While some data suggests that housing density is starting to prevail in certain cities, the vast majority of Americans still want a single-family home with a yard, even if it means sacrificing proximity to work.

Since the middle of the 20th century, one common image of the American Dream has been a suburban detached single-family home with a lush lawn and a picket fence. But in many major U.S. cities, the single-family-only zoning policies that preserve the idea come with sky-high housing costs, a homelessness crisis and racial and socioeconomic segregation.

Many housing policy experts believe the heyday of the single-family home should come to an end, and some local governments, including those in Minneapolis and Oregon, have altered zoning laws in an attempt to make homes more affordable and curb segregation. But changing zoning to allow for denser housing will only have a measurable impact on the makeup of regions if Americans are interested in changing the way we live. Below we examine the question: Is the nation moving toward a future of multi-family homes in walkable, densely populated areas, or will Americans hold on tight to their single-family houses?

Here’s a summary of key findings:

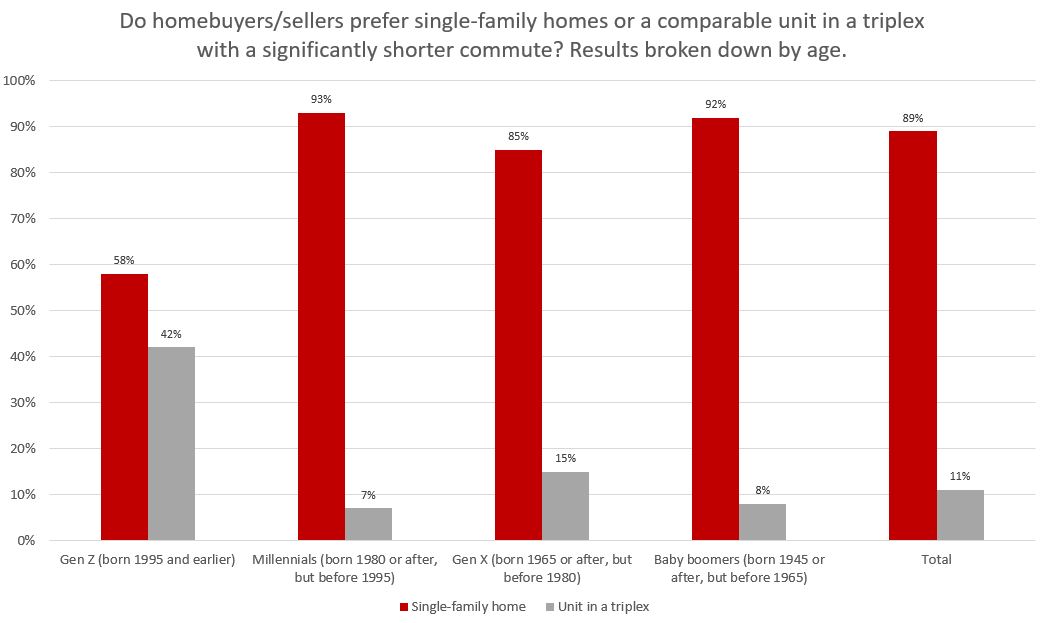

- 89% of homebuyers would prefer a single-family home with a backyard over a unit in a triplex with a shorter commute.

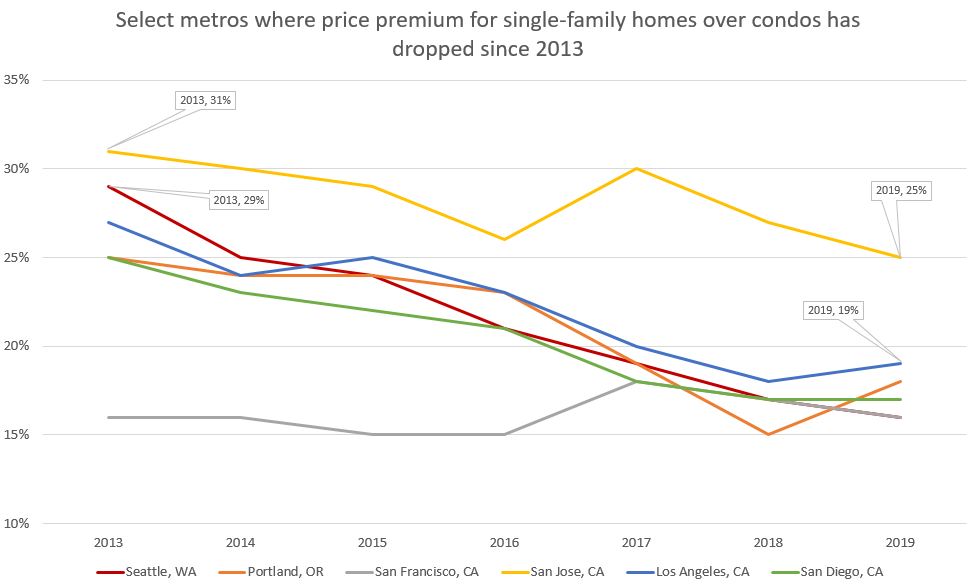

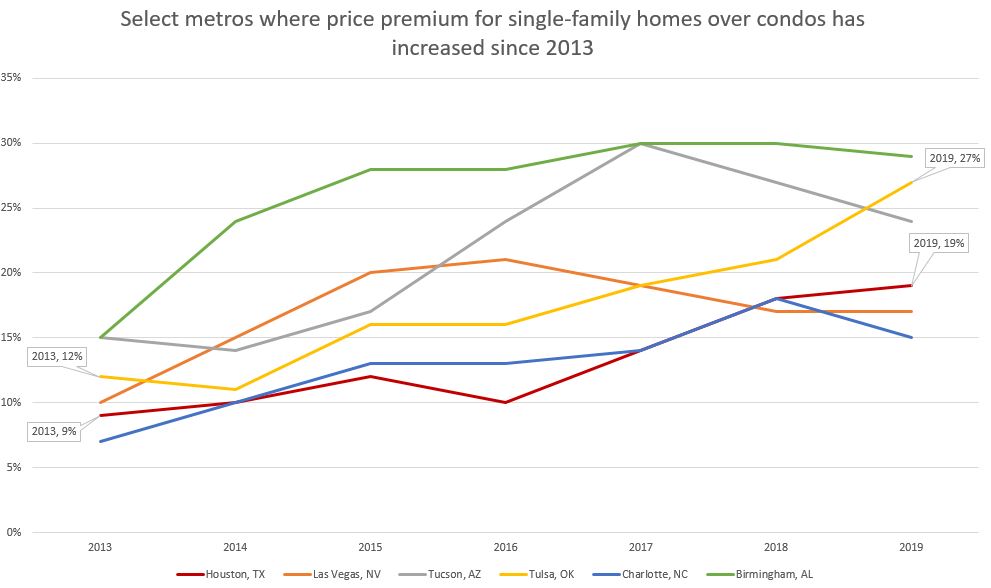

- The price premium for single-family homes over condos has generally declined since 2013 in expensive metros like San Jose (single-family homes sell for 25% more than comparable condos, down from 31% in 2013) and Los Angeles (19% premium, down from 27%), but risen in more affordable areas like Las Vegas (17% premium, up from 10%) and Birmingham (29%, up from 15%).

- 33% of Redfin.com users limit their searches to single-family homes, down from 41% in 2012.

- 28% of homebuyers said plenty of living space is the most important factor in their home choice, more than any other factor.

“This is another way America is dividing between coastal cities and the more affordable heartland,” said Redfin CEO Glenn Kelman. “All else being equal, almost everyone would prefer a house over a condo, and that preference is only getting stronger in most parts of America. But in the big city, that preference is actually getting weaker. As more folks move from San Francisco or New York in search of that house with a white picket fence, the ones left behind will be those most comfortable with life in a condo or townhouse. The question now becomes whether cities in the middle of a transition from affordable to affluent, like Minneapolis, Seattle, Portland, Austin, Nashville and Charlotte, can use local zoning laws to shift their citizens’ preference for single-family homes, so that it becomes less, not more, strong over time—or if people will shift away from them.”

The price premium for single-family homes over condos is declining in expensive areas and increasing in affordable inland areas

In many expensive metro areas, the price premium for single-family homes over comparable condos—those with similar square footage, number of bedrooms and bathrooms and location, among a few other factors—has dropped meaningfully since 2013, according to Redfin housing data. In Seattle, single-family homes sell for an estimated 19 percent more than comparable condos, down from 29 percent more in 2013. And in San Jose, the premium for single-family homes over condos is 25 percent, down from 31 percent in 2013. The decline in those places could mean single-family homes are becoming less valuable to buyers.

But the premium for single-family homes has increased over the last six years in many affordable inland areas: In Houston, the premium is 19 percent, up from 9 percent to 19 percent, and in Tulsa it’s 27 percent, up from 12 percent.

For this report, we looked at 90 major metro areas. The metros included in the charts above have sufficient data for each year from 2013 to 2019, but we did not include every metro with sufficient data. The metro areas we selected are representative of expensive coastal areas and affordable inland areas. The data for 2019 is from January through July.

“A person who wants to live in San Diego or Los Angeles for job opportunities or the weather won’t decide to live somewhere else because they either can’t afford a single-family home or can’t find one that meets their preferences,” said Redfin chief economist Daryl Fairweather. “Homebuyers are more willing to settle for a condo or another unit with shared walls if the home itself isn’t the defining feature of why they’re choosing a city. In a sprawling place with an emphasis on private homes like Houston or Las Vegas, people may actually be moving there because there are plenty of affordable, large single-family homes where they can raise a family.”

Nationwide, the premium for single-family homes over condos has hardly changed in the last six years. Single-family homes sold for 15 percent more on average than comparable condos in 2013 and 16 percent more in 2019.

If single-family homes continue to command more of a premium in affordable inland areas but less in expensive coastal areas, it could exacerbate the divide that’s already happening between the way people live on the coasts and the middle of the country.

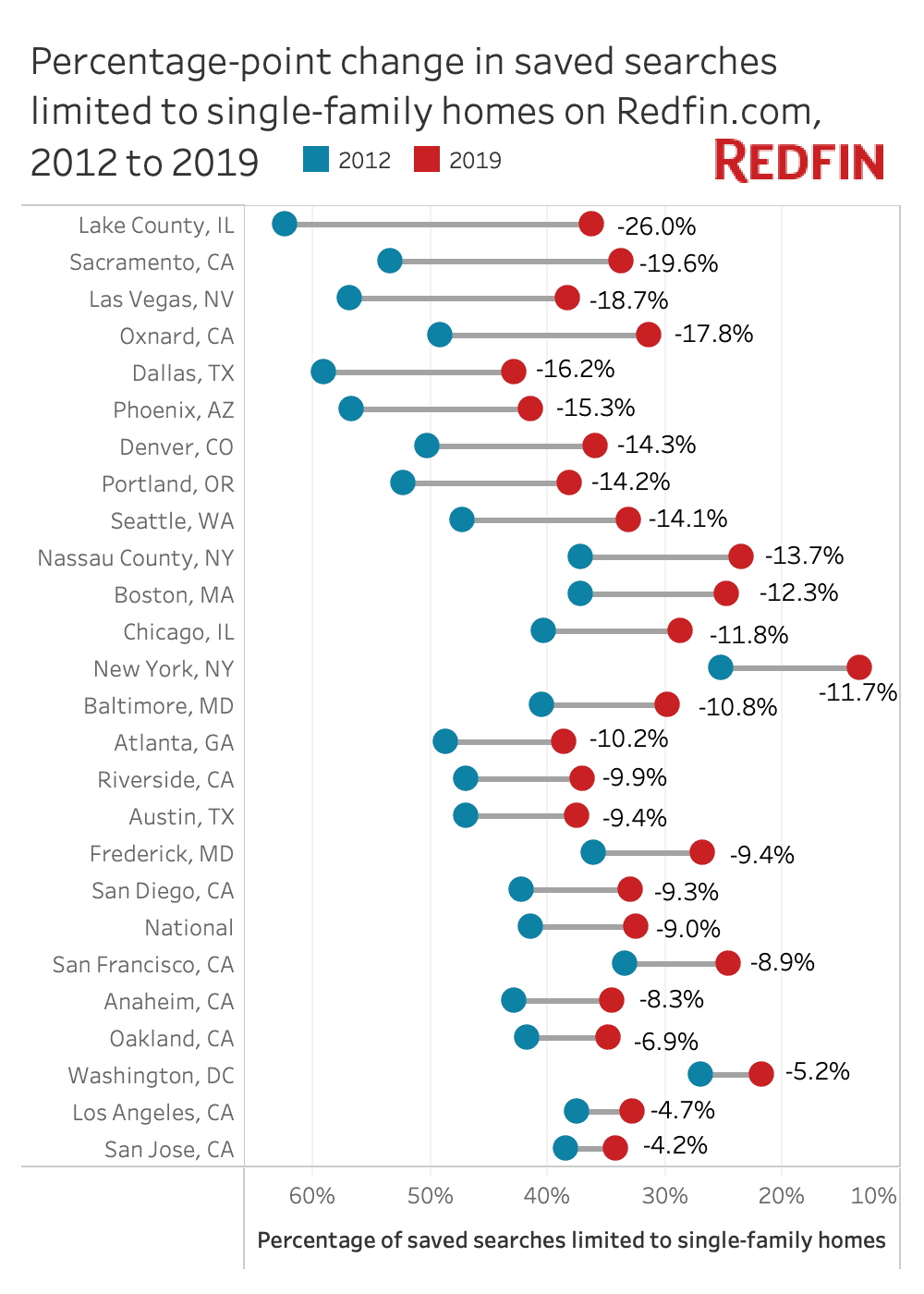

Redfin users are less likely to limit their searches to single-family homes than they were seven years ago

Thirty-three percent of saved searches on Redfin.com were limited to single-family homes (meaning they excluded condos and townhomes) in the third quarter of 2019, down from 41 percent in the first quarter of 2012. That decline could reflect the pressure high home prices are putting on buyers in the last few years: Homes have become much more expensive since they reached a low point in 2012 after the Great Recession, and units with shared walls tend to be more affordable for the typical homebuyer.

The share of Redfin.com searches limited to single-family homes has declined over the last seven years in every metro area with at least 500 saved searches in both the first quarter of 2012 and the third quarter of 2019. That includes relatively affordable areas like Las Vegas (where the share of searches limited to single-family homes was 38% in the third quarter of 2019, down from 57% in the first quarter of 2012) and expensive areas like San Francisco (26%, down from 33%).

Here’s a look at the percentage-point change for single-family-only searches on Redfin.com, ranked from the biggest percentage-point drop since 2012 to the smallest.

Most homebuyers and sellers would choose a single-family home over shared walls—even if it means a significantly longer commute

Although the share of homebuyers limiting their searches to single-family homes has shrunk over the last seven years, that’s likely due to rising prices rather than homebuyer preferences. Our research indicates that the vast majority of homebuyers and sellers would prefer a single-family home over a unit with shared walls, assuming the price is the same.

Just one out of every 10 prospective homebuyers and sellers would prefer a unit in a triplex with a short commute over a comparable single-family home farther away from their job. Nearly 90 percent of homebuyers would prefer a single-family home. That’s according to results of a Redfin survey from August 2019 of more than 1,400 U.S. residents who are thinking of buying or selling a home in the next year.

The survey asked respondents to choose a home based on the following hypothetical situation: “You find a single-family home with a backyard for the same price as a unit in a triplex (a building with three attached homes). The triplex is smaller, but meets your space needs, and has a shared backyard and significantly shorter commute. Assume the school quality and safety ratings are identical.” We broke down the results both by age and geography.

Ninety-three percent of millennials would choose a single-family home, as would the vast majority of all other age groups over 25.

And although there were just 26 responses from members of Gen Z, the stark difference between that age group and the others is worth noting: Nearly half of the under-25 set would prefer a unit in a triplex over a single-family home with a private backyard. While the youngest survey respondents’ sentiment could suggest that overall housing preferences will indeed shift away from single-family homes in the decades to come, it may be just as likely that their housing preferences will change as they start families.

“I have one millennial couple with a six-month-old baby looking to buy a condo in downtown Minneapolis, but more often homebuyers with young kids are searching for single-family homes in the suburbs with highly rated schools,” said James Garry, a Redfin agent in Minneapolis. “Commute time is less of a concern than it used to be because a lot of people are able to work from home and are no longer subject to the Monday through Friday, nine-to-five grind. But even if one person in the family has a long commute, they’re usually willing to sacrifice living close to work for proximity to their desired school and wide-open spaces where their kids can play.”

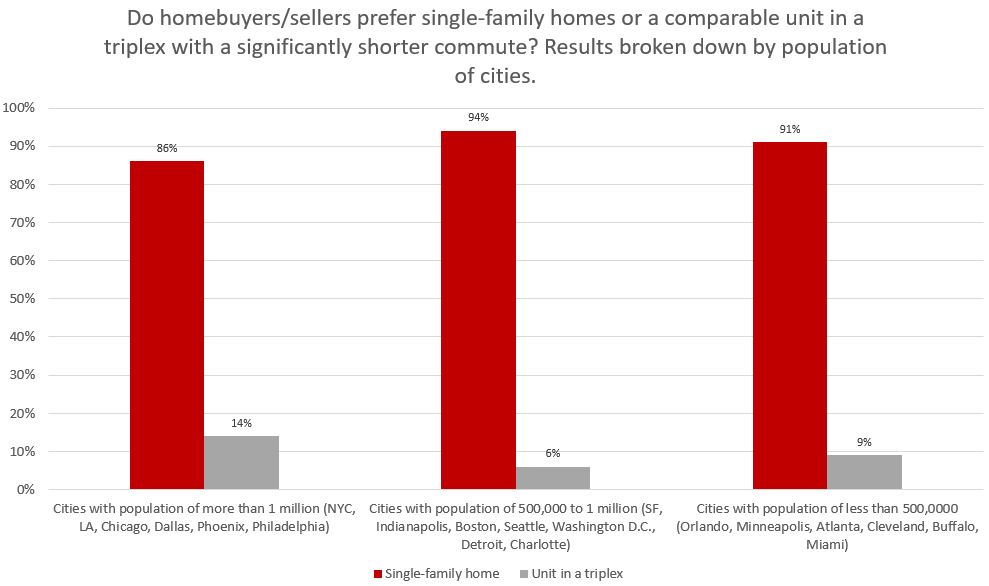

Broken down by region, we found that regardless of where people live within the U.S., more than 85 percent of homebuyers and sellers prefer single-family homes over a unit in a triplex with a shorter commute. The vast majority of respondents who live near cities of all sizes would prefer a single-family home.

Connie Durnal, a Redfin agent in Dallas, said many of her clients prioritize a healthy lifestyle and being part of a community over living close to work and other amenities.

“The old saying ‘There are three important things in real estate: Location, location and location’ may no longer be as true as it once was,” Durnal said. “A lot of homebuyers are now placing a high value on overall lifestyle and they’re willing to live further away from work, even if it means a longer commute, if being home feels like being on vacation. Many of the buyers I work with are looking for a community where it doesn’t feel too crowded; they want to feel like they have privacy from neighbors but they also want neighborhood amenities such as jogging trails and exercise facilities. Those types of lifestyle amenities are becoming more important than proximity to things like restaurants and shops.”

Homebuyers who prefer a unit with shared walls are more likely to value their commute over home size and privacy

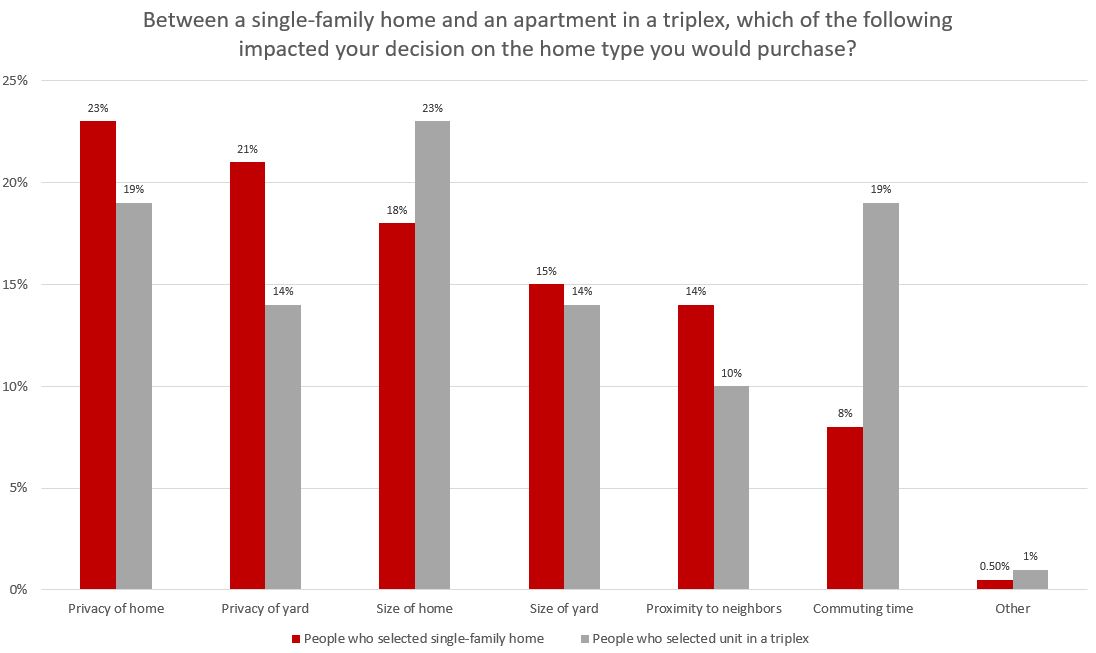

Respondents who chose a triplex unit were more than twice as likely as those who chose a single-family home to value commute time over all other factors.

“For a certain set of homebuyers, being able to walk to everything, including work, is incredibly important,” said Jessie Culbert Boucher, a Redfin agent in Seattle. “People are really thinking about how many hours of their day they’re willing to give up commuting to work. They may redesign their home search process and their life around a shorter, easier commute.”

For respondents who chose a unit in a triplex, 23 percent said home size was the most important factor, a higher share than any other feature, followed by commute time and privacy of home (19% each).

Among homebuyers and sellers who preferred a single-family home, 23 percent said privacy of the home was the most important factor in their decision, a higher share than any other factor. It’s followed by private yard (21%) and size of home (18%).

Here’s the full breakdown of responses:

Homebuyers want single-family homes, but not necessarily large single-family homes

Although our research indicates that most homebuyers prefer single-family homes, the size of those homes has recently started trending downward after years of going up. The median home size in the U.S. in 1975 was 1,535 square feet. It peaked at 2,467 square feet for the typical home in 2015 and has steadily dropped since then to 2,386 square feet in 2018. That suggests there may be a happy medium between McMansions and duplexes: Smaller homes with small private yards.

It’s possible the decline in home size is related to increasing prices. As it becomes less realistic to own a large home that’s also in a good location, homebuyers must decide what’s most important to them.

“For the most part, owning a big, expensive home isn’t as important for my millennial clients as it used to be for people of the same age range. They’re not willing to reduce travel and cut back on spending at restaurants and bars in order to buy a big house,” said Matt Novak, a Redfin agent in Portland. “I’ve been working with a young couple who were originally interested in single-family homes, but now they’re open to seeing attached homes in neighborhoods where they’d actually want to live. They reached a tipping point: The neighborhood and its walkability became more important than dealing with a shared wall and sacrificing a bit of privacy.”

The American Dream is alive and well

While every homebuyer is different and each person has her own set of values and preferences, our research suggests that homebuyers still prefer detached single-family homes with private yards to a home with shared walls—even if it means they’d be rewarded with a significantly shorter commute to work and the ability to walk to shops and restaurants.

While some cities and states like Minneapolis and Oregon are attempting to create more affordable multi-family housing options by changing zoning laws, the strategy is unlikely to gain traction nationwide and developers are likely to continue building single-family homes as long as Americans prefer to live in private homes. The American Dream ideal of a detached home with a white picket fence surrounding a private lawn appears to be alive and well—at least for the time being.

Methodology

The data on the price premium for single-family homes versus condos comes from Redfin housing data. We used linear regression to model the relationship between the sale prices of single-family homes versus condos in each metro area tracked by Redfin from 2013 through 2019 (the 2019 numbers are from January through August). We broke out the data by metro area and controlled for many features of the homes, including location, size and number of bedrooms and bathrooms. We determined the percent increase in the sale price correlated with a single-family home over a condo.

For the data on searches for single-family homes, we analyzed saved searches on Redfin.com for homes in the metro areas tracked by Redfin. We analyzed the share of Redfin users who limited their searches to single-family homes and excluded all other housing types, including condos and townhomes, from the first quarter of 2012 through the third quarter of 2019.

The data on the share of homebuyer and seller preferences comes from a Redfin-commissioned survey in August 2019. The survey yielded more than 1,400 responses from U.S. residents who are thinking of buying or selling a home in the next year.

United States

United States Canada

Canada