In May 2017, Redfin commissioned a survey of 3,350 U.S. residents in 11 metropolitan areas who in the past year bought or sold a home, attempted to do so or plan to do so soon. The purpose of the survey was to better understand the perspectives and experiences of people who were recently in the market to buy or sell a home, and to reveal trends over the past two years since we began commissioning similar surveys.

Following are six major findings:

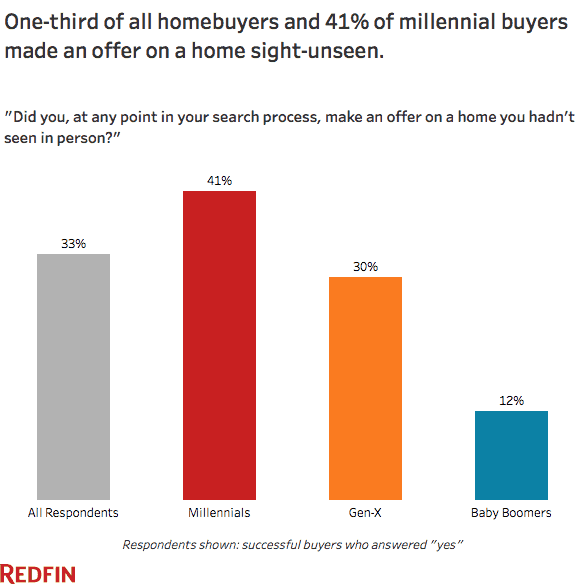

- Thirty-three percent of people who bought a home in the last year made an offer without first seeing the home in person. That’s up from 19 percent a year ago.

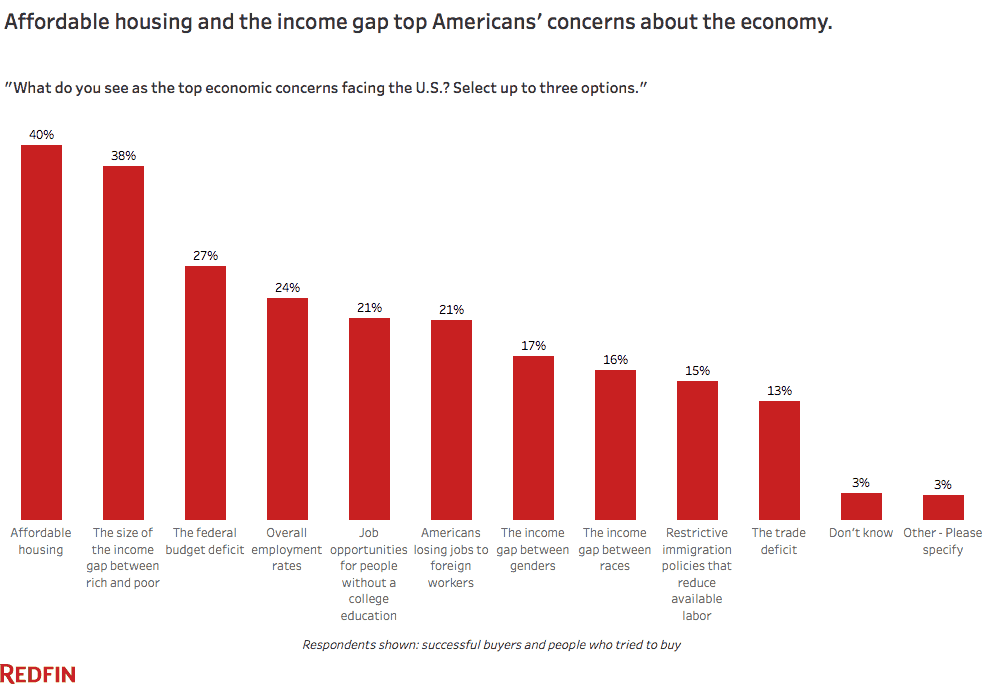

- Affordable housing was the most prevalent economic concern, cited by 40 percent of buyers; 21 percent said rising prices led them to search in more affordable metro areas.

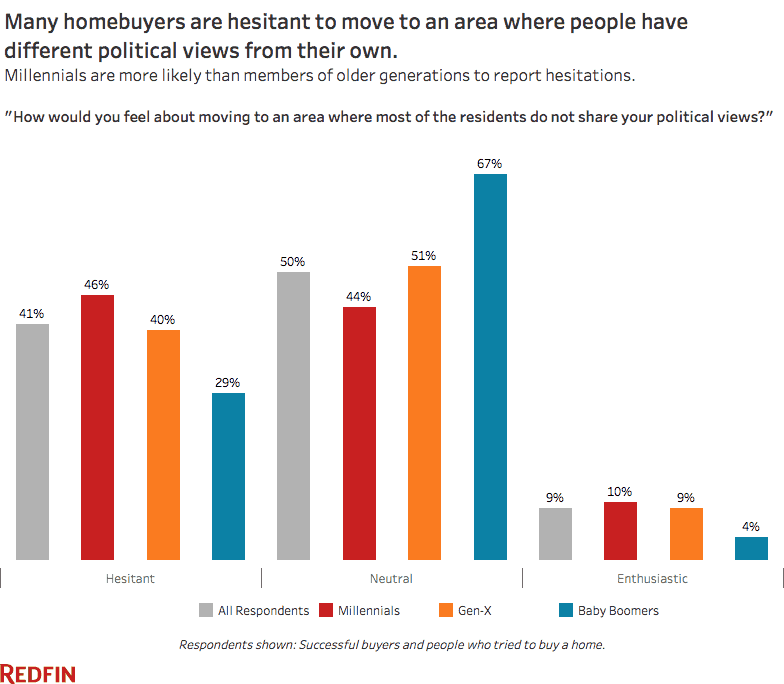

- Forty-one percent of buyers would be hesitant to move to a place where people have different political views from their own.

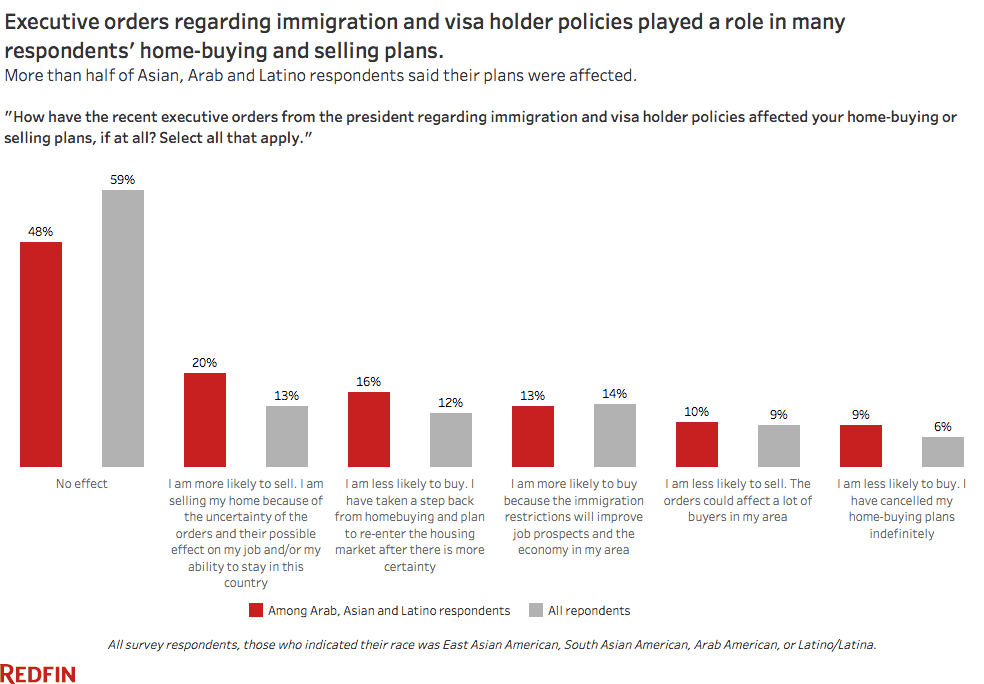

- Orders restricting immigration influenced the buying and selling plans of 52 percent of Arab, Asian and Latino respondents; 45 percent of minority buyers felt that sellers and their agents may have been less eager to work with them because of their race.

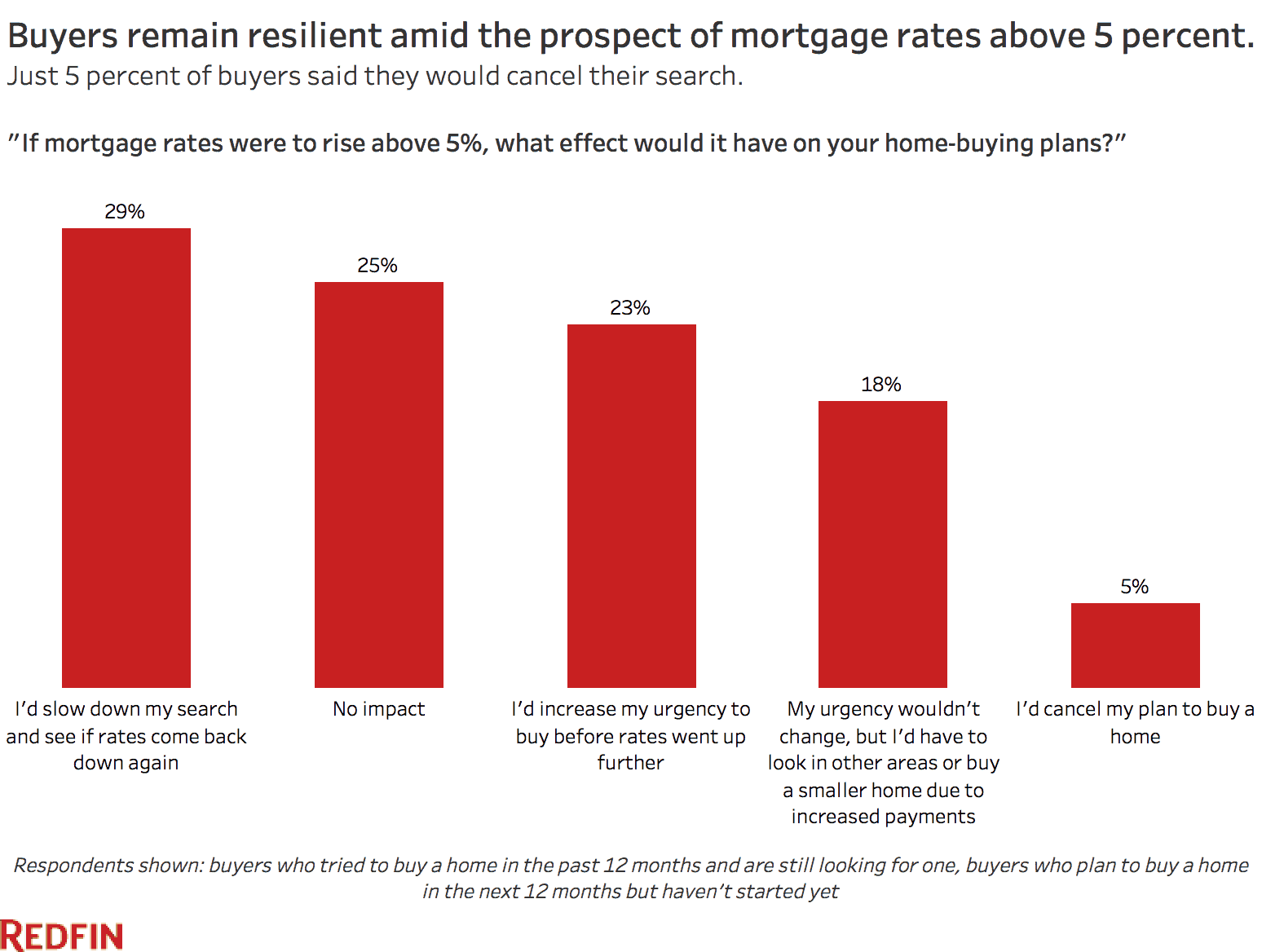

- Buyers remain resilient amid the prospect of rising mortgage rates. Just 5 percent said they’d cancel their plans if rates surpass 5 percent.

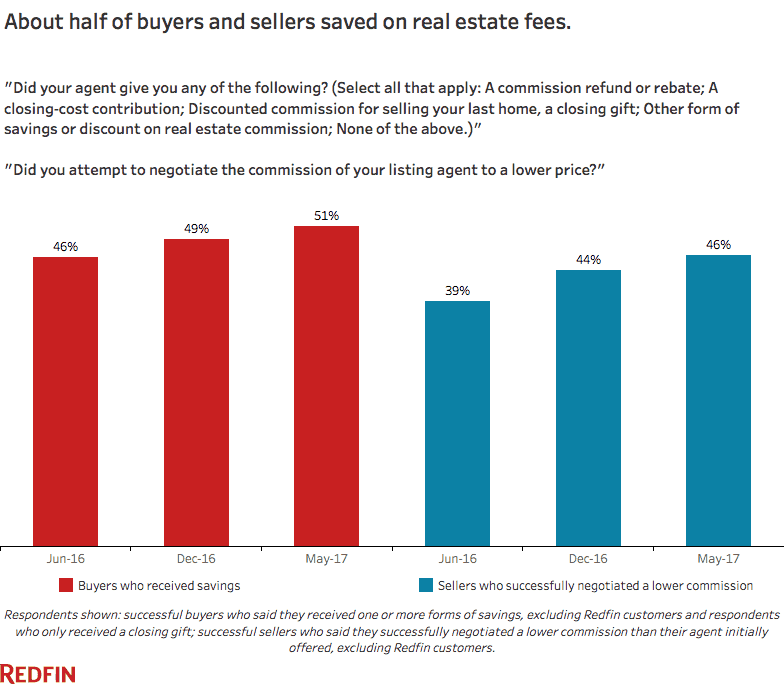

- Fifty-one percent of buyers and 46 percent of sellers saved money on real estate commissions.

“Millennials are already starting to set trends in the real estate industry,” said Redfin chief economist Nela Richardson. “They are three times more likely than Baby Boomers to make an offer sight-unseen, and they’re more likely than older buyers and sellers to negotiate commission savings. Despite their tech-savvy confidence, politics are seeping into Millennials’ decisions about where to live; nearly half cited hesitations about moving to a place where their neighbors wouldn’t share their views.”

1. More buyers made offers on homes sight-unseen.

One-third of people who bought a home in the last year said they made an offer on a home without first seeing it in person. That’s up from 19 percent last year and from 21 percent two years ago. Millennials were even more likely to have made an offer sight-unseen, with 41 percent saying they had done so, compared with 30 percent of Gen-Xers and 12 percent of Baby Boomers.

The abundance of photos–including interactive 3D photography like Redfin 3D Walkthrough that lets people virtually walk through Redfin listings–and other information available online about homes for sale helps buyers feel comfortable bidding on a home they haven’t set foot in. But the strong prevalence of sight-unseen bids this year is likely due in great part to the record-fast speed of today’s highly competitive housing market. The typical home that sold in May went under contract in just 37 days, a week faster than homes were selling a year ago and the fastest pace on record since at least 2010 when Redfin began keeping track.

2. Buyers’ most common economic concern was affordable housing; one in five said rising home prices caused them to search in another metro area.

Affordable housing was the economic concern most commonly cited by people who bought or tried to buy in the last year, with 40 percent selecting that issue, followed by the income gap between the rich and the poor (38%) and the federal budget deficit (27%). Low on the list of concerns were the trade deficit (13%) and restrictive immigration policies (15%).

With affordable housing a frequent concern, rising home prices drove more than one in five (21%) people who bought or tried to buy a home last year to search for homes in another metro area where homes were more affordable. When asked how high home prices affected their search, buyers were more likely to say only that they searched in more affordable neighborhoods (32%), searched farther outside the city center (26%) or that they considered smaller homes (23%) or fixer-uppers (22%).

3. Many buyers reported hesitations about moving to a place where most people have political views different from their own.

Despite the fact that so many people were relocating for affordability and even making offers on homes they hadn’t seen, many buyers were wary about moving to a place where their neighbors were likely to vote for an opposing candidate. Forty-one percent of people who bought or tried to buy a home in the last year said they would have hesitations about moving to a place where most of the residents do not share their political views. This is largely unchanged from December. Like in the December survey, Millennials were more likely than their elders to be hesitant about this, with 46 percent indicating they had some or significant hesitation, compared with 29 percent of Baby Boomers.

If this trend continues, it would put our neighborhoods at risk of becoming more politically segregated, which could have implications for the electoral map. Redfin recently began reporting on U.S. migration patterns using data on where its website users were searching for homes, and from where they were searching. One of the most salient migration trends in the first quarter was movement from expensive metros like Los Angeles and the Bay Area in the blue state of California to more affordable metros in red states like Texas, Georgia and Arizona. Redfin analysts are conducting further research to reconcile the migration trends seen in its user data with this survey finding and to predict whether these migration patterns could ultimately play a role in future election outcomes.

4. More than half of Arab, Asian and Latino respondents said recent immigration orders influenced their buying or selling plans; 45 percent of all minority respondents thought sellers or agents may have treated them differently because of their race.

Forty-one percent of all respondents indicated that their home-buying or selling plans were affected by the recent executive orders on immigration and visa holder policies, with 6 percent saying they cancelled their home-buying plans indefinitely, and another 12 percent saying they took a step back from homebuying and plan to re-enter the housing market when there is more certainty. Nine percent said they were less likely to sell because of the orders’ possible effects on buyers in their area. The uncertainty also caused 13 percent to sell their home, worried about the possible effect the orders could have on their job or their ability to stay in the country. Meanwhile, 14 percent of respondents said they are more likely to buy, saying the restrictions would improve job prospects and the economy in their area.

Respondents who identified themselves as East Asian American, South Asian American, Arab American or Latino were more likely to have been affected, with more than half (52%) saying the orders influenced their plans, including 9 percent who cancelled their buying plans indefinitely, 16 percent who took a step back from homebuying, 20 percent who were selling because of the uncertainty and 10 percent who said they were less likely to sell because of the orders’ effects on buyers. Thirteen percent among this group said they were more likely to buy because they believe the restrictions will improve their job prospects and the economy in their area.

Redfin agents from many parts of the country reported that when the orders were first introduced at the beginning of the year, several of their buying customers who are originally from other countries backed out of the market due to the uncertainty of their ability to stay in this country long term. However, these departures were most often characterized as temporary, with affected buyers typically saying they were going to wait and see what would happen. In recent weeks, agents have reported that some of these customers have returned to the market, while other buyers have not. A Redfin agent in the Chicago area said this week that two of her buying customers in the country on H1B visas who had backed out of the market at the beginning of the year both recently returned to the market after finding out they’d be able to remain in the country for at least a few more years. Both are now under contract. She also reported that she just listed and sold a home for customers who were not able to renew their H1B visas.

Meanwhile, there was a slight drop in the prevalence of the perception of discrimination among minority homebuyers from December to May. In May, 45 percent of minority respondents who bought or tried to buy a home in the last year said they felt that sellers or their agents may have been less eager to work with them because of their ethnicity or race. That’s down from 49 percent in December, when still nearly half of minority respondents reported they may have been treated differently. The portion of self-identified white respondents who said they may have been discriminated against was largely unchanged from December (28%) to May (29%).

5. Few buyers will stop their search if mortgage rates top 5 percent.

Mortgage rates are expected to rise due to the Federal Reserve’s June 14 announcement that it would raise its benchmark interest rate. We don’t expect to see much of a reaction in the market.

The survey asked people who said they were still looking for a home to buy and/or plan to buy one in the next 12 months about the effect a mortgage rate hike above 5 percent would have on their home-buying plans.

A quarter said it would have no impact, while nearly as many (23%) said they would increase their urgency to buy before rates went up further. Twenty-nine percent said they would slow down their search and see if rates came back down; 18 percent said their urgency wouldn’t change, but they would look in other areas or buy a smaller home. Just 5 percent said they would cancel their home-buying plans altogether.

These results are similar to the breakdown of responses collected from buyers who were asked a similar question in December about how they would react if mortgage rates rose above 4 percent.

6. Half of buyers and sellers saved on real estate fees.

Just over half (51%) of buyers (excluding all those who worked with a Redfin agent) received savings from their agent in the form of a commission refund, a closing-cost contribution or another type of savings. That’s up from 49 percent in December and from 46 percent a year ago. Millennials were the most likely to receive savings, with 59 percent indicating they did, compared to 47 percent of Gen-Xers and 29 percent of Baby Boomers.

Sellers are not far behind. The portion of all (non-Redfin) sellers who successfully negotiated their listing agent’s commission to a lower price rose to 46 percent in May, up from 44 percent in December and 39 percent a year ago. Millennials were also the most likely generation of sellers to have negotiated their listing agent’s commission down, with 63 percent getting a discount, compared to 44 percent of Gen-Xers and 16 percent of Baby Boomers.

This follows a decades-long trend toward declining commissions, according to Real Trends, which reports that the national average real estate commission was 5.12 percent in 2016, down from 5.26 percent in 2015, and from more than 6 percent in the early 90s.

Consumers are likely paying less for real estate brokerage services in part because of the increasing prevalence of companies like Redfin that offer lower-cost alternatives to the traditional real estate model. In 2016, real estate tech companies received more funding than ever before, meaning the options for new, alternative and money-saving ways to buy and sell homes have never been more abundant, and the choices for consumers are likely to grow. Millennials’ expanding role in the housing market–paired with their increased tendency to save on fees–will likely drive a shift in the real estate industry toward these tech-reliant, non-traditional brokerage models.

Affordability continues to shape American communities and the real estate industry

As Millennials continue to enter the housing market, they are likely to drive changes in the way neighborhoods in our cities across the country look and feel, as well as in the way most people buy and sell homes. We now know that issues surrounding affordability and inequality drove major change in our government. The results of this survey reveal how these issues are affecting the way that segments of people are spreading themselves out geographically–with some people driven to new communities in search of affordable homes, others avoiding places where the neighbors would disagree with their politics and still others holding off on putting down roots due to the uncertainty of their future status in this country. If these trends continue, our cities will become less diverse. More inclusionary local zoning policies and builder incentives to create more affordable housing within desirable neighborhoods and near job centers would make these places more accessible to and welcoming of people of all racial, social and economic backgrounds. By enabling more different types of people to live comfortably in the same great neighborhoods, we may begin to narrow the gaps between these diverse groups that, joined together, are the essence of American society.

Methodology

Redfin contracted SurveyGizmo to field a study between May 5 and May 24, 2017, using the SurveyGizmo audience platform to reach 3,350 people from the general population who indicated they had bought or sold a home in the past year, tried to buy or sell a home in the past year or plan to do so this year. The survey targeted 11 major metro areas where Redfin has its largest market share (Baltimore, Boston, Chicago, Dallas-Fort Worth, Denver, Los Angeles, Portland, San Diego, San Francisco, Seattle and Washington, D.C.). Out of the 3,350 respondents, 1,334 had successfully bought a home (including 75 with a Redfin agent) and 762 had successfully sold a home (including 37 with a Redfin agent). 732 people tried to purchase a home but were unsuccessful, and 477 people tried to sell their home but were unsuccessful.

Comparisons were made using results from similarly commissioned surveys conducted by SurveyGizmo in December 2016, and by SurveyMonkey in July 2016 and December 2015.

Responses from the Redfin customers were excluded from the reported findings on seller and buyer savings.

For more information about the survey and its findings, contact Redfin Journalist Services at press@redfin.com.

Search for Homes by City:

United States

United States Canada

Canada