Condos are selling above asking price for the first time in at least nine years, and the typical condo is selling in a record 22 days.

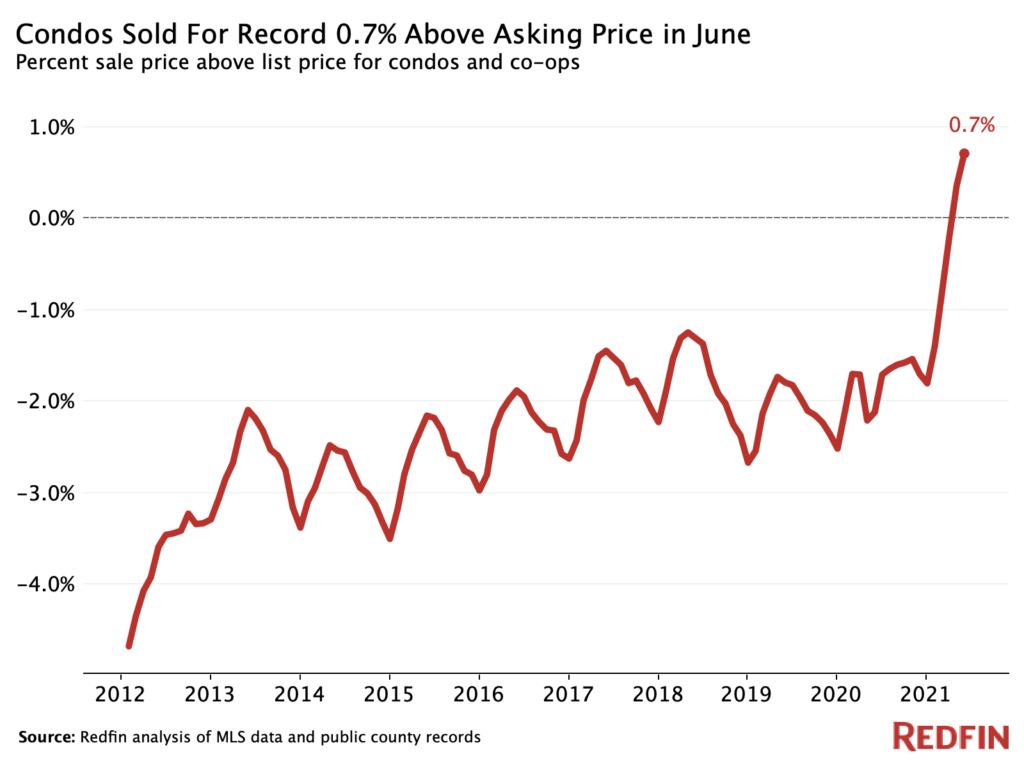

The typical condo in the U.S. sold above its asking price in June for just the second time since at least 2012. The first time was in May, signaling renewed homebuyer competition for condos after a pandemic-fueled slump.

Nationwide, the typical condo sold for 0.7% above its asking price in June, following a premium of 0.4% in May. In dollar terms, the typical condo sold for $304,000 in June. If it sold for 0.7% above its asking price, that means it was listed for $301,872.

The pattern is somewhat seasonal, as average sale-to-list ratios for condos typically peak in May or June, but this is the first year condos are selling above asking price rather than below. The data in this report is from a Redfin analysis of MLS data and public county records.

The national median sale price for condos rose a record 20.3% year over year in June to an all-time high of $304,000. Prices for single-family homes increased even more, up 26.8% to a record $405,000. Note that pandemic lockdowns significantly slowed homebuying and selling in June 2020, which means the year-over-year trends for home prices, sales and new listings are larger than they would be in a typical year.

“Many buyers who have been priced out of the market for single-family homes have turned to condos,” said Redfin Chief Economist Daryl Fairweather. “Earlier in the pandemic, many buyers shunned small condos in favor of large detached homes with space for offices and homeschooling. But now that many Americans are vaccinated and some are returning to the workplace, extra space isn’t as necessary and the benefits of shared amenities like a gym or a pool are more attractive. And the biggest benefit of condo living is the more affordable price.”

Nearly 42% of condos sold above asking price in June, another record. That’s more than double the 18.6% share in June 2020 and the 20.2% share in June 2019.

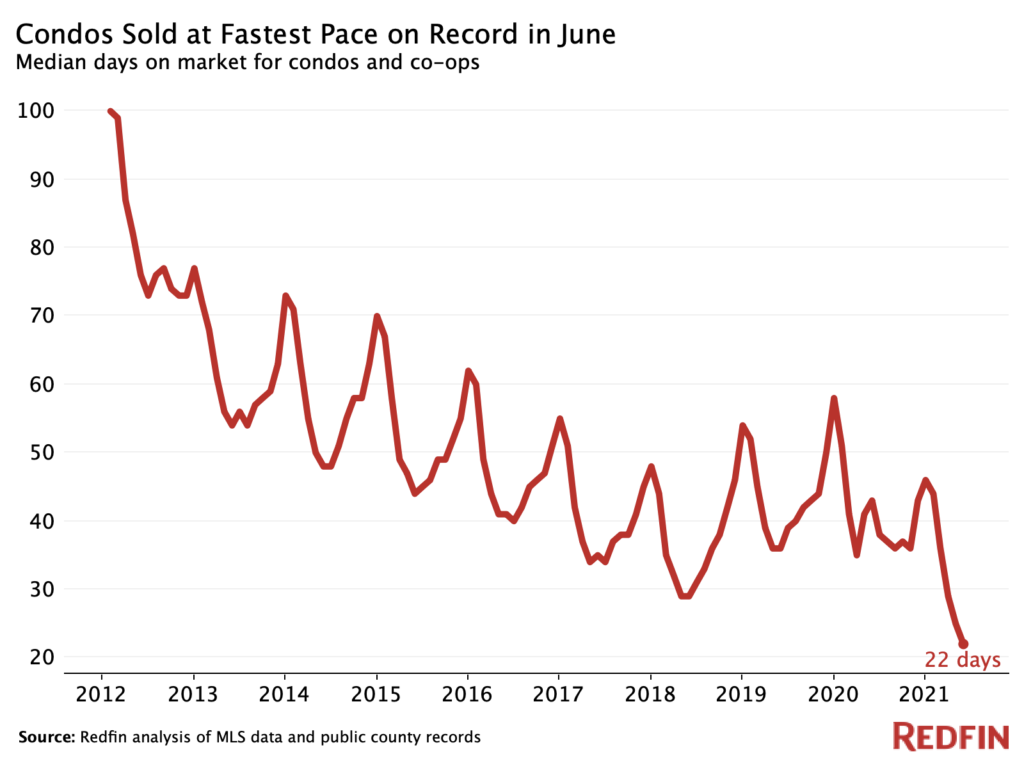

Condos sold at their fastest pace on record in June, with the typical condo that sold during the month going under contract in 22 days. That’s down from 43 days a year earlier and 36 days in June 2019, the latter of which is a better comparison because it was before the pandemic impacted the condo market.

Seasonally adjusted condo sales were up significantly in June, rising 59.7% year over year, and pending sales were up 38.2% year over year.

At the same time, the number of condos for sale (seasonally adjusted) dropped 18% from a year earlier, while new listings were up 7.6%. The fact that new listings are up while overall supply is down indicates that demand is high and condos are selling quickly.

| U.S. housing market summary: Condos, June 2021 | ||

| June 2021 | Year-over-year change | |

| Average premium above asking price (%) | 0.7% | 2.8 pts. |

| Median sale price | $304,000 | 20.3% |

| Condos sold, seasonally adjusted | 72,058 | 59.7% |

| Pending sales, seasonally adjusted | 64,668 | 38.2% |

| New listings, seasonally adjusted | 77,364 | 7.6% |

| All condos for sale, seasonally adjusted | 198,954 | -18% |

| Median days on market | 22 | -21 |

| Months of supply | 1.4 | -1.8 |

| Share of condos that sold above list price | 41.8% | 23.2 pts. |

Metro-level highlights: U.S. condo market, June 2021

- The average condo in the Austin, TX metro sold for 5.6% above asking price, the highest premium of any of the largest 85 U.S. metros tracked by Redfin. It’s followed by Rochester, NY (4.9% above asking price) and San Francisco (4.8% above asking price). Condos sold for equal to or above their asking prices in 52 of the 85 metros.

- Condo prices increased most in Oklahoma City, OK (+78.5% YoY to $116,000), Bakersfield, CA (47.1% to $177,000) and New Orleans (44.8% to $239,000). Prices increased in all but two of the 85 largest metros: St. Louis, where the median condo sale price dropped 2.5% year over year to $161,000, and Philadelphia (-4.8% to $315,000).

- Indianapolis was the fastest market, with half of all condos going under contract in just 4 days. It’s followed by Denver (5 days) and Elgin, IL (5 days).

- 74.1% of condos in Oakland, CA sold above list price, a higher share than any other metro. It’s followed by Worcester, MA (69.2%) and Oxnard, CA (67.7%).

United States

United States Canada

Canada