The biggest increase was in Austin, where rents surged 40% from a year earlier.

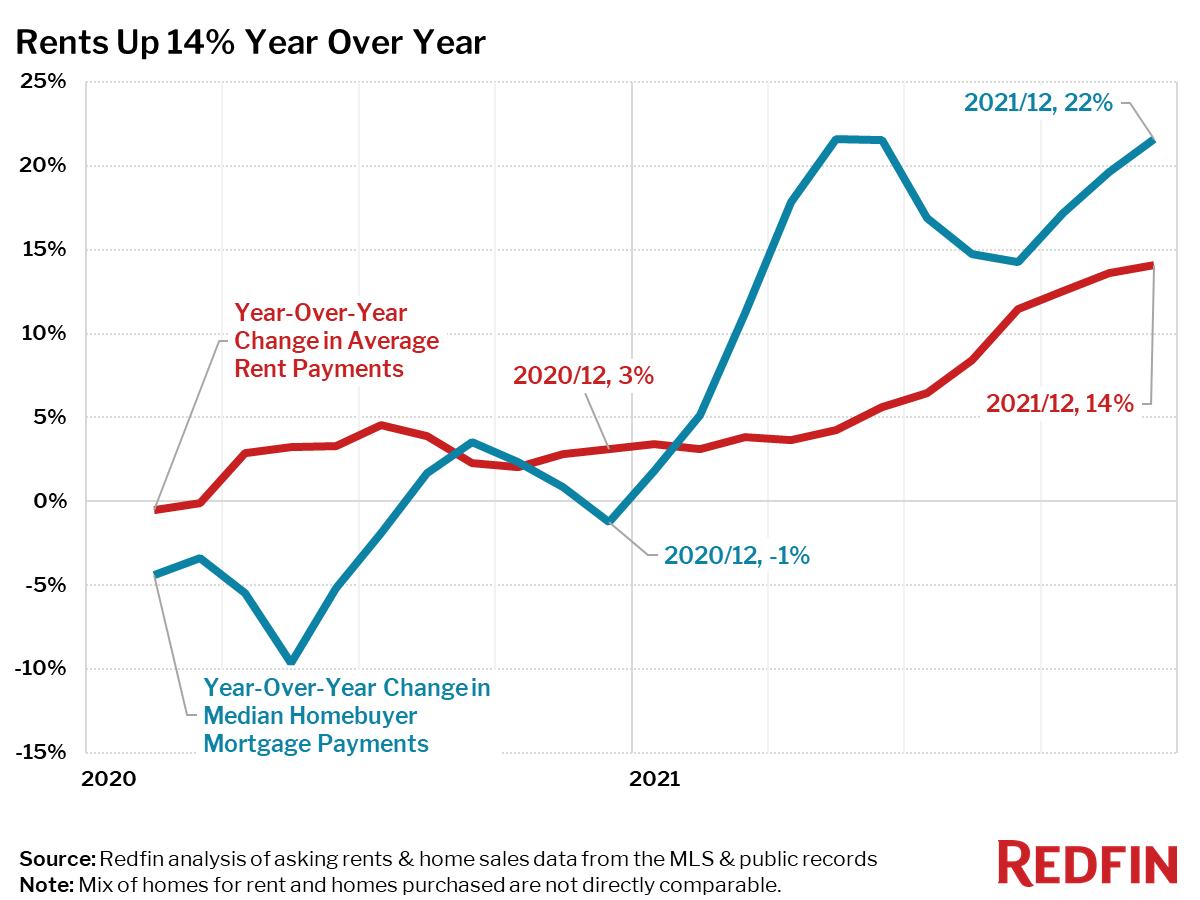

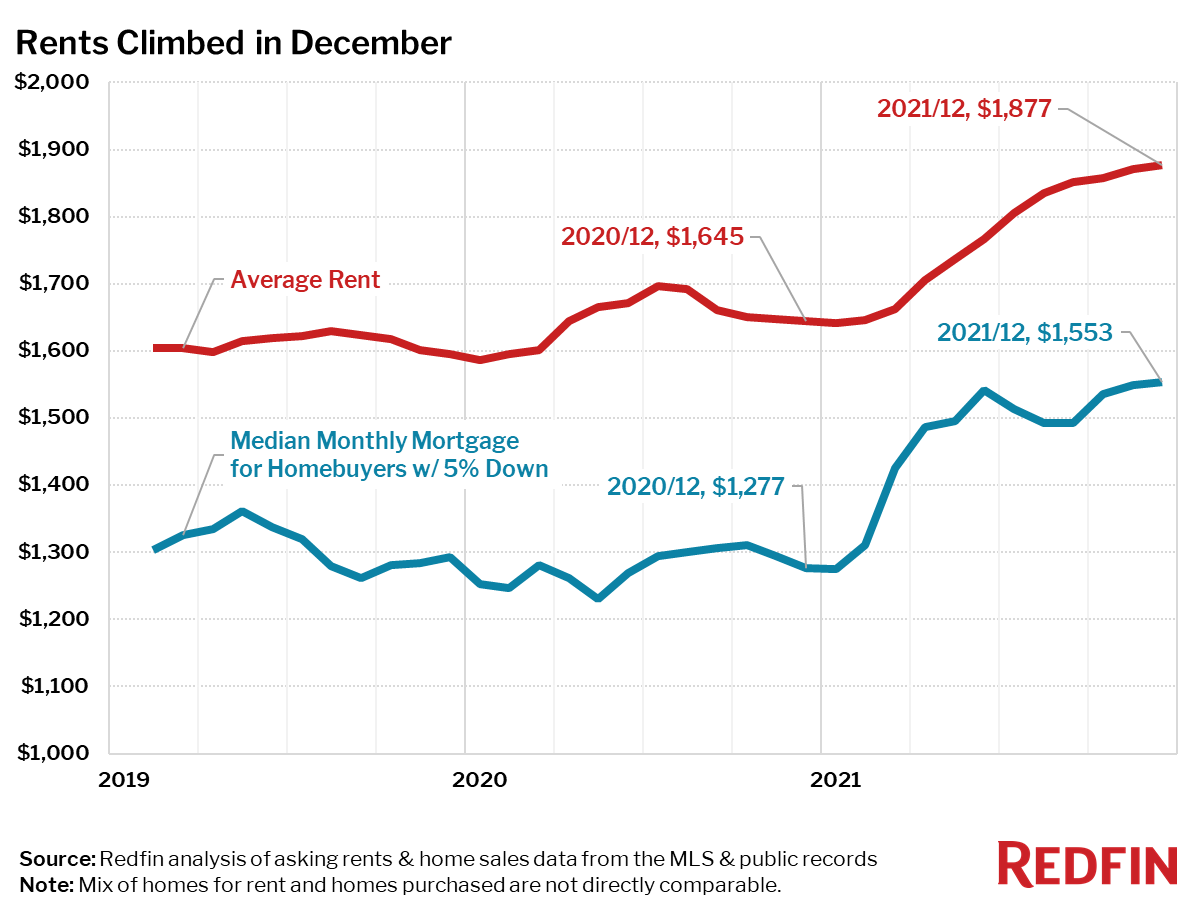

Average monthly listed rents in the U.S. increased 14.1% year over year to $1,877 in December, the largest annual jump since at least February 2019—the earliest month in Redfin’s rental data. Meanwhile, the national monthly mortgage payment for homebuyers climbed 21.6% year over year, also the biggest increase in Redfin’s records. “The growth in mortgage payments has been driven by both climbing prices and climbing mortgage rates,” said Redfin Chief Economist Daryl Fairweather. “And those rising mortgage costs push more potential homebuyers into renting instead, which pushes up demand and prices for rentals. Mortgage rate increases are accelerating, which will cause both mortgage payments and rent to grow throughout 2022.”| Rental Market Summary | December 2021 | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Average Monthly Rent | $1,877 | 0.3% | 14.1% |

| Median Monthly Mortgage Payment for Homebuyers w/ 5% down payment | $1,553 | 0.3% | 21.6% |

Year–over-year rent-price increases outpaced year-over-year mortgage payment increases for new homebuyers in just 16 of the 50 largest U.S. metro areas in December.

Year–over-year rent-price increases outpaced year-over-year mortgage payment increases for new homebuyers in just 16 of the 50 largest U.S. metro areas in December.

Rents are Up Over 30% In Many Major Metro Areas

The 10 metro areas with the biggest increases in rent prices—up 29% year over year or more—were almost exclusively on the East Coast. The only exceptions were Austin, TX and Portland, OR.Top 10 Metro Areas With Fastest-Rising Rents Year Over Year

- Austin, TX (40%)

- Nassau County, NY (35%)

- New York, NY (35%)

- Newark, NJ (35%)

- New Brunswick, NJ (35%)

- Miami, FL (34%)

- West Palm Beach, FL (34%)

- Fort Lauderdale, FL (34%)

- Jacksonville, FL (31%)

- Portland, OR (29%)

Only Kansas City saw rent decline year over year

- Kansas City, MO (-0.8%)

Year-Over-Year Change in Rents and Median Monthly Mortgage Payments for Homebuyers, December 2021

| Region | Average Rent | Year-Over-Year Change in Average Rent | Monthly Mortgage (5% down) | Year-Over-Year Change in Monthly Mortgage (5% down) | Difference Between Year-Over-Year Change in 5% Down Mortgage Payment & Rent |

|---|---|---|---|---|---|

| Anaheim, CA | $3,394 | 9.6% | $3,813 | 24.0% | 14 pts |

| Atlanta, GA | $2,016 | 12.1% | $1,420 | 29.6% | 18 pts |

| Austin, TX | $2,290 | 39.9% | $1,956 | 37.5% | -2 pts |

| Baltimore, MD | $2,018 | 10.7% | $1,318 | 11.0% | 0 pts |

| Boston, MA | $3,637 | 22.3% | $2,511 | 18.8% | -3 pts |

| Charlotte, NC | $1,730 | 11.5% | $1,448 | 27.1% | 16 pts |

| Chicago, IL | $2,351 | 9.0% | $1,168 | 14.3% | 5 pts |

| Cincinnati, OH | $1,473 | 24.2% | $957 | 15.1% | -9 pts |

| Cleveland, OH | $1,378 | 11.6% | $730 | 9.8% | -2 pts |

| Columbus, OH | $1,458 | 7.5% | $1,095 | 16.3% | 9 pts |

| Dallas, TX | $2,081 | 28.5% | $1,562 | 27.0% | -1 pts |

| Denver, CO | $2,661 | 19.0% | $2,191 | 26.1% | 7 pts |

| Detroit, MI | $1,552 | 11.4% | $710 | 19.1% | 8 pts |

| Fort Lauderdale, FL | $3,020 | 34.0% | $1,481 | 23.5% | -11 pts |

| Fort Worth, TX | $2,081 | 28.5% | $1,367 | 30.8% | 2 pts |

| Houston, TX | $1,807 | 10.4% | $1,294 | 23.8% | 13 pts |

| Indianapolis, IN | $1,280 | 9.1% | $1,014 | 19.9% | 11 pts |

| Jacksonville, FL | $1,625 | 31.5% | $1,298 | 25.3% | -6 pts |

| Kansas City, MO | $1,391 | -0.8% | $1,116 | 18.5% | 19 pts |

| Las Vegas, NV | $1,820 | 25.2% | $1,620 | 31.7% | 7 pts |

| Los Angeles, CA | $3,394 | 9.6% | $3,387 | 20.7% | 11 pts |

| Miami, FL | $3,020 | 34.0% | $1,785 | 29.0% | -5 pts |

| Milwaukee, WI | $1,731 | 9.7% | $1,005 | 14.5% | 5 pts |

| Minneapolis, MN | $1,860 | 9.0% | $1,359 | 14.1% | 5 pts |

| Montgomery County, PA | $2,233 | 13.2% | $1,562 | 16.1% | 3 pts |

| Nashville, TN | $1,872 | 13.9% | $1,663 | 31.1% | 17 pts |

| Nassau County, NY | $3,718 | 34.5% | $2,333 | 13.4% | -21 pts |

| New Brunswick, NJ | $3,718 | 34.5% | $1,724 | 16.5% | -18 pts |

| New York, NY | $3,718 | 34.5% | $2,596 | 14.5% | -20 pts |

| Newark, NJ | $3,718 | 34.5% | $1,866 | 14.2% | -20 pts |

| Oakland, CA | $3,520 | 15.0% | $3,554 | 14.2% | -1 pts |

| Orlando, FL | $2,050 | 28.8% | $1,444 | 29.6% | 1 pts |

| Philadelphia, PA | $2,233 | 13.2% | $1,051 | 13.9% | 1 pts |

| Phoenix, AZ | $2,107 | 26.0% | $1,766 | 35.1% | 9 pts |

| Pittsburgh, PA | $1,707 | 8.9% | $820 | 11.0% | 2 pts |

| Portland, OR | $2,392 | 29.4% | $2,069 | 19.6% | -10 pts |

| Providence, RI | $2,176 | 13.1% | $1,542 | 20.5% | 7 pts |

| Riverside, CA | $2,666 | 18.5% | $2,150 | 24.9% | 6 pts |

| Sacramento, CA | $2,582 | 20.7% | $2,224 | 21.8% | 1 pts |

| San Antonio, TX | $1,386 | 11.5% | $1,252 | 25.3% | 14 pts |

| San Diego, CA | $3,077 | 10.8% | $3,142 | 23.9% | 13 pts |

| San Francisco, CA | $3,520 | 15.0% | $6,038 | 16.4% | 1 pts |

| San Jose, CA | $3,300 | 6.7% | $5,550 | 21.3% | 15 pts |

| Seattle, WA | $2,724 | 20.9% | $2,949 | 23.4% | 3 pts |

| St. Louis, MO | $1,448 | 1.3% | $901 | 13.8% | 13 pts |

| Tampa, FL | $2,076 | 28.1% | $1,371 | 31.2% | 3 pts |

| Virginia Beach, VA | $1,681 | 20.4% | $1,156 | 12.1% | -8 pts |

| Warren, MI | $1,552 | 11.4% | $1,043 | 13.0% | 2 pts |

| Washington, D.C. | $2,538 | 12.0% | $1,978 | 14.4% | 2 pts |

| West Palm Beach, FL | $3,020 | 34.0% | $1,582 | 20.4% | -14 pts |

| National | $1,877 | 14.1% | $1,553 | 21.6% | 7 pts |

United States

United States Canada

Canada