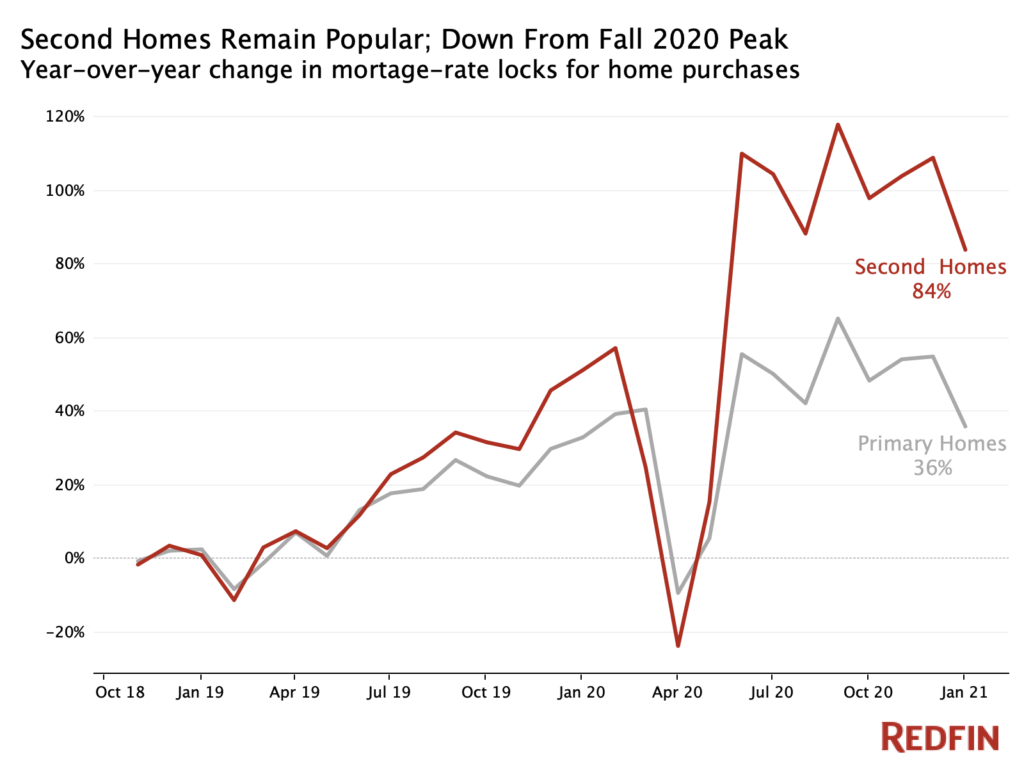

Pandemic-driven demand for vacation homes is continuing into 2021 as mortgage applications for second homes see their eighth consecutive month of 80%-plus growth. Demand for second homes is increasing twice as fast as it is for primary residences.

Mortgage applications for second homes soared 84% year over year in January. While that’s down from a peak 118% year-over-year increase in September, it’s up significantly from a year ago and marks the eighth straight month of 80%-plus year-over-year growth.

The annual rise in second-home applications is more than double the increase in applications for primary homes. Demand for primary residences rose 36% year over year in January, down from the 65% peak in September and the smallest increase since May.

That’s according to a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

The continued popularity of vacation homes is indicative of the rise in remote work due to the coronavirus pandemic. With white-collar workers able to work remotely and children learning from home, many affluent Americans are opting to spend at least part of their time outside of densely packed cities and decamping to vacation destinations.

The demand for second homes is also representative of the K-shaped economic recovery from the pandemic-driven recession, with scores of lower-income Americans continuing to suffer financially while many high earners benefit from skyrocketing home values and well-performing stock portfolios.

“Although demand is down slightly from the fall peak, the fact that nearly twice as many second-home buyers submitted applications in January as the year before means the popularity of vacation towns is not a fad,” said Redfin economist Taylor Marr. “Many Americans have realized remote work is here to stay, allowing some fortunate people to work from a lakefront cabin or ski condo indefinitely. But while many well-off remote workers are able to follow their dreams and purchase second homes, it has become even more difficult for many lower-income people to buy a primary residence as home values rise and the recession disproportionately impacts employees in the service sector.”

Several of Redfin’s hottest neighborhoods of 2021 are located in vacation destinations, including Lake Tahoe, Mountain House, CA and the Lakes Region of New Hampshire. The majority of the top 10 hottest neighborhoods on that list experienced double-digit growth in home values and sales in 2020.

“There’s just as much desire for vacation homes as ever, but inventory is so low that fewer people are actually able to submit offers and apply for mortgages,” said Jaime Moore, a Redfin agent in Lake Tahoe. “The market is still highly competitive, and almost all the buyers are people from the San Francisco area purchasing their second home. The only time I see a buyer looking to purchase a primary residence is when they already live here in a rental, and they’re looking for something more permanent.”

Overall homebuying demand has been up over the last several months due to low mortgage rates, remote-work-driven relocation and desire for more space for home offices and homeschooling. Total home sales were up 16% year over year in December (the most recent month for which data is available), the fourth-biggest increase on record, and pending sales were up 35%.

Home prices in seasonal towns rose 19% year over year in December

Meanwhile, home values are rising by double digits in both seasonal and non-seasonal towns, but seasonal towns are seeing bigger increases.

The median sale price for homes in seasonal towns rose 19% year over year in December—the most recent month for which data is available—to $408,000. Home prices in non-seasonal towns grew 13% to $365,000 over the same time period. For this analysis, we defined a seasonal town as an area where more than 30% of housing is used for seasonal or recreational purposes.

United States

United States Canada

Canada