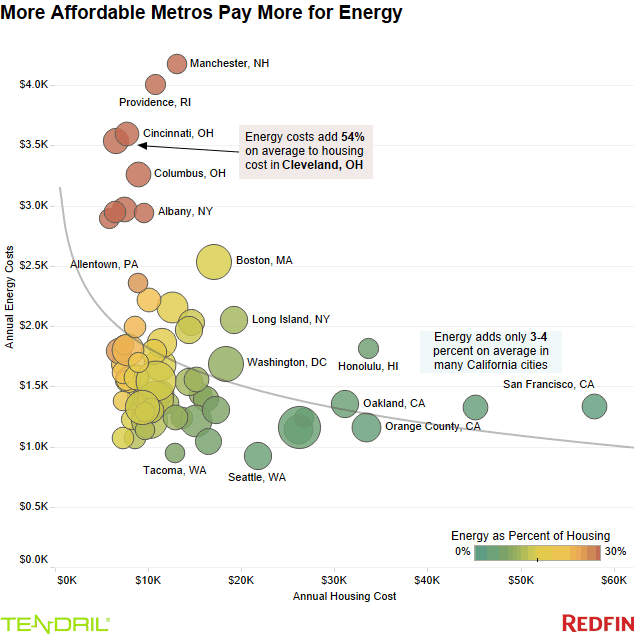

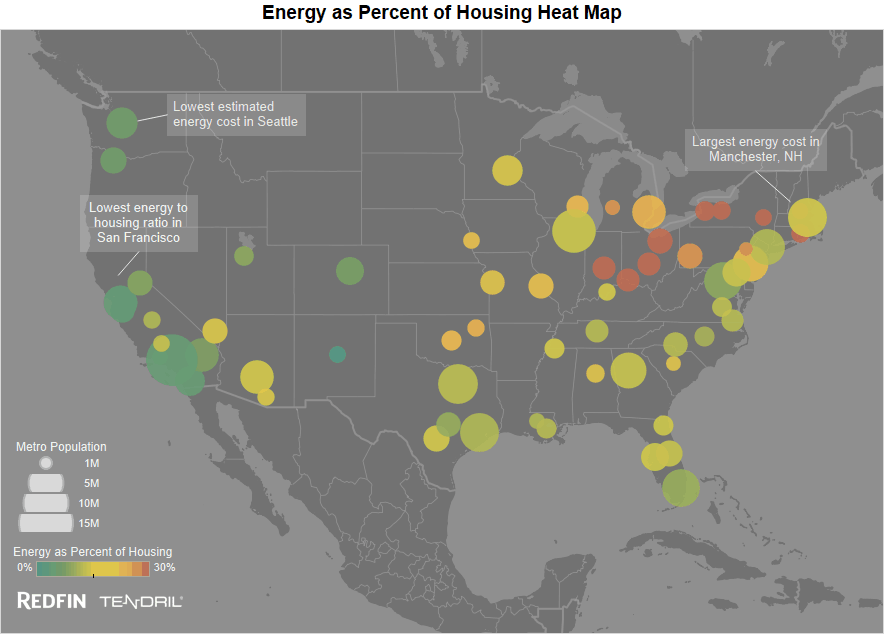

Energy costs can add more than 50 percent to annual housing costs, especially if you live in the Rust Belt (see chart below), according to energy cost estimates provided by Tendril. People in Ohio and Western New York strongholds Cleveland, Rochester, Cincinnati and Buffalo pay more for energy, relative to their annual housing costs, than homeowners in any of the other 71 metropolitan areas analyzed. Clevelanders spend an additional 54 percent of their annual housing payments on energy. Seven of the 10 metros where homeowners spend the least on energy, relative to their annual mortgage, are in California. In San Francisco and San Jose, energy bills add just 2 to 3 percent to annual housing costs.

It’s not just that housing is more expensive in California, but that annual energy costs are also lower. Conversely, in metros where people pay less for housing, they spend more on annual energy.

*Note: Annual housing cost used the median sale price in August 2016 for the metro area with 20% down at 4% interest for a 30-year fixed rate mortgage.

The metros where energy adds the most to housing costs tend to be in the Rust Belt and the Northeast.

Why is the cost of energy so high in these areas? Part of it is that the homes are often older and tend to have less insulation than newer homes. They also tend to rely on more expensive forms of heating, such as an electric furnace as opposed to a gas furnace in the Midwest, or more expensive still, oil boilers in New England. One of the most effective ways consumers can reduce their energy cost in these areas is to upgrade their heating equipment.

The Midwest and the Northeast regions also have much colder and longer winters than the South or the West Coast, resulting in higher overall energy consumption. Energy prices vary by region as well, with electricity costing the most in the Northeast, at an average of $0.189 per Kilowatt hour—48 percent more than the national average.

The Kicker

In many places, there is assistance and legislation ensuring heat does not get shut off when people need it most, allowing those cash-strapped individuals to still pay rent and forgo utilities payments during the winter. There can then be a challenge to meet both rent and utility payments later in the year and tenants often lose their homes as a result.

Using data provided by American Information Research Services, Inc, we found that evictions have a regular seasonal pattern. In Ohio, for example, where the protection dates for utility service spans from October 20 to April 15 each year, evictions drop off sharply at the end of the year and spike in May and June as high home-energy cost hits the wallets of those struggling to make ends meet.

Some states, namely California, have also made strides to encourage renewable energy sources by providing more than $400 million in incentives to residents for solar panel installation. This appears to be working, as California is outpacing other states in solar power. States like those in the Rust Belt and Northeast could do more to improve energy efficiency. This would help ensure that lower-income households renting older units aren’t paying eminently more than that of wealthier households.

“The aging housing stock reduces the benefits of shrinking energy costs to homeowners,” said Redfin chief economist Nela Richardson. “Energy costs, specifically oil and natural gas (not electricity), have been declining since their peak in 2008 and are at some of their lowest rates in more than a decade. This helps, but it doesn’t remove the high costs of energy to homeowners and renters in older units. For buyers, it’s important to know the full annual cost of upkeep, including the energy outlays that come with homeownership.”

Methodology

For this analysis, Redfin partnered with Tendril to estimate the annual costs of energy by metro area. They used data on heating type, cooling type, whether a pool was present and solar energy use for single-family homes in the area. They also used regional factors for energy costs, such as electricity and gas rates for the metro area. Then, Redfin calculated the estimated mortgage cost using the median sale price of single-family homes for August 2016 in each metro area with a population of at least 750,000, assuming a 20 percent down payment and 4 percent interest rate.

United States

United States Canada

Canada