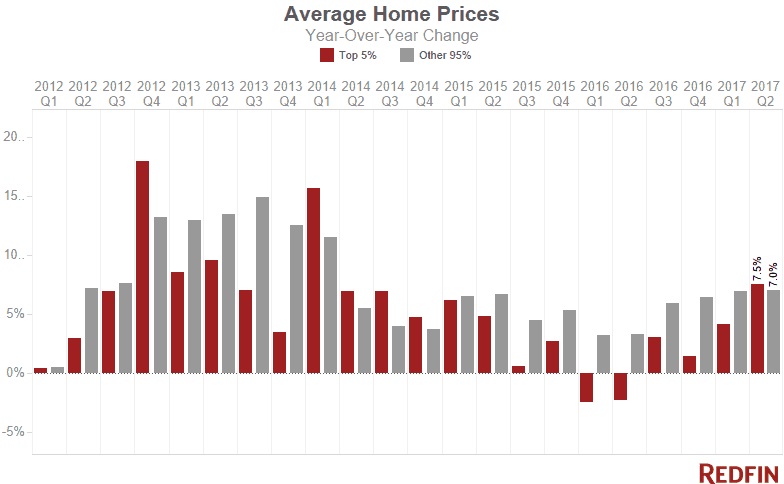

Luxury home prices rose 7.5 percent in the second quarter of 2017 compared to last year, to an average of $1.79 million. The analysis tracks home sales in more than 1,000 cities across the country and defines the luxury market as the top 5 percent most expensive homes sold in the city in each quarter.

The average price for non-luxury homes was $336,000, up 7 percent compared to a year earlier. This is the first time since the fourth quarter of 2014 that luxury homes had stronger price growth than homes in the bottom 95 percent of the market.

The price increase may have been driven by a drop in the number of luxury homes on the market. The number of homes for sale priced at or above $1 million fell 9.4 percent compared to the same period last year. The number of homes priced at or above $5 million saw a similar decline at 9.5 percent. This marked the first quarter in which luxury inventory fell year over year since Redfin began reporting on the luxury market in 2014.

Luxury sales were strong. Sales of homes priced at or above $1 million were up 22.2 percent from a year ago, while sales of homes priced at or above $5 million were up 19.6 percent. The strong growth in sales, especially paired with the falling supply, suggests that high-end buyers have confidence in the economy and see U.S. real estate as a smart place to invest their wealth.

“The housing shortage is now affecting the top of the housing market,” said Redfin chief economist Nela Richardson. “After five consecutive quarters of double-digit inventory growth, the number of million dollar-plus homes for sale dropped by 9.4 percent. Yet despite the strong uptick in prices, the luxury market is not nearly as competitive as the rest of the market. Only one in 50 luxury homes homes sold above list price in the second quarter, compared to more than one in four homes in the bottom 95 percent.”

[redfin_table file=https://redfin.com/blog/wp-content/uploads/2017/08/Summary-1.csv][/redfin_table]

Biggest Winners

The luxury market in the city of Irvine, CA led the nation with the strongest year-over-year price growth in the second quarter. The average price of a luxury property increased 37.4 percent compared to last year to $3.5 million. Reno, NV; Long Beach, CA and Clearwater, FL also had big gains, with average luxury home prices up 35.4 percent, 25.4 percent and 25 percent respectively.

Karl Stenske, a Redfin agent in Orange County, believes that the strong luxury price gains in both Irvine and Long Beach may reflect growth in the local tech economy. “With technology companies continuing to move into the area, bringing high-wage jobs, we are seeing the related increase in demand impact high-end housing prices,” he said.

Stenske says builders are developing communities with price points in the millions, further propelling the luxury market. “Irvine is still growing and has a lot of land to develop. With the mix of more high-wage employers in the area, lower housing costs than Silicon Valley and the draw of the Southern California beach life, I believe will see this growth in the luxury market continue.”

List of Biggest Winners

[redfin_table file=https://www.redfin.com/news/wp-content/uploads/2017/08/Winners.csv][/redfin_table]

Biggest Losers

The average price for a luxury home fell furthest in Miami, down 23 percent from a year ago to $1.86 million. Redfin Miami agent Jose Medina believes the price decline is due to an abundance of luxury condo developments in Miami. The number of homes for sale priced at or above $5 million was up 166.7 percent compared to last year.

“The luxury condo market is completely saturated right now,” said Medina. “High-end developments used to require deposits of up to 50 percent. Now we’re seeing those deposit amounts drop to 10 percent in some cases as developers compete to win over luxury buyers.”

While the luxury market is saturated, competition is still high for moderately priced homes in Miami. Prices for the bottom 95 percent of the market were up almost 8 percent.

Among the biggest luxury market losers were Delray Beach, FL and Alpharetta, GA, down 17.3 percent 10.5 percent, respectively.

List of Biggest Losers

[redfin_table file=https://www.redfin.com/news/wp-content/uploads/2017/08/Losers.csv][/redfin_table]

Most Expensive Sales

Curious about the most expensive homes sold last quarter? Take a peek at the top-five most expensive sales and live vicariously through these new luxury owners:

- The famed L.A. estate of Edie Goetz sold for $40.8 million. Billionaire investor Nicolas Berggruen now owns a piece of Hollywood history.

- This brand new lakefront Palm Beach, FL home features modern styling and was offered fully furnished. It sold for $31.6 million.

- This luxury penthouse on the exclusive Fisher Island boasts a rooftop pool and desk and a whooping 9,700 square feet. It sold for $31.3 million.

- Celine Dion had this custom resort home designed and built for her family in 2010. Listed for $38.5 million, it sold for $28 million.

- With 15,000 square feet of luxurious living space, landscaped gardens and a 90210 zip code, this $25 million property has everything (except photos)!

Visit the Redfin Data Center to find more housing market data for metro areas around the country.

Methodology: Redfin tracks the most expensive 5 percent of homes sold in more than 1,000 U.S. cities and compares price changes to the bottom 95 percent of homes in those cities. Analysis is based on multiple-listing and county recorder sales data in markets served by Redfin. To determine luxury market winners and losers, we looked at cities with at least 40 luxury sales in the quarter and an average luxury sale price of $1 million or higher.

Search for Homes by City:

United States

United States Canada

Canada