Second-home buyers are out in full force as affluent Americans continue to work remotely from vacation destinations.

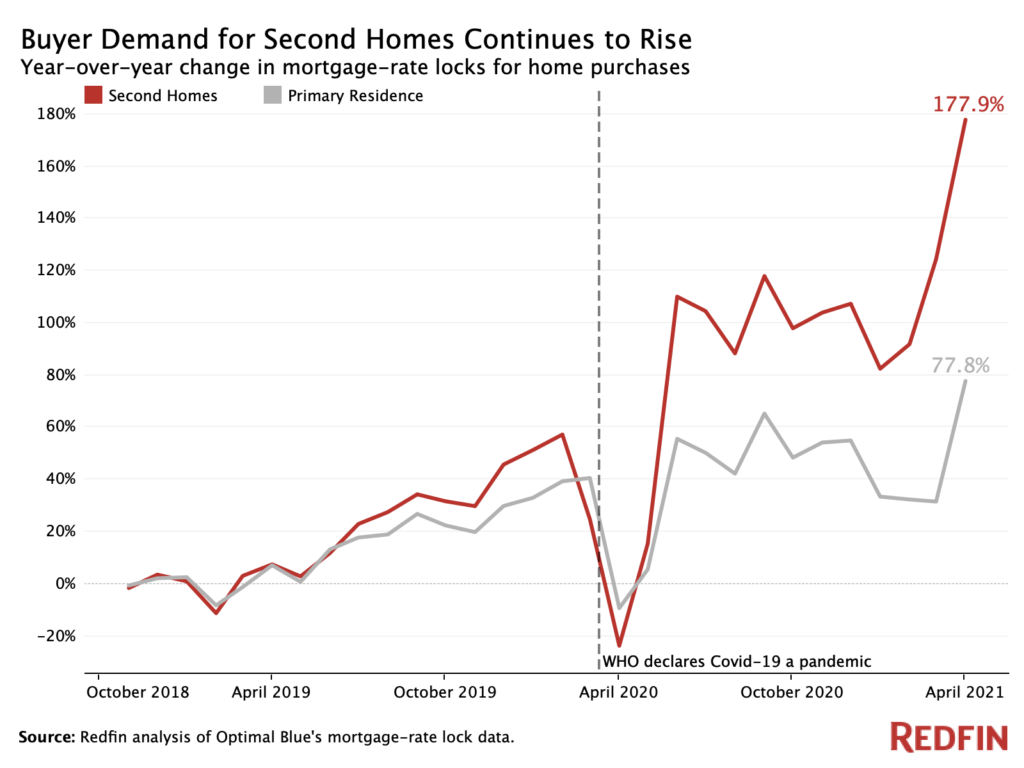

The number of buyers who locked in mortgage rates for second homes soared 178% year over year in April, marking the 11th straight month of 80%-plus growth. The record increase should be taken in context: It is likely exaggerated because demand for second homes dropped 24% year over year last April, the month after the coronavirus pandemic hit the U.S. and real estate activity in the country nearly ground to a halt.

Still, second-home mortgage rate locks are holding steady at more than double pre-pandemic levels.

The rise in demand for second homes is more than twice the increase for primary homes, with the number of buyers who locked in mortgage rates for primary homes rising 78% year over year in April. That’s a record jump, too, but should also be taken in context, as demand for primary homes dropped last April due to the pandemic.

The data in this report is based on a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

Demand for vacation homes remains elevated as wealthy Americans continue to have the freedom to work remotely and earn money from robust stock portfolios and rising home values. Even as some offices start to reopen, many Americans plan to work remotely for the long term, at least part of the time.

“The combination of the wealthy becoming wealthier, remote work turning into the new normal and low mortgage rates is creating an ideal environment for affluent Americans to buy vacation homes,” said Redfin Chief Economist Daryl Fairweather. “As long as the economy continues to grow, I don’t foresee demand for second homes slowing down anytime soon.”

The elevated demand for second homes in the pandemic era is one sign of economic inequality in the U.S., with some buyers able to afford second homes and others unable to become homeowners at all.

“I’m working with several second-home buyers right now, and a few other clients who are selling vacation homes that have been in the family for decades,” said Lisa C. Smith, a Redfin real estate agent in Myrtle Beach, SC. “The vacation rental market is predicted to be especially hot this summer because most people are still able to work remotely, and others are using vacation time they saved up at the height of the pandemic. A lot of investors are noticing the intensity of the rental market here and snapping up homes and condos for short-term rentals. They feel property is still affordable and taxes are cheaper in this area than other parts of the country. There are new listings hitting the market every day because homeowners are realizing now is a great time to sell their vacation properties. Sellers have seen prices go up, and many of them are able to sell and pocket the equity.”

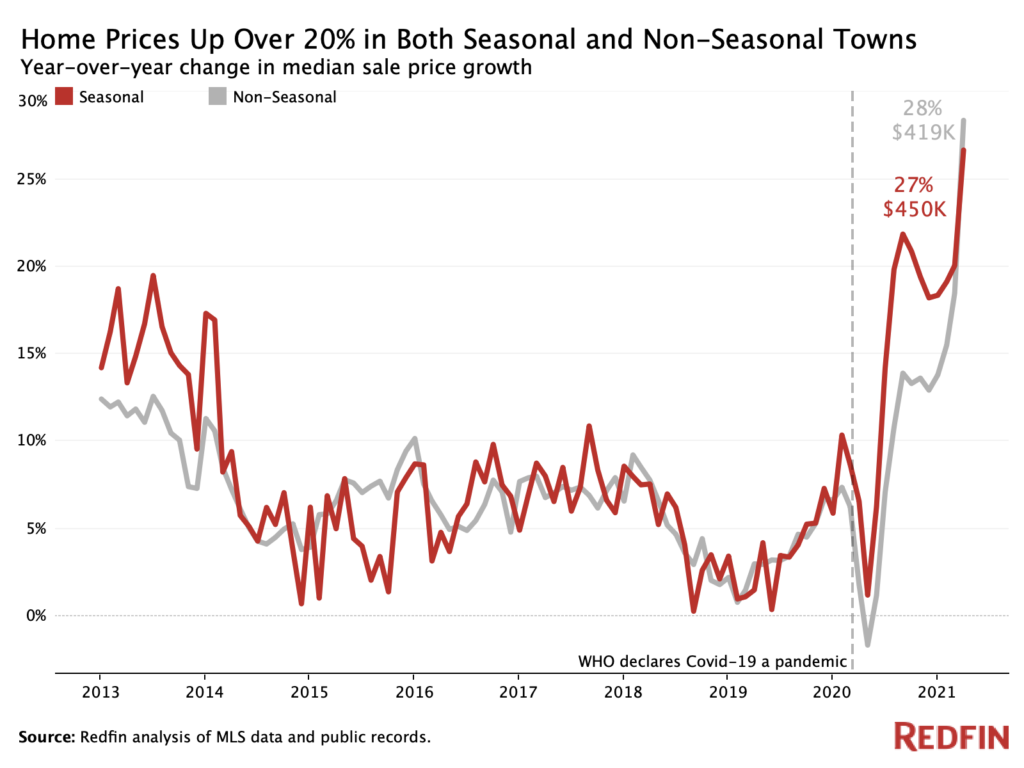

Home prices are up 27% year over year in seasonal towns

Home prices in seasonal towns, where second homes are often located, rose 27% year over year in April to $450,000. Prices in non-seasonal towns are up by a similar margin: 28% to $419,000. Though those jumps are both the biggest on record, the increases are somewhat inflated because price growth was slow at this time last year due to stay-home orders and economic lockdowns related to the pandemic. Non-seasonal price growth is slightly bigger than seasonal price growth this month partly because prices in non-seasonal towns dropped more significantly at this time last year.

Price growth for homes in seasonal towns started recovering last summer, and April marks the 10th straight month of 10%-plus year-over-year growth.

For this analysis, a seasonal town is defined as an area where more than 30% of housing is used for seasonal or recreational purposes.

United States

United States Canada

Canada