In the hottest job markets, federal loan programs aren’t helping people land homes in the areas that are closest to the best jobs.

Federal Housing Authority (FHA) borrowers are often working-class first-time homebuyers. In hot job markets, the supply of affordable homes close to work is so limited that FHA homebuyers chase affordability into neighborhoods that are far from their jobs. Mapping the parts of booming cities that have the fewest FHA borrowers can show city planners and homebuilders where to target new home construction.

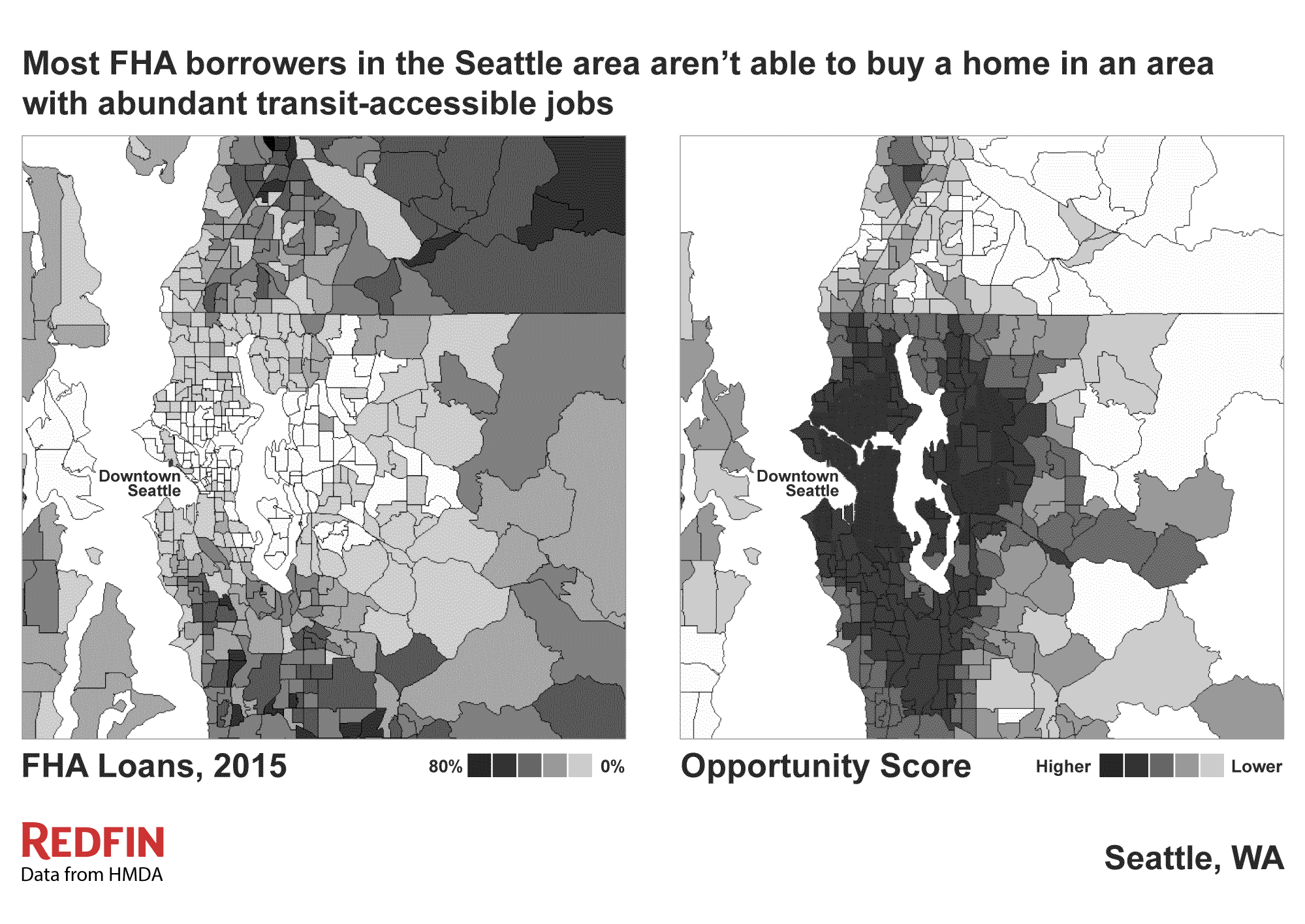

One example of a hot job market is Seattle. In the city of Seattle, data from the Home Mortgage Disclosure Act (HMDA) reveals that FHA loans made up just 5 percent of all home loans last year, compared to 22 percent nationwide, or even 19 percent in Seattle suburbs like Mill Creek that are more than an hour away by bus.

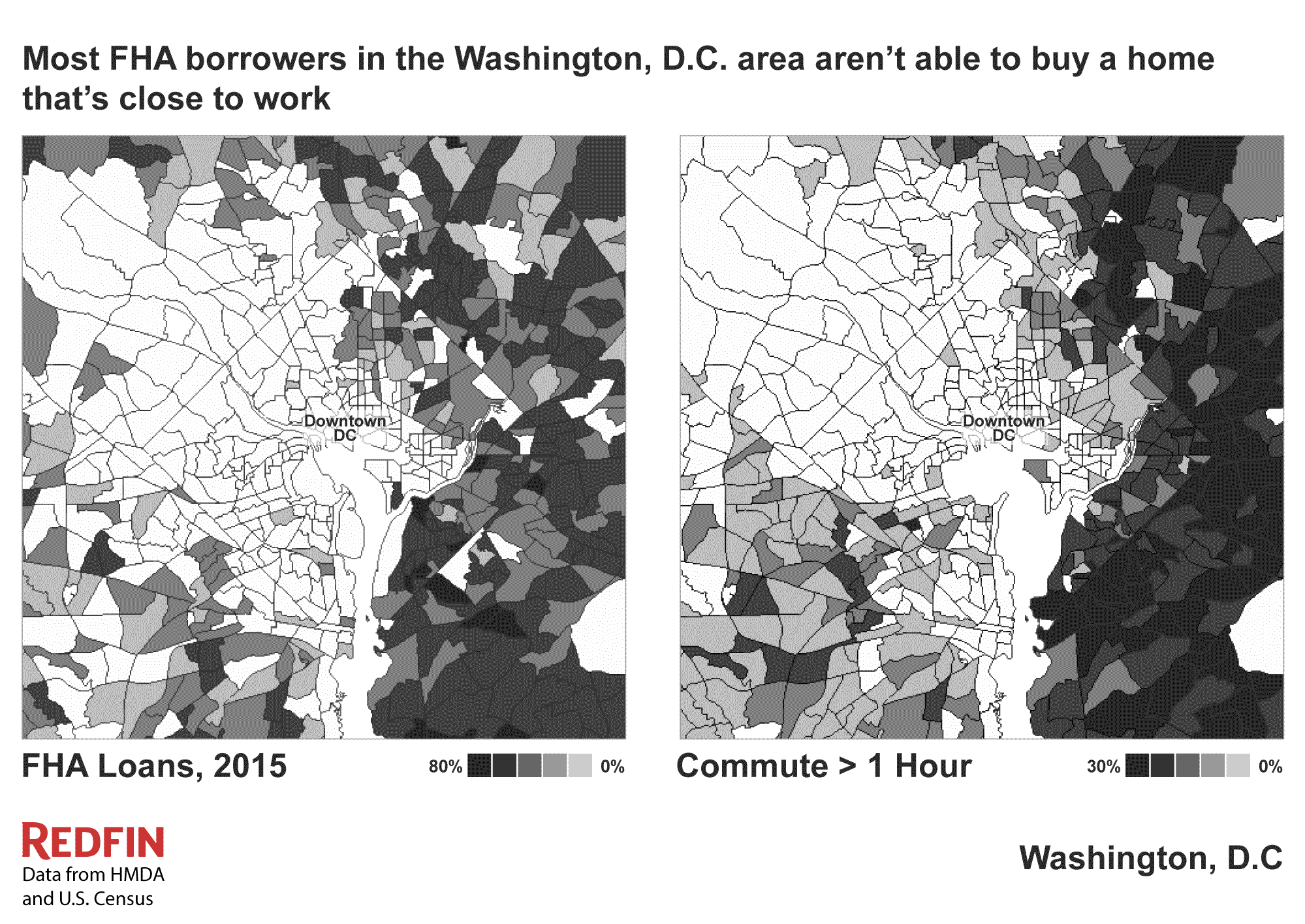

This means that people who depend on FHA loans are trading ownership for opportunity, missing out on proximity to jobs. And it’s not just Seattle. The pattern holds in other booming cities. Families in Washington, D.C. that depend on FHA loans are overwhelmingly settling in the areas with the longest commutes.

United States

United States Canada

Canada