Howdy Redfinnians!

Strap in for Redfin’s monthly round-up of U.S. real estate news! This month is action-packed, so we’re going Moby-Dick on you guys, with an epic market survey, crammed full of gossip, poodles, and inside baseball.

Prices Up, Inventory Down, Sales Volume OK, Rates at Record Lows

Let’s start with the numbers since the numbers are good. We already have access to broker-only data on how the market moved in April 2012, and the eye-popper is a big drop in the number of houses for sale. For the major cities in the West, the April supply of listings sank below three months:

| County | # For Sale YoY | YoY Price Change | MoM Price Change | # Sales YoY | # Sales MoM | Months of Supply |

| San Francisco | -39% | 8% | 8% | -2% | -14% | 1.7 |

| Silicon Valley (San Mateo) | -48% | 2% | 3% | 8% | -10% | 1.6 |

| Denver | -49% | 17% | 13% | -5% | -1% | 2.0 |

| Phoenix (Maricopa) | -37% | 21% | 5% | -10% | -5% | 2.1 |

| San Diego | -45% | -1% | 2% | 8% | 6% | 2.2 |

| Orange County | -45% | -3% | 0% | 17% | 0% | 2.4 |

| Los Angeles | -39% | -4% | 2% | 3% | -5% | 2.5 |

| Northern Virginia (Fairfax) | -12% | 3% | 3% | 21% | 18% | 2.6 |

| Seattle (King) | -40% | -2% | 6% | 3% | 4% | 2.6 |

| Sacramento | -35% | -2% | 2% | 2% | -8% | 2.8 |

| Portland (Multnomah) | -29% | -1% | 1% | 16% | 15% | 2.8 |

| Washington DC | -17% | 16% | -1% | -30% | -28% | 4.3 |

| Las Vegas (Clark) | -20% | -4% | 1% | 1% | -11% | 4.8 |

| Baltimore (Balt. County) | -21% | 3% | 11% | -7% | -8% | 5.1 |

| Boston (Suffolk) | 24% | 17% | -4% | -3% | -8% | 6.1 |

| Chicago (Cook) | 7% | -4% | 3% | 12% | 1% | 8.5 |

| New York (Westchester) | 3% | -1% | 0% | -6% | -8% | 15.4 |

| 17-County Composite | -23% | 4% | 3% | 2% | -3% | 3.3 |

Redfin’s Data for April 2012 on Single-Family Home Sales in 17 Urban Counties

We measure price changes in terms of median dollars per square foot.

Three months is low. If supply dips below six months, it’s considered a seller’s market.

Bidding Wars Are Back

And now the laws of supply and demand are kicking in. In San Francisco, Seattle, Southern California and Washington DC, the Wall Street Journal reports that bidding wars are back. Redfin clients in DC just won a deal by adopting the seller’s toy poodle, “Buddy.” An agent just wrote me to say that Inland Empire homes move in 50 hours, not 50 days: “I can’t even go out for a sandwich without losing another deal.” The shacks now selling for more than $1 million will make you cry.

Appraisal Roulette

Lenders are understandably nervous about these prices. Lots of deals are dying at the appraisal, with the bank refusing to loan money for a house under contract because the appraiser says it’s overpriced. Our DC listing agents have seen nearly half their deals kyboshed by a lender’s low appraisal. In some markets, agents are removing the lock-box immediately, just to be sure to walk the appraiser through the home in person.

The Bottom? We Hit That Last Year

Eventually, higher prices will show up in the historical data used by appraisers — and in the indexes used by economists too. The Wall Street Journal reports that “nearly six years after home prices started falling, more U.S. housing markets appear to be nearing a new phase: a prolonged bottom.”

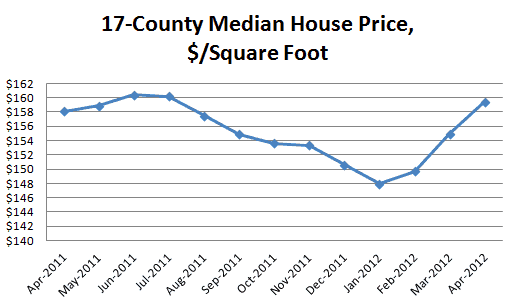

According to our own analysis of 17 urban counties, we aren’t “nearing” the bottom: we hit it last year. From April 2011 to April 2012 in the mostly coastal cities we serve, house prices increased 4%. This is the first year-over-year gain we’ve seen in a long time:

|

|

|

No one else has April data yet, but the CoreLogic index only declined .6% in March compared to last year — once you exclude foreclosures and homes sold by underwater owners, CoreLogic prices actually rose .9%.

At the Bottom, Home-Owners Hesitate

So why aren’t more people selling homes? Well it’s hard to replace a million foreclosures per quarter, which is how fast the banks were once putting homes on the block. Most home-owners aren’t willing or even able to sell at the prices set by the banks. Having tanked the market, the banks no longer have so many foreclosures to sell.

The Shadows Recede

The rate of seriously delinquent mortgages is at a three-year low, but — fair warning — still stands at 3.67%, far above the normal delinquency rate of 1%. Foreclosures are down 19% year over year, and the number of foreclosed homes that banks still have to sell has declined over the past year.

Freddie Mac, the government institution that ends up owning lots of foreclosures, reported that its losses from the sale of foreclosed homes declined by 33%, and Fannie Mae is now in such good shape that for the first time since 2008 it’s paying a dividend.

What about the foreclosure tsunami everyone expected after the robo-signing lawsuits settled? It never hit our shores because the settlement forced banks to ease up on underwater home-owners and approve more short sales.

For Rent or For Sale

That leaves only conventional home-owners to hang a yard-sign — and most won’t do it. We talk to lots of would-be sellers who now believe time is on their side, and decide to hold off a year before listing their home.

With the apartment vacancy rate across 82 markets at an eleven-year low and renters coming out of the woodwork, even the folks who do put their house up for sale sometimes also try to find a renter at the same time, to see if someone else will pay the mortgage for a few years while the property hopefully appreciates.

Since the rest of the market is flat-footed, home-builders are the only ones with plenty of product, which is why the biggest builders just reported huge sales increases over last year, up 43%, 26%, 40% and 37%.

So Where’s the Sales Volume?

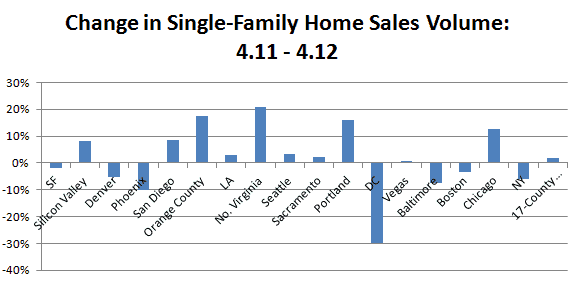

But home sales overall aren’t up that much, only an anemic 4% in March. Just because it’s a competitive market doesn’t mean it’s a hot market. The places where the market is most competitive — like Washington DC, Phoenix and San Francisco — are where sales volume is actually declining:

|

|

|

When demand is high and inventory is low, it’s sort of like trying to drive a Maserati on a Matchbox track: there’s nowhere really for buyers to go. The rate at which we take our own buyers on tour dropped 2% last week after a month-long plateau; like everyone else, we’re putting record numbers of homes under contract, but wonder if demand will keep building through the summer.

What’s Driving Demand? Interest Rates

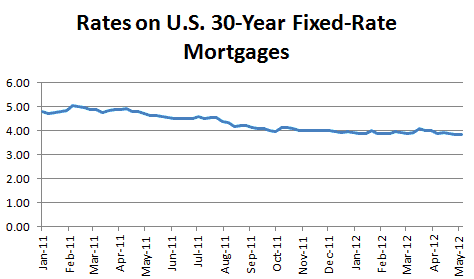

Why are so many buyers anxious to buy now even when the pickings are slim? Rates. Over and over again, I’ve worried that, despite government promises, rates won’t last. Wednesday, the Mortgage Bankers Association reported the lowest rates on 30-year loans in the history of its survey:

|

|

|

But there’s another paradox here. Money’s cheap but it’s not easy. We just had a buyer worth $3 million get rejected for a $400,000 loan for lack of a steady paycheck. Right now, about half the country can’t qualify for a loan.

And rules requiring more lending documentation worked out fine in 2009 but the banks are struggling to keep up now that the market’s moving faster. Many sellers want the buyer’s loan approved in a week, and underwriting can’t swing it. In Southern California, our buyers are getting pre-approved for a loan not just by the lender, but by his underwriter too.

OK, that’s it! Comments, questions, just post in the comments section below, where the fur usually flies… And thanks for your attention, and for giving Redfin a try.

Best, Glenn

United States

United States Canada

Canada