The Cape Coral metro area has more than made up for the plunge in new listings caused by the storm. Home sales have also started to rebound.

Listings of homes for sale in the Cape Coral-Fort Myers, FL metropolitan area have recovered after plunging in the wake of Hurricane Ian last fall, and sales have begun to bounce back.

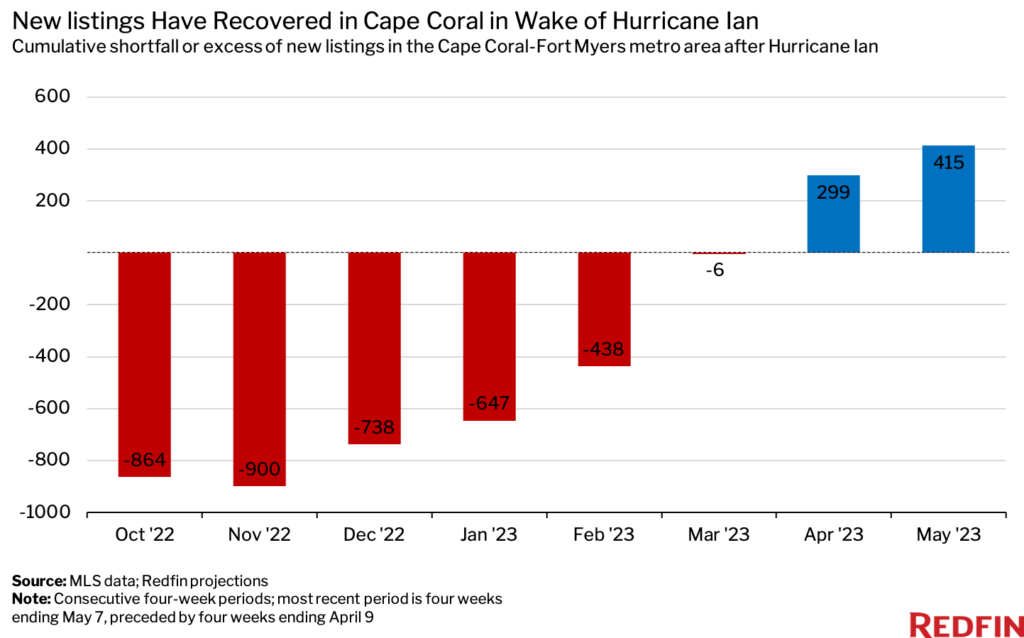

In the two months after the devastating September 2022 storm, there were 900 fewer new listings in Cape Coral–Fort Myers than there would have been had the storm not hit, according to Redfin projections. But in the six months after that, there were 1,314 more new listings than projected, more than offsetting the shortfall. To put it another way, the metro had gained 415 more new listings than it had lost by early May. The Cape Coral-Fort Myers metro area will be referred to as “Cape Coral” for the remainder of this report.

This is according to a Redfin analysis of MLS data, and Redfin projections based on listings and sales performance in comparable Florida metros that weren’t impacted by Hurricane Ian.

New listings are likely outperforming expectations due to a backlog created by the storm; homeowners who paused their selling plans or delisted their properties in the wake of Hurricane Ian are now putting their homes on the market. There are likely other homeowners who didn’t intend to sell before the storm but are now moving because their home was damaged and/or they want to live in a safer area.

“Intense storms are becoming more frequent in Florida due to climate change, but homebuyers are still moving to the Sunshine State in search of warm weather and relatively affordable home prices,” said Redfin Senior Economist Sheharyar Bokhari. “But as homebuyers have moved into Florida, insurers have moved out, leaving homeowners with fewer and more expensive coverage options. Ultimately, lower-income residents may be pushed out of the riskiest areas due to rising insurance and rebuilding costs. Those who can afford to remain will likely see their home values appreciate at a slower clip as the dangers of climate change become impossible to ignore.”

Insurers aren’t just leaving flood-prone areas; State Farm and Allstate recently announced they will stop issuing new homeowner’s insurance policies in California due to climate risk, citing increased exposure to catastrophes including wildfires.

Summary: Actual Vs Projected New Listings After Hurricane Ian

| Four weeks ending: | Actual new listings | Projected new listings | Gap between actual and projected new listings | Cumulative shortfall/excess of new listings after storm |

| 10/23/22 | 956 | 1,820 | -864 | -864 |

| 11/20/22 | 1,744 | 1,780 | -36 | -900 |

| 12/18/22 | 1,704 | 1,542 | 162 | -738 |

| 1/15/23 | 1,680 | 1,589 | 91 | -647 |

| 2/12/23 | 2,372 | 2,162 | 210 | -438 |

| 3/12/23 | 2,572 | 2,140 | 432 | -6 |

| 4/9/23 | 2,340 | 2,035 | 305 | 299 |

| 5/7/23 | 2,228 | 2,112 | 116 | 415 |

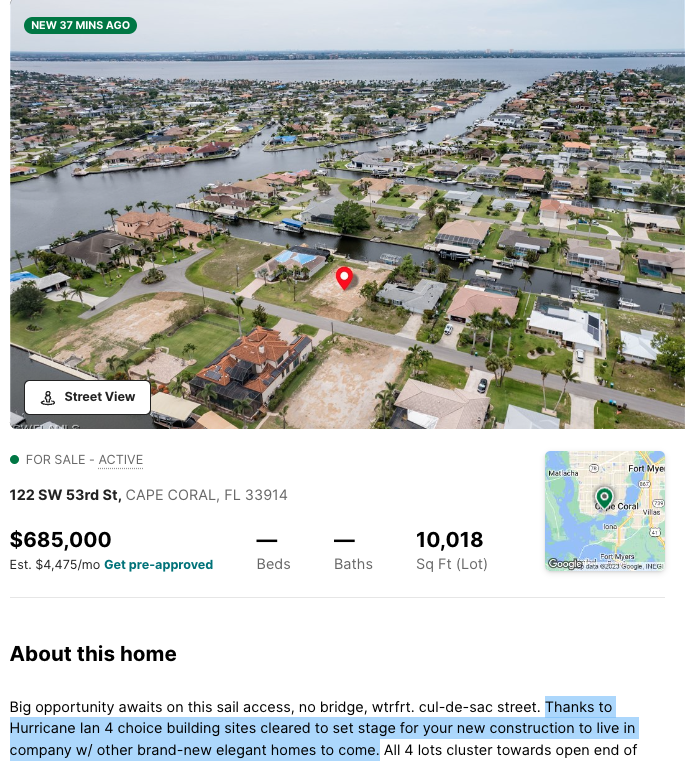

This analysis focuses on home listings, but it’s worth noting that scores of vacant plots have also hit the market in Cape Coral after the homes atop many of those lots were destroyed. There were 6,167 land listings in Cape Coral as of June 16—comparable with the number of home listings (6,619). Some don’t mention the impact of the storm or the potential for future natural disasters. Other listings do mention Hurricane Ian, and tout the opportunities for builders and homebuyers despite continued storm risk.

While some people who moved to Florida during the pandemic are leaving, new out-of-staters continue to move in, which is incentivizing homebuilders in Cape Coral to keep building, according to local Redfin Premier real estate agent Isabel Arias-Squires.

Florida has doled out 80,000 residential building permits so far this year—more than any other state but Texas. Arias-Squires noted that new-construction homes in Florida have the advantage of being built under the most recent building codes, providing better resistance against natural disasters

Sales Are Bouncing Back, But Haven’t Fully Recovered

In the three months after Hurricane Ian, there were 723 fewer home sales in Cape Coral than there would have been had the storm not hit, according to Redfin projections. In the following five months, there were 538 more sales than projected. That meant that by early May, the sales shortfall had shrunk from 723 to 185.

Home sales typically recover more slowly than listings after natural disasters because there have to be listings for people to purchase homes.

Summary: Actual Vs Projected Home Sales After Hurricane Ian

| Four weeks ending: | Actual home sales | Projected home sales | Gap between actual and projected home sales | Cumulative shortfall of home sales after storm |

| 10/23/22 | 880 | 1,435 | -555 | -555 |

| 11/20/22 | 1,143 | 1,294 | -151 | -706 |

| 12/18/22 | 1,223 | 1,240 | -17 | -723 |

| 1/15/23 | 1,150 | 1,110 | 40 | -683 |

| 2/12/23 | 1,249 | 1,100 | 149 | -535 |

| 3/12/23 | 1,695 | 1,577 | 118 | -417 |

| 4/9/23 | 1,886 | 1,822 | 64 | -352 |

| 5/7/23 | 2,038 | 1,871 | 167 | -185 |

The fact that home sales in Cape Coral have started to recover indicates that many homebuyers continue to prioritize waterfront views, relatively affordable home prices and lower taxes above climate concerns.

Cape Coral is the seventh most popular migration destination for homebuyers, according to Redfin’s latest ranking. Four other Florida metros—Miami, Tampa, Orlando and North Port—are also in the top 10 as the Sunshine State attracts house hunters from New York, Chicago and other major metros.

Hurricane Ian Had No Major Impact on Home Prices

We also looked at Hurricane Ian’s impact on home prices, but the results were not statistically significant. Median sale prices in Cape Coral were neither higher nor lower than projected after the storm.

“The storm’s effect on prices was likely muted because at first, new listings fell, which pressured prices to rise due to a shortage of homes for sale. But new listings then more than recovered, which pressured prices to fall because there was more supply than usual,” Bokhari said. “In the end, the two effects canceled each other out.”

Methodology

To analyze the impact of Hurricane Ian on the Cape Coral-Fort Myers metropolitan area, we created a control market of select Florida metro areas not impacted by the hurricane that behaved similarly to Cape Coral prior to the hurricane’s impact (from January 2021 up until the storm). Since mortgage rates were low in 2021 and rose in 2022, creating a control market allowed us to isolate the impact of Hurricane Ian. Absent an impact of the hurricane on the Cape Coral market, we would expect its data to follow the control market (“projected” home sales or “projected” new listings).

For new listings, the control market is a weighted average of the following metros’ new listings data: West Palm Beach (61%) and Panama City (39%). For home sales, the control market is a weighted average of the following metros’ home sales data: West Palm Beach (54%), Port St. Lucie (44%) and Ocala (2%). The impact of Hurricane Ian on home sales and new listings in Cape Coral is statistically significant.

United States

United States Canada

Canada