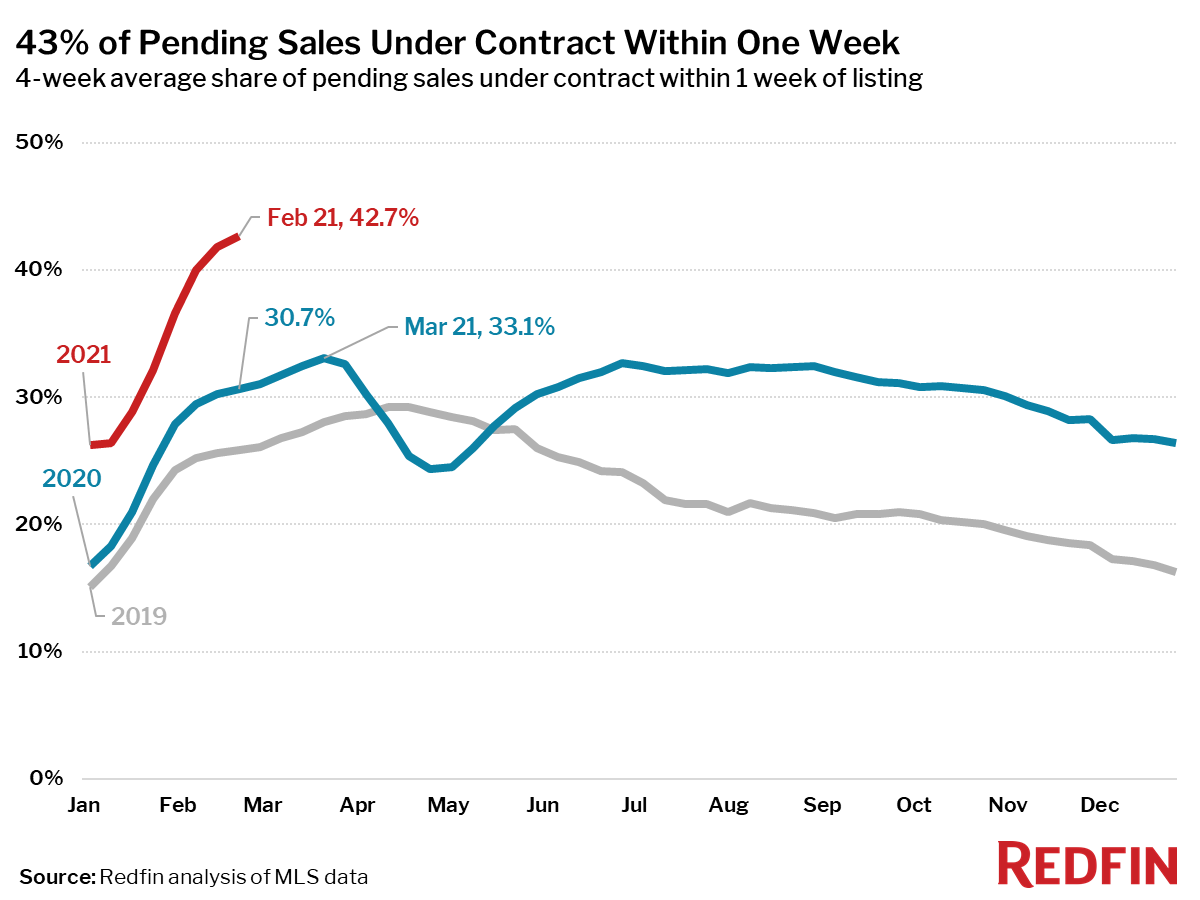

A record 43% of homes spent a week or less on the market.

Key housing market takeaways for 400+ U.S. metro areas during the 4-week period ending February 21:

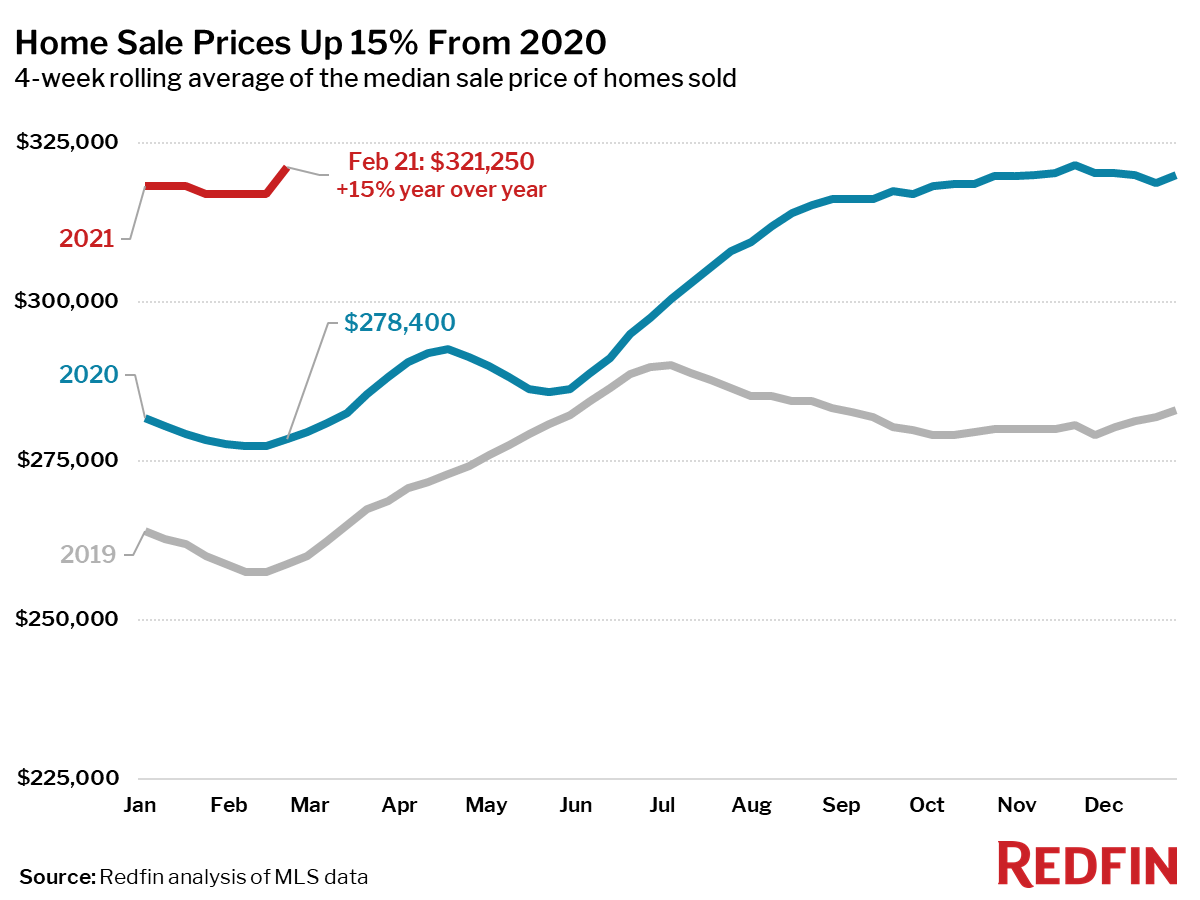

- The median home-sale price increased 15% year over year to $321,250.

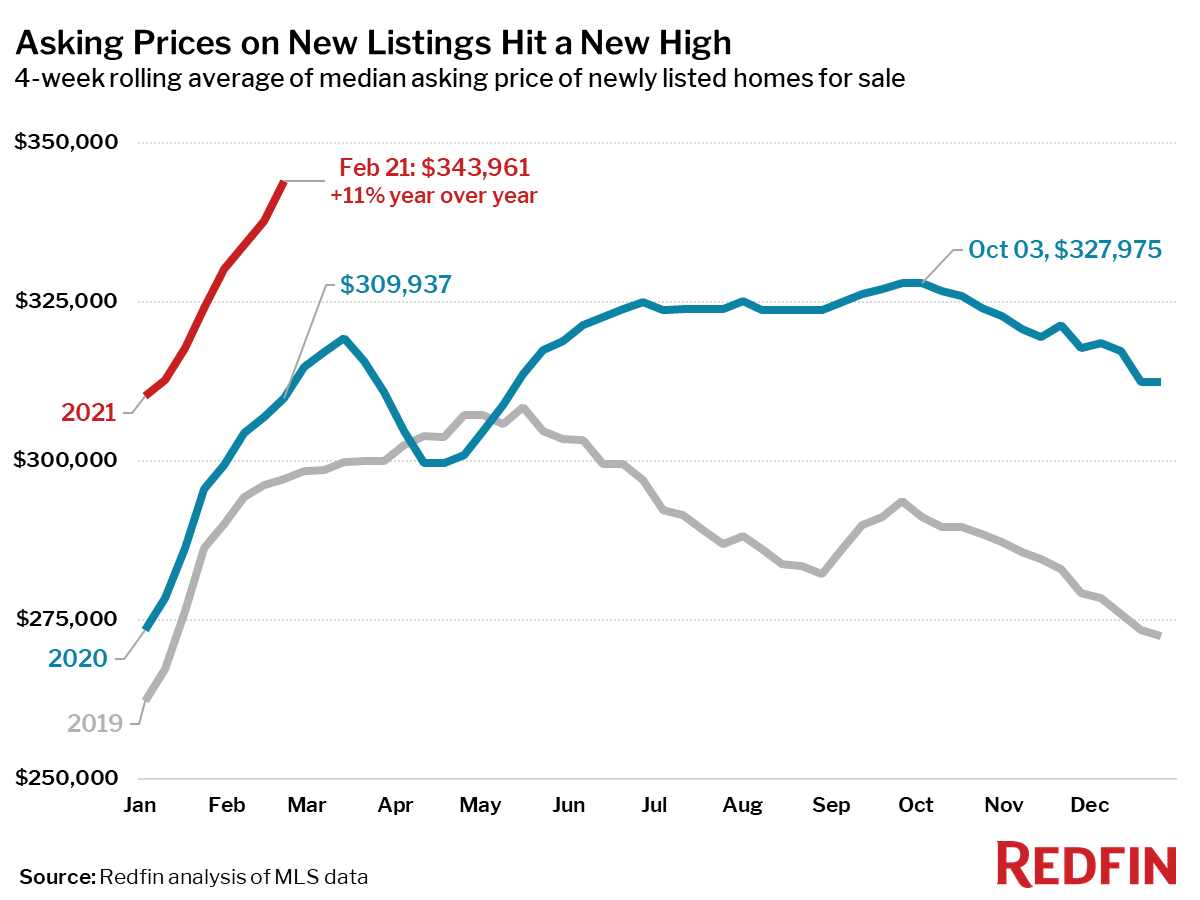

- Asking prices of newly listed homes hit a new all-time high of $343,961, up 11% from the same time a year ago.

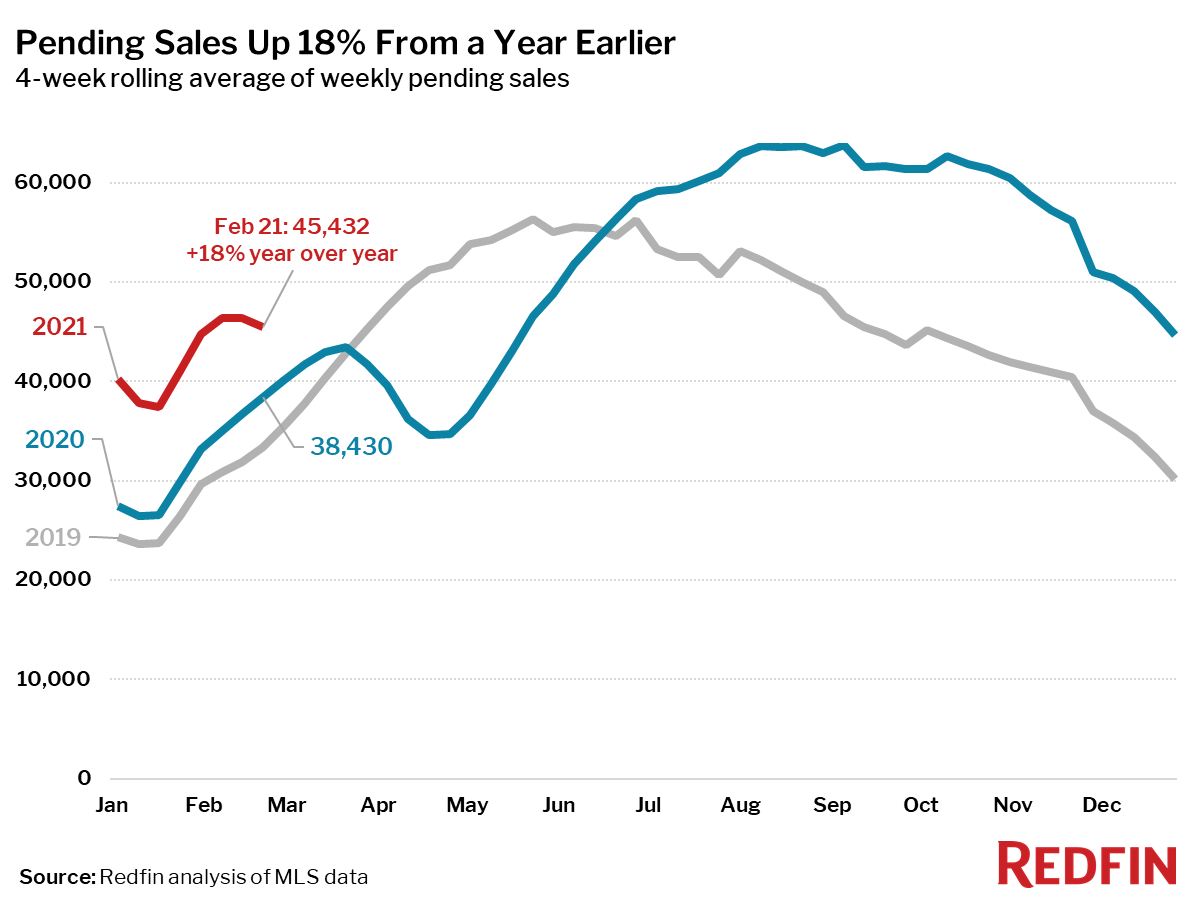

- Pending home sales were up 18% year over year. During the single week ending February 21, pending sales were down 9% from two weeks prior. Over the same period in 2020, pending sales were up 7%. It’s likely that last week’s massive winter storm impacted housing market activity in many parts of the country.

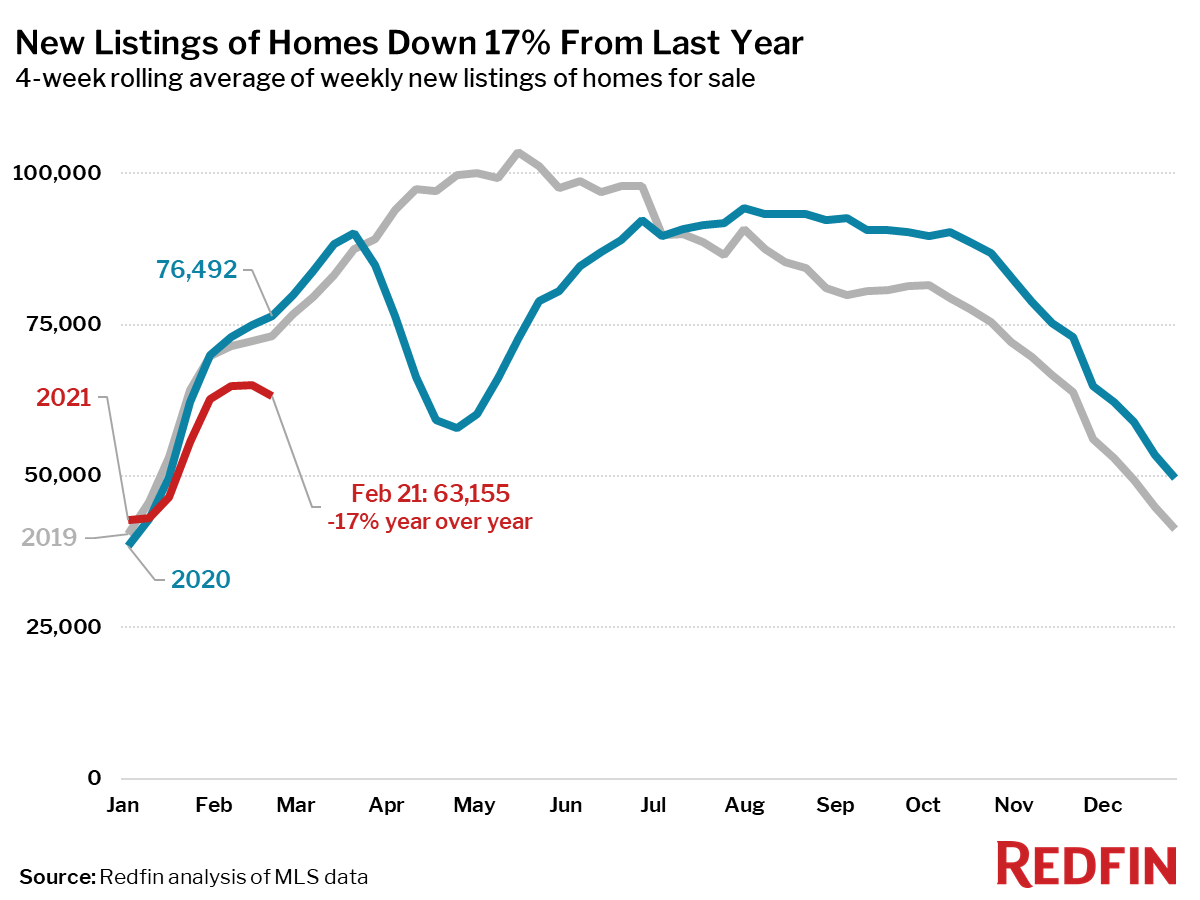

- New listings of homes for sale were down 17% from a year earlier.

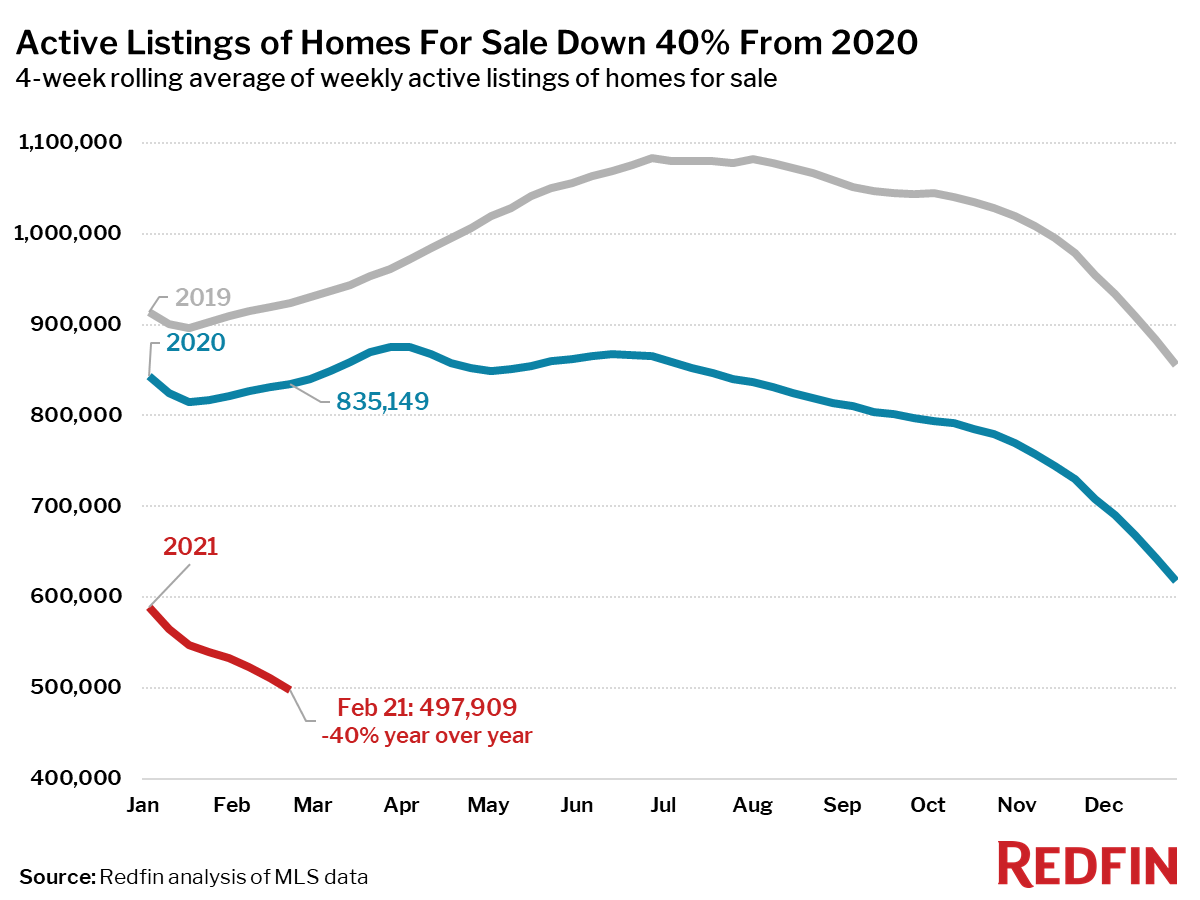

- Active listings (the number of homes listed for sale at any point during the period) fell 40% from 2020 to a new all-time low.

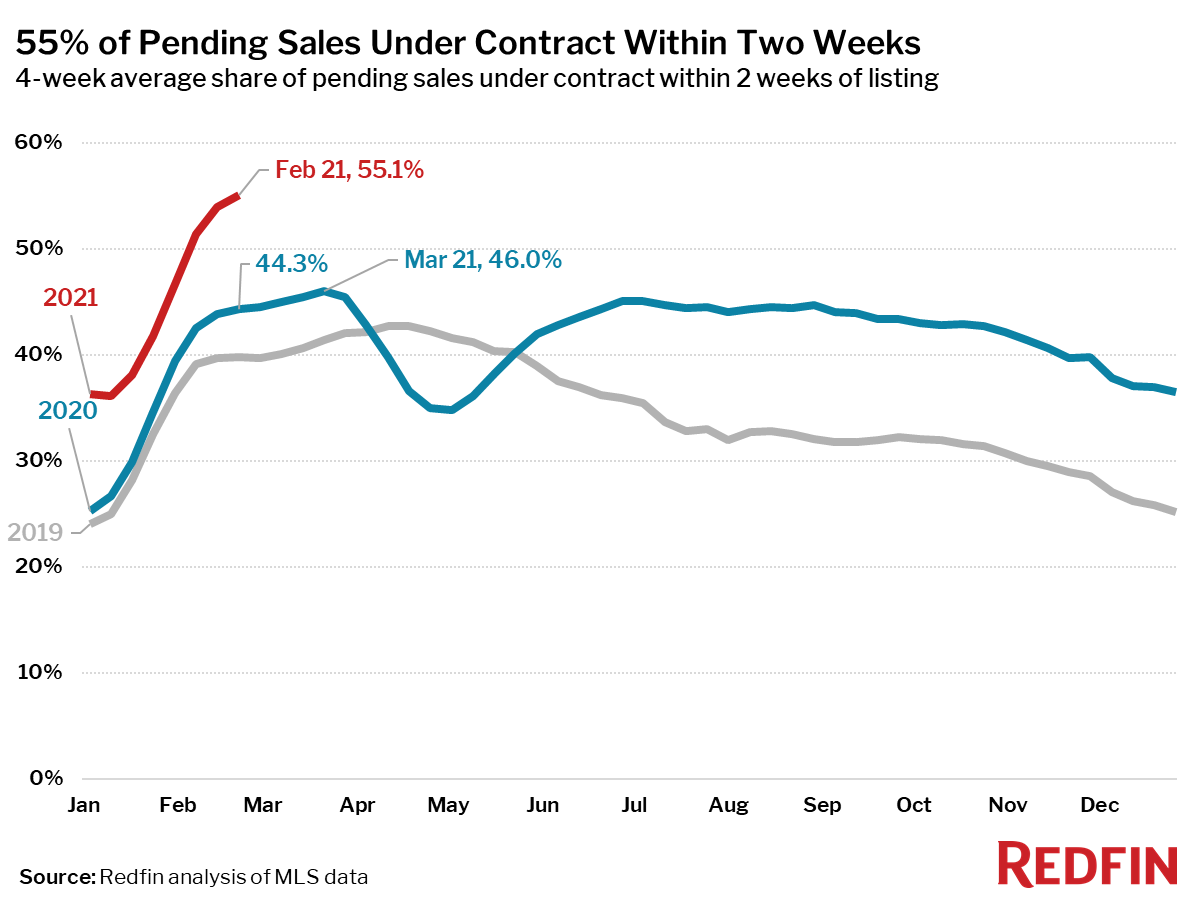

- 55% of homes that went under contract had an accepted offer within the first two weeks on the market, well above the 44% rate during the same period a year ago. This is another new all-time high for this measure since at least 2012 (as far back as Redfin’s data for this measure goes). During the week ending February 21, 57% of homes sold in two weeks or less.

- 43% of homes that went under contract had an accepted offer within one week of hitting the market, up from 30% during the same period a year earlier. This is also an all-time high for this measure. During the week ending February 21, 44% sold in one week or less.

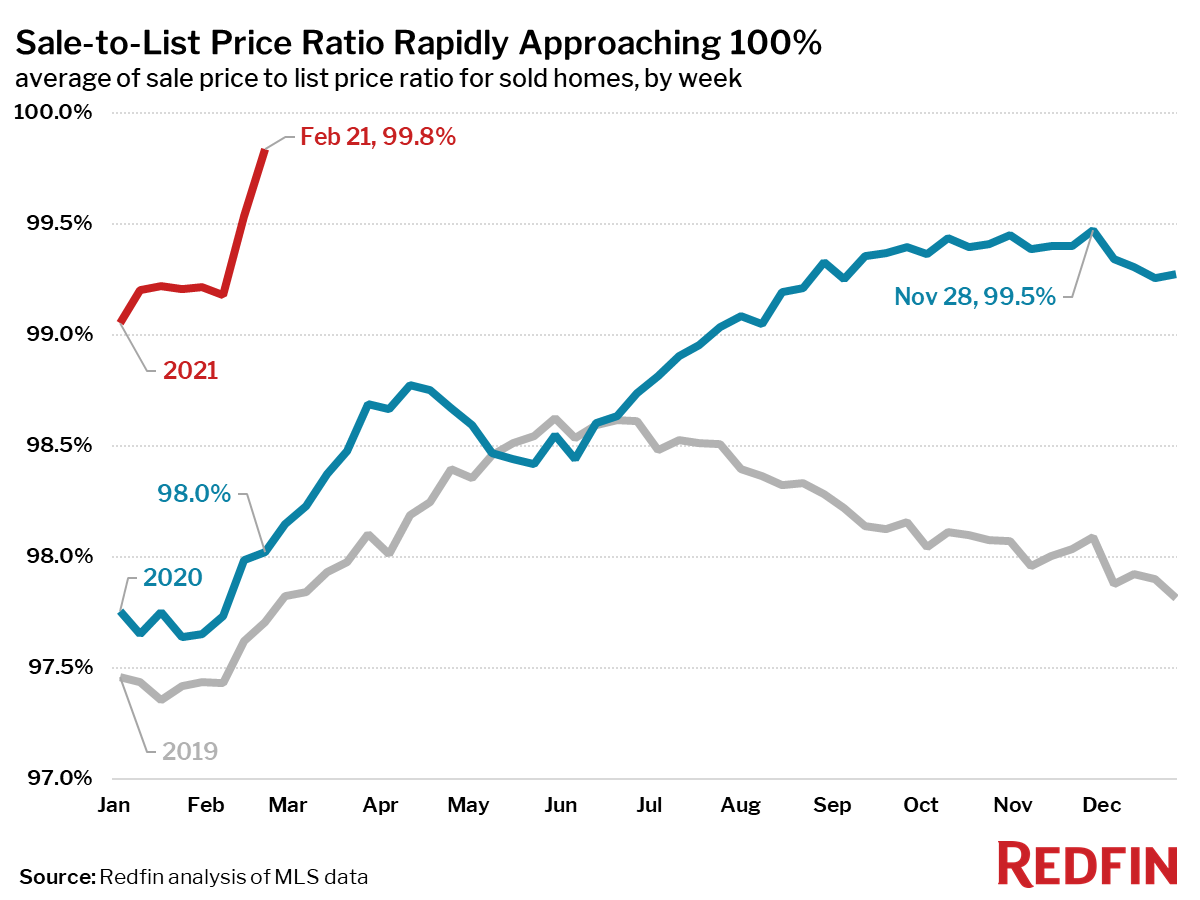

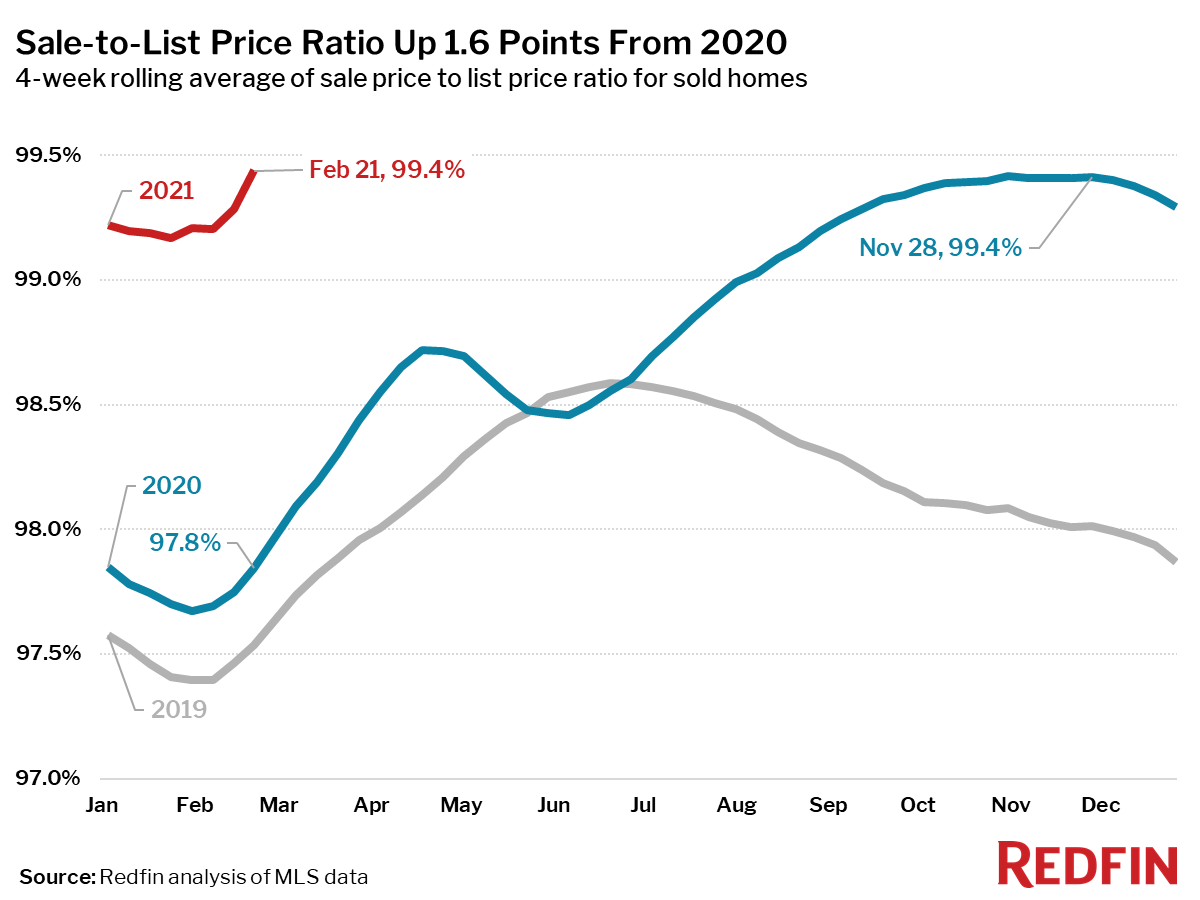

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased slightly to 99.4%—1.6 percentage points higher than a year earlier and an all-time high. During the week ending February 21, the ratio shot up to 99.8%, also an all-time high.

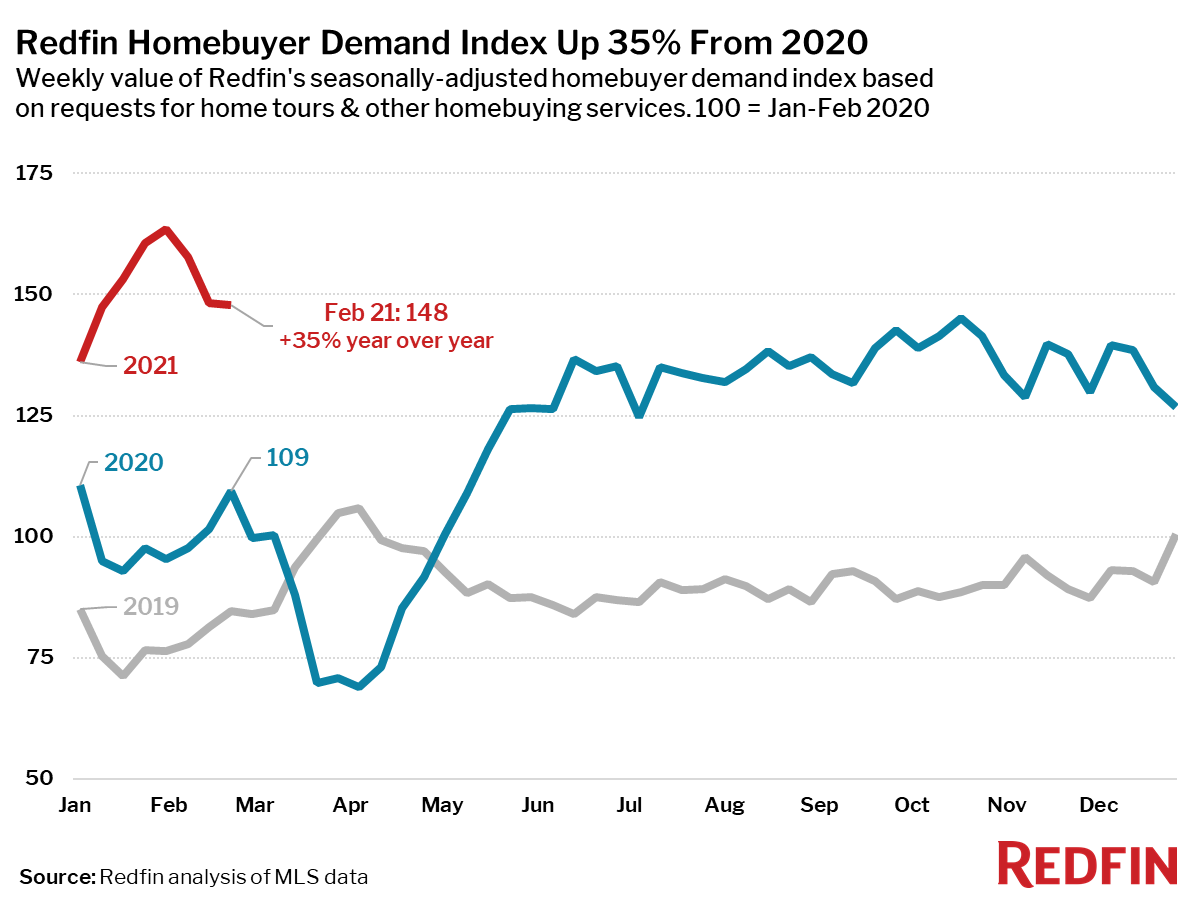

- For the week ending February 21, the seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other services from Redfin agents—was up 35% from the same period a year ago.

- Mortgage purchase applications decreased 12% week over week (seasonally adjusted) and were up 7% from a year earlier (unadjusted) during the week ending February 19. For the week ending February 25, 30-year mortgage rates increased to 2.97%, the highest level since August.

“The housing market is now like a Soviet-era supermarket, with most of the shelves empty,” Said Redfin CEO Glenn Kelman in remarks on Redfin’s Q4 earnings call this week. “In the week leading up to this call, demand slackened for the first time in months, probably because of cross-country snowstorms. But prior to that, the stories we heard from our agents were harrowing, juicy and bizarre. Migrations are warping the space-time continuum of small-town economies. The affordability crisis that flowed like some huge, unspent electrical charge from San Francisco to Seattle to Portland to Denver and to Boise is now reaching virtually every town in North America, bringing dazzling prosperity but also new anxieties.”

United States

United States Canada

Canada