Homebuyer interest in million-dollar-plus homes reached a record high in January, reflecting the K-shaped economic recovery that’s unequally benefiting affluent Americans.

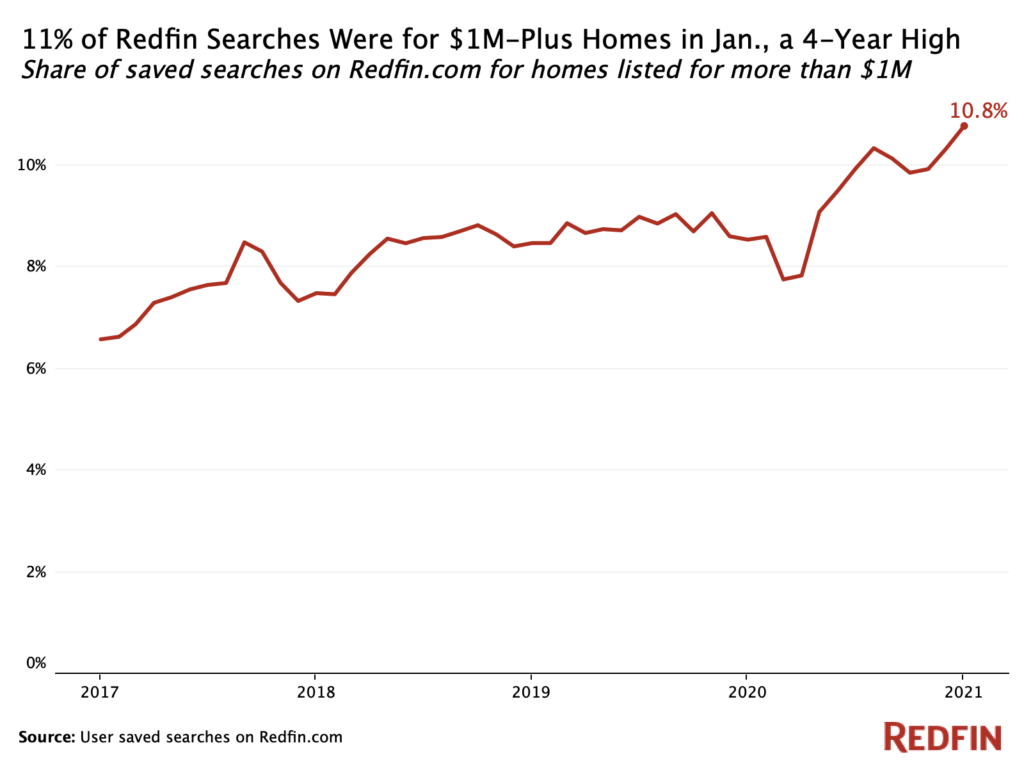

Nationwide, 10.8% of saved searches on Redfin.com filtered exclusively for homes priced over $1 million in January. That’s up from 8.5% a year earlier and the highest share since Redfin started tracking this data in the beginning of 2017.

At the same time, 36% of home searches in January filtered exclusively for homes priced under $500,000, down from 39.3% a year earlier and the lowest share since September 2017.

Low mortgage rates and quickly rising home values—the national median home-sale price rose 13% year over year in December—are two reasons why a record share of homebuyers are looking for homes priced over $1 million. The trend is also partly due to the fact that in today’s economic climate, affluent Americans are the ones who can afford to buy homes.

“Wealthy people are reaping the benefits of unequal recovery from the pandemic-driven recession as they earn money from robust stock portfolios and rising real estate values,” said Redfin chief economist Daryl Fairweather. “Not only can they afford to move, they also have big budgets. Unfortunately, many lower-income people, particularly those in the service industry, are struggling financially and aren’t in the market for homes.”

Luxury home sales in the U.S. soared 61% in the three months ending November 30, the biggest jump since at least 2013 and a much bigger increase than sales of mid-priced or affordable homes.

California Redfin.com users most likely to search for $1 million-plus homes

In San Jose, 48.5% of searches filtered for homes priced over $1 million in January, the highest share of the metros tracked by Redfin. It’s followed by four other expensive California metros: San Francisco (48%), Oakland (31.8%), Anaheim (25.1%) and Los Angeles (24.9%). That’s the highest share since at least the beginning of 2017 in all five of those metros.

Those areas are home to the five most expensive housing markets in the U.S. The median home-sale price is $1.4 million in San Francisco, $1.2 million in San Jose, $817,000 in Oakland, $800,000 in Anaheim and $730,000 in Los Angeles.

The median home-sale price is above $500,000 in seven other metros. Six of those seven areas saw record-high shares of searches for homes over $1 million in January: Boston (15.5%), Nassau County, NY (9.7%), New York, NY (12.6%), Oxnard, CA (16.2%), San Diego, CA (20.2%) and Seattle (17.8%). The exception is Honolulu, where 16.8% of searches filtered for homes priced over $1 million, the second-highest share in the last four years (the highest share was 17.9% in September).

“With home prices up from last year and escalating even higher with bidding wars, a lot of buyers have no choice but to up their budgets,” said Seattle Redfin agent Bliss Ong. “A home that would have cost $699,000 a year ago would be listed for $750,000 today and it may end up selling for $850,000. Expensive homes are more popular than they used to be, too. In the past, anything over $1.5 million would stay on the market for several weeks, but that’s not the case anymore. Even in the $2 million range, homes are selling within the first week.”

United States

United States Canada

Canada