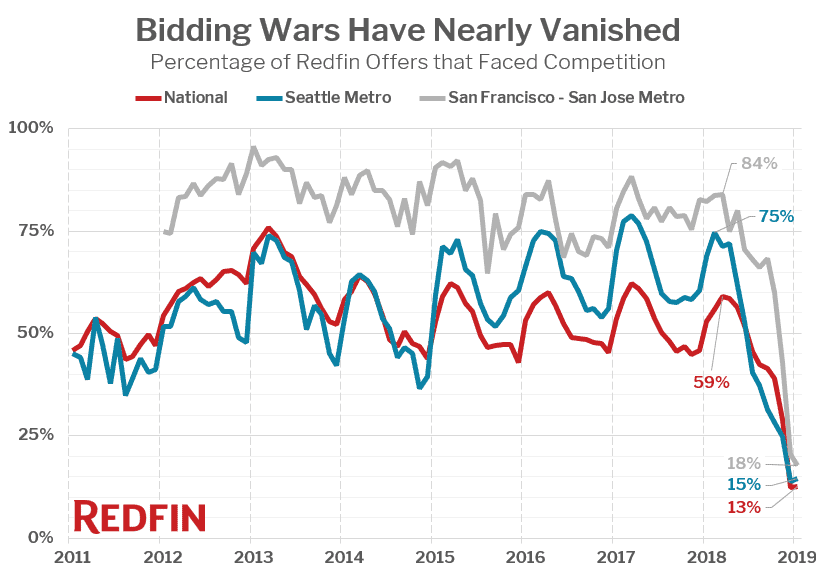

Just 13 percent of offers written by Redfin agents on behalf of their home-buying customers last month faced a bidding war, little changed from December’s record low, and down from 53 percent in January 2018.

Two of last spring’s most competitive markets—Seattle and San Francisco—kicked off 2019 with fewer than one in five offers facing competition, down from seven or eight out of 10 a year earlier.

“Buyers have heard that the market has slowed, so now they’re trying to get all of their ‘wants,’ not just their ‘needs,’” said Palo Alto Redfin agent Kalena Masching. “They’re waiting until they find a home that can check more boxes—for instance three bedrooms instead of two or a higher rated school. In general they are being more judicious as they think through their purchase. Meanwhile, many sellers have not yet recognized that the market has shifted.”

So why is 2019 shaping up to be so much less competitive for homebuyers than any recent year? It all comes down to supply and demand. The number of homes for sale is increasing just as the number of buyers is falling off, resulting in fewer homebuyers competing for each home. As of December the number of homes for sale was up 5 percent from a year earlier, while the number of homes sold was down 11 percent.

Get local insights at a free Home Buying class

Portland, Denver and San Diego were the most competitive housing markets in January, but none was all that competitive, especially when compared with last year’s bidding war rates. Each saw less than one out of five Redfin offers face a bidding war, down from more than half a year earlier.

The least competitive housing markets in January were Miami (3%), Dallas (6%), and Houston (6%). Even in these markets, more than a third of Redfin offers were facing competition a year ago.

The rate of bidding wars was down dramatically in every market that Redfin agents serve, with the biggest percentage-point declines coming in the San Francisco Bay Area (-64 points), Los Angeles (-57 points), and Seattle (-54 points). The smallest declines were in Austin (-11 points), Raleigh (-13 points), and Chicago (-29 points).

| Rank | Metro Area | Share of Redfin Offers that Faced Competition (Jan. 2019) | Share of Redfin Offers that Faced Competition (Jan. 2018) | Share of Redfin Offers that Faced Competition (Dec. 2018) |

|---|---|---|---|---|

| 1 | Portland, OR | 19% | 53% | 8% |

| 2 | Denver, CO | 19% | 54% | 17% |

| 3 | San Diego, CA | 18% | 63% | 16% |

| 4 | San Francisco, CA | 18% | 82% | 20% |

| 5 | Raleigh, NC | 18% | 31% | 0% |

| 6 | Los Angeles, CA | 16% | 73% | 14% |

| 7 | Seattle, WA | 15% | 69% | 14% |

| 8 | Boston, MA | 14% | 53% | 18% |

| 9 | Phoenix, AZ | 14% | 43% | 12% |

| 10 | Austin, TX | 14% | 25% | 5% |

| 11 | Atlanta, GA | 12% | 41% | 6% |

| 12 | Sacramento, CA | 11% | 58% | 4% |

| 13 | Philadelphia, PA | 10% | 44% | 18% |

| 14 | Washington, D.C. | 10% | 48% | 7% |

| 15 | Chicago, IL | 10% | 39% | 12% |

| 16 | Houston, TX | 6% | 40% | 11% |

| 17 | Dallas, TX | 6% | 39% | 10% |

| 18 | Miami, FL | 3% | 37% | 9% |

The table above indicates the bidding war rates for each of the largest metro areas Redfin agents serve.

Editor’s Note: Early in 2020 we discovered an issue with the data we had been collecting on bidding wars, which caused us to underestimate the rate of bidding wars in several markets. Redfin is currently in the process of fixing these data issues. Once complete, we will provide an updated estimate of the bidding wars for 2019.

United States

United States Canada

Canada