Sales of luxury homes significantly outpaced the 7% growth in sales of affordable homes this fall, as affluent Americans were more likely to have the means and the flexibility to move during the coronavirus pandemic.

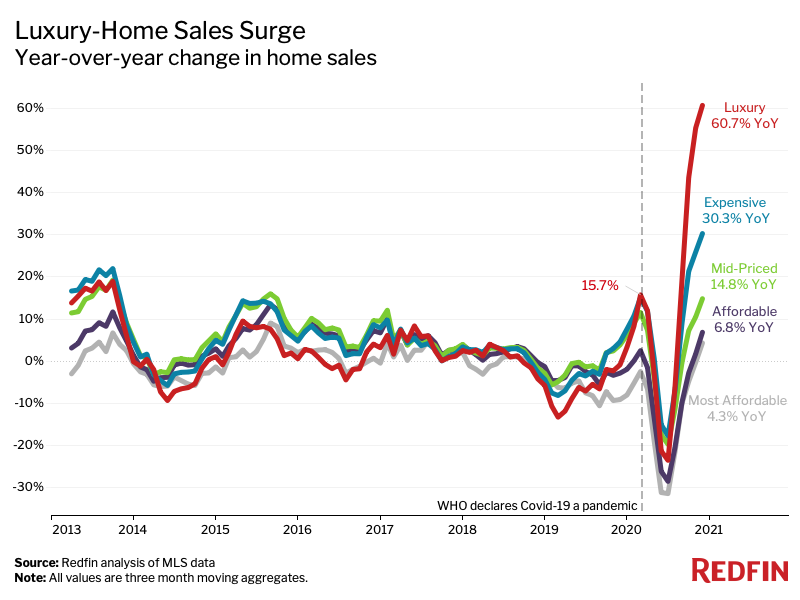

U.S. luxury home sales surged 60.7% year over year during the three months ending Nov. 30, the biggest jump since at least 2013, when Redfin began recording this data. That nearly quadrupled the growth we saw during the three months ending Feb. 29, before the coronavirus was declared a pandemic. It also far outpaced the 14.8% increase in sales of mid-priced homes and the 6.8% uptick in sales of affordable homes, as America’s “K-shaped” economic recovery put more money into the pockets of the country’s wealthiest homebuyers.

This is according to an analysis that divided all U.S. residential properties into five price tiers based on Redfin Estimates of the homes’ market values. Scroll down to the methodology section at the bottom of this report to read more about how we determined which homes were placed in each bucket.

As the U.S. unemployment rate has declined, sales of affordable homes have made a comeback after plunging around 30% in the spring. But growth in this segment still pales in comparison to growth in the luxury tier, as high-earning Americans take advantage of stock-market gains, record-low mortgage rates and the flexibility to work from anywhere, said Redfin Chief Economist Daryl Fairweather.

“Low- and middle-income Americans aren’t out of the woods when it comes to this recession. Affluent Americans are out of the woods, and they’re at their beach houses sipping margaritas,” Fairweather said. “When times are tough, banks are most likely to dole out home loans to the people who need them the least.”

U.S. Housing Market Summary, Three Months Ending Nov. 30, 2020

| Luxury | Expensive | Mid-Priced | Affordable | Most Affordable | |

|---|---|---|---|---|---|

| Homes sold, YoY change | 60.7% | 30.3% | 14.8% | 6.8% | 4.3% |

| Median sale price | $899,000 | $412,000 | $264,000 | $180,000 | $94,500 |

| Median sale price, YoY change | 9.0% | 9.6% | 9.1% | 8.4% | 8.6% |

| Number of homes for sale, YoY change | 2.3% | -8.7% | -10.2% | -7.5% | -2.7% |

| New listings, YoY change | 31.5% | 6.5% | 4.2% | 7.8% | 13.4% |

| Median days on market | 55 (-27 days YoY) | 33 (-18 days YoY) | 23 (-15 days YoY) | 24 (-11 days YoY) | 31 (-9 days YoY) |

The 49 most populous U.S. metropolitan areas all experienced at least double-digit growth in luxury-home sales during the three months ending Nov. 30. The biggest jump was in Newark, NJ, where sales of luxury homes skyrocketed 101.6% year over year. It was followed by West Palm Beach, FL, up 97.1%, and San Antonio, TX, up 82.4%. Riverside, CA and Jacksonville, FL rounded out the top five, both up about 80%. Even Cincinnati—the market with the slowest growth rate—saw luxury sales rise 16.7%.

“Americans are pouring money into their homes. Sometimes that means remodeling, and sometimes it means purchasing a luxury beach house in Florida,” said Delray Valle, Redfin’s market manager in Palm Beach. “We’ve always seen luxury buyers come to West Palm Beach from New York and California, but this year, they’re also coming from Maryland, Las Vegas, Chicago and other midwestern states. Florida is normally a second-home state, but now it’s shifting to a primary-home state.”

Valle continued: “The luxury market is so hot that we’re starting to see some seller’s remorse. Someone will sell their high-end home, and when they go to buy their next luxury property, they realize that they have to pay way more than they were hoping due to sky-high demand and a lack of inventory.”

With affluent Americans on the move, the market for vacation homes—many of which are luxury properties—has been on fire. Demand for second homes soared 100% year over year in October, surpassing the 50% increase in demand for primary homes. And many of the country’s hottest neighborhoods, such as Lake Tahoe and the Lakes Region of New Hampshire, are popular resort destinations full of high-end houses.

An Expanding Supply of Luxury Homes Is Allowing Sales to Flourish

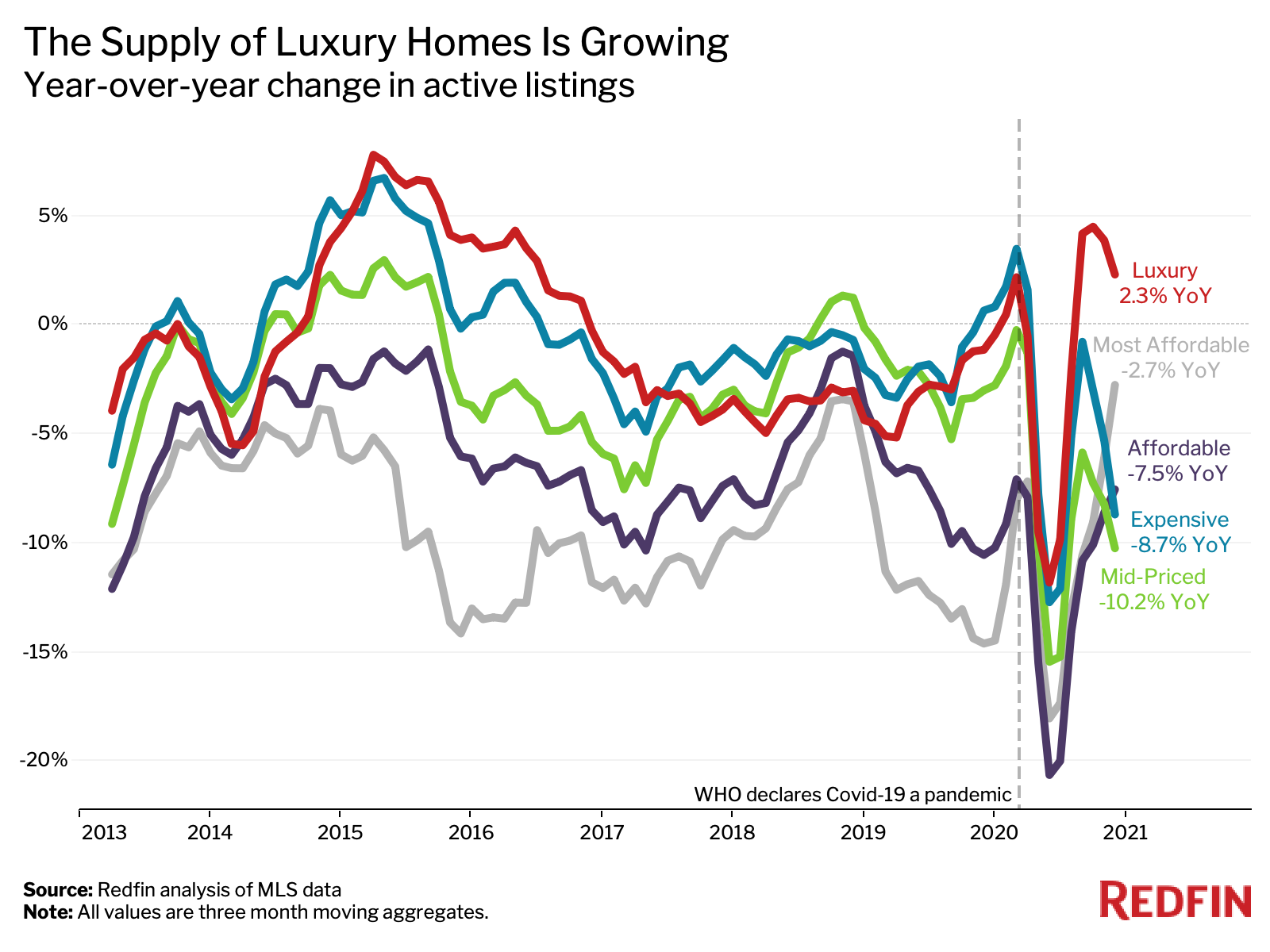

The number of luxury homes for sale climbed 2.3% year over year during the three months ending Nov. 30, while the supply of homes in all other price tiers declined.

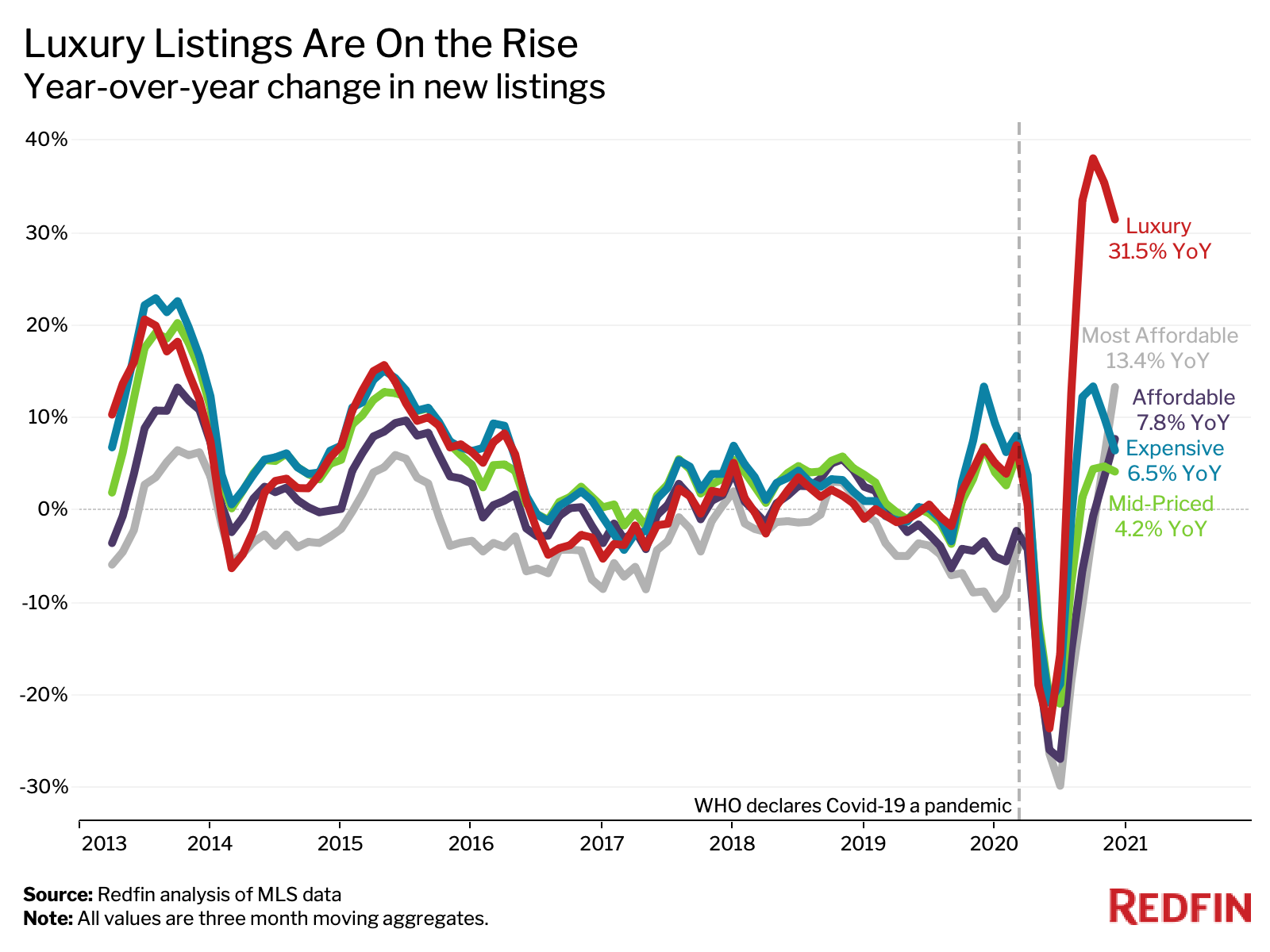

The growing supply of luxury homes is one factor supporting surging luxury-home sales. Luxury inventory is on the rise in part because affluent homeowners have had the means to put their homes up for sale and move elsewhere during the pandemic. New listings of luxury homes jumped 31.5% during the three months ending Nov. 30, more than double the growth of any other price tier.

Luxury-home supply will likely continue to expand, especially as builders ramp up construction, Fairweather said. U.S. building permits rose 8.5% year over year in November to a seasonally-adjusted annual rate of 1.6 million, and Fairweather believes builders will increasingly focus on luxury homes.

Meanwhile, the supply of affordable homes may keep growing at a relatively slow pace, at least until the pandemic is over; the owners of those homes are more likely to stay put as a result of financial uncertainty and federal forbearance policies that allow Americans to remain in their homes even if they can’t pay their mortgages.

Luxury Homes Are Selling Much Faster Than Last Year

The typical luxury home that was for sale during the three months ending Nov. 30 spent 55 days on the market—27 fewer days than the same period a year earlier. That compares with 15 fewer days for mid-priced homes and 11 fewer days for affordable homes.

“The luxury housing market is becoming increasingly competitive, in part because the pandemic has put a premium on luxury features like pools, home offices, spare rooms and fancy backyards,” Fairweather said. “Details that were once considered luxuries are now considered necessities by many homebuyers.”

Price Growth Converges for Luxury and Affordable Homes

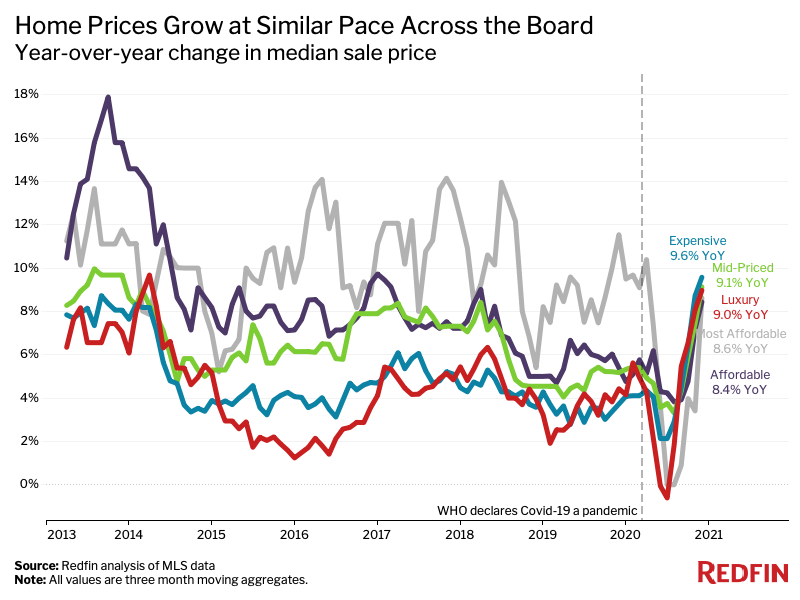

Up until the coronavirus pandemic, prices of affordable homes had been increasing at a faster clip than prices of high-end homes. Now, prices across all tiers are growing at a similar rate.

The most affordable bucket of homes saw prices grow 8.6% during the three months ending Nov. 30, comparable to the luxury tier’s 9.0% growth. That’s a much smaller gap than we saw during the three months ending Feb. 29, when prices of the most affordable homes were up 9.1%, versus growth of just 4.9% for luxury homes.

Luxury price growth has caught up to affordable price growth as a result of increasing competition in the luxury market, Fairweather said.

Summary of Luxury Market by Metro Area (49 Most Populous*), Three Months Ending Nov. 30, 2020

| Metro Area | Homes Sold, YoY Change | Median Sale Price | Median Sale Price, YoY Change | Active Listings, YoY Change | New Listings, YoY Change |

|---|---|---|---|---|---|

| Anaheim, CA | 59.3% | $2,750,000 | 3.8% | -7.0% | 27.9% |

| Atlanta, GA | 52.3% | $847,300 | 4.3% | 24.0% | 65.9% |

| Austin, TX | 73.5% | $1,350,000 | 10.3% | 13.5% | 40.0% |

| Baltimore, MD | 78.9% | $850,500 | 4.1% | -9.0% | 14.8% |

| Boston, MA | 54.6% | $1,828,000 | 1.6% | 10.9% | 25.7% |

| Charlotte, NC | 38.7% | $894,000 | 9.0% | -6.4% | 3.3% |

| Chicago, IL | 64.3% | $989,500 | 1.0% | -1.2% | 27.7% |

| Cincinnati, OH | 16.7% | $633,900 | 4.4% | -1.2% | 8.2% |

| Cleveland, OH | 39.7% | $561,300 | 7.9% | -16.2% | 19.4% |

| Columbus, OH | 42.5% | $670,000 | 5.6% | -10.4% | 32.2% |

| Dallas, TX | 63.0% | $915,000 | 0.6% | -3.6% | 2.7% |

| Denver, CO | 78.4% | $1,285,000 | 7.5% | 14.0% | 45.7% |

| Detroit, MI | 17.0% | $514,700 | 8.4% | 24.7% | 55.2% |

| Fort Lauderdale, FL | 73.8% | $1,050,000 | 10.5% | -4.6% | 8.4% |

| Fort Worth, TX | 65.4% | $769,100 | 8.0% | -5.4% | 4.2% |

| Houston, TX | 61.1% | $832,000 | 3.4% | 2.2% | 26.1% |

| Indianapolis, IN | 49.5% | $633,000 | 7.3% | -11.4% | -2.5% |

| Jacksonville, FL | 79.5% | $839,500 | 6.1% | -5.1% | 34.6% |

| Kansas City, MO | 66.3% | $670,000 | 6.4% | -22.1% | 2.1% |

| Las Vegas, NV | 60.7% | $827,500 | 3.4% | 15.5% | 32.8% |

| Los Angeles, CA | 34.6% | $3,050,000 | 6.4% | 15.5% | 29.7% |

| Miami, FL | 53.7% | $1,800,000 | 4.5% | 6.0% | 13.5% |

| Milwaukee, WI | 45.3% | $690,000 | 7.8% | 0.4% | 21.8% |

| Minneapolis, MN | 48.5% | $825,000 | 3.1% | -2.7% | 16.1% |

| Montgomery County, PA | 66.8% | $950,000 | 4.4% | 2.2% | 18.5% |

| Nashville, TN | 42.2% | $1,100,000 | 13.4% | 1.2% | 17.0% |

| Nassau County, NY | 41.8% | $1,995,000 | 6.4% | 0.2% | 48.6% |

| New Brunswick, NJ | 70.0% | $1,325,000 | 17.6% | 1.8% | 56.7% |

| Newark, NJ | 101.6% | $1,200,000 | 9.1% | 19.0% | 62.8% |

| Oakland, CA | 59.4% | $2,200,000 | 7.3% | 29.8% | 70.0% |

| Orlando, FL | 48.9% | $740,000 | 2.8% | -1.4% | 10.7% |

| Philadelphia, PA | 32.7% | $848,500 | 6.3% | 16.6% | 12.7% |

| Phoenix, AZ | 67.3% | $1,100,000 | 17.0% | -0.5% | 10.8% |

| Pittsburgh, PA | 54.0% | $622,500 | 5.6% | 6.4% | 3.8% |

| Portland, OR | 73.1% | $1,050,000 | 5.2% | 7.0% | 59.4% |

| Providence, RI | 62.1% | $979,000 | 13.2% | 1.5% | 65.9% |

| Riverside, CA | 81.1% | $1,000,000 | 9.9% | -1.7% | 32.0% |

| Sacramento, CA | 75.4% | $1,240,000 | 12.5% | 48.0% | 219.7% |

| San Antonio, TX | 82.4% | $676,000 | 5.6% | 16.7% | 37.4% |

| San Diego, CA | 45.4% | $2,350,000 | 11.4% | 6.0% | 38.9% |

| San Francisco, CA | 31.7% | $4,355,000 | -3.2% | 40.8% | 21.6% |

| San Jose, CA | 41.1% | $3,800,000 | 5.6% | 33.1% | 50.7% |

| Seattle, WA | 66.9% | $2,010,000 | 5.8% | 14.0% | 55.1% |

| St. Louis, MO | 35.0% | $675,000 | 8.0% | -14.9% | -9.1% |

| Tampa, FL | 48.3% | $897,900 | 12.2% | -8.9% | 13.9% |

| Virginia Beach, VA | 54.6% | $741,300 | 9.0% | -13.5% | 45.4% |

| Warren, MI | 59.2% | $685,000 | 3.0% | 21.4% | 67.6% |

| Washington, DC | 38.4% | $1,375,000 | 6.8% | 12.2% | 13.5% |

| West Palm Beach, FL | 97.1% | $1,759,500 | 6.6% | 8.7% | 10.3% |

| National—U.S.A. | 60.7% | $899,000 | 9.0% | 2.3% | 31.5% |

*Excludes New York City

Methodology

We divided all U.S. residential properties into five buckets. There are three equal-sized tiers based on Redfin Estimates of the homes’ market values as of Dec. 15, 2020, as well as tiers for the bottom 5% and top 5% of the market. The top 5% of the market by price is considered “luxury” for the purposes of this report, while the bottom 5% is titled “most affordable.” The “affordable” tier is homes estimated to be in the 5th-35th percentile. The “mid-priced” tier represents homes estimated to be in the 35th-65th percentile. The “expensive” tier represents homes estimated to be in the 65th-95th percentile. By using Redfin Estimates of homes’ market value, we are able to use the same group of homes to report on price, sales and inventory.

United States

United States Canada

Canada