Why hire a real estate agent, if not to get a better home? We endlessly rate homebuyers’ satisfaction with their real estate agent, but not with the home itself. It’s easy to imagine that a different neighborhood, a sunnier kitchen, a shorter commute could lead, over the years that you live in a home, to a better life. What’s hard to know is how to get that.

This month, Redfin surveyed 657 people who bought a home with a Redfin agent in the last 18 months. To help future customers make better decisions, we wanted to understand why one homebuyer loves her new place and another moves as soon as she can afford to. We believe it’s the first research of its kind.

Reviewing the data, we came to realize that we as humans don’t always know what to look for in a home, that even in the biggest, most considered purchase of our lives, we pay for things that make us unhappy, and overlook the things we really need. What we found is that the homebuyers with no experience often make the best choices, and that the people with the most money are the least likely to love their homes.

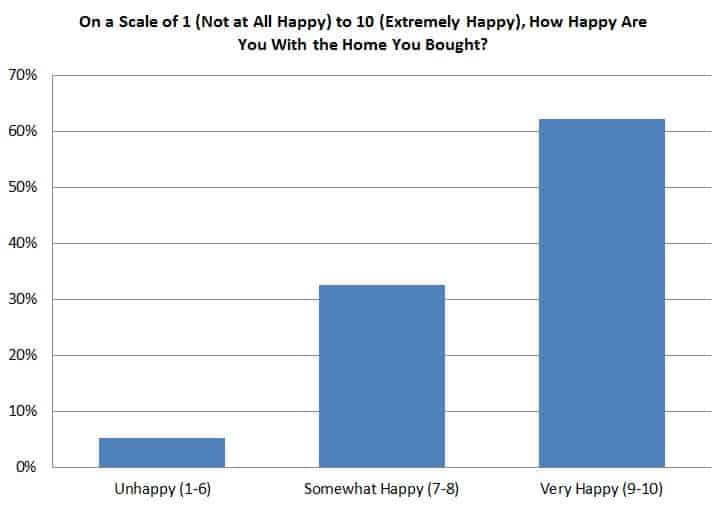

The good news is that overall, the people who bought a home via Redfin are happy. Sixty-two percent were very happy with their home, 33 percent were somewhat happy and 5 percent were unhappy.

Given that most people are spending hundreds of thousands of dollars to buy a house, should we expect more happiness overall? We don’t know. Later this year, we’ll hire an independent research firm to survey the general population of homebuyers, including only a small sample of Redfin customers, to see what level of happiness with a home is the norm.

Nine Ways to Make Sure You Love Your Home

Beyond the general level of satisfaction with a new home, what was more interesting were the factors correlated with recent homebuyers’ being very happy with their home, where we define “very happy,” as rating your happiness with the home as a 9 or a 10 out of 10:

- Move to an area with a lower cost of living: 73% of people moving to an area with a lower cost of living were very happy, compared to 60% of people moving to a higher-cost area and 59% of people moving to an area with the roughly the same cost of living. The Californians moving to Portland, Salt Lake City and Seattle are onto something.

- Head for the hills: 74% of of people moving to a rural area were very happy with their home, compared to only 56% of city-dwellers. The suburbs were, as you might expect, in between, at 64%.

- Avoid fixer-uppers: only 46% of those who have had to do more repairs than expected are very happy with their home, while 77% who have had to do fewer repairs than expected feel the same. We asked, “If you had to buy a home over again, would you prefer a move-in condition home that costs more, or a home that requires some renovations that costs less?” Sixty-four percent of respondents preferred a move-in-ready home at a higher price, while 19% preferred a fixer-upper at a lower price.

- If you start losing bidding wars, avoid the temptation to settle: 64% of those who made offers on less than three other homes were very happy with their home, compared to 52% of those who made offers on three or more other homes. By your fourth offer, the likelihood that you’ll hold out for a home you love has declined by twelve points.

- But don’t break the bank: 65% of those who felt their home was a fair price at the time of purchase were very happy compared to only 48% of those who felt the price of their home was high at the time. When asked, “If you had to buy a home over again, would you have the same budget?” 63% of buyers said yes, 13% said a higher budget, 10% said a lower budget and the rest didn’t know. It’s your agent’s job to find a home within your budget, not to show you houses that you like but can’t afford.

- Get an agent you trust (more than your spouse?!?): of the homebuyers who got meaningful advice about which homes to see and buy from their agent, 67% were very happy with the home. Of the people who got meaningful advice from their spouse, 61% were very happy. If you have an agent who isn’t giving you advice you value, you’re significantly increasing your risk of buying the wrong home.

- Location, location, location: We asked, “If you had to buy a home over again, would you prefer a larger home in a less desirable location, or a smaller home in a more desirable location?” Fifty-three percent of respondents had a moderate or strong preference for a better location, while only 8% preferred a larger home.

- Ditch the townhouse: 67% of people who previously lived in a townhouse were happy with their new home, compared to 61% who moved from condos, and 60% who moved from houses. Sixty-four percent of people moving to a house were very happy, compared to 60% moving to a condo, and 57% moving to a townhouse. I still remember a woman who wrote me seven years ago asking Redfin.com to identify townhouses with a different icon than the one we use for houses. “Cockroaches!” she wrote. “They’re cockroaches, crawling all over our city.” At the time, my own family lived quite happily in a townhouse.

- Oh, and get in touch with your feminine side: 67% of women were extremely happy with their home, compared to only 57% of men.

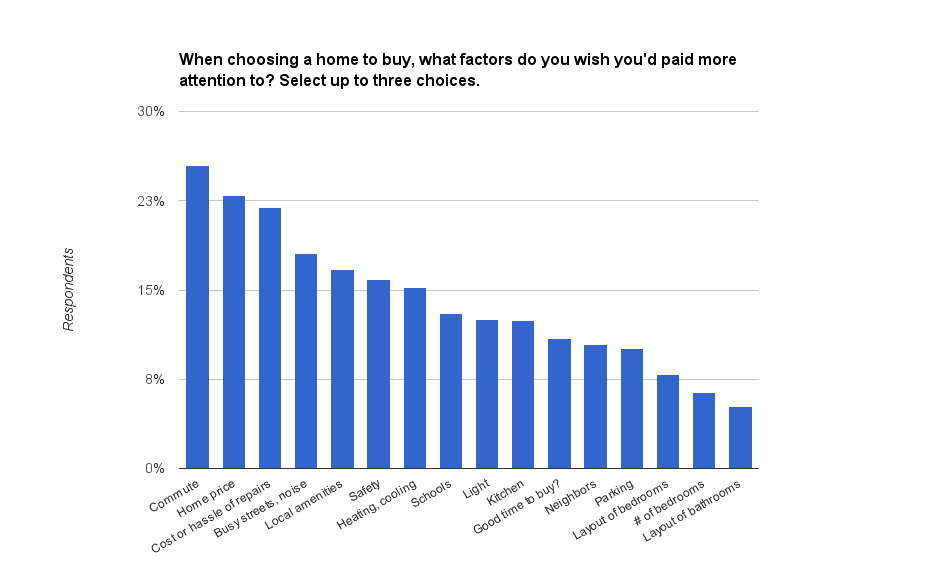

The factors that homebuyers wished they had paid more attention to were mostly related to the home’s location and its condition, not its layout which, after all, is self-evident during the tour. The commute was the #1 issue, chosen out of sixteen choices by one in four respondents. This is consistent with research showing that a long commute to work is the factor most consistently associated with lower levels of human happiness, even when the more-distant job leads to nearly 40% higher income.

The Surprising Stuff That Doesn’t Matter (A Lot Doesn’t Matter)

What was almost comical about the survey results is what didn’t matter:

- Seeing the house: 9% of respondents bought a home without having seen it before making the offer. 67% of these folks were very happy with their purchase, compared to 62% of everyone else.

- Involving your spouse: 61% of people with spouses who were “somewhat engaged” in the home search reported being very happy, compared to 62% whose spouses were very engaged, a negligible difference. The one person who said her spouse “wasn’t engaged at all” was the happiest person in the entire survey.

- Having home-buying experience: people don’t get better with experience at buying homes, as 62% of first-time buyers were very happy with their home, which was the same percentage as move-up buyers.

- Having money: the happiest cohort of homebuyers were people with household incomes between $50,000 – $75,000, with 67% very happy with their home purchase, compared to 61% of folks with incomes above $200,000. But if it’s true that money doesn’t matter, it’s only true to a point: the unhappiest cohort consisted of people with incomes below $50,000, where only 55% were very happy with their home.

- Getting an inspection: getting an inspection is considered fundamental to sound home-buying decisions, and yet the 10% of respondents who didn’t get an inspection before buying their home were happier than the other 90%. Sixty-nine percent of the folks who skipped the inspection were very happy with their home, compared to 62% of everyone else.

Perhaps the worst choice is no choice at all. When I lived in a home I didn’t like, I repeated to myself over and over again the heroic refrain that the mind is its own place, and in itself can make a heaven of hell, a hell of heaven. What I forgot was who made that claim, Satan in his Pandemonium, or what the name of the poem was in which he made it: Paradise Lost. Despite my belief that it wouldn’t make a difference, we moved at my wife’s insistence to a better, smaller place, and to a better life. This research shows that you can too.

Photo credit: Freaktography on Flickr.

United States

United States Canada

Canada