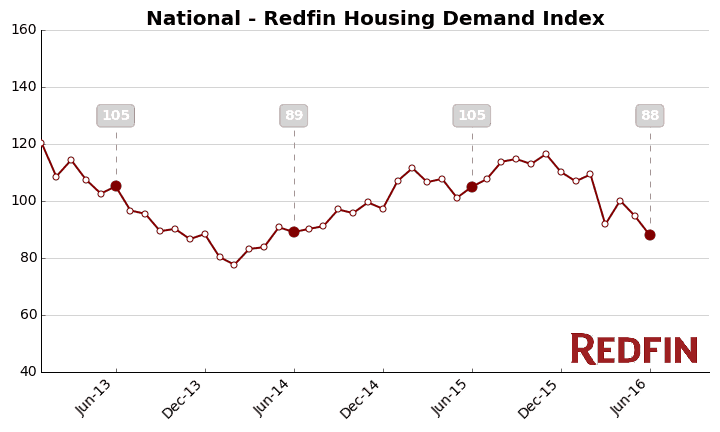

Homebuyer demand fell 17 percent in June, the fifth-consecutive month of year-over-year declines in early-stage homebuyer activity. The Redfin Housing Demand Index, based on thousands of Redfin customers requesting home tours and writing offers, fell 7 percent from May to a seasonally adjusted level of 88 in June.

Today Redfin unveils an improved version of its Demand Index, which tracks the earliest stages of homebuyer demand across 15 major metro areas. The Demand Index uses a new methodology that computes a seasonally adjusted value to reflect the level of homebuyer activity, enabling us to compare demand from one month to another accounting for expected seasonal changes. Redfin also introduces seasonally adjusted metro-level Demand Indices for 14 markets.

The Redfin Housing Demand Index, the industry’s first and only measure of homebuyer activity prior to purchase, has a benchmark of 100, representing the three-year historical average from January 2013 through December 2015. A Demand Index reading over 100 reflects high, or stronger-than-expected demand. A reading below 100 means demand is relatively weak and there is less activity than expected. The Demand Index is a forward-looking metric that is highly correlated with existing-home sales levels seen two months later as reported by the National Association of Realtors.

The number of Redfin customers requesting tours in June was up 9.2 percent year over year, the smallest increase in tour activity seen since August 2014. Customers requesting tours fell 6 percent from May. Seven percent fewer people wrote home-purchase offers in June than did a year earlier and there was a 5.6 percent drop in offer-writing activity from May.

Based on June’s demand decline, we expect sales to slow from their current pace in August.

Even though the market feels hot, with 7.6 percent fewer homes for sale across the 15 metros tracked by Demand Index, there simply wasn’t much for buyers to act on last month. Still, there were more buyers than homes, which meant homes sold quickly, many over list price and often in bidding wars.

“These major metro areas have all felt the squeeze from inventory, meaning there was just less for buyers to look at,” said Redfin chief economist Nela Richardson. “It’s not surprising that demand reflects that squeeze. Even strong buyer interest can’t squeeze a fresh listing from what’s become a dry turnip of housing supply.”

Metro-Level Demand

Demand fell from last year in 10 metro areas in June from May. The biggest year-over-year decrease in demand was seen in Denver, where the Demand Index fell 54.7 percent. Baltimore saw the biggest annual increase in demand, up 20.7 percent in June. Six markets posted month-over-month decreases in demand. Atlanta posted the biggest monthly decrease, with the local Demand Index down 47.1 percent in June. San Francisco posted the biggest month-over-month gain, up 45 percent.

“After enduring slumping sales for most of 2016, San Francisco is poised to rebound in the second half of the year,” said Richardson. “The increase in homes for sale and slowing price growth have encouraged Bay Area buyers, drawing them back into the market.”

Read the full Demand Index methodology here. See Redfin’s data center for the latest updates on Demand Index.

United States

United States Canada

Canada