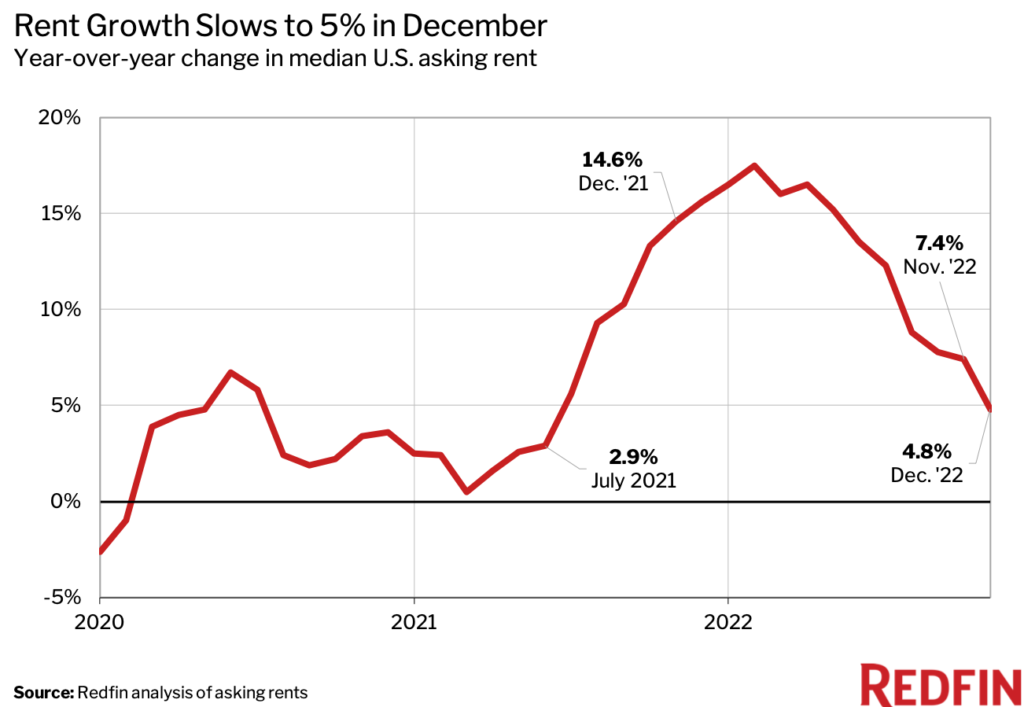

Rents rose 5% from a year earlier, the smallest increase in nearly a year and a half. That’s roughly one-third the pace of growth seen last December.

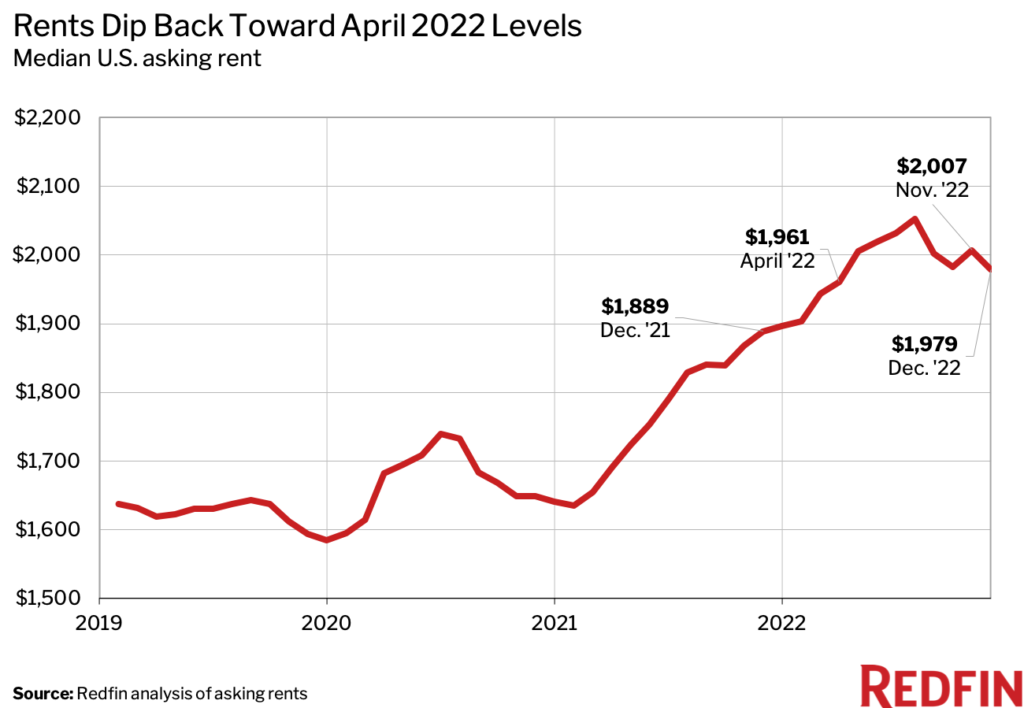

The median U.S. asking rent rose 4.8% year over year to $1,979 in December—the smallest increase since July 2021—as persistently high rental costs, inflation and economic uncertainty continued to dampen rental demand. Rents grew at more than three times that pace one year earlier.

December also marked the seventh straight month in which annual rent growth slowed and the fourth consecutive month of single-digit rent growth following nearly a year of double-digit increases. Rents fell 1.4% from a month earlier and were down 3.6% from the August peak of $2,053.

“Rents have room to fall. While they’ve cooled significantly from their peak, it still costs the typical renter 20% more to take on a new lease than it did two years ago,” said Redfin Economics Research Lead Chen Zhao. “An increase in the number of rentals on the market should also cause rents to ease in the coming months. Rental supply is growing due to an influx of construction in recent years, ebbing household formation and a slow homebuying market, which is driving many homeowners to rent out their properties rather than sell.”

|

Rental Market Summary |

December 2022 | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Median Asking Rent | $1,979 | -1.4% | 4.8% |

“A lot of sellers are turning to the rental market because they’re still having trouble wrapping their heads around the fact that they’re not going to get sky-high offers like they would have at the height of the pandemic homebuying frenzy,” said Josh Felder, a Redfin real estate agent in the Bay Area. “Some sellers are reluctant to drop their price, even when their home has been sitting on the market for a long time. I’ve had two sellers recently decide to rent out their homes because they couldn’t get the price they wanted. Both homes were listed for over $2 million.”

Rents Declined in 14 Major U.S. Metro Areas

In Minneapolis, the median asking rent declined 8.5% year over year in December, the largest drop among the 50 most populous U.S. metropolitan areas. Next came Oklahoma City (-6.4%), Phoenix (-5%), Houston (-4.6%) and Milwaukee (-4.1%).

- Minneapolis, MN (-8.5%)

- Oklahoma City, OK (-6.4%)

- Phoenix, AZ (-5.0%)

- Houston, TX (-4.6%)

- Milwaukee, WI (-4.1%)

- Chicago, IL (-3.6%)

- Baltimore, MD (-2.1%)

- Austin, TX (-2.0%)

- Birmingham, AL (-1.8%)

- Los Angeles, CA (-1.5%)

- Virginia Beach, VA (-0.9%)

- Jacksonville, FL (-0.8%)

- New Orleans, LA (-0.4%)

- Las Vegas, NV (-0.4%)

Salt Lake City Saw the Largest Rent Increase

In Salt Lake City, the median asking rent rose 29.8% year over year in December, the biggest increase among the 50 most populous metros. It was followed by Raleigh, NC (24%), Indianapolis (16.3%), Cleveland (14.6%) and Nashville, TN (11.7%).

- Salt Lake City, UT (29.8%)

- Raleigh, NC (24.0%)

- Indianapolis, IN (16.3%)

- Cleveland, OH (14.6%)

- Nashville, TN (11.7%)

- Charlotte, NC (10.6%)

- Buffalo, NY (9.6%)

- Kansas City, MO (9.4%)

- Columbus, OH (7.7%)

- St. Louis, MO (7.4%)

Median Asking Rents: December 2022

| U.S. Metro Area | Median Asking Rent | Year-Over-Year Change in Median Asking Rent |

| Atlanta, GA | $2,042 | 1.4% |

| Austin, TX | $2,270 | -2.0% |

| Baltimore, MD | $1,978 | -2.1% |

| Birmingham, AL | $1,545 | -1.8% |

| Boston, MA | $3,735 | 1.3% |

| Buffalo, NY | $1,612 | 9.6% |

| Charlotte, NC | $1,906 | 10.6% |

| Chicago, IL | $2,294 | -3.6% |

| Cincinnati, OH | $1,516 | 2.7% |

| Cleveland, OH | $1,568 | 14.6% |

| Columbus, OH | $1,566 | 7.7% |

| Dallas, TX | $2,131 | 0.9% |

| Denver, CO | $2,758 | 2.8% |

| Detroit, MI | $1,600 | 3.4% |

| Hartford, CT | $1,994 | 4.4% |

| Houston, TX | $1,745 | -4.6% |

| Indianapolis, IN | $1,492 | 16.3% |

| Jacksonville, FL | $1,595 | -0.8% |

| Kansas City, MO | $1,523 | 9.4% |

| Las Vegas, NV | $1,805 | -0.4% |

| Los Angeles, CA | $3,378 | -1.5% |

| Louisville, KY | $1,339 | 5.9% |

| Memphis, TN | $1,520 | 1.5% |

| Miami, FL | $3,157 | 3.9% |

| Milwaukee, WI | $1,657 | -4.1% |

| Minneapolis, MN | $1,704 | -8.5% |

| Nashville, TN | $2,099 | 11.7% |

| New Orleans, LA | $1,752 | -0.4% |

| New York, NY | $4,033 | 7.1% |

| Oklahoma City, OK | $1,173 | -6.4% |

| Orlando, FL | $2,130 | 4.0% |

| Philadelphia, PA | $2,258 | 1.0% |

| Phoenix, AZ | $2,003 | -5.0% |

| Pittsburgh, PA | $1,773 | 4.0% |

| Portland, OR | $2,467 | 3.0% |

| Providence, RI | $2,264 | 3.9% |

| Raleigh, NC | $2,133 | 24.0% |

| Richmond, VA | $1,732 | 3.2% |

| Riverside, CA | $2,675 | 0.7% |

| Sacramento, CA | $2,717 | 5.2% |

| Salt Lake City, UT | $2,256 | 29.8% |

| San Antonio, TX | $1,456 | 5.1% |

| San Diego, CA | $3,278 | 6.1% |

| San Francisco, CA | $3,670 | 3.2% |

| San Jose, CA | $3,467 | 4.8% |

| Seattle, WA | $2,808 | 2.5% |

| St. Louis, MO | $1,554 | 7.4% |

| Tampa, FL | $2,157 | 3.8% |

| Virginia Beach, VA | $1,663 | -0.9% |

| Washington, D.C. | $2,571 | 1.2% |

| National—U.S.A. | $1,979 | 4.8% |

Methodology

Redfin analyzed rent prices from Rent. across the 50 largest U.S. metro areas. This analysis uses data from more than 20,000 apartment buildings across the country.

It is important to note that the prices in this report reflect the current costs of new leases during each time period. In other words, the amount shown as the median rent is not the median of what all renters are paying, but the median cost of apartments that were available for new renters during the report month. Currently, Redfin’s data from Rent. includes only median rent at the metro level. Future reports will compare median rent prices at a more granular geographic level.

United States

United States Canada

Canada