Still, 14% said they lowered their price range and 13% are moving to a nearby city with lower taxes

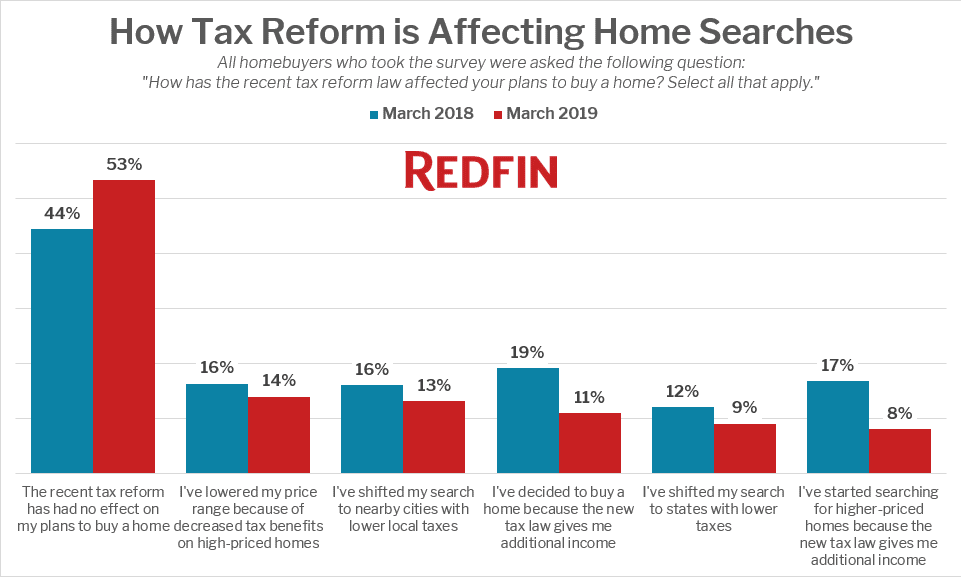

Over a year after the historic tax code overhaul that lowered the caps on tax deductions allowed for mortgage interest payments and state and local taxes, less than half of homebuyers (47%) say that tax reform has had an effect on their home search. That’s down from 56 percent last year, when tax reform’s effects were still mostly speculative and not yet realized in people’s paychecks. Overall the actual effects on home searches are less significant than people expected them to be a year ago.

This is according to a March survey commissioned by Redfin of over 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months.

The findings in this report are based on responses from over 1,800 homebuyers who responded to the question “How has the recent tax reform law affected your plans to buy a home? Select all that apply.” Results from this year’s survey are also compared to the over 1,300 responses to the same question in a similar survey commissioned in March 2018.

Compared with the effects homebuyers reported a year ago, we saw the biggest drops in the prevalence of buyers indicating that they were better off because of tax reform. This year, 8 percent of respondents said they are searching for higher-priced homes because the new tax law gives them additional income, down from 17 percent last year. Eleven percent of buyers this March said they decided to buy a home because the new tax law gives them additional income, down from 19 percent in the March 2018 survey.

The most common tax-reform effect reported by homebuyers this year was that they lowered their price range because of decreased tax benefits on high-priced homes (14%, down from 16% last year).

Another prevalent way tax reform has been affecting the housing market is in the form of migration to places with lower taxes, a trend we’ve noted in reports on Redfin.com user search patterns for more than a year. According to the homebuyer survey, this effect is now slightly less significant than last year’s survey findings suggested. This March, 13 percent of buyers said they shifted their search to nearby cities with lower taxes, and 9 percent said they shifted their search to states with lower taxes, down from 16 percent and 12 percent, respectively, last year.

“Last year more homebuyers were worried that tax reform would hurt their homebuying budgets, but it turns out tax reform wasn’t all bad or all good for homebuyers,” said Redfin chief economist Daryl Fairweather. “Some homebuyers, especially in low-tax states, are now paying less in taxes overall, which has left them with more cash for a more expensive home. For others, not being able to deduct as much of their property taxes or mortgage interest from their taxable income was the other shoe that needed to drop to make them pick up and move to a more affordable area. In the long run, we will see demand for luxury homes in high-tax states suffer the most because those homes have been hit the hardest by this tax reform, and there’s actually early evidence of that already happening.”

How Were Households with Different Incomes Affected by Tax Reform?

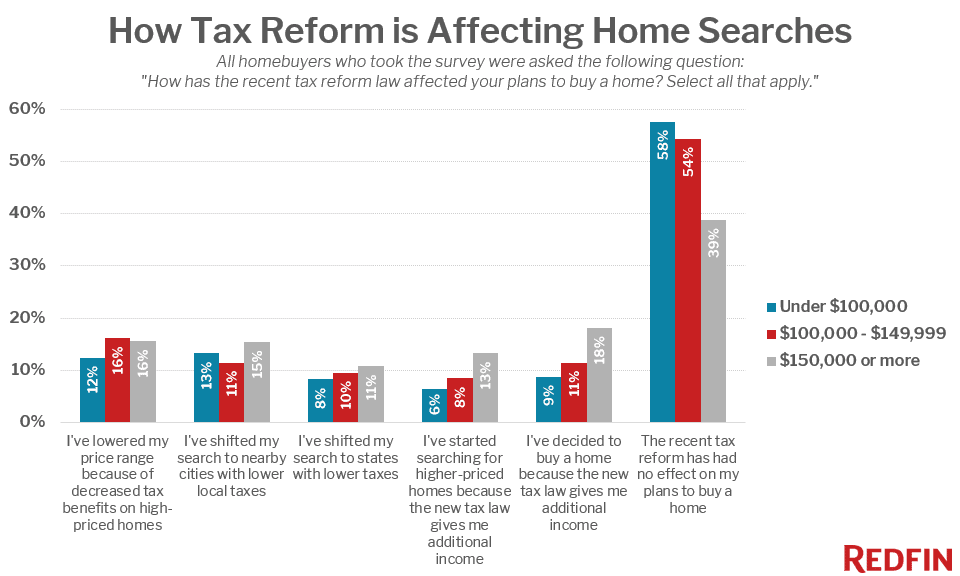

High-income homebuyers were the most likely to report in this year’s survey that tax reform has had some sort of effect on their home search. Of those homebuyers earning $150,000 or more, 61 percent said that the new tax law had an effect on their home search, which was true for less than half of households earning under $150,000.

The largest reported effect on high-income homebuyers was that 18 percent said they have now decided to buy a home thanks to their extra take-home income, but 16 percent said they are now lowering their price range due to decreased tax benefits on high-priced homes.

It’s worth noting that people’s opinion of whether tax reform negatively or positively affected them in general, and their home search in particular, is likely to be skewed by their overall political leanings.

Which States Were Most and Least Affected by Tax Reform?

New York had the largest share of homebuyers who said that tax reform had affected their home search—61 percent. Homebuyers in New York were most likely to have lowered their price range (17%) or shifted their home search to cities with lower taxes (17%). California had the next-highest share of homebuyers impacted by tax reform at 55 percent. The largest effect there was homebuyers shifting their search to cities with lower taxes (18%). Thirteen percent of both New York- and California-based respondents said they were moving to a state with lower taxes.

On the other end of the spectrum, Kansas and Indiana had the smallest share of homebuyers whose search was affected by tax reform, each at 24 percent. Washington, D.C., was just behind with 25 percent of homebuyers saying tax reform had some effect on their search.

Survey Question: How has the recent tax reform law affected your plans to buy a home?

| State/District | The recent tax reform has had no effect on my plans to buy a home | I’ve lowered my price range because of decreased tax benefits on high-priced homes | I’ve shifted my search to nearby cities with lower local taxes | I’ve decided to buy a home because the new tax law gives me additional income | I’ve shifted my search to states with lower taxes | I’ve started searching for higher-priced homes because the new tax law gives me additional income |

|---|---|---|---|---|---|---|

| Kansas | 76% | 6% | 9% | 6% | 3% | 3% |

| Indiana | 76% | 9% | 3% | 3% | 6% | 6% |

| Washington, D.C. | 75% | 11% | 0% | 7% | 14% | 7% |

| Minnesota | 68% | 14% | 7% | 5% | 7% | 2% |

| Wisconsin | 65% | 8% | 12% | 4% | 4% | 8% |

| Arizona | 64% | 5% | 7% | 12% | 7% | 14% |

| Virginia | 62% | 8% | 15% | 12% | 12% | 4% |

| North Carolina | 62% | 12% | 12% | 11% | 9% | 6% |

| Nevada | 61% | 3% | 12% | 12% | 6% | 12% |

| Pennsylvania | 60% | 13% | 9% | 11% | 7% | 10% |

| Georgia | 59% | 14% | 6% | 8% | 14% | 10% |

| Tennessee | 58% | 15% | 10% | 18% | 5% | 0% |

| Washington | 57% | 12% | 14% | 9% | 6% | 6% |

| Michigan | 56% | 11% | 15% | 8% | 8% | 11% |

| Ohio | 56% | 15% | 11% | 12% | 3% | 8% |

| Missouri | 53% | 15% | 18% | 3% | 9% | 9% |

| Florida | 52% | 8% | 11% | 14% | 8% | 13% |

| Massachusetts | 51% | 18% | 14% | 8% | 10% | 8% |

| Texas | 50% | 17% | 12% | 12% | 10% | 8% |

| Oregon | 50% | 23% | 17% | 7% | 3% | 7% |

| Illinois | 46% | 17% | 17% | 15% | 12% | 6% |

| California | 45% | 14% | 18% | 12% | 13% | 9% |

| New York | 39% | 17% | 17% | 15% | 13% | 10% |

Chart above shows the breakdown for states with at least 25 individual responses to the question “How has the recent tax reform law affected your plans to buy a home? Select all that apply.”

United States

United States Canada

Canada