Nearly 40% of homes in the U.S. are selling for more than their asking price, the highest share on record.

More than three out of five homes in San Jose, Sacramento, Salt Lake City, Austin and Denver sold above their asking price in the last month, driving the national share to an all-time high.

Sacramento Redfin agent Andrea White said she’s never seen such a competitive housing market, with locals taking advantage of relatively low mortgage rates and out-of-towners moving into the area for comparatively affordable home prices.

“Homes that were selling for $450,000 a year ago are listed at $550,000 and they may ultimately sell for over $600,000,” White said. “Many of my sellers are listing their homes significantly higher than current comparable homes. We end up with fewer offers, but buyers are still offering over the list price. At this point, we’re actually trying to reduce the number of offers on a home so we can respond to the serious offers that we do receive.”

Nationwide, 39.2% of homes sold above their asking price in the four weeks ending March 21, a record high that comes as the pandemic-driven housing boom continues and a lot of buyers vie over limited inventory, with more than 60% of Redfin offers for homes facing at least one competing offer in February.

Roughly 24% of homes in the U.S. sold above their asking price a year earlier. Though the housing market reached a near standstill last March as the pandemic began, the year-over-year jump is still telling because it reflects closed sales, which would have gone under contract before the coronavirus spread throughout the U.S.

Homes selling above asking price is partly due to competition from remote workers searching for single-family homes

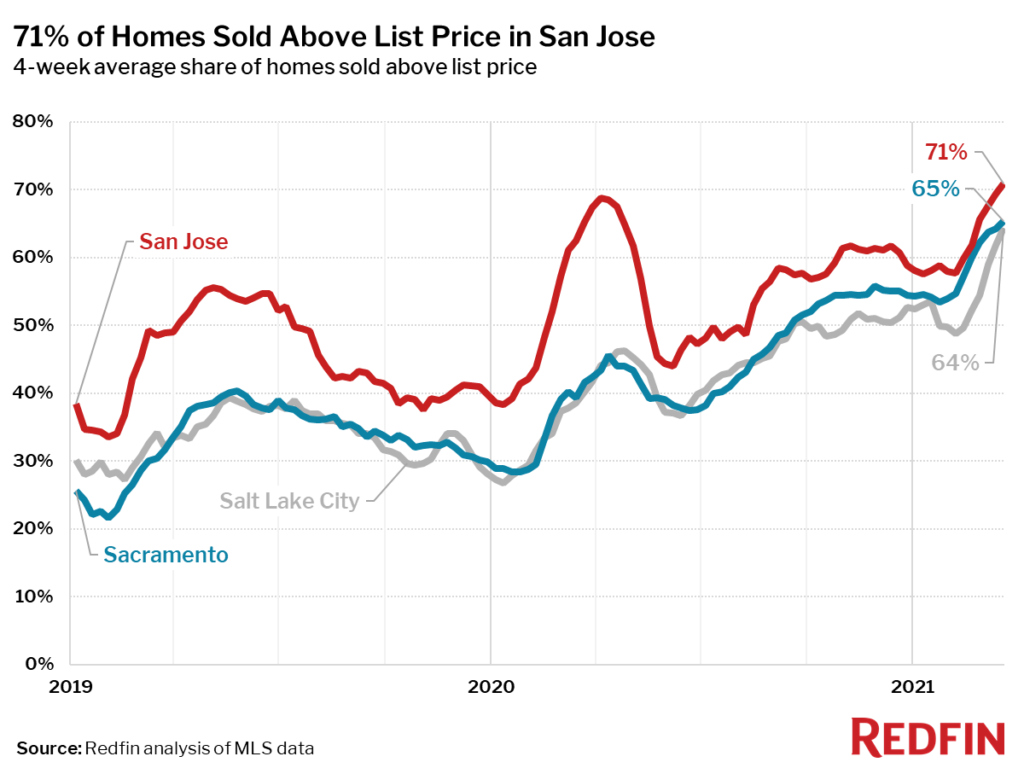

In the San Jose metro, 70.9% of homes sold above their asking price during the four weeks ending March 21, the highest share of all the metros included in this analysis. It’s followed by Sacramento (65.4%), Salt Lake City (64.5%), Austin (62.9%) and Denver (62.5%).

The markets driving the record high reflect several different pandemic housing market trends. In San Jose, the share of homes selling above asking price has recovered to pre-pandemic levels. Sacramento and Austin are popular destinations for remote workers leaving expensive coastal cities in search of a more affordable cost of living, while Salt Lake City homes are also popular with out-of-towners in addition to locals with relatively high-paying jobs in its burgeoning tech industry.

“For people leaving San Francisco, relocations to places like Austin are common, but most of the moves are happening within the Bay Area, from inside the city to neighborhoods an hour or an hour and a half outside,” said local Redfin agent Joanna Rose. “People know they will only need to be in the office one or two days a week, so they’re going somewhere they can get more space and be closer to nature. Single-family homes are selling like hotcakes, with houses in desirable neighborhoods getting multiple offers and selling for above asking price in less than two weeks.”

Austin and Denver are also on the list of places with the largest increases in the share of homes sold above asking price since last year. Austin saw a 33.8 percentage-point gain, with 29.1% of homes selling for above asking price last year, the biggest increase of all the metros included in this analysis. Austin is one of the hottest housing markets in the country, with the average home selling for 7% above its asking price, more than any other metro. The median home price in Austin rose 23% year over year in February and the typical home sold in 30 days, 12 days faster than the year before.

Next come Denver (28.1-point gain to 62.5% of homes selling above asking price), Dallas (26.1-point gain to 43.4%), Phoenix (25.9-point gain to 47.9%) and Providence, RI (25.1-point gain to 53.7%).

Nearly 60% of homes are selling above list price in San Francisco, but the portion is down from last year

Twelve percent of homes in the Miami metro sold for above their asking price in the four weeks ending March 21. Though that’s the smallest portion of all the metros included in this analysis, it’s up 3.1 percentage points from a year earlier and one of the highest shares Miami has seen in the last five years. It’s followed by New York (18.9%), New Orleans (21.6%), Orlando (21.9%) and Houston (25.5%).

San Francisco is the only metro where the share of homes selling above their asking price has declined since last year. Though the share is down 4.6 percentage points from a year ago, 59.4% of homes in San Francisco sold above list price during the four weeks ending March 21, the seventh-biggest share of the metros included in this analysis. Although some people are moving away from the city of San Francisco, residential neighborhoods inside the metro area remain desirable.

Share of homes sold above list price by metro area, four weeks ending March 21

Metros ranked from highest to lowest share sold above list price

| Metro area | Share of homes sold above list price | Share of homes sold above list price a year ago |

|---|---|---|

| San Jose, CA | 70.9% | 65.3% |

| Sacramento, CA | 65.4% | 41.6% |

| Salt Lake City, UT | 64.5% | 40.3% |

| Austin, TX | 62.9% | 29.1% |

| Denver, CO | 62.5% | 34.4% |

| Seattle, WA | 59.8% | 44.5% |

| San Francisco, CA | 59.4% | 64% |

| Portland, OR | 58.2% | 36.9% |

| San Diego, CA | 56.6% | 37.3% |

| Los Angeles, CA | 54.8% | 43.7% |

| Riverside, CA | 54.8% | 32.5% |

| Richmond, VA | 54.2% | 33.4% |

| Providence, RI | 53.7% | 28.6% |

| Boston, MA | 53.7% | 37% |

| Minneapolis, MN | 52.6% | 37.2% |

| Washington, D.C. | 51.5% | 38.3% |

| Milwaukee, WI | 51.2% | 32.7% |

| Columbus, OH | 49.2% | 29.6% |

| Raleigh, NC | 48.8% | 28.4% |

| Buffalo, NY | 48.4% | 31.9% |

| Phoenix, AZ | 47.9% | 22% |

| Virginia Beach, VA | 46.8% | 22.4% |

| Hartford, CT | 46.0% | 26.6% |

| Dallas, TX | 43.4% | 17.3% |

| Atlanta, GA | 40.0% | 19.1% |

| National | 39.2% | 23.9% |

| Baltimore, MD | 38.6% | 23.1% |

| Memphis, TN | 38.4% | 23.8% |

| Birmingham, AL | 37.5% | 24.7% |

| Cleveland, OH | 37.3% | 20.6% |

| Detroit, MI | 35.7% | 20.3% |

| Nashville, TN | 35.7% | 20.5% |

| Cincinnati, OH | 35.4% | 19.6% |

| Indianapolis, IN | 34.8% | 17.4% |

| San Antonio, TX | 33.9% | 17.8% |

| Las Vegas, NV | 33.4% | 19.3% |

| Oklahoma City, OK | 30.6% | 23.8% |

| Louisville, KY | 29.6% | 19.9% |

| Pittsburgh, PA | 29.3% | 21.1% |

| Tampa, FL | 28.5% | 16.2% |

| Philadelphia, PA | 27.9% | 18.4% |

| Jacksonville, FL | 27.2% | 13.8% |

| Chicago, IL | 27.2% | 17.7% |

| Houston, TX | 25.5% | 13.1% |

| Orlando, FL | 21.9% | 14.7% |

| New Orleans, LA | 21.6% | 14.5% |

| New York, NY | 18.9% | 13.9% |

| Miami, FL | 12.0% | 8.9% |

United States

United States Canada

Canada