Mortgage-purchase applications and Redfin’s Homebuyer Demand Index both increased as rates stayed around 6.6%, down sharply from 7% earlier this month, saving the typical buyer over $100 in monthly mortgage payments. Still, supply is piling up–posting a record annual increase–as pending sales fell the most on record.

We are taking a short break from analysis this week, but please see the bullet points and charts below for this week’s housing-market data. We’ll be back with full commentary in next week’s report. Happy Thanksgiving!

Leading indicators of homebuying activity:

- For the week ending November 23, 30-year mortgage rates ticked down to 6.58%.

- Mortgage purchase applications during the week ending November 18 increased 8.7% from a month earlier, seasonally adjusted. Purchase applications were down 41% from a year earlier.

- Fewer people searched for “homes for sale” on Google than this time in 2021. Searches during the week ending November 19 were down about 38% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other homebuying services from Redfin agents— was up 1.6% from a month earlier but down 33% from a year earlier during the four weeks ending November 20.

- Touring activity as of November 20 was down 35% from the start of the year, compared to a 3% year-over-year decrease at the same time last year, according to home tour technology company ShowingTime.

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data in this report covers the four-week period ending November 20. Redfin’s weekly housing market data goes back through 2015.

Data based on homes listed and/or sold during the period:

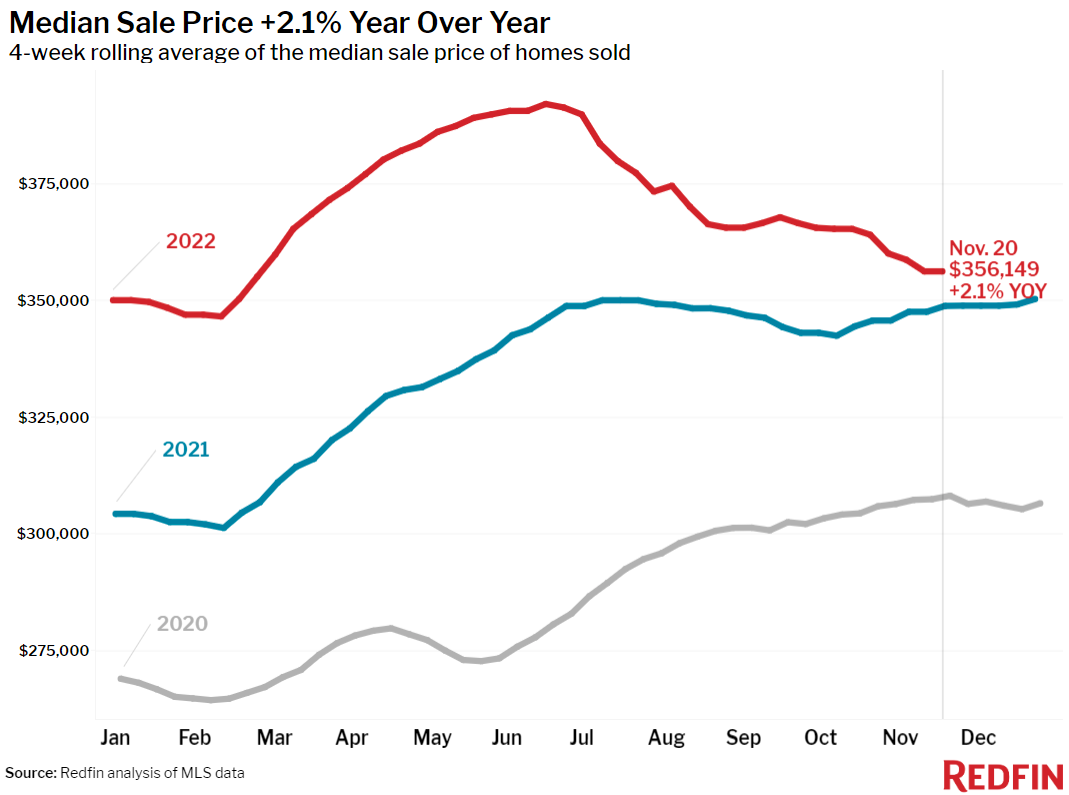

- The median home sale price was $356,149, up 2.1% year over year, the smallest increase since the start of the pandemic.

- Among the 50 most populous U.S. metros, home-sale prices fell from a year earlier in five of them. Prices declined 9.5% year over year in San Francisco, 2.1% in Sacramento, 1.7% in Detroit and less than 1% in San Jose, CA and San Diego.

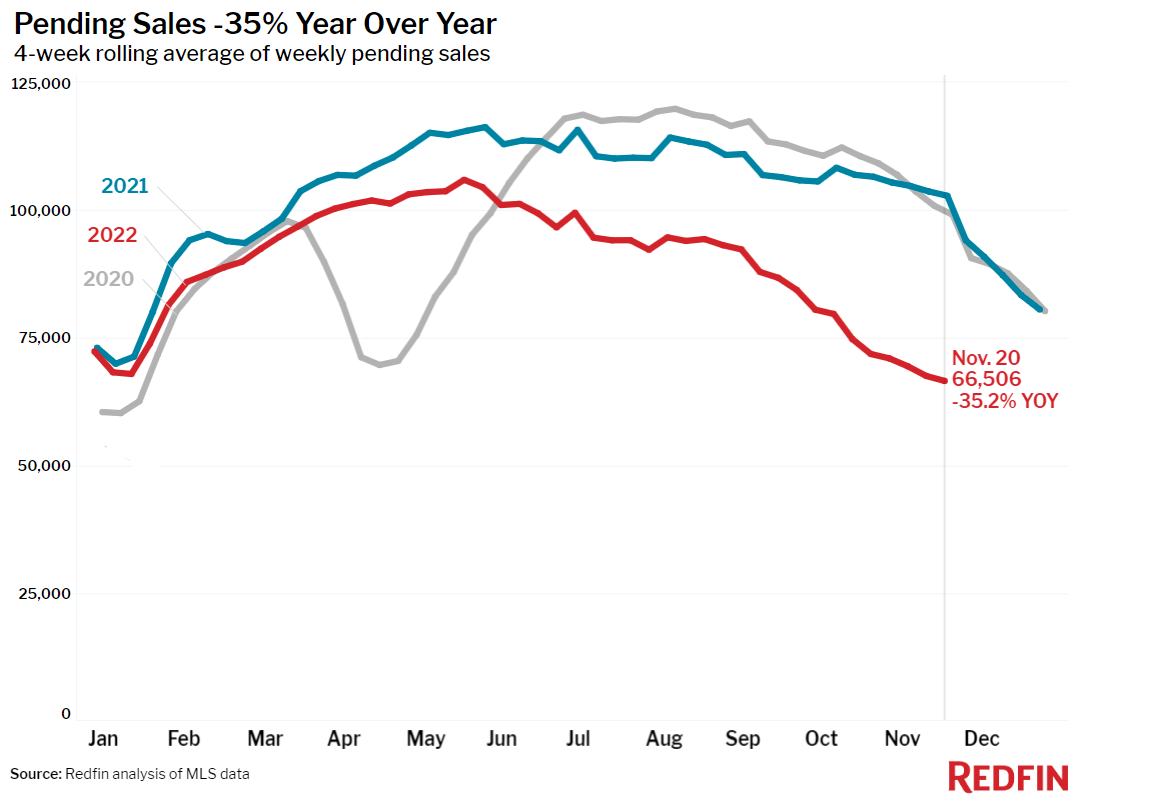

- Among the 50 most populous U.S. metros, pending sales fell the most from a year earlier in Las Vegas (-64%), Austin (-58.2%), Phoenix (-57%), Jacksonville, FL (-57%) and Sacramento (-54%).

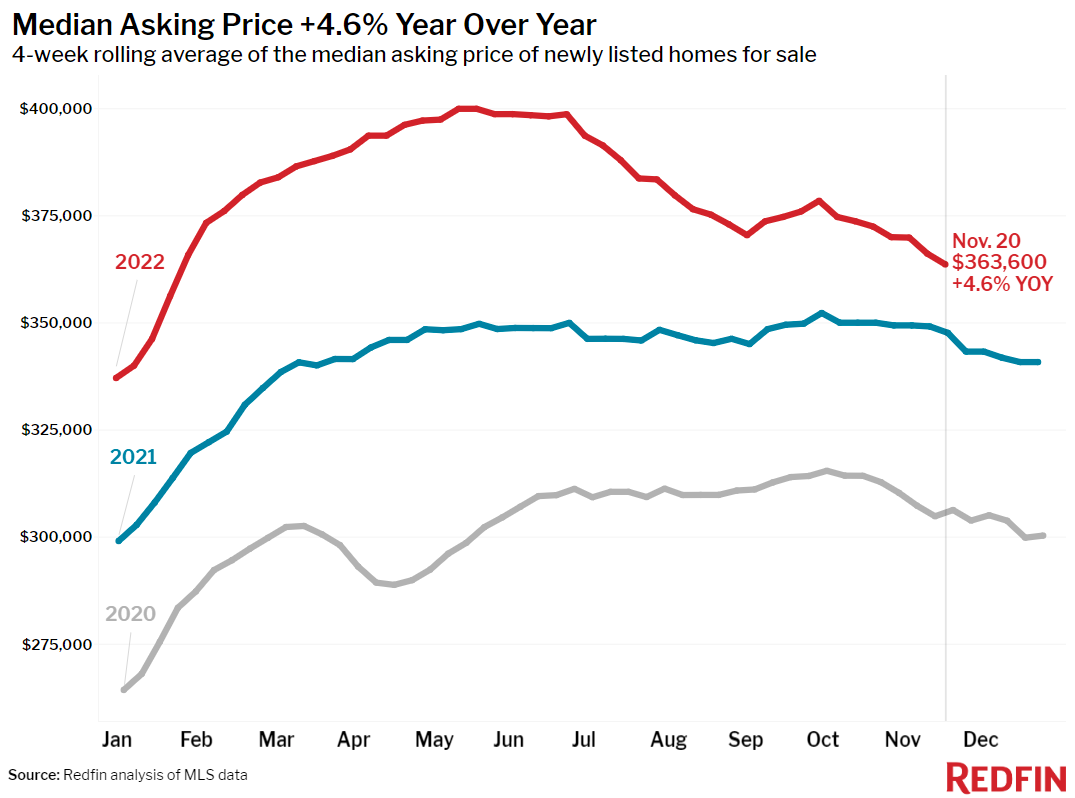

- The median asking price of newly listed homes was $363,600, up 4.6% year over year, the slowest growth rate since the beginning of the pandemic.

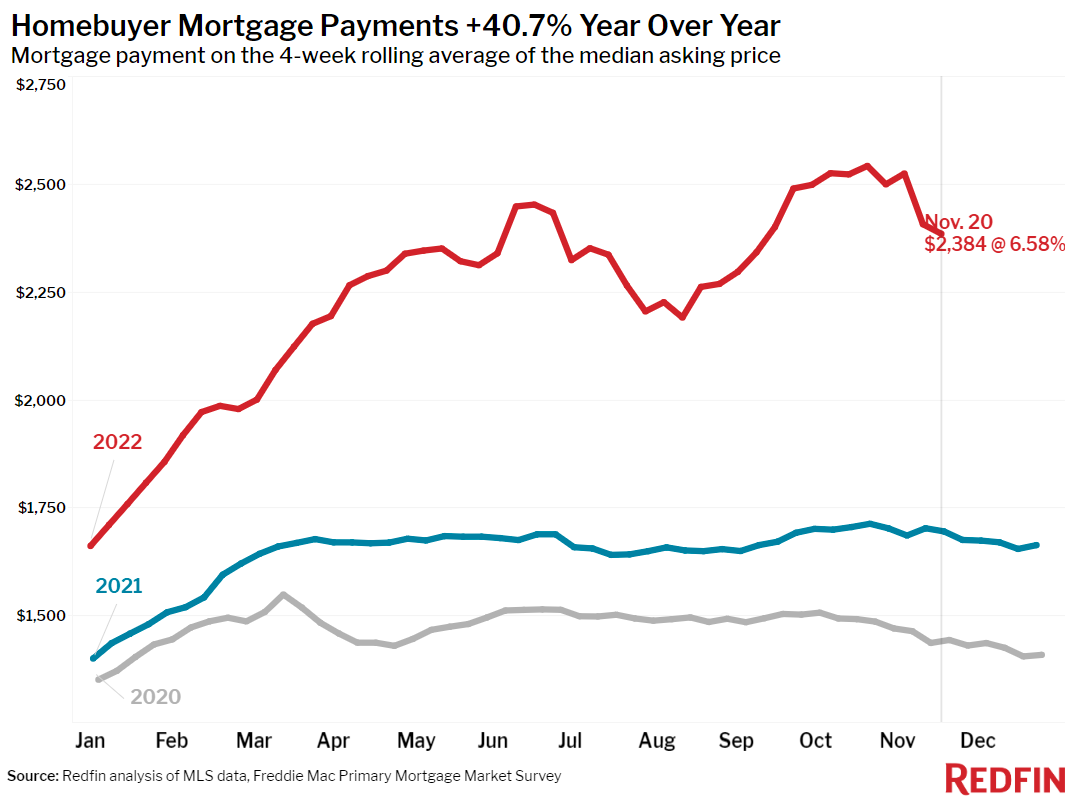

- The monthly mortgage payment on the median-asking-price home was $2,384 at the current 6.58% mortgage rate. That’s down slightly from a week earlier and down 6% from two weeks earlier, when mortgage rates were at 7.08%. That’s equal to $140 in monthly mortgage savings from two weeks ago for the typical buyer. Still, monthly mortgage payments are up 41% from a year ago.

- Pending home sales were down 35.2% year over year, the largest decline since at least January 2015, as far back as this data goes.

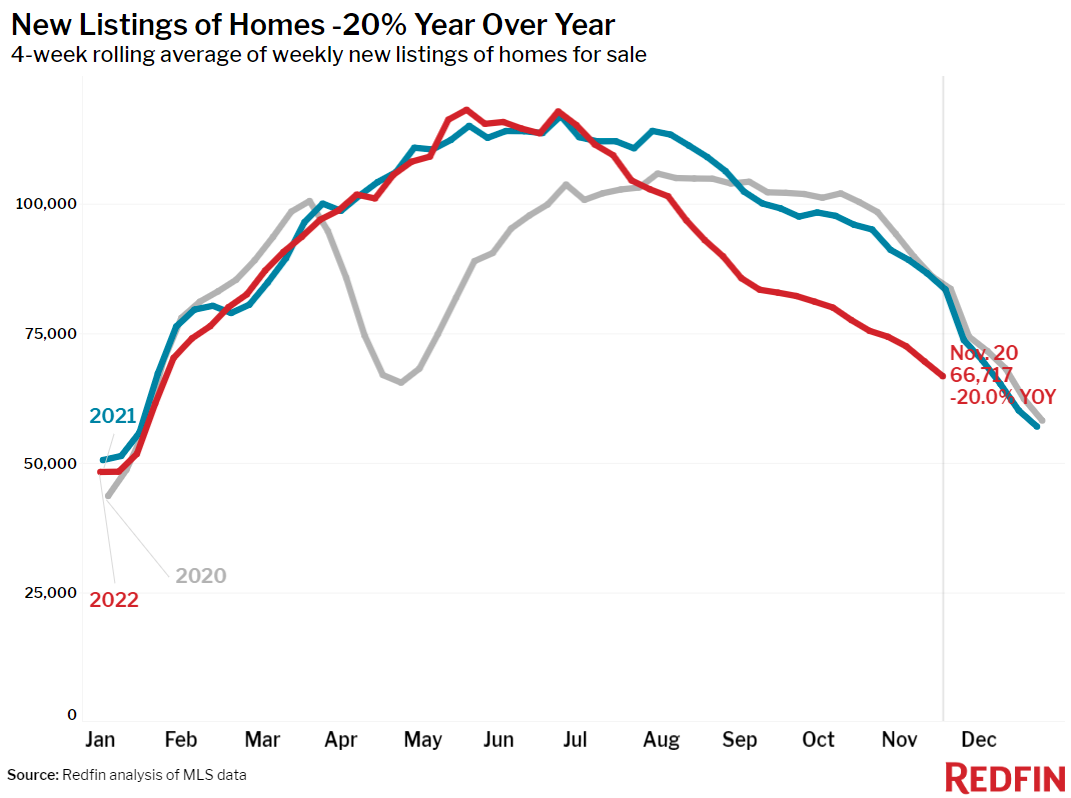

- New listings of homes for sale were down 20% from a year earlier, one of the largest declines since the beginning of the pandemic.

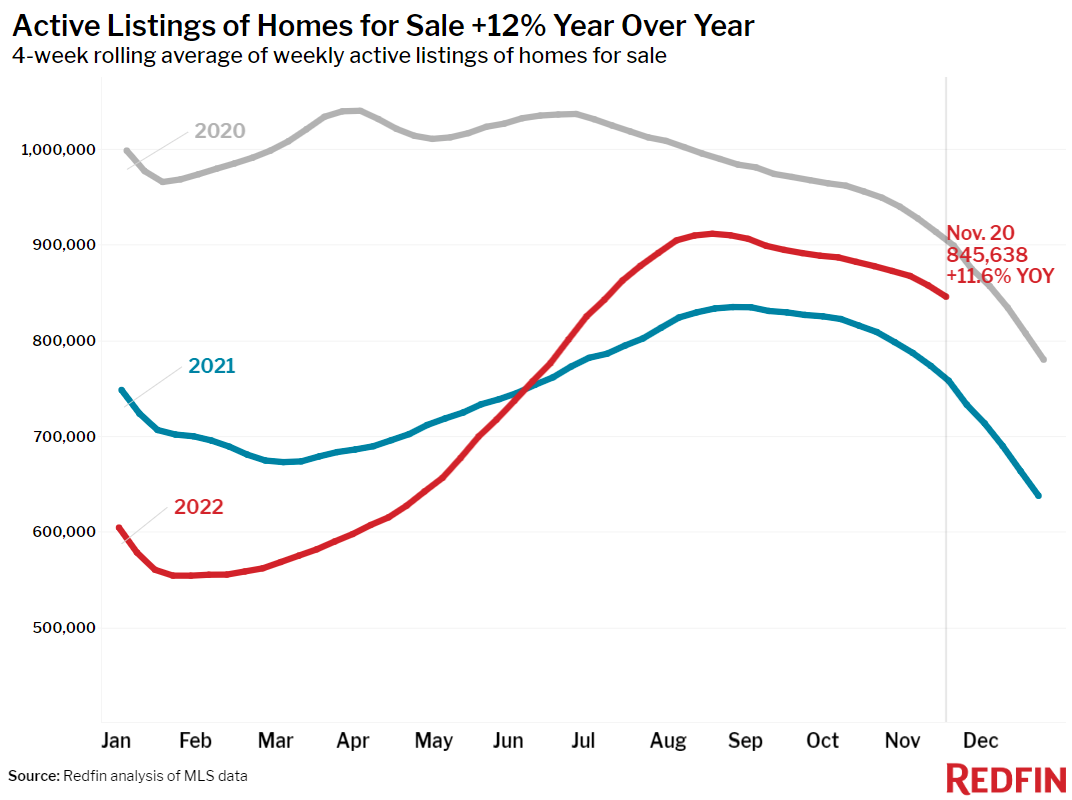

- Active listings (the number of homes listed for sale at any point during the period) were up 11.6% from a year earlier, the biggest annual increase since at least 2015.

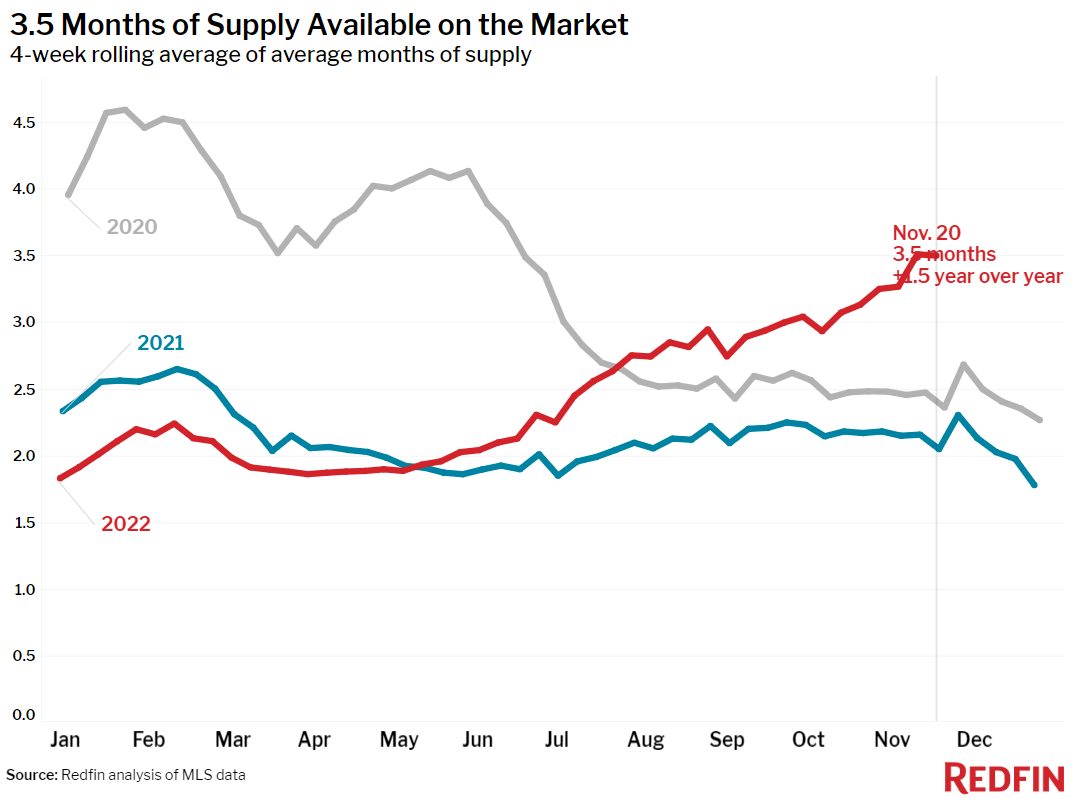

- Months of supply—a measure of the balance between supply and demand, calculated by dividing the number of active listings by closed sales—was 3.5 months, the highest level since June 2020.

- 32% of homes that went under contract had an accepted offer within the first two weeks on the market, little changed from the prior four-week period but down from 40% a year earlier.

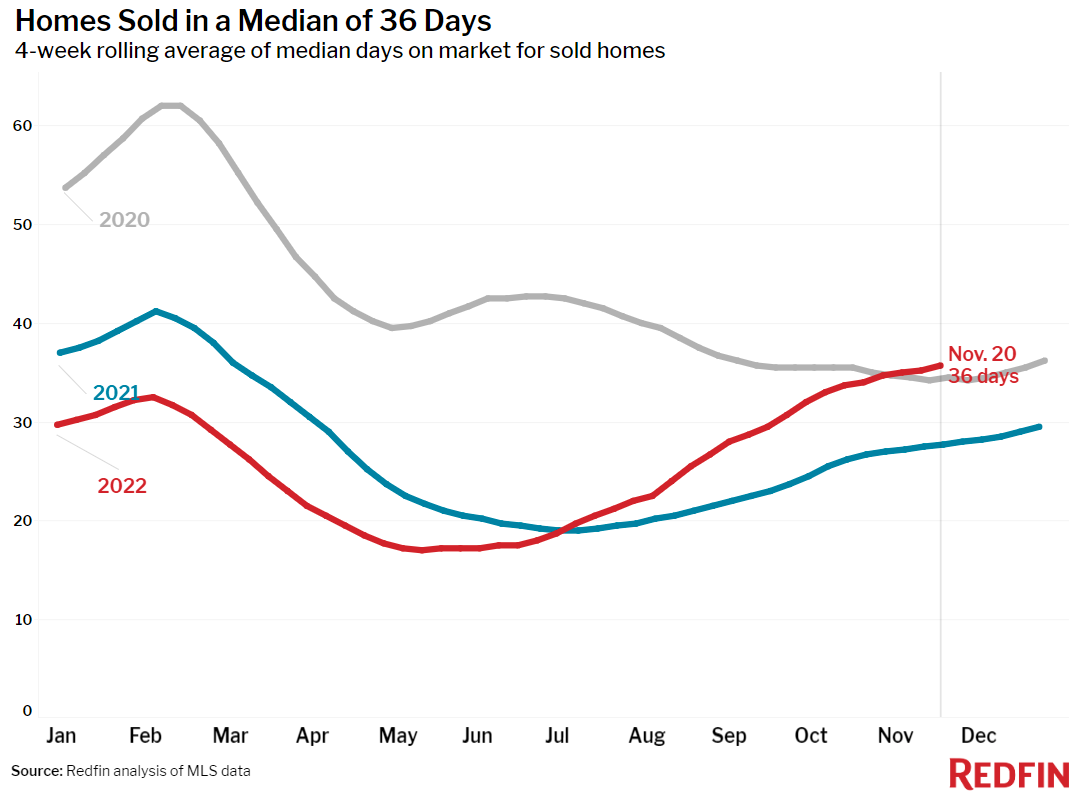

- Homes that sold were on the market for a median of 36 days, up more than a week from 28 days a year earlier and up from the record low of 17 days set in May and early June.

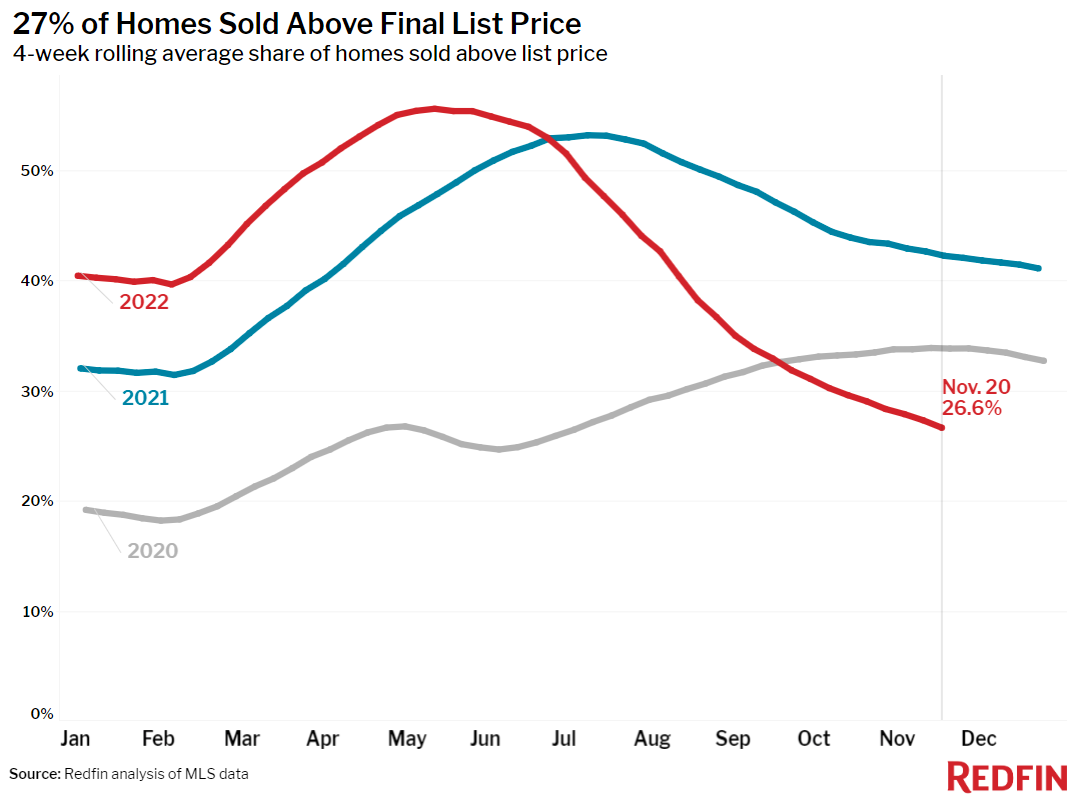

- 27% of homes sold above their final list price, down from 42% a year earlier and the lowest level since July 2020.

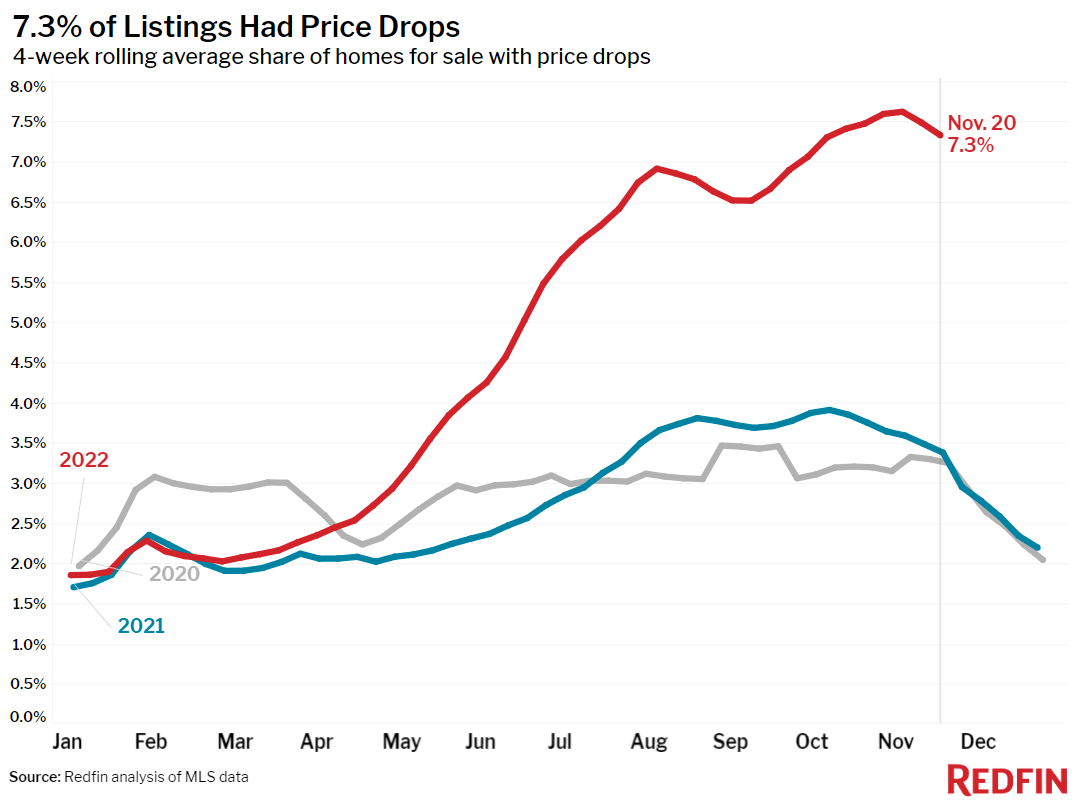

- On average, 7.3% of homes for sale each week had a price drop, up from 3.4% a year earlier but down slightly from the previous two weeks.

- The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, fell to 98.5% from 100.4% a year earlier. That’s the lowest level since June 2020.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada