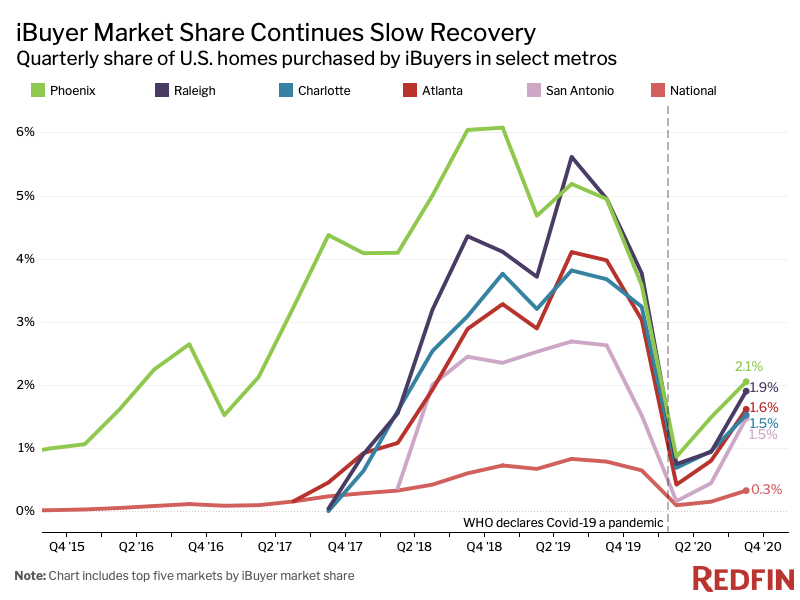

iBuying companies bought just 0.3% of U.S. homes that sold in the fourth quarter. While that’s up slightly from 0.2% in the third quarter, it remains below the 0.8% market share they held at the end of 2019.

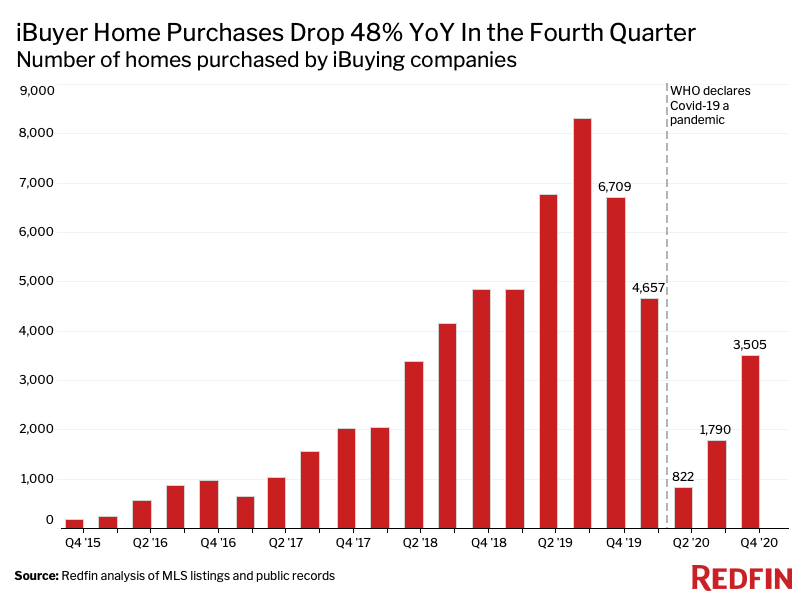

The nation’s top iBuying companies purchased 3,505 homes in the fourth quarter of 2020, down 48% from a year earlier. That’s an improvement from the third quarter’s 78% year-over-year decline.

U.S. iBuyers bought 0.3% of homes that sold across the 418 U.S. metropolitan areas tracked by Redfin in the fourth quarter, down from 0.8% a year earlier but up slightly from 0.2% in the third quarter of 2020.

This is according to a Redfin analysis of MLS and public records data on home purchases and sales made by the most well-known national iBuyers, including RedfinNow (Redfin’s iBuying business), Opendoor, Zillow and Offerpad. The fourth quarter is the most recent period for which iBuyer data is available.

The term “iBuyer” (short for instant buyer) is used to describe real estate companies that purchase houses from homeowners in quick cash transactions by using algorithms to evaluate a property’s worth based on comparable market data. iBuyers typically charge sellers a higher fee than a traditional real estate agent would given the certainty of a cash offer with a flexible move-out day and the convenience of avoiding home prep, showings and open houses. These companies then make any necessary improvements to the homes and resell them.

Real estate firms including Redfin, Zillow and Opendoor put iBuying on hold at the onset of the coronavirus pandemic amid substantial economic uncertainty. These companies resumed their iBuying businesses in May and June as housing demand began to rebound thanks to record-low mortgage rates and a wave of relocations made possible by remote work.

Still, business remains slower than usual, in part because the housing market is so hot. With homebuyer demand through the roof, many sellers figure they can offload their homes without having to share the profits. Plus, an intense shortage of homes for sale means there aren’t as many properties for iBuyers to purchase in the first place.

“We’re being very aggressive when it comes to buying homes right now—it’s all gas, no brakes,” said Myron Curry, a senior investment specialist at RedfinNow in the Los Angeles area. “The primary reason iBuyer home purchases remain lower than normal is the lack of homes for sale, but the inventory situation is improving each quarter as we get further away from the worst of the pandemic. People are becoming more comfortable selling their homes as a larger share of the population gets vaccinated.”

iBuyers are closely watching the shift in mortgage rates, though it hasn’t yet impacted business, Curry added.

Phoenix Kept Its Crown as the Metro With the Highest iBuyer Market Share

In Phoenix, iBuyers purchased 2.1% of the homes that sold during the fourth quarter—the largest market share for the third quarter in a row. Next came Raleigh, NC at 1.9%, and Atlanta at 1.6%. Charlotte, NC and San Antonio, TX rounded out the top five, both at 1.5%. Each of these markets saw an increase in market share from the prior quarter, but a decrease from the prior year.

iBuyers Purchased Less Expensive Homes Than the Typical Homebuyer

iBuyers bought homes for a median of $284,450 in the fourth quarter. By comparison, the median purchase price for the typical American homebuyer was $318,300. In every top iBuyer market*, iBuying companies purchased homes for less than the metro-area median.

iBuyers Sold Homes In 14 Days—A Record Pace

Nationally, the typical iBuyer-owned home found a buyer after being listed on the market for 14 days—the quickest pace since at least 2015, when Redfin began recording iBuyer data. That’s down from 42 days a year earlier and a revised 17 days in the third quarter. By comparison, the typical non-iBuyer home spent 30 days on the market, down from 46 days a year earlier and 33 days in the third quarter.

“Most homes that RedfinNow puts on the market in Los Angeles are selling within the first week and getting multiple offers,” Curry said. “This lightning-fast market has been fueled by a shortage of homes for sale and surging demand due to low mortgage rates. Our properties are also renovated and move-in ready, which means the process typically moves quickly.”

In a majority of the top 27 iBuying markets, iBuyers sold their inventory faster than the typical homeowner, with the largest margins in Austin, TX (29 days faster), Riverside, CA (28 days faster) and Raleigh (27 days faster). Minneapolis, Tampa, FL and San Diego were the only metros where iBuyers took longer to sell homes.

When iBuyers sold homes in the fourth quarter, they offered a 2.48% average commission to the real estate agents representing the buyers, down from 2.78% a year earlier.

iBuying companies have been experimenting with paying lower commissions to buyers’ agents as a way to cut costs, which could allow them to make more competitive offers when purchasing homes themselves. This could help pave the way for declining buyer’s agent commissions across the industry, as data on these fees is about to become widely available to the public for the first time.

Fourth-Quarter iBuyer Market Summary By U.S. Metro Area

| Metro Area | Number of Homes Bought by iBuyers, Y/Y Change | Share of Homes Bought by iBuyers | Share of Homes Bought by iBuyers, Y/Y Change | iBuyer Median Sale Price | Overall Median Sale Price | iBuyer Median Days On Market | Overall Median Days On Market |

|---|---|---|---|---|---|---|---|

| Anaheim, CA | 200.0% | 0.9% | 0.5% pts | $630,000 | $790,000 | 20 | 40 |

| Atlanta, GA | -52.4% | 1.6% | -2.4% pts | $224,100 | $284,735 | 14 | 22 |

| Austin, TX* | -10.1% | 0.9% | -0.3% pts | — | $365,000 | 6 | 35 |

| Charlotte, NC | -52.0% | 1.5% | -2.2% pts | $243,000 | $298,900 | 40 | 42 |

| Cincinnati, OH† | — | 0.3% | — | $214,000 | $219,000 | 31 | 43 |

| Dallas, TX* | -52.7% | 0.9% | -1.4% pts | — | $323,000 | 14 | 29 |

| Denver, CO | -68.0% | 0.5% | -1.5% pts | $435,050 | $460,000 | 5 | 8 |

| Durham, NC | -60.8% | 1.4% | -2.8% pts | $242,000 | $315,000 | 21 | 42 |

| Fort Worth, TX* | -57.1% | 1.1% | -2.0% pts | — | $271,000 | 19 | 27 |

| Houston, TX* | -75.9% | 0.4% | -1.5% pts | — | $269,900 | 11 | 26 |

| Jacksonville, FL | -62.7% | 0.5% | -1.1% pts | $226,000 | $265,000 | 28 | 36 |

| Lakeland, FL | 66.7% | 0.5% | 0.1% pts | $202,200 | $235,000 | 15 | 18 |

| Las Vegas, NV | -43.2% | 1.4% | -1.6% pts | $309,750 | $320,000 | 20 | 41 |

| Los Angeles, CA | 111.4% | 0.5% | 0.2% pts | $635,000 | $721,000 | 22 | 37 |

| Minneapolis, MN | -72.5% | 0.3% | -1.2% pts | $245,750 | $310,000 | 32 | 19 |

| Nashville, TN | -60.3% | 0.5% | -1.1% pts | $270,600 | $333,295 | 18 | 37 |

| North Port, FL | 212.5% | 0.3% | 0.2% pts | $295,000 | $322,900 | 13 | 23 |

| Orlando, FL | -39.2% | 0.9% | -0.9% pts | $253,000 | $289,000 | 17 | 18 |

| Phoenix, AZ | -48.2% | 2.1% | -2.9% pts | $301,100 | $338,000 | 9 | 32 |

| Portland, OR | -43.3% | 0.9% | -1.0% pts | $397,900 | $450,000 | 9 | 11 |

| Raleigh, NC | -55.4% | 1.9% | -3.0% pts | $263,250 | $316,000 | 16 | 43 |

| Riverside, CA | -60.9% | 0.5% | -1.3% pts | $412,500 | $443,000 | 6 | 34 |

| Sacramento, CA | -1.3% | 0.8% | -0.2% pts | $442,000 | $475,000 | 6 | 9 |

| San Antonio, TX* | -33.7% | 1.5% | -1.2% pts | — | $259,900 | 20 | 32 |

| San Diego, CA | -8.0% | 0.4% | -0.2% pts | $562,500 | $655,000 | 16 | 13 |

| Tampa, FL | -24.9% | 0.7% | -0.4% pts | $236,500 | $272,300 | 20 | 13 |

| Tucson, AZ | -47.3% | 1.2% | -1.5% pts | $245,750 | $265,000 | 27 | 43 |

| National—U.S.A. | -47.8% | 0.3% | -0.5% pts | $284,450 | $318,300 | 14 | 30 |

*iBuyer median sale prices are not available in Texas metros due to limited public records data.

†iBuyer records for Cincinnati only go back to the third quarter of 2020, so year-over-year comparisons for the fourth quarter are not available.

Methodology

To identify purchases made by iBuyers, we analyzed public records data of home sales across all the markets that Redfin covers. To determine iBuyer market share, we divided homes sold across all of the markets that Redfin covers by all known home purchases made by RedfinNow, Opendoor, Offerpad, Zillow Offers and Bungalo. There are numerous other companies that engage in iBuying in various markets, however Redfin tracks only the most prominent, national iBuyers.

We determined the top iBuying markets by identifying the metro areas where iBuyers had a market share of at least 1% and purchased at least 20 homes in the fourth quarter. The 27 metros that met that threshold in the fourth quarter can be found in the table above.

United States

United States Canada

Canada