Now that the Senate passed its version of the tax reform bill, the Senate and the House of Representatives will meet to hash out the differences between their respective plans and present a single bill for President Trump’s approval. Up for debate are a handful of proposed changes that could affect homebuyers and homeowners, especially those in coastal markets where home prices have been rising quickly over the past few years and in states with relatively high state and local taxes, such as California, New York and New Jersey. A big change for many of these homeowners could come in the form of caps on mortgage interest and state and local tax (SALT) deductions, proposed in the House plan, or the elimination of deductions for state and local taxes, as called for in the Senate plan.

“The uncertainty of the tax reform bill is looming on our customers’ minds, and it has caused well-qualified clients who have found a home they like to hold off until the matter is resolved,” said Redfin Silicon Valley agent Kalena Masching. “In a market like ours where potential loan amounts regularly hit six figures and residents pay high state taxes, the proposed tax reform has serious ramifications for homebuyers.”

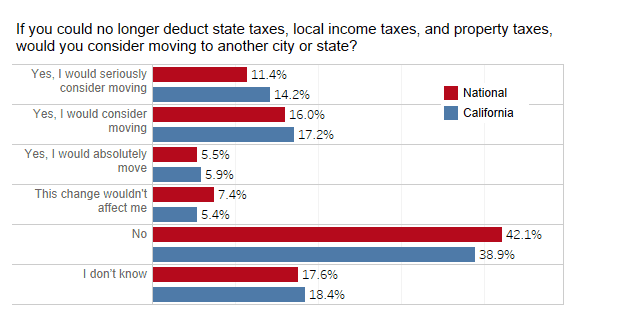

From November 18 to 21, we surveyed nearly 900 homebuyers who are active on Redfin.com to find out whether the–still hypothetical–elimination of such local tax deductions would be enough to cause people to consider relocating. Among the 876 who said they are under contract or plan to buy a home within the coming year, 42 percent said they would not consider moving. One-third of respondents said they would consider a move, with 6 percent saying they would absolutely move, 11 percent saying they would seriously consider moving and another 16 percent saying they would consider a move.

*Based on a November survey of homebuyers under contract or planning to buy a home in the coming year.

Californians were more likely to say they would consider a move if they could no longer deduct state, local and property taxes, with 37 percent indicating so in the survey. Six percent of Californians said they would absolutely move, 14 percent said they would seriously consider it and 17 percent said they would simply consider it. Among the 239 respondents under contract or planning to buy a home in the coming year in California, 39 percent said they would not consider moving and 18 percent said they did not know.

“Eliminating this deduction is analogous to pouring SALT on a wound for California buyers,” said Redfin chief economist Nela Richardson. “Why? Because buyers are already confronting severe inventory shortages and high home price appreciation. In addition, Prop 13, a regressive state tax, subsidizes current homeowners at the expense of new buyers. For many California buyers the solution may be to head out of state.”

United States

United States Canada

Canada