Slowing price growth and a growing percentage of price drops are other signs that the regions’ real estate markets may finally be cooling.

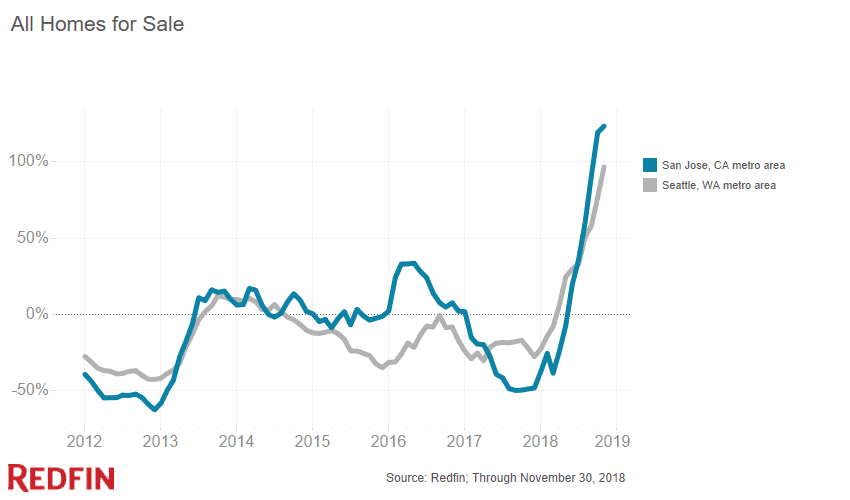

Signals are emerging that the party may be coming to an end for home sellers in San Jose and Seattle, which have been two of the hottest seller’s markets in the country for the last few years. In the San Jose metro area, inventory in November was up 123.2 percent year over year, and in the Seattle metro it rose 96.5 percent. Those are by far the largest inventory jumps in all the metro areas Redfin tracks. Oakland experienced the third biggest inventory bump, with a 60 percent increase. National inventory was up 4.9 percent year over year, marking the highest level of inventory growth since June 2015.

And although home prices in both areas were up slightly in November, the bump was significantly smaller than it’s been in recent years. In San Jose, the typical home sold for $1,087,500 last month, a year-over-year gain of 1.2 percent—the smallest price increase in the area for the last six years. As recently as March of this year, prices were up 34 percent annually. The story is similar in Seattle, where the median sale price in November was $548,000, up 4.4 percent annually. That’s the smallest price increase in the area since February 2015, and it’s a continuation of a decline in price growth that started at the beginning of this year.

Jessie Culbert, a Redfin agent in Seattle, said the increase in inventory is likely due in part to interest rates, which have been on a general upward trajectory in 2018, hovering below 5 percent over the last few months. “Rising interest rates mean that homebuyers can afford less house now than they could for the same monthly payment a few years ago, when rates were lower,” Culbert said. “Rates are still historically low, but there’s some sticker shock, particularly for first-time homebuyers who were watching the market over the last few years.”

Buyers in San Jose and Seattle are also getting some relief when it comes to homes selling above list price. San Jose experienced the biggest drop of all the regions Redfin tracks, and Seattle came in second. In San Jose, 76.1 percent of homes sold above list price in November 2017—a year later, in November 2018, the share had declined to 45.2 percent of homes. And in Seattle, 43.3 percent of homes sold above list price in November 2017, then dropped to 21.7 percent by November 2018.

The San Jose region, one of the most expensive in the country, is also experiencing the biggest year-over-year increase in price drops. Last month, 31.6 percent of active listings in San Jose had price drops, compared to 14.4 percent a year earlier. In Seattle, 36.4 percent of listings experienced a price drop last month, up from 28.6 percent in November 2017, a difference that’s more in line with other metro areas across the country.

Another sign that the Seattle market may finally be cooling slightly is a falling rate of bidding wars. As of November, only about one of every four Redfin offers in the Seattle metro area faced competition, one of the lowest rates among Redfin’s largest markets. Back in the spring, roughly three-quarters of Redfin offers in Seattle were part of bidding wars. About two out of every five Redfin offers in the San Jose metro faced competition last month.

United States

United States Canada

Canada