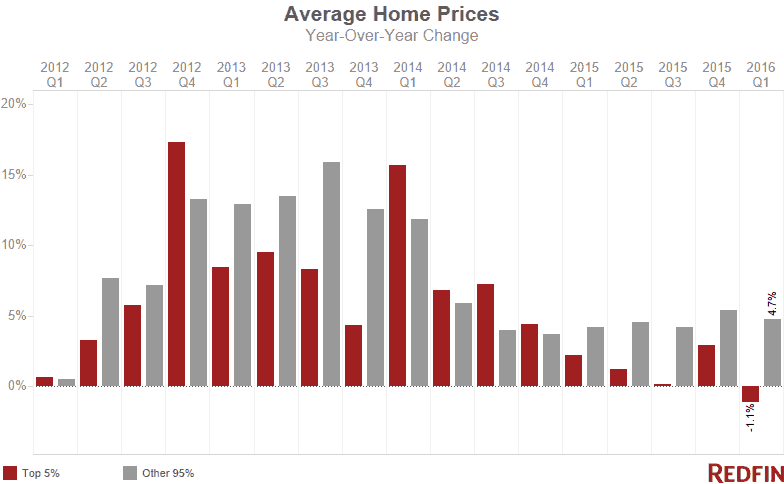

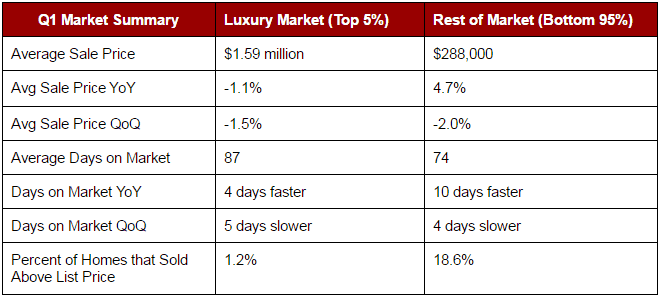

Global economic volatility rocked the U.S. luxury housing market in the first quarter of 2016, as the average sale price of luxury homes fell 1.1 percent compared to last year. The decline followed a year of weakening luxury home price growth. Redfin defines the luxury market as the most expensive 5 percent of homes sold in a given quarter. Home prices for the bottom 95 percent of the market maintained positive momentum, increasing 4.7 percent year over year.

Luxury home sales were solid, up 6 percent compared to a year ago. The number of homes for sale priced above $1 million increased 3.3 percent from a year prior, with homes priced above $5 million up 13.2 percent. These numbers on existing homes may actually understate overall luxury inventory as builders continue to bet on luxury in some cities, building extravagant homes on ‘spec,’ or without have a buyer lined up in advance.

What Drove the Price Decline?

Stock prices dropped steeply in January and February before rebounding. Such market fluctuations are often felt more acutely by high-end buyers who pull from investment portfolios to finance luxury home purchases. In a recent survey, one in five Redfin agents said the volatile stock market has affected homebuyers.

With the global economy sputtering, the U.S. dollar remains strong. The relative weakness of other currencies has dissuaded many foreign buyers from purchasing luxury real estate in the States.

“Luxury buyers are out of step with the rest of the market because their wealth is at stake,” said Redfin chief economist Nela Richardson. “Instead of cheering rock-bottom mortgage rates, luxury buyers recoiled from high-end spending in the face of volatile asset prices. Luxury demand, especially for vacation and investment properties, has been more fragile this year, causing prices to slump.”

With more inventory at the top of the market, buyers had more choices and therefore more opportunity to negotiate on price.

“It’s common to see a big gap between the asking price and the ultimate sale price for luxury homes,” said Tonya Nelson, a Redfin agent in Northern Virginia. “From a basic math perspective, a 5 percent price difference is a bigger number when your starting point is $3 million compared to $300,000. I tell my high-end home sellers to build in flexibility to negotiate because there are fewer qualified buyers at that price point.”

Biggest Losers

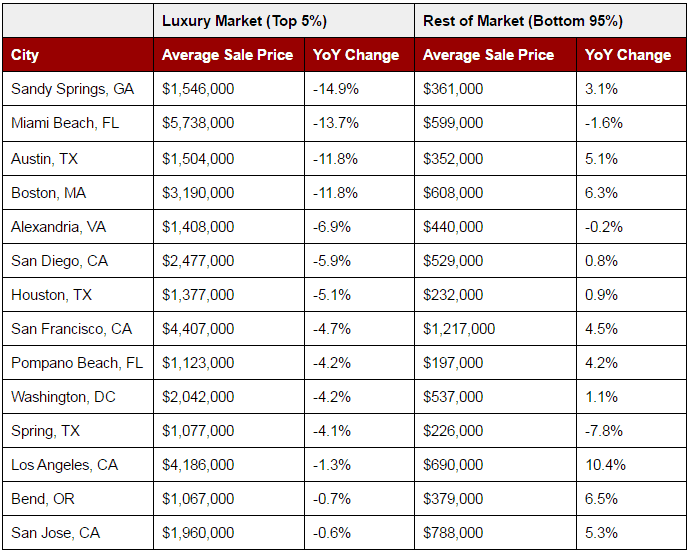

Several cities recognized internationally for their luxury housing markets saw luxury home prices fall significantly. In Miami Beach, a glut of luxury development paired with foreign buyer skittishness caused luxury home prices to fall 13.7 percent. How much of a glut? In 2016 there were more than twice as many million-dollar homes for sale as last year, but despite all the choices, buyers weren’t biting. Miami Beach luxury home sales fell over 3 percent.

In the super-hot Austin and Boston markets, competition for moderately-priced homes pushed prices up in the bottom 95 percent of the market. However prices at the top of the market fell nearly 12 percent.

In San Francisco, luxury home prices dropped 4.7 percent in the first quarter from a year prior. In the tech world, executives hold much of their wealth in company stocks and options, and a rocky stock market and lower tech company valuations kept some on them sidelines. But not every city in the San Francisco Bay Area saw luxury market declines. Read on.

Biggest Winners

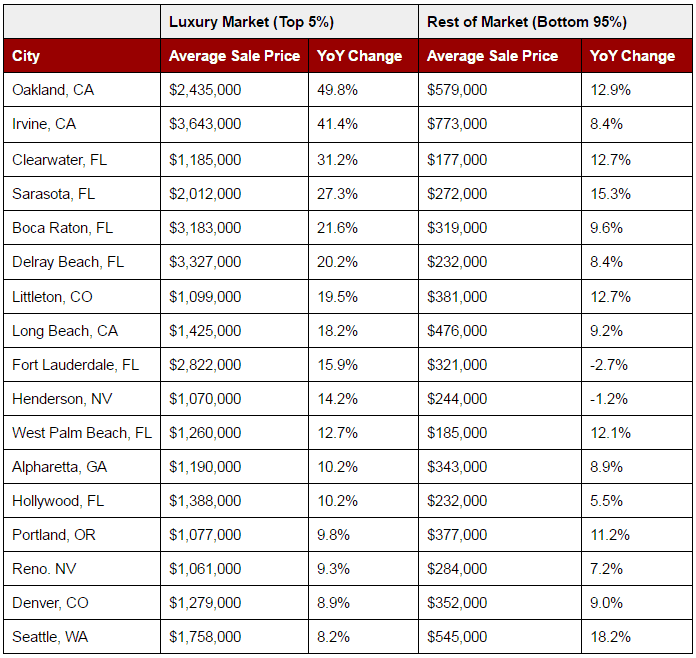

Oakland is emerging as a new destination for luxury buyers expanding their search beyond San Francisco. The average price for a home in the top 5 percent was over $2.4 million this year compared to $1.6 million last year — a year-over-year jump of nearly 50 percent. The $20 million sale of this Frank Lloyd Wright-inspired estate in January certainly pulled up the average, but Redfin Oakland agent Tom Hendershot explained that while Oakland has long been a hot market, competition has exploded over the last few months.

“The intensity in the Oakland market is driven by two factors: buyers fleeing San Francisco and moves by Uber, Amazon and other companies to establish offices in Oakland,” Hendershot said. “Last year, we saw minimal competition for homes in the $1.5 million-plus range, and now homes in the $1.2 – $1.6 million range typically get 10 offers. That competition drives pressure up the food chain. While the multi-million dollar homes at the very top have fewer buyers and less competition, it’s no surprise to see prices rising across the board.”

The luxury market in Irvine in California’s Orange County also experienced impressive price growth of 41 percent. Clearwater and Sarasota along Florida’s Gulf Coast were also luxury market winners in the first quarter with respective year-over-year price growth of 31.2 percent and 27.3 percent.

To see data for your city, download the data at this link and visit the Redfin Data Center to find more housing market data for metro areas around the country.

Methodology: Redfin tracks the most expensive 5 percent of homes sold in more than 600 U.S. cities and compares price changes to the bottom 95 percent of homes in those markets. Analysis is based on multiple-listing and county recorder sales data in markets served by Redfin. To determine luxury market winners and losers, we looked at cities with at least 30 luxury sales in the quarter and an average luxury sale price of at least $1 million.

Other popular posts:

1. Home After Rehab: Finding the Right Place for Recovery

2. The Veterans’ Complete Guide to Relocation

3. Disaster Safety for People with Disabilities: When Emergency Weather Strikes

United States

United States Canada

Canada